Fiscal Year: What Is It and Why Does It Matter?

In Singapore, companies have the flexibility to select their fiscal year-end based on their business needs. It can align with the calendar year, financial quarter-ends, incorporation anniversary, seasonal cycles, or business cycles. Find out more in this article written by Osome experts.

Key takeaways:

- A fiscal year is a 12-month period that a company selects to report its financial information.

- A fiscal year includes financial reports, external audits, and federal tax filings, all of which are based on the company’s fiscal year.

- Depending on the nature and revenue cycle of their business, companies may choose to report their financial information on a non-calendar fiscal year.

Skip to:

What Is a Fiscal Year?What Is a Financial Year End in Singapore?

How To Determine an FYE for a New Company in Singapore

Advantages and Disadvantages of Fiscal Years

What Is the Difference Between a Fiscal Year and Calendar Year?

IRAS Requirements for Fiscal Years

Examples of Company Fiscal Years

Where Can I Get Advice About My Company's Fiscal Year-End?

Conclusion

What Is a Fiscal Year?

In Singapore, a fiscal year, also known as a financial year, is the 12-month period used by businesses and organisations for financial reporting and tax purposes. The fiscal year typically starts on April 1st and ends on March 31st of the following year. However, companies have the flexibility to choose their fiscal year end, as long as it aligns with the statutory requirements and is consistent from one year to the next. For example, some businesses may choose a fiscal year that aligns with their industry's peak season, while others may choose a fiscal year that aligns with their budgeting and forecasting cycles.

Fun fact: did you know that the concept of a fiscal year has existed for centuries? The ancient Egyptians were one of the first civilisations to use a fiscal year based on the Nile River's annual flooding. They would divide the year into three seasons: Akhet (inundation), Peret (growth), and Shemu (harvest). This allowed them to plan their agricultural activities and manage their resources effectively.

After selecting your fiscal year-end date, you must inform the IRAS about it since the deadlines for unaudited financial statements, annual reports, and tax filings are contingent on this date. When outsourcing accounting services for Singapore companies, they will handle this information and relieve you of the burden of preparing the necessary documents per the designated timeline.

What Is a Financial Year End in Singapore?

The Singapore Financial Year is crucial to the country's financial system. As a hub for global business and finance, Singapore follows a unique fiscal calendar that differs from the calendar year used in many other countries. Singapore's financial system is renowned for its stability, transparency, and efficiency. It encompasses various institutions and services that facilitate economic growth and investment. Understanding the key players in Singapore's financial market is essential to comprehend the intricacies of the Singapore Financial Year.

For businesses operating in Singapore, adherence to national regulations is critical when submitting annual returns and tax documentation annually. This requirement is determined based on your financial year-end, referred to as a fiscal year in accounting. As mentioned earlier, the fiscal year does not necessarily align with the calendar year and can commence or conclude on any day of the year. Nevertheless, the standard duration for a fiscal year is typically 12 months, mirroring that of a calendar year.

How To Determine an FYE for a New Company in Singapore

According to the Accounting and Corporate Regulations Authority (ACRA), common choices by companies for the end of a financial year in Singapore include 31 March, 30 June, 30 September or 31 December. Based on the Singapore Companies Act, a fiscal year normally begins on the day of company incorporation and ends on the day of your choice. However, your first financial year cannot be over 18 months (unless the Registrar allows you to extend it). Any subsequent fiscal year should be 12 months long; it starts on the day following the end of the previous financial year and ends on the anniversary of your first financial year-end.

It’s essential to make an informed decision when selecting your company’s FYE at the time of incorporation. Something else to keep in mind is that you’ll also need to choose whether your accounting period covers 12 months or a timeframe of 52 weeks.

How Long Should My Company's First Fiscal Year Be?

While your very first fiscal year can be as long as 18 months, the IRAS — the national tax administrator — operates within 12-month-long periods. Any period longer than 12 months will be split and assessed as 2 independent periods, even if, from your point of view, this accounting period is a single financial year. When considering this, you can see how it may directly affect the taxes you’ll need to pay, especially if you want to make use of tax exemption schemes. This is why it’s important to consider what exemptions you’d like to file for before you set the date of your first FYE.

Can I Change My Company's Financial Year End?

You can change the end of the financial year only for the current or previous fiscal year. However, you cannot change your FYE if statutory deadlines for holding your company’s Annual General Meeting (AGM), submitting annual returns or filing financial statements have passed.

You can change your FYE by sending a notice to the Registrar to put this process into action, but you’ll need the Registrar’s approval if:

- The change in FYE will make your financial year longer than 18 months,

- It’s the third request for the change of FYE

- The FYE was changed within the last 5 years (from the last changed FYE)

Advantages and Disadvantages of Fiscal Years

Advantages of Fiscal Years

Utilising fiscal years for financial reporting and planning has several advantages.

- Alignment with Business Operations: Setting a fiscal year that aligns with your business cycle allows for smoother financial management and reporting. It helps track revenues, expenses, and financial performance in a manner that corresponds to your operational activities.

