Alternative Ways to Finance SMEs

Funding Societies is the largest digital SME Lending platform in Southeast Asia, with a mission to enable fast and effortless access to funds by bringing SMEs and investors together on its platform. The concept is also popular as Peer-to-Peer (P2P) lending or Debt Crowdfunding. Since 2015, the fintech company has helped a number of small & medium enterprises grow their businesses, and in the process helped individual/ institutional investors to grow their investment portfolio.

SMEs usually fail to meet the credit criteria of traditional financial institutions because of their low to zero credit track record and lack of assets to pledge. As a result, they are largely underserved. 51% of Southeast Asia’s SMEs, although filled with economic potential, have been denied affordable credit, if at all. Where could they turn to?

With up to 58% of the ASEAN GDP coming from SMEs, SMEs must get the financing they need especially as economies are rebuilding and recovering from the impact of Covid-19. However, 41% of formal micro, small and medium enterprises (MSMEs) in emerging markets currently have unmet financing needs or requirements, according to the SME Finance Forum. This funding gap presently stands at around $5 trillion, which is notably 1.3x the current level of available financing. The way to bridge this lending gap is to turn towards alternative financing solutions.

Government Support Facilitates Acceptance of Alternative Financing

5 years ago, there were no regulations and minimal awareness about Peer-to-Peer (P2P) lending in this part of the world. It was considered expensive by SMEs and risky by investors. Nowadays fintech is getting a lot more attention and resources from regulators and Governments, who are realising the importance of technology in financial services as an enabler for better products, services and reduced costs for the end consumer.

With more education by platforms and support from Governments and regulators in terms of licenses, recognition and inclusion, alternative financing has become more mainstream. Within the last few months, we have seen unprecedented support and cooperation from the Singapore government. We received a tax exemption for retail investors’ earnings, increasing net returns for the investors and stimulating funding. We were also acknowledged as a Participating Financial Institution under the Enterprise Singapore's Enterprise Financing Scheme, among the first fintech companies to be recognised this way. These steps towards recognising the role and potential of Alternative Financing show the importance of these sources for future SME growth.

A More Competitive Banking Landscape with Digital Banks

The Covid-19 pandemic has also accelerated remote and contactless transactions, providing the impetus for the establishment of digital banks. Digital Banks will be more common in the next few years across the world. The Hong Kong Monetary Authority (HKMA) hopes to promote fintech, innovation and CX with eight new virtual banks. The Monetary Authority of Singapore (MAS) in Dec 2020 announced that it will award digital full bank licences to the Grab-Singtel consortium and tech giant Sea, for the first time in history.

Like traditional banks, these players will offer retail customers with services such as opening accounts, deposits in addition to issuing debit and credit cards. However, digital banks will not have a physical presence and all banking services will be done online. This news means that banks will become more competitive in their offerings to further benefit the end-user. This gives more power and choice to consumers as the entrance and popularity of digital lenders have increased healthy competition in the nation’s financial landscape.

Covid-19 has also accelerated the need for partnerships between traditional financial institutions (FI) and fintechs. FIs are beginning to realise that fintechs can offer the speed, flexibility and convenience that customers demand today. However, this is not to say that fintechs are competing with incumbents for a portion of the pie. Instead, fintechs are complementary to FIs, addressing primarily the under-served or unserved segments.

Underserved SMEs Turning to Alternative Financing

Due to social distancing norms and limitations in meeting customers face to face, it became difficult for traditional financial institutions to provide loans to SMEs. Even if they could, the turnaround time was a lot longer and requirements a lot stricter due to heightened risks in SME lending. Naturally, banks were sceptical of SMEs performing in this economic climate. Even established SMEs have found it difficult to get loans and are recognising the need to look for digital financing alternatives both from a viability perspective as well as the speed of disbursement.

Specifically, within the SME population, we have seen more willingness to use online resources for their financing needs. At Funding Societies, we noticed a spike in the application of loans between April to August 2020. So far we have given out S$1.9 billion in funding across more than 3.3 million loans throughout the region. We think there will be a spike again once government assisted schemes and grants have tapered off.

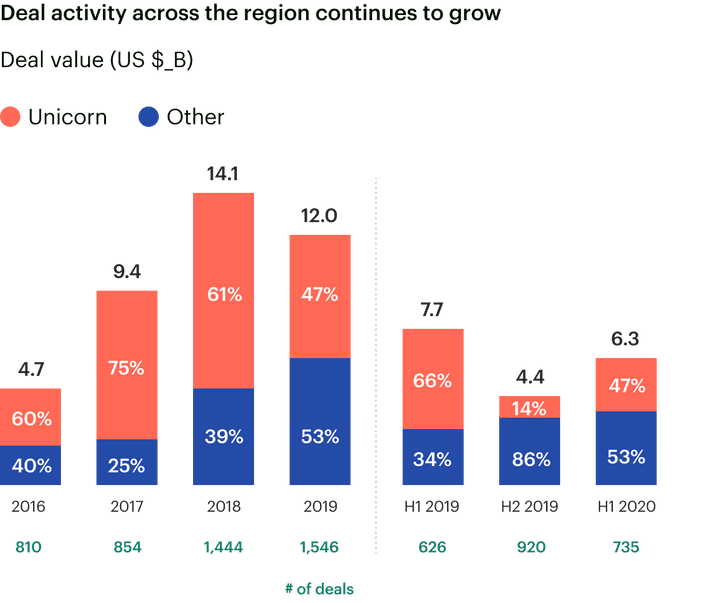

Source: Industry reports, VC partners, Bain Analysis. Note deals include investments by Venture Capital, Private Equity, and Strategic Investors

Digitalising the Financing Process Brings More Growth, Control and Convenience

Where face-to-face contact is limited to the extreme, Covid-19 has made it clear that digitalisation is important in the financing process. Fintech’s advantages of operating fully online without the need for a physical touchpoint (ie. bank branch) has become more apparent during the pandemic.

Cash used to be king in most SE Asian regions. Around 70% of all transactions In the Philippines, Thailand and Indonesia were still settled with cash, according to a 2017 PayPal study. However, we have witnessed that consumers are now more open to online solutions. For example, recently, thousands of migrant workers who previously only dealt in cash for receiving salaries and making payments, opened bank accounts to be able to send money home.

Besides workers remitting money home, the new generation of consumers prefers to conduct all their financial transactions on their own rather than depend on their financial advisors or relationship managers. This convenience and control have meant that more and more consumers are adopting investments such as P2P and Robo-investing, and even banks which were traditionally reliant on teams of Relationship Managers are increasingly rolling out self-serve investment products, further expanding the investment landscape.

Conclusion

Covid-19 has accelerated SMEs’ adoption of technology, in particular digital financing, to serve their financial needs. Additional Government support, healthy competition between Digital and Traditional Banks, and more convenient options for business owners to manage their finances signal a bright future for the alternative financing space in spite of, or perhaps because of, this crisis.