Total visibility over your finances

Dedicated accountant

Your dedicated accountant is on-call through live chat and responds within 24 hours

VAT and corporate tax

Leave the tax, deadlines, and filing with VAT to us. We’ll make sure you pay the right tax and stay compliant.

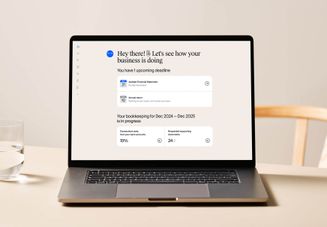

Web & Mobile App

Run your business from your pocket. With Osome’s app and web platform, you’ll have instant access to dashboards, expenses, and cash flow updates.

Unlimited transactions

Whether you’re growing fast or just getting started, Osome keeps up. Unlimited transactions mean you can scale without worrying about bookkeeping limits.

For new founders and seasoned entrepreneurs

Solo founders

You don’t have to do it alone. We’ll get you up and running quickly with guidance on VAT deadlines and compliance with the Federal Tax Authority (FTA).

Small businesses

We provide outsourced accounting expertise to handle your Corporate Tax and FTA filings, while equipping you with tools to manage your finances and grow with confidence

Enterprise

As a top accounting firm, we go beyond generic services, offering financial solutions built to scale with large organisations managing multiple entities, subsidiaries, or regional offices

Feel fully in control of your business finances

Experts on your side

Get a personal accountant for your business from day one. Our UAE accountants provide expert guidance on bookkeeping services, VAT registration, corporate tax, and overall tax compliance.

Get clear on cash flow

With our dashboard, your cash flow and financial statements are at your fingertips. Osome’s bookkeeping services ensure your accurate financial data is ready for reporting and decision-making.

Pay the right tax

We help you stay on top of your finances. Our accounting solutions track deadlines for VAT, corporate tax, and other compliance needs. Experts handle tax returns and filings with the FTA so your financial statements are always accurate.

Run your finances anytime, anywhere

Smart software made for business owners

Our winning formula combines expert accountants with powerful, easy-to-use tools. Together, they give you the cash flow visibility you need to make confident business decisions.

With Osome’s in-house platform, you can manage bookkeeping, invoicing, payments, and reporting – all your financial data, updated in real time and stored in one secure place.

Plans to fit your business

Our packages are tailored to your business stage and annual revenue. Customise your package with add-ons to suit your needs as you grow.

Operate

Annual revenue under AED 375,000

AED 8,000 billed annually, per financial year

Osome Accounting software

Bookkeeping

Expert service

Tax and filings

Historical work (takeovers only)

Optional add-ons

Grow

Annual revenue under AED 1,000,000

AED 15,000 billed annually, per financial year

Osome Accounting software

Bookkeeping

Expert service

Tax and filings

Historical work (takeovers only)

Optional add-ons

Scale

Annual revenue under AED 4,000,000

AED 30,000 billed annually, per financial year

Osome Accounting software

Bookkeeping

Expert service

Tax and filings

Historical work (takeovers only)

Optional add-ons

Plans for growth past AED 1M or dormant company filing

What our clients think about Osome services

92 %of customers recommend us

“I use Osome to help me succeed”

“The onboarding was seamless, and everything was up and running within a day. I highly recommend them for their service and efficiency.”

Luigi Carecci

FAQ

What are accounting services in Dubai, UAE?

Accounting services in Dubai, UAE include bookkeeping, financial reporting, payroll, VAT registration, and corporate tax compliance. They help businesses maintain accurate financial statements and ensure compliance with UAE regulations.

What types of accounting services are available for small businesses?

Small businesses can choose from bookkeeping services, payroll processing, tax services, financial statements preparation, and outsourced accounting solutions tailored to free zone and mainland companies.

Why are bookkeeping services important for companies in a free zone?

Bookkeeping services help free zone companies maintain compliance with corporate tax rules and financial reporting requirements while ensuring accurate financial data for audits and growth planning.

Do I need to register for VAT in Dubai?

Yes, businesses exceeding the mandatory turnover threshold (AED 375,000) must complete VAT registration. Even below the threshold, voluntary registration can improve credibility and cash flow management.

What is corporate tax in Dubai?

Corporate tax in the UAE is a 9% levy on business profits exceeding AED 375,000. This mandatory tax applies to most companies, with exceptions for businesses in qualifying free zones that meet specific conditions. Accounting firms help businesses stay compliant with tax regulations, prepare financial reports, and plan effectively to ensure smooth operations and avoid penalties.

Can I switch from another accounting firm to Osome?

Absolutely. We’ll liaise directly with your current accountant, collect your records, and migrate everything smoothly. We check compliance, prepare reports, and guide you on UAE tax regulations. With Osome, you can focus on growing your business while we handle the accounting.

How does Osome handle outsourced accounting in Dubai?

Osome provides outsourced accounting and bookkeeping services, combining technology and expert accountants to deliver accurate financial data, reduce costs, and ensure compliance.

Can Osome manage payroll and VAT registration together?

Yes. Osome streamlines payroll processing, VAT registration, and tax compliance under one platform, saving small businesses time and minimising errors.

Does Osome support businesses in both free zones and the mainland?

Absolutely. Osome offers tailored accounting solutions for free zone companies and mainland businesses, ensuring compliance with local regulations and corporate tax rules.

How does Osome ensure compliance with UAE tax regulations?

Our accounting firm uses automated systems and experienced accountants to monitor changes in tax compliance and corporate tax requirements, keeping your financial statements up to date.

Why choose Osome over other accounting companies in Dubai?

Osome combines top accounting expertise with intuitive technology. You get best accounting services in Dubai UAE – reliable financial reporting, faster processes, and a team that understands small business needs.

How does your pricing work?

We charge based on your company’s revenue profile, not per transaction. All fees are transparent, with no hidden costs. Pricing is usually annual, covering bookkeeping, VAT submissions, and corporate tax filing for the financial year.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?