- Flexibility in Reporting: Unlike the calendar year, a fiscal year can begin or end on any date within the year. This flexibility allows businesses to select a fiscal year-end that best suits their needs, considering factors such as seasonal fluctuations or industry-specific considerations.

- Enhanced Financial Analysis: Fiscal years provide a consistent and standardised financial analysis and comparison time frame. The benefit is that annual financial statements covering a full fiscal year make it easier to identify trends, evaluate performance, and make informed strategic decisions.

- Tax Planning and Compliance: Fiscal years can impact tax planning and compliance. By strategically selecting a fiscal year-end, businesses can optimise their tax positions, align tax reporting with business cycles, and effectively plan for tax obligations.

- Simplified Regulatory Compliance: Many regulatory requirements and deadlines, such as annual reports and tax filings, are tied to the fiscal year-end. The pro of this is that, by adhering to a consistent fiscal year, businesses can streamline their compliance efforts and ensure the timely submission of necessary documents.

- Consistency in Financial Forecasting: A fixed fiscal year provides a foundation for accurate financial forecasting and budgeting. It allows businesses to project future revenues, expenses, and cash flows based on historical data and trends observed within the fiscal year period.

Disadvantages of Fiscal Years

While there are several advantages to utilising fiscal years, it's also essential to consider the potential disadvantages.

One drawback is that using a non-calendar fiscal year may create challenges in aligning financial data with external stakeholders who follow a standard calendar year. This misalignment can lead to confusion and difficulties in comparing financial information across different entities.

Additionally, selecting a fiscal year that doesn't align with the natural business cycle or industry norms may make financial planning and forecasting less intuitive.

Another con is that it can complicate tax planning and compliance efforts, as businesses may need to adjust reporting and calculations to fit within the fiscal year framework. Lastly, changing the fiscal year-end can disrupt financial continuity and historical trend analysis, making it harder to track long-term financial performance accurately.

What Is the Difference Between a Fiscal Year and Calendar Year?

Differences in Time Frames

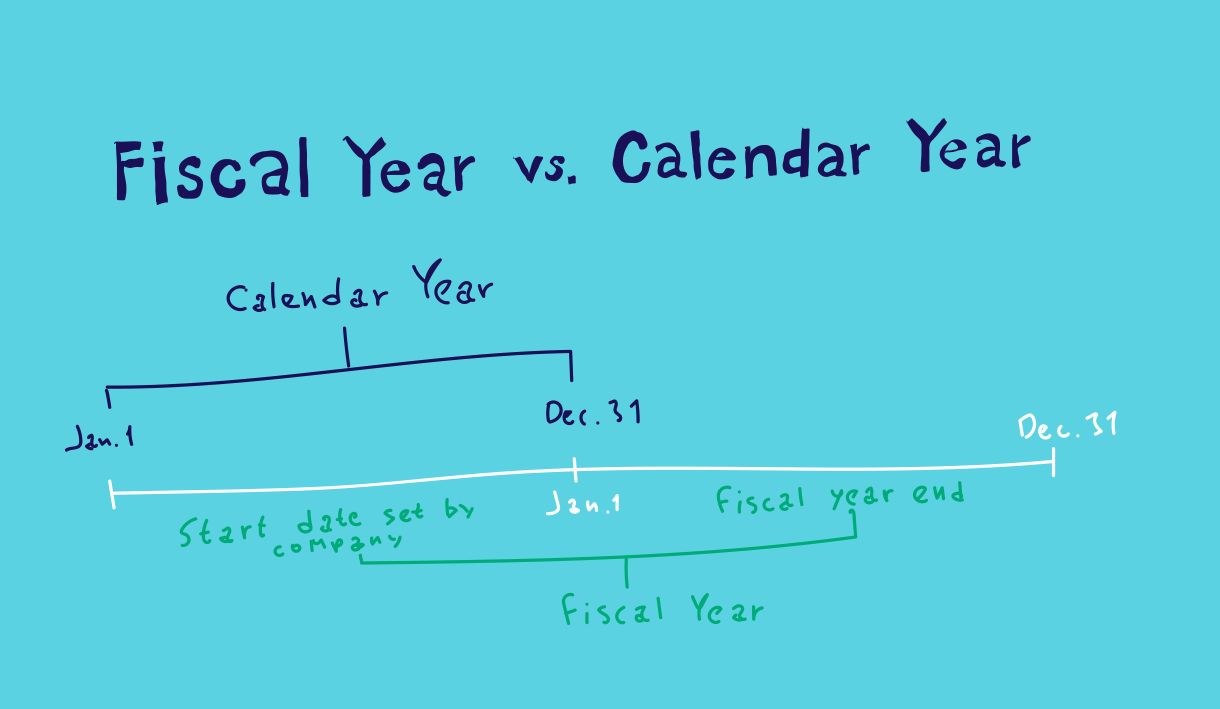

One of the primary differences between fiscal and calendar years lies in their time frames. While a fiscal year can start on any date, a financial year follows the calendar year, starting on January 1st and ending on December 31st. This difference can impact financial reporting and planning practices within a business.

