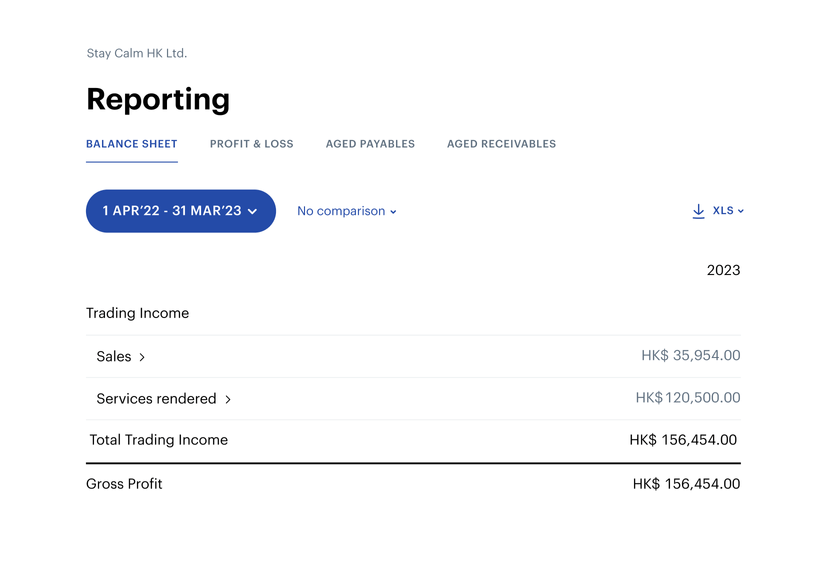

Total transparency and control over your finances

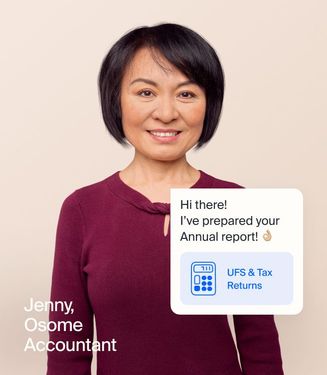

Dedicated accountant

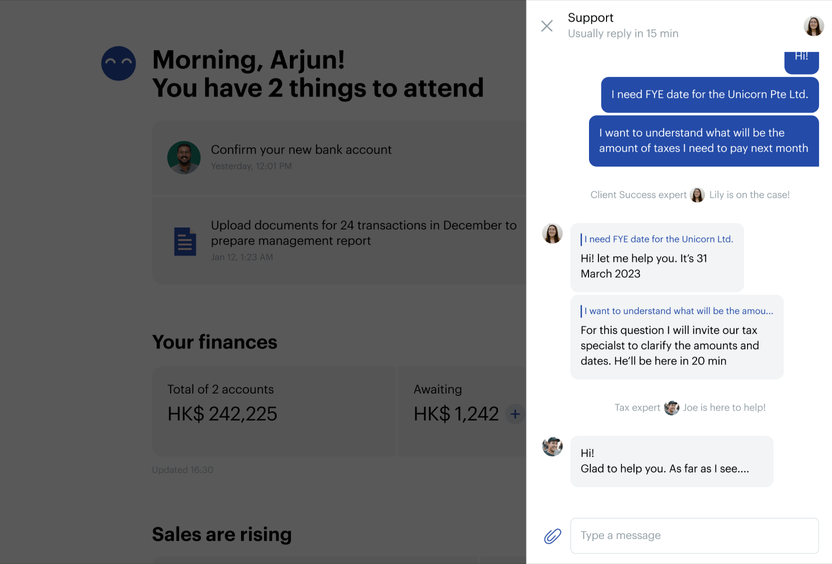

Your dedicated accountant is on-call via live chat and responds within a day.

- Learn more

Audit and compliance filing

Every Hong Kong business must be audited by a certified third-party Auditor, who then submits the results to the Inland Revenue Department.

