Singapore Tax System Guide: Types & Rates

Singapore is famous for its attractive corporate tax rates. We explain how it works in a snapshot.

Other than low tax rates and tax incentives for foreign investors, the friendly Singapore tax system has turned the country into a preferred destination for starting a business.

When foreign investors look to establish their business in another country, they review several factors, including the ease of setting up and operating. From that perspective, Singapore is a leading country. According to the World Bank’s Doing Business Index, Singapore ranks 2nd in the world. If you’re thinking of registering a company in Singapore, let us help you from incorporation to setting up a business bank account.

The tax regime of Singapore is already well-known among the business communities across the world for its easy-on-pocket personal and corporate tax rates, tax incentive, and tax relief measures, and the absence of capital gains tax.

Features of Singapore’s Taxation System

Here are the major components of Singapore taxation system:

Low Tax Rates

Singapore income tax rates are relatively low. The highest corporate tax rate in the country is 17 percent. Also, the highest personal tax rate is 22 percent. There are various tax incentives available to lower the effective tax rates.

No Capital Gains Tax

Another major highlight of Singapore’s taxation system is that the country does not impose any tax on capital gains, income generated from foreign sources, and dividends. Also, there is no tax on acquiring assets as gifts or inheritance.

Single-Tier Tax

Under the single-tier tax system, taxation on profits occurs at the corporate level and this is the only tax that payees will incur on such earnings. Paying dividends to shareholders is exempt from tax.

No Double Taxation

There are extensive treaties for avoiding double taxation in place, which means individuals and companies who receive income and assets from overseas, pay tax only once.

Despite having low tax rates for individuals and businesses, Singapore consistently generates significant budget surpluses while developing world-class infrastructure in the country. Many countries have set the economy of Singapore as their benchmark, and are trying to catch up.

