Investing in the Disruptors of Tomorrow

Alex ZhuravlevPortfolio Director, Altair Capital

You might have thought investment stalled during the pandemic. Surprisingly, it didn’t. Across Southeast Asia more deals were struck in the first 6 months of 2020 than 2019. Though many of them were likely agreed upon before the COVID, investors remain cautiously optimistic about the future.

Who got the money

Uncertainty shrank deal sizes: there were more deals struck, but less money raised. Part of it is due to unicorns receiving fewer deals. That gave way to companies with smaller appetites, many of them in the early stage. 95% of the transactions were Seed, Series A, and Series B investments.

What industries are attractive

Some of the obvious recipients have been e-commerce, food and groceries delivery, and online media. Online travel has understandably stalled though investors still consider that in the future the industry will get its performance back.

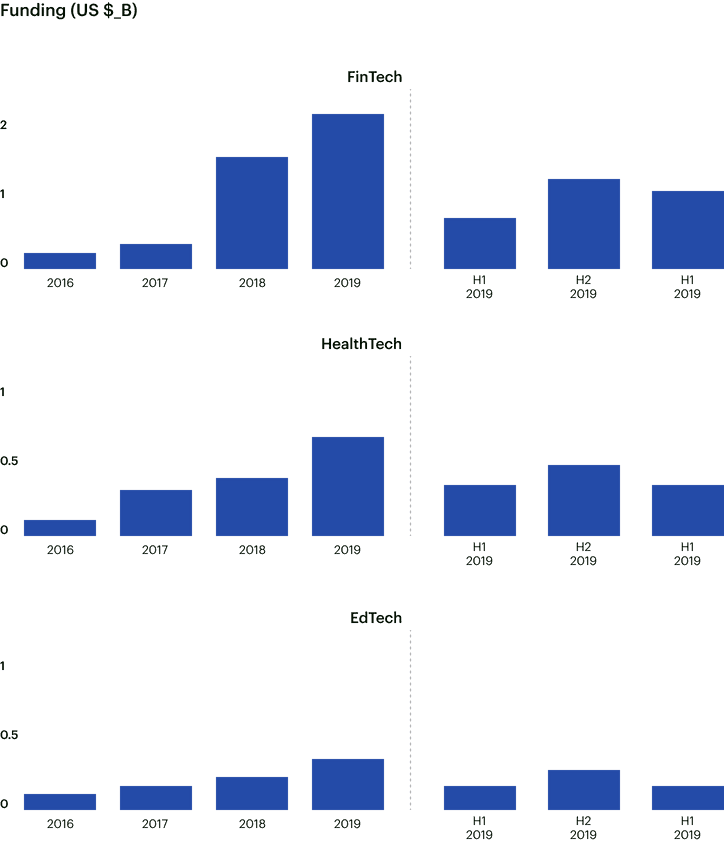

And then there are the 3 industries on the rise gaining investors’ attention: fintech, healthtech, and edtech.

Fintech has seen the most momentum in 2020, growing both in number of deals and size of investment. This segment is less mature and consolidated than e-commerce, which might mean that investors will still explore it in the years to come.

Healthtech and Edtech are still relatively small. In 2020, these industries have arguably made the biggest leap in terms of attracting new customers, most of them for the very first time. Numbers suggest the customers will stay, and then so will investors.

Source: E-conomy SEA 2020 Google, Temasek, Bain & Company report

How to get funded

The tide of the pandemic seems to have eased in Southeast Asia, so investors feel cautiously excited. There’s also money to be spent: funds have reported record capital levels in 2019, and much of that cash has yet to be committed. However, thanks to the lessons of the COVID crisis, investors have become pickier.

Be sustainable

Investor appetite for sustainable business models has started growing before the pandemic. Yet the crisis has accelerated this trend. 2-3 years ago many startups would ‘blitzscale’ - burn cash to acquire market share fast. This kind of approach has lost its appeal as investors tend to favor more sustainable growth models instead.

Find a niche

The way to become attractive may vary depending on the industry. Competing in e-commerce, for one, is hard: startups are aplenty, and many large companies come to the market with deep pockets. So either find a niche that makes you stand out against others, or go into a different industry altogether (medtech and healthtech grow nicely and are less populated as of yet).

Streamline

Take Grab for example: Southeast Asia's largest unicorn decided to sunset any non-core projects back in June. Focusing on their 3 main lines of business: transportation, delivery, and financial services, has helped maintain profitability. Grab now says their revenue is currently about 95% of pre-COVID level.

Bigger part of customer’s wallet

This means that instead of being everything for everyone, your business should focus on what you’re best at. Get a bigger part of your customer wallet before trying to bite a bigger market share.

In order to look attractive for the investors right now, you have to make a smart choice regarding how you grow your business. Focus on your core products and services and get rid of the distractions. Build loyalty and a bigger share of the customer’s wallet rather than being in a constant recruiting game. Now that seems like a great business to pitch.