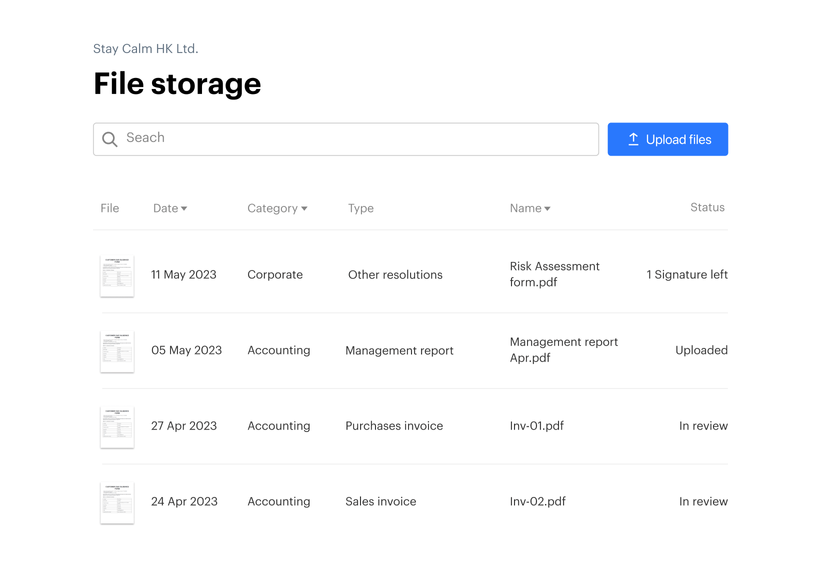

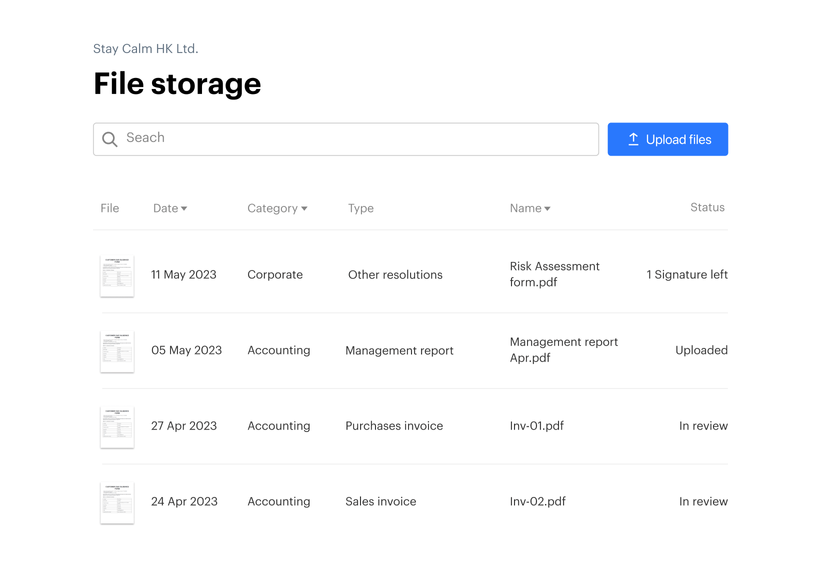

All documents in one place

Securely store all your important documents in one place. We automate the upload of bank statements, invoices, bills, and expenses for easy tax filing.

Unlimited bookkeeping

Bookkeeping is included in your package. We'll take care of your financial records, taxes and reconciliation of transactions.

Accounting services for every business, from startups to those scaling

Startups

Ambitious startups need flexible, proactive accounting services. We prepare financial statements and handle bookkeeping to give your business the support it needs to grow.

Entrepreneurs

As a founder, your time should be focused on building your business. We'll be your trusted adviser, providing bookkeeping and easy-to-access accounting support.

Corporations

As your business grows, so does our support with you. Our services will adapt to increasing turnover and evolving business needs.

