Goods and Services Tax (GST) in Singapore: What Is It and How It Works?

Once your company has generated over S$1 million in revenue within a year, you need to register for GST. We look into the process and the requirements.

Goods and Services Tax (GST) in Singapore is a value added tax which is levied on the supply of goods and services and the import of goods. Once your company has generated over S$1 million in revenue within a year, you need to register for GST. We look into the process and the requirements.

If you are looking for someone who could take this load off your shoulders, try our accounting services!

What Is GST?

Goods and Service Tax, known as Value Added Tax (VAT) in other countries, stands at 9% in Singapore. The Singapore GST rate applies to most goods and services exchanged in Singapore. For the ones that are exported from the country, GST stands at 0%.

Should My Company Pay GST?

Inland Revenue Authority of Singapore (IRAS) requires companies to register for GST in Singapore once their taxable turnover exceeds S$1 million in a year. A year, in this case, is either the turnover for the past 4 financial quarters or the turnover at the end of the calendar year.

If your turnover is less than S$1 million, you don't have to register for GST, but you can volunteer if you want. In such voluntary cases, you will have to remain GST registered for at least 2 years. We look into reasons for registration in a separate guide.

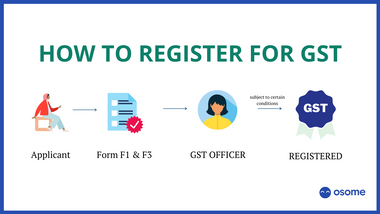

How To Register for GST?

The company fills in a form called GST F1 and submits it to IRAS. It requires preparing paperwork (IRAS provides a detailed checklist on their website) and F3 form in which you acknowledge all possible responsibilities you take, transforming your company into GTS registered company. It takes IRAS about 10 working days to process the application and provide you with your GST registration number.

It is important that GST submission of supporting documents and registration for GST happens no later than 30 days after your company has generated S$1 million within a year. It is best to register ahead of time, once you know you’re on track for S$1 million.

Does Registration Require Additional Taxes?

Once you’ve registered for GST, you need to collect the tax on taxable goods and services that your business provides. Normally the added cost is passed on to the consumer. For example, if your service costs S$500, you will charge S$545. S$45 is an 9% GST tax that you’re collecting for IRAS.

What if My business Is Not registered for GST?

In this case your invoice must not say Tax Invoice, it will just say Invoice. You can't charge 10% extra for your services and you can't obviously claim the GST paid on items you purchased.

Compulsory Registration

In two cases, GST registration is mandatory:

- If your business made more than S$1 million in the past year of assessment.

- If you are making sales and you are expecting the future turnover of your company to be more than 1 million for the next 12 months. This includes any agreements and contracts signed with expected revenue of S$1 million or more.

You have to apply to IRAS for GST within 30 days after your revenue exceeds S$1 million. If you don’t register your company with IRAS within this stated timeframe it will lead to penalties.

Be transparent about this as there are special anti-avoidance restrictions which ensures that businesses don’t avoid registration by keeping the turnover less than the threshold.

Voluntary Registration

You may also go through GST submission process voluntarily if your business does not require you to do the compulsory registration. In this case your business entity must be planning or already making sales in Singapore.

NOTE

There are additional terms for voluntary registration for GST.

After you register, you must:

- Stay registered at least 2 years

- Comply with the GST laws

- Fill the GST return on time

- Keep all your records for no less than 5 years after your business has stopped functioning

The tax authority can impose any other extra conditions on your entity and you will have to comply with all of them.

Can I Deregister From GST?

Yes, if your business no longer generates S$1 million a year and you can support it with projections and documents. In this case, you can apply to IRAS to cease the GST registration. If the drop in revenue is only temporary for a year, you can't change your Goods and Services tax status.

How To File GST Returns?

The GST return, also called GST F5, is filed in a time period that IRAS determines for each GST-registered company individually. Usually it is a quarter. The payment is processed online via GIRO. The report specifies the total sales amount, GST received and GST paid. Even if there is nothing to report, a 'nil' return must be filed.

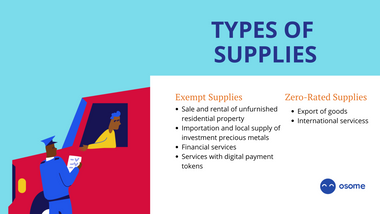

Types of Supplies

GST applies to most goods or services sold inside Singapore jurisdiction.

Exempt supplies

- Sale and rental of unfurnished residential property

- Importation and local supply of investment precious metals

- Financial services. E.g. issue of a debt security

- Services with digital payment tokens like Bitcoin.

Zero-rated supplies

- Export of goods

- International services like an air flight from Singapore to Australia

GST transactions happening outside of Singapore are considered to be “out of scope” of Singapore jurisdiction and hence are not GST taxable.

In Singapore, there are FTZ’s (Free Trade Zones) and ZG (Zero GST) warehouses. Any transaction inside these zones will be treated like a transaction on foreign soil or ‘out-of-scope’ for GST purposes.

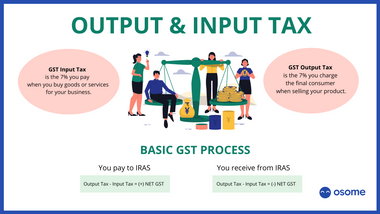

What Is Input and Output Tax?