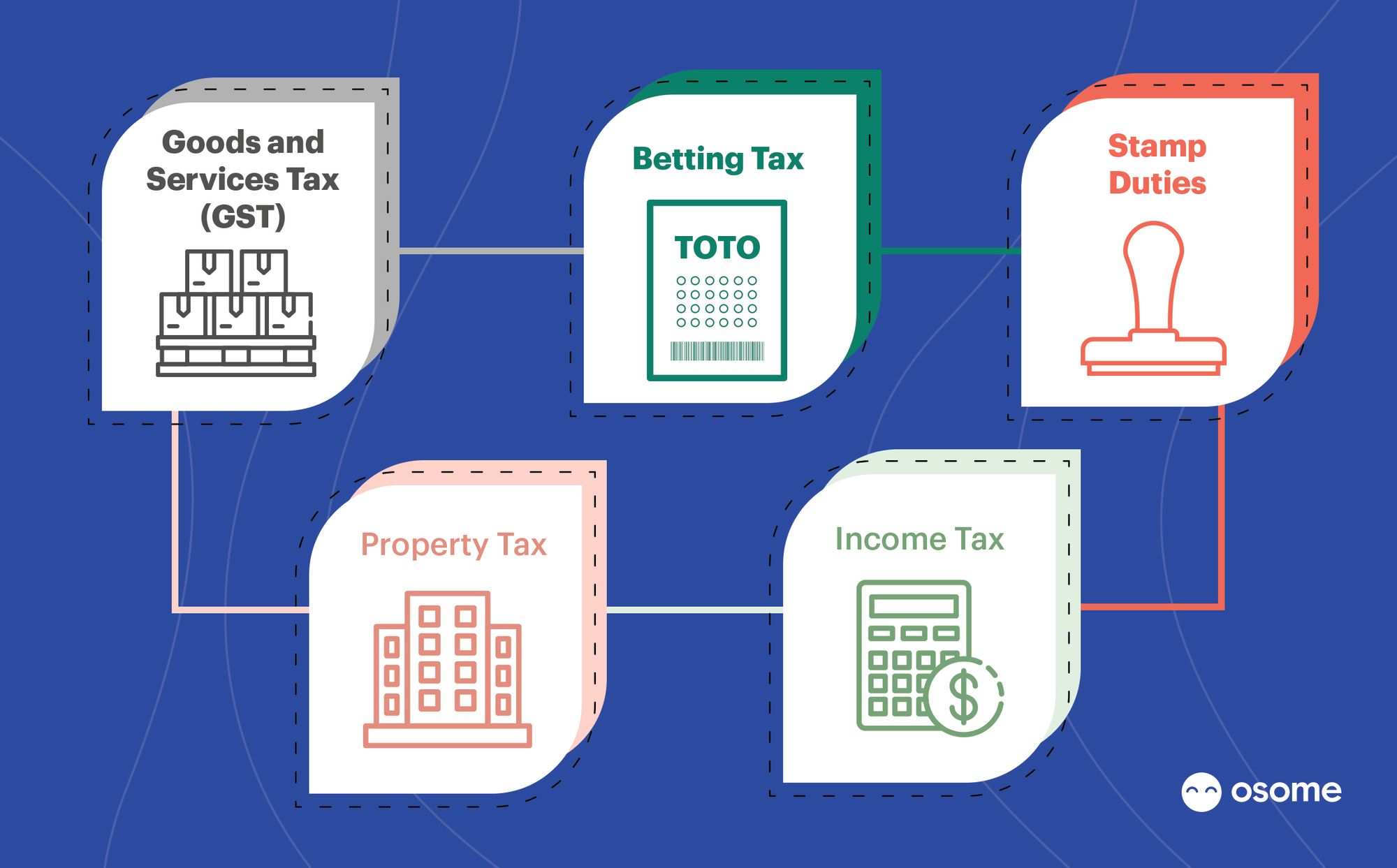

Types of Taxes in Singapore

Singapore’s tax revenue collection consists of corporate tax, personal tax, Goods & Services tax, and property tax. Simple, attractive, and efficient, and attractive, this is how we can describe Singapore’s tax system.

Here are the types of taxes in Singapore:

- Income Tax: This is also called “personal tax,” which is charged on individual and corporate earnings.

- Property Tax: This is a type of tax for property owners based on the estimated rental values of their properties.

- Goods & Services Tax (GST): The government imposes GST on the consumption of goods and services. The tax is chargeable when people and companies spend money on goods or services, including imports. This type of indirect tax is also called “Value Added Tax (VAT)” in different countries.

- Customs and Excise Duties: Singapore has only a few customs and excise duties. The country imposes excise duties mainly on the items such as petroleum products, tobacco, and liquors. Also, there are very few items on which import duties are payable. These duties are payable mainly on motor vehicles, liquor, tobacco, and petroleum products.

- Estate Duty: Not in effect anymore. It was withdrawn on February 15, 2008.

- Stamp Duty: The stamp duty is for legal and commercial and legal documents regarding immovable properties and stock & shares.

- Vehicle Taxes: Taxes on motor vehicles are payable besides import duties. The purpose of imposing these taxes is to reduce the number of vehicle ownership and road congestion.

- Betting Taxes: These taxes are duties imposed on betting, private lottery, and sweepstakes.

- Other Taxes: In the category of miscellaneous taxes contains mainly two taxes: a levy on foreign workers and the service charge on airport passengers. The purpose of imposing the foreign worker levy is to regulate the process of employing foreign workers in Singapore.

What Is Taxable Income in Singapore

Taxable and Non-taxable Income

Taxable Income Singapore

For Singapore taxation, the following items fall under taxable income:

- Profits or gains generated from any trade or business;

- Any income received from investments, including interest, dividends, and rental;

- Premiums, royalties, and any profit from the property; and

- Various gains, which are considered revenues.

Businesses can claim tax deductions such as capital allowances, business expenses, and reliefs to lower their taxes.

An Income is Taxable in the Following Cases

A company has to pay tax in Singapore when:

- The accrued income is generated in Singapore; or

- Any income received in Singapore but sourced from another country.