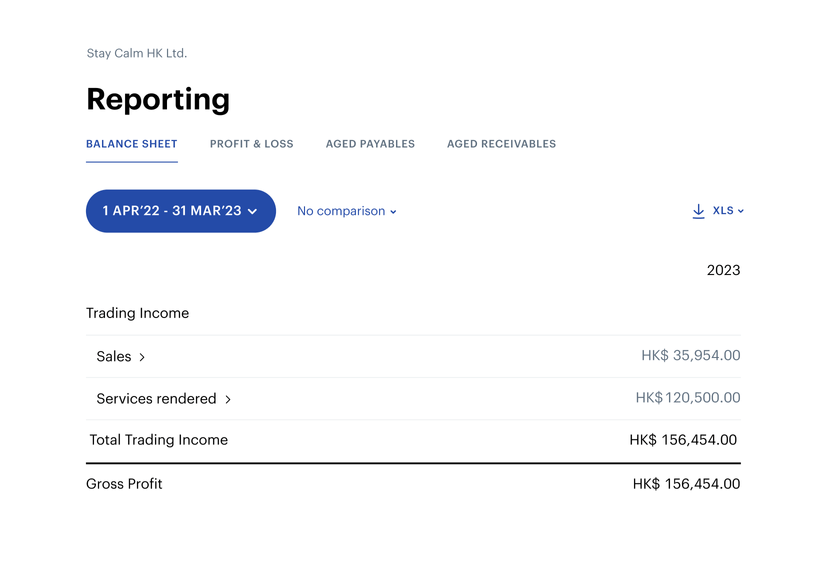

Keep your finger on the pulse of your business finances

Experts who get to know your business

Get a personal accountant from day one. Our local team prepares your accounts and seamlessly manages the third-party audit and delivery to the Inland Revenue Department. Stay complaint the stress-free way.

Pay the right tax

We'll help you navigate the Hong Kong tax system, including rates and local allowances, so that you can do business while remaining compliant.

Never miss a deadline

We ensure you never miss a filing deadline with our streamlined processes, so you don't have to worry about nasty fines.

Bookkeeping?

Easy-to-use tools to handle all your business operations

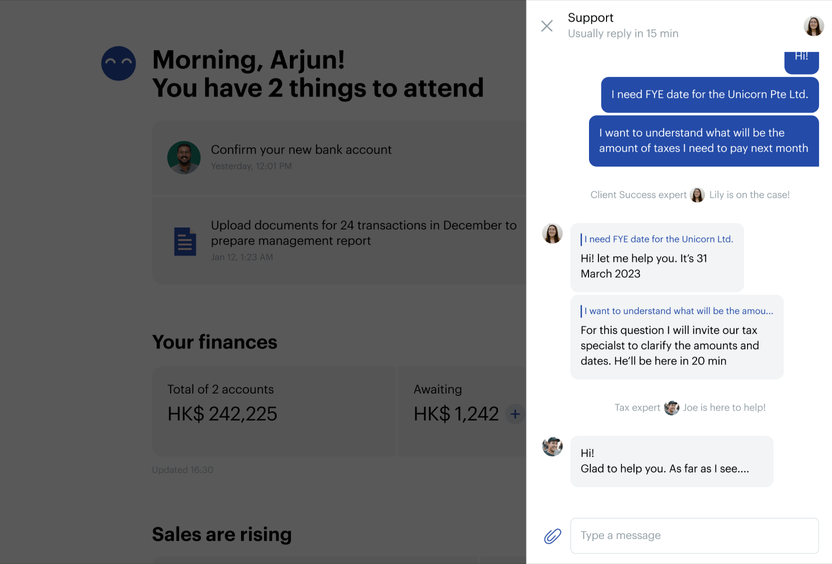

Consistent support from your accountant

Get answers and expert guidance within 24 hours from your accountant via live chat.

From bookkeeping to filing tax

We process documents within 24 hours, giving you an updated snapshot of your financials when needed. We'll file your reports when the time comes — you just need to sign and click ‘approve’.

