- Osome UK

- Invoicing

Online invoicing?

It's a breeze

Understand how much money is coming into your business cash flow, create and send invoices, and get paid faster.

Get full control of your business finances

Get paid faster with PayPal

Create invoices and give your customers secure way to pay. Activate PayPal and accept credit and debit card payments — your customers don’t even need a PayPal account.

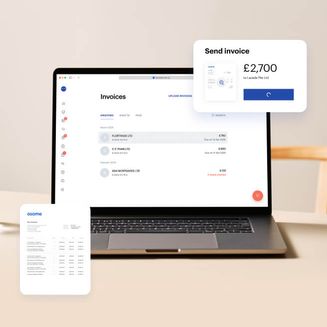

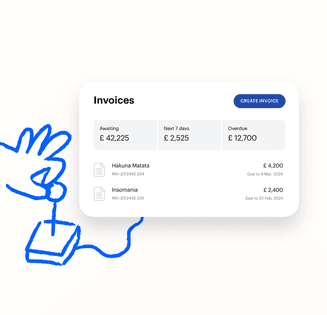

Keep on top of your finances

Your dashboard gives you a quick and confident overview of all your invoices, what's due, what's overdue and what's been paid.

Get invoicing done quicker

Set up your invoice template, save customer details and send invoices to customers quickly and easily.

Automatic tax reporting

Our app pulls your transactions, automatically applies tax codes, prepares tax records and makes sure you're fully tax compliant – giving you the time to focus on the important stuff.

Get things done with Osome

- Learn more

Integrations

Connect your marketplaces and bank accounts to see real-time sales, returns, and fees and make smarter business decisions.

- Learn more

Accounting

Your dedicated accountant will know your business inside out, helping you manage your taxes, VAT reports and more.

- Learn more

Ecommerce

Automate bookkeeping from all your sales platforms and lean on your accounting expert who understands ecommerce business.

- Learn more

Reporting

Сlearly see how your business is doing at any point in time, take action, and make your business more profitable.

- Learn more

Expenses

Organise your expenses and stay compliant when you declare your personal spending.

- Learn more

Payments

Capture bills, receipts, and have a complete control over what’s due and when.

Osome who?

We're glad you asked

We power small businesses with financial management tools and a dedicated accounting expert to maximise your business success.

Lean on your dedicated expert

You can't trust a robot for all your financial and business needs. So you'll get one of our friendly, loveable accounting experts as your dedicated go-to. Think of it as having a Financial Director – without the cost.

Smart software made for business owners

That said – robots are nice when used right. We automated menial tasks – collecting documents, recognising accounts, assigning tax rates, preparing draft reports, etc. Where necessary, our robots reroute their output to a human expert so that you can be compliant with confidence!

What our clients think about Osome

“Osome just made everything easier.”

91 %of customers recommend Osome services

“They’ve been a great help with accounts and VAT returns, answering any questions and helping me stay on top of things.”

Sarwech Shar

FAQ

How can I send my customers an invoice?

There are three ways you can create a simple invoicing process:

- Via Post. You can send invoices via post for customers who do not often check their emails. However, using the post is a much slower invoicing method. It is also less secure and harder to reach customers directly since registered addresses can often change.

- By Email. Business invoicing via email is a popular and easy method. Additionally, email invoices do not get lost. You only need to double-check the address before sending an email to ensure the right person receives your invoice.

- Using E-Invoicing. Online invoicing or e-invoicing is the fastest and most efficient method. After creating an invoice using a reliable software app like Osome, you can send a secure link to your customers. You can even see whether customers have opened the invoice. E-invoices also have a ‘pay now’ button that makes it easier for customers to pay online instantly using a debit/credit card or via payment channels like PayPal.

How can I automate my billing system?

You can automate your invoicing process by using a software application or hiring a service provider.

Automating your billing method will help to streamline the account receivable/payable functions by giving automatic reminders to customers or making payments to suppliers for recurring invoices automatically.

Automation software (or application) extracts invoice data and inputs this data seamlessly into your ERP to coordinate the generation of cash flow for your business. Invoice automation eliminates the need for labor and manual data entry efforts by providing efficiency and accuracy.

What is included in the Osome service package?

Osome can take care of all the accounting, bookkeeping, and invoicing requirements of your business registered in the UK.

Regardless of whether you have a sole trading business, a non-UK enterprise, or running a multinational company, you can rely on Osome for full-service online accounting support.

Osome service packages are below:

- Operate.For business owners who want to ensure they tick all basic compliance boxes as they kickstart their business. From £65 per month.

- Grow. For businesses nearing VAT registration, seeking up-to-date analytics and consultations for informed decisions. From £124 per month.

- Scale. For busy entrepreneurs juggling multiple roles, freeing up time from financial complexities for business growth. From £208 per month.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?