In the United Kingdom, for example, the concept of the fiscal year is slightly different from that of the financial year. The fiscal year in the UK starts on April 6th and ends on April 5th of the following year. This peculiar time frame is rooted in historical reasons and originates in the Julian calendar, which was used in the UK until 1752. The shift from the Julian to the Gregorian calendar caused a discrepancy, resulting in the unusual April 6th start date. This unique arrangement adds an interesting twist to the British fiscal year.

Moreover, it is worth noting that fiscal years can be different for various countries worldwide. For instance, in Australia, the fiscal year starts on July 1st and ends on June 30th; in India, it begins on April 1st and concludes on March 31st. These variations reflect the diverse cultural and historical factors that influence the definition of fiscal years globally.

Differences in Purpose and Use

Another significant difference is the purpose and use of fiscal and financial years. Organisations often choose a fiscal year to align with their operational cycles or industry standards. In contrast, a financial year that follows the calendar year is commonly preferred for ease of reporting and tax filing.

Within the realm of fiscal years, additional distinctions can be explored. In the United States, for example, the federal government's fiscal year begins on October 1st and ends on September 30th. This particular time frame coincided with the agricultural cycle prevalent during its inception. By starting in October, the government could account for the harvest season and the subsequent financial activities of farmers.

Furthermore, the choice between fiscal and financial years can affect international businesses. Companies operating in multiple countries often face the challenge of aligning their financial reporting across different fiscal year periods. This requires careful coordination and adjustment to present accurate and consistent financial information.

While fiscal and financial years in line with the calendar year share similarities in terms of purpose, they also exhibit distinct characteristics in their time frames and usage. Understanding these differences is crucial for businesses and individuals alike, as it can influence financial planning, reporting, and compliance with tax regulations.

IRAS Requirements for Fiscal Years

In Singapore, the tax authority is known as the Inland Revenue Authority of Singapore (IRAS). The IRAS company annual filing requirements regarding fiscal years for tax purposes need to consider:

- Determining Fiscal Tax Year: Singapore companies can choose their fiscal tax year, which does not need to align with the calendar year. The fiscal year can commence and end on any date within the tax year.

- Consistency: Once a fiscal year is selected, it is generally expected to remain consistent over time. Changing the fiscal year-end may require approval from the IRAS and should be supported by valid reasons.

- Duration: The fiscal year is typically 12 months long, similar to a calendar year. However, a company's first fiscal year can be shorter or longer than 12 months, depending on its incorporation date.

- Financial Statements and Tax Filing Deadlines: The deadlines for submitting unaudited financial statements, annual reports, and tax filings depend on the chosen fiscal year-end. The IRAS provides specific tax year due dates, and companies must comply with these deadlines to fulfil their reporting obligations.

- Tax Assessments: Upon filing the annual tax return, the IRAS will assess the tax payable for the fiscal year based on the financial information provided. Any discrepancies or issues may be subject to review, audits, or further inquiries from the IRAS.

It is essential for businesses operating in Singapore to be aware of the specific requirements and deadlines set by the IRAS regarding fiscal years and comply with them to ensure proper tax compliance and reporting. It is advisable to consult with accounting professionals or seek guidance from the IRAS directly for any specific inquiries or clarifications.

Examples of Company Fiscal Years

In Singapore, companies have the flexibility to select their fiscal year-end based on their specific business needs. While the choice ofthe fiscal year may vary across companies, here are a few examples of fiscal years commonly observed in Singapore:

- Calendar Year: Align the fiscal year with the calendar year (January 1st to December 31st).

- Financial Year-Ends: Correspond fiscal year with financial quarter-ends (March 31st, June 30th, September 30th, or December 31st).

- Anniversary of Incorporation: Set fiscal year-end based on the company's incorporation date (e.g., June 15th to June 14th of the following year).

- Seasonal Considerations: Choose a fiscal year that aligns with the industry's seasonal cycles (e.g., high-demand holiday season).

- Business Cycle Alignment: Align the fiscal year with a unique business cycle, considering project timelines, contract renewals, and industry fluctuations.

The chosen fiscal year should be well-suited to the company's operational and reporting requirements while complying with the regulations of the IRAS.

Where Can I Get Advice About My Company's Fiscal Year-End?

If you have more questions regarding changing the FYE of your company, you don’t have to figure it out yourself. Drop us a question any time of the day, and our experienced corporate secretaries in Singapore will get you on your way!

Conclusion

All-in-all, your Singapore company’s fiscal year is entirely dependent on what suits you — that’s the joy of opening a company in this magnificent country! Think about your industry and when you incorporated your business, and what makes sense or is easiest when determining your fiscal year. For more guidance on this, get in touch with one of our experts.