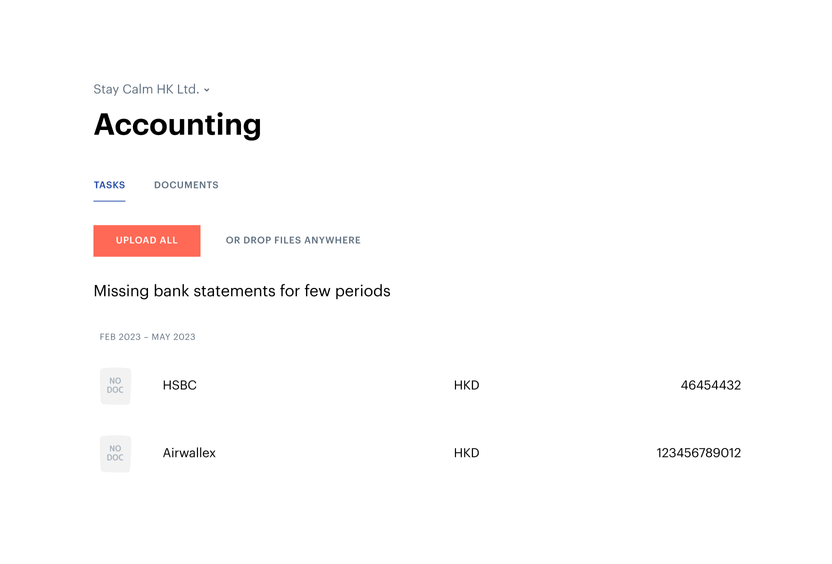

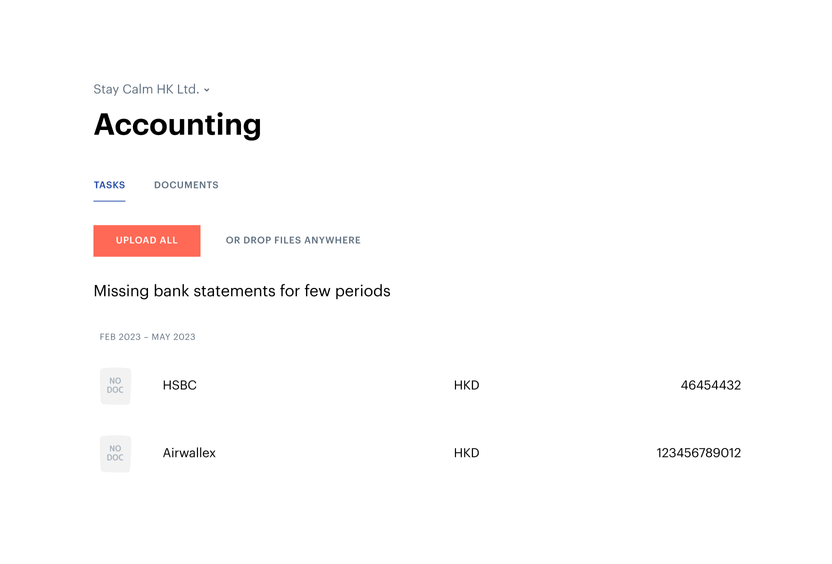

Timely reminders on missing data

We nudge you for any missing documents necessary for reporting and make it easy for you to upload them.

Easy storage of documents in one place

All your company and accounting documents are stored securely in one place where nothing gets lost.

Plans suited to your business

Mini

Monthly revenue under HK$30k

HK$288/mHK$3,456 billed annually- Accountant's support

- Response within 24 hours via in-app chat

- Annual review by accountant

- Unaudited Financial Statements

- Annual management report

- Bookkeeping & Accounting software

- Own accounting software

- Annual automated bookkeeping

Starter

Monthly revenue under HK$60k

HK$600/mHK$7,200 billed annually- Accountant's support

- Dedicated accountant

- Response within 24 hours via in-app chat

- Annual review by accountant

- Unaudited Financial Statements

- Monthly management report

- Bookkeeping & Accounting software

- Own accounting software

- Regular automated bookkeeping

- Bills & receipts upload & categorisation

Booming

Monthly revenue under HK$150k

HK$1,167/mHK$14,000 billed annually- Accountant's support

- Dedicated accountant

- Response within 24 hours via in-app chat

- Monthly review by accountant

- Unaudited Financial Statements

- Monthly management report

- Bookkeeping & Accounting software

- Own accounting software

- Regular automated bookkeeping

- Bills & receipts upload & categorisation

Rocking

Monthly revenue under HK$300k

HK$1,334/mHK$16,000 billed annually- Accountant's support

- Dedicated accountant

- Response within 24 hours via in-app chat

- Monthly review by accountant

- Unaudited Financial Statements

- Monthly management report

- Bookkeeping & Accounting software

- Own accounting software

- Regular automated bookkeeping

- Bills & receipts upload & categorisation

Unicorn

Monthly revenue under HK$600k

HK$1,500/mHK$18,000 billed annually- Accountant's support

- Dedicated accountant

- Response within 24 hours via in-app chat

- Monthly review by accountant

- Unaudited Financial Statements

- Monthly management report

- Bookkeeping & Accounting software

- Own accounting software

- Regular automated bookkeeping

- Bills & receipts upload & categorisation

What our clients think about Osome services

“We saved a lot of time which we could reallocate to scaling our business”

91 %of customers recommend Osome services

“Accounting, audits, and any raised question was resolved quickly and professionally — an exceptionally good service level!”

