Latest Posts

10 Ways To Gain a Competitive Edge on a Budget With ChatGPT

Discover how ChatGPT can revolutionise small businesses in Singapore, providing a competitive edge without straining finances. Explore expert insights from Osome and success stories from entrepreneurs like Ben Alistor who leverage ChatGPT for remarkable results.

Better Business

Better Business

Better BusinessFiscal Year: What Is It and Why Does It Matter?

In Singapore, companies have the flexibility to select their fiscal year-end based on their business needs. It can align with the calendar year, financial quarter-ends, incorporation anniversary, seasonal cycles, or business cycles. Find out more in this article written by Osome experts.

·9 min read Money Talk

Money TalkHow a Revenue-Based Accounting Plan Can Help You Grow

A revenue-based accounting plan offers businesses in their first year of business a flexible approach to financial management and an opportunity to grow their revenues. Learn more about how this strategy can benefit your business.

·3 min read Better Business

Better BusinessFinancial Forecasting: A Guide for New Business Owners

Discover the full potential of your Singapore startup through financial forecasting. Gain reliable insights for success and attract investors confidently with Osome's empowering tools. Read our blog today!

·5 min read Better Business

Better BusinessWhat Is the Singapore Progressive Wage Credit Scheme (WCS)

The Singapore Progressive Wage Credit Scheme (WCS) uplifts low-wage workers by incentivizing employers to raise wages. It bridges income gaps, boosts morale, supports businesses in wage increment efforts, fosters productivity, and promotes a more equitable income distribution within companies.

·7 min read Better Business

Better BusinessChoosing a Virtual Registered Office Address for My Company

Explore the benefits of choosing a virtual registered office address for your Singapore-based company. Learn how it provides flexibility, enhances professionalism, and saves costs. Find out how to select the right virtual office, and discover the cheapest options available in Singapore.

·7 min read Better Business

Better BusinessUnderstanding Singapore’s Foreign Worker Quota and How It Works

Discover how the Foreign Worker Quota in Singapore impacts the hiring practices of companies across various industries. This essential policy measure maintains a balanced workforce and guides eligibility criteria for foreign labour. Learn more about the system's intricacies and its significance.

·7 min read Better Business

Better Business5 Essential AI Tools Every Singapore SME Should Use

This insightful article outlines five essential AI tools that can revolutionise your SME. From automating mundane tasks to refining the customer experience, understand why SMEs need to embrace AI. Featuring insights from successful Amazon FBA entrepreneur, Ben Alistor.

·6 min read Better Business

Better BusinessDefining the Role and Duties of a Non-Executive Director

Osome’s article unveils the world of non-executive directors in Singapore. From understanding their roles in corporate governance, discussing responsibilities and considerations, to comparing with executive directors, we cover it all. Gain insights into how you can excel in this crucial role.

·11 min read Better Business

Better Business10 Ways To Gain a Competitive Edge on a Budget With ChatGPT

Discover how ChatGPT can revolutionise small businesses in Singapore, providing a competitive edge without straining finances. Explore expert insights from Osome and success stories from entrepreneurs like Ben Alistor who leverage ChatGPT for remarkable results.

·6 min read Better Business

Better BusinessScaling Your Business to New Heights: Tips from Entrepreneurs

Ready to take your business to the next level? Discover essential tips from successful entrepreneurs. From market demand to profitability, funding, team-building, and beyond — we've got the roadmap to seamlessly scale your business.

·10 min read Better Business

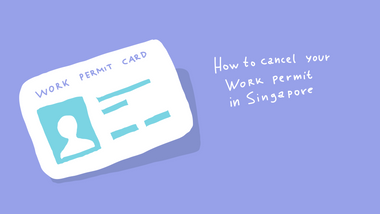

Better BusinessHow To Cancel Your Work Permit in Singapore

Intending to leave your existing employment, or terminate an employee? Don't forget to cancel the existing Work Permit. Read on to find out everything you need to know about Work Permit cancellations in Singapore.

·7 min read Better Business

Better BusinessClosing a Company in Singapore

The decision to close a company that you painstakingly built can be difficult, but it can also be a necessary one. To make the process easier for you, we’ve got you covered. Read on to find out the entire process of closing a company.

·12 min read

Money Talk

Money Talk

Money TalkHow a Revenue-Based Accounting Plan Can Help You Grow

A revenue-based accounting plan offers businesses in their first year of business a flexible approach to financial management and an opportunity to grow their revenues. Learn more about how this strategy can benefit your business.