The authorities do not want goods and services to become too expensive because of GST. So they created rules to prevent it. If you buy goods and services to produce your own, you can claim back the GST that you paid on those supplies.

Let's say you own a coffee shops chain, and both you and your coffee beans supplier are registered for GST. Buying those beans from your supplier, you incur 9% GST that is included in the beans' price. When you sell a cup of coffee to a customer, you include the 9% you paid on the beans into the coffee price. On top of that, you are supposed to add the 9% of your own GST. Hence, your customer must pay the GST twice, on the cup of coffee and on your purchase of the coffee beans. Not fair! Especially for the person buying that americano. And if one bought a cappucino, the milk GST would be in place, too.

This is where Input and Output Taxes come in action. GST Input Tax is the 9% you pay when you buy goods or services for your business. GST Output Tax is the 9% you charge the final consumer when selling your product.

To avoid the double taxation we described above, businesses have the right to claim Input Tax back from the state. In the example above, the Input tax is GST paid on coffee beans. By claiming back the GST you paid to your supplier, you leave the customer with only the Output Tax of 9% included in the price of the americano. This Input-Output rule applies to most goods and services that are subject to GST.

How To Claim Input Tax Back?

Every accounting period you submit your F5 to IRAS. You have to account for both Input and Output tax. Claims for Input Tax must be supported by either Tax Invoices or Simplified Tax Invoices.

Here is what the document must contain to qualify for a Tax Invoice:

- Words ‘Tax Invoice’;

- Supplier’s name, address, and GST number;

- Date of the transaction and identification number for the document itself;

- Name and address of the customer;

- Description of all the goods and/or services;

- Their total value in S$ both with GST and excluding GST.

If the total cost of goods and services in one transaction is under S$1,000, you can use Simplified Tax Invoices. They do not require you to put the words "Tax Invoice" on them, but you do need to include your GST number and follow the rest of the rules for a full-fledged tax invoice. Most of the times, simple sales vouchers and debit notes have all the needed information, so you can just use them to claim Input Tax back.

If in your transactions other currencies besides S$ are used, you will need to state the foreign currency exchange rate on the invoice as well as the foreign currency equivalent. Use the official IRAS exchange rates for GST purposes.

Whenever your employee spends money on behalf of your company, you can claim Input tax on those expenses. However, you will need proof of reimbursing the employee to support the claim for Input Tax.

Cases When You Can't Claim Input Tax Back

The general rule is that you can claim back your Input Tax only on the business expenses of your company. Here are the expenses that can't be considered business-related:

- Benefits a business provides to the staff’s family members, like day-care for employees’ kids.

- Expenses related to the company’s cars except for trucks and vans. Put simply, you cannot claim Input tax on expenses related to small cars, only to big ones. “Small car” means “a motor vehicle constructed or adapted to carry up to 7 passengers besides the driver, the weight of which is no more than 3,000 kg when the vehicle is unladen”. So your delivery vans are still good to go for Input Tax claim. But a Merc your CEO drives isn’t.

- Any medical expenses of your employees, unless they are mandatory under either Work Injury Compensation Act (WICA) or under any agreement that falls into the jurisdiction of Industrial Relations Act.

- Corporate party expenses — except for food and drinks. You can’t get your Input Tax back on inviting a clown.

- Club subscription fees charged by sports and recreation clubs. But you still can claim GST on expenses such as renting the gear or vehicles in the clubs.

You can claim Input Tax back on gifts you gave to your staff. However, if the cost of a gift is more than S$200, you will have to pay Output Tax on it, based on the gift’s Open Market Value. The same goes for gifts and samples for customers.

Prescribed Goods and Customer Accounting

The rules below only apply when both parties are GST-registered companies.

On January 1st, 2019 GST regulations got a new definition — prescribed goods. Prescribed goods are mobile phones, memory cards, and ‘off-the-shelf’ software. If your business sells these goods, you won’t have to account for GST yourself. Instead they are subject to “Customer Accounting”. Key characteristics of those items would be:

- Phones can communicate spoken messages over cellular network and have a screen no bigger than 17,5 cm diagonally without bezels;

- Memory cards can only have Flash memory modules and can not have USB interface (RAM, SSD, M.2, HDD are not Flash, so they are not Memory cards, and thumb drives have a USB interface, which also kicks them from the list);

- ‘Off-the-shelf’ is software that requires a physical product key to work. It can be printed on a piece of paper, or on a memory device that has the program. This excludes your normal Microsoft Store or basically any digital purchase since you don’t get any physical items with the buy.

Unless these things are sold used, for purposes of extracting precious metals out of them or imported using the services of an approved third-party logistics company, the customer will have to account for GST of the supplier. Both customer and supplier have to be GST registered, just a reminder.

After that, the supplier sells say laptops without accounting for GST themselves. Instead, they issue a tax invoice that identifies the customer by their GST number and specifies that GST, in this case, is subject to customer accounting. This invoice should have the exact sum that the customer will have to pay in GST for the supply.

The customer just puts all this GST on his Output Tax. And if they bought the laptops strictly for business use, they still can claim the Input Tax back.

How to Claim GST Refund?

You can claim a GST refund on the 7% Goods and Services Tax, only if you are a tourist in Singapore and if you buy goods and spend more than S$100 (which includes GST) at participating shops.

Tip

To learn more about the criteria and the goods that you can ask the refund for visit Singapore IRAS website.