Arif Dewi

FAQ

Why should my small business or startup outsource an accounting service?

As a small business owner, you’ve shouldered the work of bookkeeping yourself to keep a close eye on your expenses. As your business grows, most owners find that their time is better served on focusing on their products and services, rather than your accounting debits and credits. Outsourcing these tasks means hiring a service that provides a full accounting department experience. You can outsource everything from day-to-day accounts receivable, accounts payable, payroll, transaction coding, filing Profits Tax Return, to financial reporting.

What accounting software do you use?

We have developed our own tools. We recognise invoices and receipts, reconcile them with transactions, and update your documents and outstanding bank balance daily. We support single and multiple currencies, show the actual list of all unpaid invoices and report to you if any document is missing.

In what form should I submit my data?

Send us your records in whichever format you have them. Drop your files in our app, store them in a cloud, or email them to our experts — they’ll take care of the rest.

What are my tax filing requirements?

All companies are required to submit Profits Tax Return annually. A newly incorporated company will receive the first Profits Tax Return after 18 months of incorporation. Three months will be allowed for preparing the accounts and audit report for the first profits tax filing. Thereafter, the tax return should be filed with the deadline depending on the Company’s Accounting Year End Date.

Employer’s Return of Remuneration & Pensions is required annually as well. Companies that have hired employees should report the salary and wages paid to employees for each fiscal year (April to March) in April every year.

Why choose Osome as an accounting and bookkeeping service provider?

When you’re ready to take your business to the next stage of growth, you’ll want to hand over the routine and administrative tasks like accounting and bookkeeping to trusted experts who know what the entrepreneurial grind is like.

We help small businesses in Hong Kong with all the necessary accounting services. We prepare financial statements and handle bookkeeping. The accounting advice would save you time from figuring this out on your own and save costs by being compliant with the local authority instead of paying late fees or penalties which can add up to a huge sum.

You don’t only get your dedicated accountants with Osome, you also get access to all your documents and financial data anywhere you want to work, using our app. All your documents are digitized and stored securely on the cloud.

What is cloud accounting?

Cloud accounting, also known as online accounting, involves hosting the accounting software on remote servers. It contains the same functionality as desktop accounting. However, the entire process gets moved to a cloud system. This is similar to the PaaS (Platform-as-a-Service) business model. The data gets sent to a different location, where it is processed and returned to the user or client.

What’s more, users can access software applications remotely using the Internet or Intranet. For a Hong Kong accounting firm, employees from other departments can access the same data and software version without missing any updates. Cloud accounting software also frees the business from having to install and maintain software on individual desktops. It’s a type of online accounting that essentially enables users to get real-time reporting and visibility.

Furthermore, most cloud platforms have API functionality. With this, third-party software can connect to your system to provide even more value through your business accounting.

How does pricing work?

Our pricing is revenue based. We don’t charge on the number of transactions in your account or the number of invoices you upload. All prices are based on the financial year, not the calendar one.

Fresh insights from our business blog

How Machine Learning Can Help Tech Business Owners

In the dynamic landscape of the tech industry, machine learning has become a transformative force for Hong Kong business owners, offering unparalleled opportunities for growth, efficiency, and innovation. Learn more about it’s potential for your business.

How Profit Tax Exemptions Work for Hong Kong Companies

In Hong Kong, tax exemptions are applied to profits received from offshore funds. Here’s how to apply so your offshore company can benefit.

Mastering Financial Forecasting for New Business Owners

Discover the full potential of your startup through financial forecasting. Gain reliable insights for success and make attracting investors a breeze with clear financial projections. Visit Osome today for the tools to empower your startup's financial future.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?