·3 min read Money Talk

Money TalkUnderstanding the Workflow of Transfer Pricing in Singapore

Affiliated businesses often trade on preferential conditions and thus pay less tax. To prevent that, countries developed a system to control the “family business” — the transfer pricing rules. Let’s see how they influence the prices you set, how to play by these rules and what documents to prepare.

·7 min read Better Business

Better BusinessWhat Is the Singapore Progressive Wage Credit Scheme (WCS)

The Singapore Progressive Wage Credit Scheme (WCS) uplifts low-wage workers by incentivizing employers to raise wages. It bridges income gaps, boosts morale, supports businesses in wage increment efforts, fosters productivity, and promotes a more equitable income distribution within companies.

·7 min read Money Talk

Money Talk2023 Tax Deadlines in Singapore You Need To Know About

One of the most important aspects of running a business includes planning ahead. Kickstart your 2023 by getting a headstart on important tax deadlines, so you can always stay on top of things. Read on to find out more.

·8 min read Money Talk

Money Talk7 Things SMEs Need To Know About the 2023 Singapore Budget

Singapore's Budget 2023 sets out measures to boost local businesses and encourage innovation, amid uncertainties in the global economy. Find out what the measures are, and how it impacts your small business.

·3 min read Better Business

Better Business25 Best Side Hustle Ideas in Singapore for Generating Extra Cash

Get ready to make the most of your free time and earn some extra cash with the 25 best side hustle ideas in Singapore! Turn your passion into a business while you to top up your bank account, find a sense of purpose, or start your own venture. Discover a side hustle to help you achieve your goals.

·17 min read Money Talk

Money TalkImportance of Record Keeping in Singapore & How Long To Keep It

Record keeping is a legal requirement in Singapore, and is crucial for managing costs If you are just starting up your business, it might not be the first thing that comes to your mind, but it can help you establish a strong foundation.

·9 min read Money Talk

Money TalkWhat You Need To Know About Singapore’s GST Rate Change in 2023

Here’s the thing: every Singapore business will experience a major change in 2023 as a result of the GST hike. So, what can you do to prepare for the rate change, and what is the Government doing to help? Here’s what you need to know, all wrapped up in one article.

·5 min read Money Talk

Money TalkA Complete Guide to Ecommerce Accounting

If you’re an online seller looking for help, we’ve got you covered. Here’s your guide to ecommerce accounting, why it’s essential and the basics you need to know to get started. Working through these points will help you decide how much help, if any, you need.

·11 min read Money Talk

Money TalkHow Small Businesses Can Ease the Pain of Late Payments

Late payments are more than just a nuisance – they can affect your company's cash flow severely. In this article, we cover how you can take control of your cash flow and mitigate the risks of late payments.

·5 min read Money Talk

Money TalkHow To Save Electricity for Your Small Business in Singapore

When it comes to running a business, energy is one of the biggest costs. While energy prices are on the rise, you can still minimise the impact. Read on to find out all you need to know about rising energy costs, and how you can save money.

·5 min read Money Talk

Money TalkRecording Charity Donations in Bookkeeping

Other than earning profits, giving back to society can bring about both environmental and social benefits. However, documentation is crucial in tracking your charitable donations. Fret not, for this article delves into how you can record donations in bookkeeping.

·6 min read

That's Osome

Better Business

Better BusinessFinancial Forecasting: A Guide for New Business Owners

Discover the full potential of your Singapore startup through financial forecasting. Gain reliable insights for success and attract investors confidently with Osome's empowering tools. Read our blog today!

·5 min read Better Business

Better Business5 Essential AI Tools Every Singapore SME Should Use

This insightful article outlines five essential AI tools that can revolutionise your SME. From automating mundane tasks to refining the customer experience, understand why SMEs need to embrace AI. Featuring insights from successful Amazon FBA entrepreneur, Ben Alistor.

·6 min read Better Business

Better Business10 Ways To Gain a Competitive Edge on a Budget With ChatGPT

Discover how ChatGPT can revolutionise small businesses in Singapore, providing a competitive edge without straining finances. Explore expert insights from Osome and success stories from entrepreneurs like Ben Alistor who leverage ChatGPT for remarkable results.

·6 min read That’s Osome

That’s OsomeHow Selling Her Belongings Helped Huda Build Two Successful Businesses

Some people make an impact on others. Some people help others make an impact on the world. Entrepreneur Huda Hamid sold her belongings to turn S$800 into a social enterprise. Learn more about how Fempreneur Secrets is changing the lives of female entrepreneurs everywhere, only on the Osome blog.

