- Osome SG

- Incorporation for Foreigners

For foreign entrepreneurs: set up a company in Singapore

We've helped over 30,000 businesses worldwide with hassle-free incorporation. Get a registered company as a foreigner and a team of local experts to set you up 100% online, no need for you to go anywhere.

Fully-guided online company registration for foreigners

Local experts on your side

Work closely with experts on-the-ground in Singapore. Get support via live chat, email or phone as well as easy access to advice and in-person consultations.

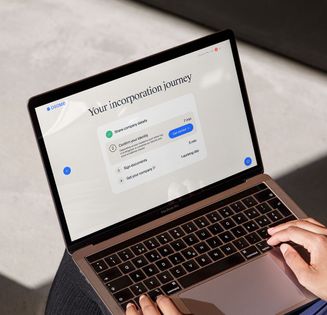

Register online from anywhere

No need to travel; we handle everything remotely and online. We collect documents, fill in forms and help you comply with local requirements.

Tax right from day one

Our local experts in Singapore will advise on business structure, accounting, set-up, and tax reliefs available to your business.

Long-term visa support

We help you get an Employment Pass — a long-term visa to stay and work in Singapore, and Dependant's Passes for your family.

For founders starting or scaling their business

Solopreneur

We help consultants, trading experts, IT specialists and other professionals flying solo. Set up your businesses hassle-free and find local tax benefits.

Entrepreneurs expanding

Scaling your business to new markets? We help you navigate local compliance and set up accounting and financial reporting.

Operating from Singapore

We help you get the right visa for starting your foreign business in Singapore, whether you're already here on an Employment or Dependant's Pass or relocating from abroad.

Costs of company incorporation in Singapore

Fully compliant

For business owners seeking a hassle-free, Singapore-based incorporation service

from

Incorporation

Government required services

Corporate secretary

Accounting and tax

Bookkeeping

Financial software

Fully compliant + Visa

For business owners seeking to incorporate with permission to live and work in Singapore

from

Incorporation

Government required services

Business immigration services

Corporate secretary

Accounting and tax

Bookkeeping

Financial software

Add-ons you might need

Letter of Consent (LOC)

S$ 400

Foreign nationals holding a Dependent Pass or Long-Term Visit Pass need an LOC to work in Singapore. For Employment Pass holders, an LOC is specifically required when seeking work and directorship at a company related to their current employer.

Dependant’s Pass (DP)

S$ 550

A Dependent's Pass is a Singapore visa for an Employment Pass holder's spouse or children (under 21). A DP holder can live and work in Singapore.

5 steps for setting up a foreign company in Singapore

Meet the official requirements

We help you with everything Singapore's Accounting and Corporate Regulatory Authority (ACRA) needs from business founders:

Singapore law requires each company to have a secretary. This officer is in charge of state compliance. They file annual returns and resolutions on changes, prepare Annual General meetings, and processes dividends distribution.

At least one of your directors has to be a Singapore resident. Hiring a nominee is a common and legal practice.

A nominee puts their name on your papers but can’t make any core business decisions. If there’s any wrongdoing, such as late or incorrect reports, the nominee director shares legal responsibility. That’s why you have to get an accounting package with this service.

All Singaporean companies must have a local registered address. It goes on all legal documents. We receive your correspondence, scan and forward them to you.

Get your company set up and registered

Foreigners need a certified agency to file for incorporation. We collect and sort all your documents online and send you the application to sign electronically. Here's how it works:

- First, complete your identity verification (MyInfo Verification for Singapore Permanent Residents). All company directors and shareholders need to complete this to stay compliant.

- Provide proof of address and company information, such as the share structure for your company constitution.

- Let us know your paid-up capital — S$1 is enough.

Open a business account

We partner with Singapore banks and payment services that can open a business bank account for you remotely online. We present you to the banks, but we can’t guarantee you’ll get an account for your business. The decision is always up to banks.

Each bank has their own procedure to open an account without physically visiting the branch. They do KYC interviews online using video conferencing and send couriers to exchange docs. Talk to us to learn about details, rates, and requirements.