Non-Taxable Income Singapore

Capital Gains

In Singapore, capital gains are not taxable. A couple of examples are below:

- Profits or gains by selling of fixed assets; and

- Profits or gains on foreign exchange for transacting capital.

Corporate Tax Rates in Singapore

For reference, below you’ll find the tax rate for companies below:

| Corporate tax types | Tax rate (%) |

|---|---|

| Tax on corporate revenues | 17% (highest rate; different tax incentives and exemptions to lower the eventual tax rate) |

| Tax rate on capital gains by corporate | 0% |

| Tax rate on dividends paid to shareholders | 0% |

| Tax rate on eligible income from foreign sources | 0% |

Tax Exemptions for SMEs

The most common tax exemptions for companies to lower their tax are:

Tax Exemption Programme for Fresh Start-Up Companies

The tax exemption programme for fresh start-up companies came into effect in the Assessment Year 2005 to support business initiatives and help local companies grow.

When other support initiatives for enterprises to help build capabilities consolidated, it was announced during the Budget 2018 that the tax exemption under the programme will undergo revision.

The changes came into effect from the assessment year 2020 for all eligible companies that claim the tax exemption under the programme.

- On the first $200,000 of chargeable income, tax exemptions are below:

| Chargeable Income | % Tax Exempted | Amount Tax Exempted |

|---|---|---|

| First $100,000 | 75% | $75,000 |

| Next $100,000 | 50% | $50,000 |

The highest tax exemption for every assessment year is $125,000 ($75,000 + $50,000).

- On the first $300,000 of chargeable income, tax exemptions are below:

| Taxable Income | % Tax Exempted | Amount Tax Exempted |

|---|---|---|

| First $100,000 | 100% | $100,000 |

| Next $200,000 | 50% | $100,000 |

The highest tax exemption for every assessment year is $200,000 ($100,000 + $100,000).

Partial Tax Exemption for all companies

All types of organisations, including the ones limited by guarantee, can get the benefit of PTE unless they have already availed tax exemption for fresh start-up companies.

- Assessment Year 2020 onwards:

| Taxable Income | % Tax Exempted | Amount Tax Exempted |

|---|---|---|

| First $10,000 | @75% | = $7,500 |

| Next $190,000 | @50% | = $95,000 |

The maximum exemption for each YA is $102,500 ($7,500 + $95,000).

- Assessment Year 2019 and before:

| Taxable Income | % Tax Exempted | Amount Tax Exempted |

|---|---|---|

| First $10,000 | @75% | = $7,500 |

| Next $290,000 | @50% | = $145,000 |

The maximum exemption for each YA is $152,500 ($7,500 + $145,000).

Other Tax Incentives

Your organisation needs to fulfil the requirements to get the following benefits:

- Foreign Tax Credit (FTC): If an individual working in Singapore has already paid tax somewhere else on the income generated in a foreign country that is also taxable, he/she can claim a foreign tax credit for it. The amount of credit would lower the tax payable in Singapore and actual foreign tax paid.

- Pioneer Certificate Incentive (PC): If a company has got approval as a ‘pioneer’ in its industry, there will be a tax exemption on the pioneer activity for up to 15 years. This tax exemption is available if you have a business in the fields such as IT, R&D, or emerging or underdeveloped industries.

- Double Tax Deduction for Internationalisation (DTDi): A business owner can apply for double tax exemption for up to S$150,000 of eligible business expenses till March 31, 2020. These tax deductions are available for supporting market expansion, market surveys, and activities relating to investment development, or taking part in business fairs overseas.

- Development and Expansion Incentive (DEI): This incentive provides tax rate concessions of 5% or 10% on eligible incremental income to organisations doing high-value or developmental activities that economically benefit Singapore.

Conclusion

Singapore’s tax system can be easy to understand but when you get into tax season and need help, reach out to our expert accountants for advice.