·3 min read That’s Osome

That’s OsomeEffortless Invoicing With Osome Invoices

Every facet of the invoice process (sending, chasing, getting paid) is now easier than ever with Osome Invoices. And this improvement to your experience will cost you nothing. It’s free. Getting paid faster, with less admin and an unchanged fee? Now that’s Osome.

·3 min read That’s Osome

That’s OsomeOsome Raises $16M in Series A Round to Expand its AI-based Accounting Platform to Global Markets

Osome has raised $16M in a Series A funding from a group of investors including Target Global, AltaIR Capital, Phystech Ventures, S16VC, Ace & Company and Peng T. Ong, who joined as an angel investor

·3 min read That’s Osome

That’s OsomeNewCampus Manages Documents Worry-Free With Osome’s Corporate Secretary

New Campus had set up its operations in Dubai for around 5 years, working with a traditional company secretary company. When they wanted to set up their company in Singapore, venture capital fund 500 startups recommended that they try Osome.

·1 min read That’s Osome

That’s OsomeOsome Wins Singapore Partner of the Year at Xero Asia Awards

A confirmation of Osome’s commitment at innovation and customer service, this is simply a great way to end 2020. Find out more on how and why we won.

·1 min read That’s Osome

That’s OsomeOsome Raises US$3m in Funding from XA Network and AltaIR Capital

The accounting and corporate compliance super app will use funds to further develop its engineering, product development, and marketing.

·4 min read That’s Osome

That’s OsomeOsome Ranks on Singapore’s Top 4 Platinum Partners of Xero

Xero, the global small business platform, awarded Osome with a platinum partner status. This is the highest level of recognition that Xero offers to their counterparts, with only 3 other companies in Singapore holding the title.

·2 min read That’s Osome

That’s OsomeOsome Shines Bright in IMDA SG:D Spark Programme

SG:D Spark Programme by Infocomm Media Development Authority of Singapore (IMDA) will simplify access to various grants and allow Osome to pitch to reference customers, leveraging government demand.

·2 min read That’s Osome

That’s Osome$3 Million Raised To Expand Osome in the UK and Hong Kong

Osome announced a $3 million financing led by Target Global. The new investment will help expand its technology platform to the UK and Hong Kong, and already started testing these markets.

·2 min read

What Is the Singapore Progressive Wage Credit Scheme (WCS)

The Singapore Progressive Wage Credit Scheme (WCS) uplifts low-wage workers by incentivizing employers to raise wages. It bridges income gaps, boosts morale, supports businesses in wage increment efforts, fosters productivity, and promotes a more equitable income distribution within companies.

Registering a Company in Malaysia: A Step-by-Step Guide

Malaysia offers opportunities for foreign businesses with no restrictions on foreign shareholding. Let’s walk you through the process of registering a company in Malaysia, including; the role of SSM Malaysia, business entity types, pros & cons of company registration, and a guide to get started.

Choosing a Virtual Registered Office Address for My Company

Explore the benefits of choosing a virtual registered office address for your Singapore-based company. Learn how it provides flexibility, enhances professionalism, and saves costs. Find out how to select the right virtual office, and discover the cheapest options available in Singapore.

Understanding Singapore’s Foreign Worker Quota and How It Works

Discover how the Foreign Worker Quota in Singapore impacts the hiring practices of companies across various industries. This essential policy measure maintains a balanced workforce and guides eligibility criteria for foreign labour. Learn more about the system's intricacies and its significance.

5 Essential AI Tools Every Singapore SME Should Use

This insightful article outlines five essential AI tools that can revolutionise your SME. From automating mundane tasks to refining the customer experience, understand why SMEs need to embrace AI. Featuring insights from successful Amazon FBA entrepreneur, Ben Alistor.

Defining the Role and Duties of a Non-Executive Director

Osome’s article unveils the world of non-executive directors in Singapore. From understanding their roles in corporate governance, discussing responsibilities and considerations, to comparing with executive directors, we cover it all. Gain insights into how you can excel in this crucial role.

10 Ways To Gain a Competitive Edge on a Budget With ChatGPT

Discover how ChatGPT can revolutionise small businesses in Singapore, providing a competitive edge without straining finances. Explore expert insights from Osome and success stories from entrepreneurs like Ben Alistor who leverage ChatGPT for remarkable results.

Scaling Your Business to New Heights: Tips from Entrepreneurs

Ready to take your business to the next level? Discover essential tips from successful entrepreneurs. From market demand to profitability, funding, team-building, and beyond — we've got the roadmap to seamlessly scale your business.