Set up your accounting calendar

You need to submit several tax reports a year. Your accounting team will organise your docs, prepare reports, and file them neatly. We also advise on exemption options for you as a foreign business owner in Singapore.

Even if you have no transactions, you still need to submit annual reports: Estimated Chargeable Income, financial statements, and annual tax return called Form C or Form C-S. It’s crucial to prepare them right and on time, otherwise your company and the Nominee director can face fines and penalties.

Get an Employment Pass, move to Singapore

A permit that allows you to work, live and bring your family to Singapore. Only a Singapore registered company can apply for an EP. It has to be a real operational business. We can register a company for you, set up the reporting and apply for EP.

We will file your CV with relevant professional experience, education data and the company profile to get the visa. The process can take up to 3-6 months depending on the requirements. Once you get it, the employment pass is valid for 1 or 2 years and can be renewed afterwards.

Boom!

What our clients think about Osome services

“I use Osome to help me succeed”

91 %of customers recommend Osome services

“My company was successfully incorporated within just 3 days! I was blown away by the speed and efficiency of the process.”

Jason Choo

Helping you succeed in Singapore

Digital incorporation

Our team of experts has simplified the process by making it fully digital and handling all requirements — from local directors to company secretaries and legal compliance.

Bank account opening, sorted

We partner with a variety of local banks that can open a business bank account for you remotely online. Our partners include Airwallex, Aspire and WorldFirst. We present you to the banks, but we can’t guarantee you’ll get an account for your business. The decision is always up to the banks.

Business support beyond starting

From setting up your business to tax, accounting, and bookkeeping services, our local accountants have you covered for the first year and beyond.

FAQ

Can a foreigner set up a company in Singapore?

Singapore is very welcoming to foreigners who want to incorporate. Foreigners can become directors and shareholders here without any restrictions. The only requirement is that each local company must have at least one resident director when setting up their business — a Singapore national or a Permanent Resident. To comply with this law, you can hire a Nominee director.

Do I need a company address?

Yes, all Singaporean companies must have a local registered address. It goes on all legal documents. If you don’t have an office address, use our service. We handle your incoming letters, scan and store them in your Osome account so you have easy access to all your documents.

Can a business owner relocate to Singapore?

Yes, it’s possible. To do that, you’ll need to receive an Employment Pass. It’s a permit that allows to live and work in Singapore. Employment Passes are sponsored by Singapore companies. To get one you need a salary of about S$6,000, especially if you plan to bring your family, too.

How does Osome open a company in Singapore for a foreigner?

We check that the company name you’ve chosen is available when you start the set up process. You send us your IC or passport copy, details on directors and shareholders. We prepare all the necessary documents, send them to you for electronic signature, and submit them to ACRA (a government entity that registers companies). On your end, it’s just a message thread in a secure chat. Once a UEN has been issued, your company is operational.

What is an Employment Pass?

It’s a type of working visa issued per specific company so it can invite foreign professionals, managers, executives, and technicians. It allows you to work exclusively for that company, live and bring your family to Singapore. It’s valid for 1 or 2 years and can be renewed afterwards.

What’s your timeline?

We can set up a company as fast as within 1 hour. The most important factor is to collect all the docs: once you’ve handed them over to us, we can act fast. Keep in mind that the authorities only process registrations during working hours.

Fresh insights from our business blog

Doing Business in Indonesia vs Singapore: A Comprehensive Comparison

Comparing Indonesia vs Singapore? This article explores their economic landscapes, business climates, and cultural differences. Learn how each country stands out and what to expect.

Trade Mark Registration in Singapore

Now let's take a look at the trade mark registration procedure itself. Here is a step-by-step guide that will help you protect your trade mark in Singapore and worldwide.

Singapore Company Constitution — Everything You Need To Know

The Company Constitution is one of the legal requirements in your company’s incorporation process in Singapore. As a new business owner, you would need to know about Singapore’s Company Constitution as you are required to submit it during incorporation.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?