EORI Number: Streamlining International Trade

In the realm of global trade, the EORI number stands as a pivotal tool, seamlessly bridging borders and bureaucracy. This unique identifier simplifies customs processes, ensuring compliance with regulations, and facilitating efficient import-export declarations.

An Economic Operator Registration and Identification (EORI) number is a unique code for international trade within the EU, crucial for cross-border businesses.

In the ever-expanding realm of international trade, efficiency and compliance are paramount. One key tool that plays a pivotal role in achieving these goals is the Economic Operator Registration and Identification (EORI) number. This unique identifier is a crucial component in simplifying customs procedures, ensuring regulatory compliance, and facilitating smooth cross-border transactions.

In this article, we will delve into the intricacies of the EORI number, its significance in international trade, application processes, renewal procedures, and its integration with digital solutions. Additionally, we will explore its implications in the post-Brexit landscape, common mistakes to avoid, and the legal considerations surrounding its use.

Skip to:

What Is an EORI Number?Why Is an EORI Number Important for International Trade?

Purpose and Benefits of an EORI Number

EORI Number Application Process

Validity and Renewal of EORI Numbers

Using the EORI Number in Trade

EORI Number and Brexit Implications

Common Mistakes and Challenges

EORI Number and Digital Solutions

Legal and Regulatory Considerations

Industry Insights and Case Studies

Conclusion

What Is an EORI Number?

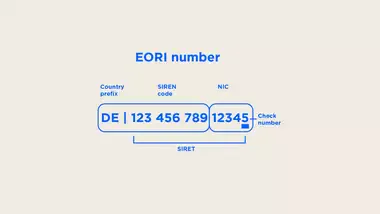

An EORI number, short for Economic Operator Registration and Identification Number, is a unique identification code assigned to businesses engaged in importing and exporting goods outside the European Union (EU). It serves as a customs identification number, enabling customs authorities to trace and monitor trade activities.

To obtain an EORI number, businesses must register with their respective national customs authorities. Once issued, the EORI number becomes a crucial reference point for all customs-related interactions.

Let's delve deeper into the significance of EORI numbers and how they facilitate international trade.

When a business engages in cross-border trade, it becomes essential to have a system in place that allows customs authorities to identify and track the movement of goods. This is where the EORI number comes into play. By assigning a unique identification code to each business involved in international trade, customs authorities can efficiently monitor and regulate the flow of goods.

Obtaining an EORI number is a relatively straightforward process. Businesses must register with their national customs authorities, providing the necessary documentation and information about their trade activities. Once the registration is complete, the customs authorities issue the EORI number, which becomes an integral part of the business's customs interactions.

Having an EORI number is mandatory and highly beneficial for businesses engaged in international trade. It streamlines customs procedures, making the import and export process more efficient. With an EORI number, businesses can easily complete customs declarations, ensuring compliance with all relevant regulations and requirements.

Moreover, the EORI number is a central reference point for customs authorities when conducting risk assessments and audits. It allows them to gather comprehensive data on a business's trade activities, helping them identify any potential irregularities or discrepancies.

For businesses involved in multiple countries, the EORI number simplifies trade transactions by providing a consistent identification code across different jurisdictions. This eliminates the need for separate identification codes in each country, reducing administrative burdens and enhancing operational efficiency.

It is worth noting that the EORI number is not limited to businesses alone. Individuals who engage in international trade activities, such as private importers and exporters, must also obtain an EORI number. This ensures that all parties involved in cross-border trade are accounted for and can be easily identified by customs authorities.

Why Is an EORI Number Important for International Trade?

An EORI number is of utmost importance for businesses involved in international trade, particularly when navigating VAT after Brexit. It facilitates seamless customs clearance processes and ensures compliance with customs regulations. With an EORI number, businesses will avoid significant delays and challenges in trading goods.

Having an EORI number allows businesses to navigate import and export rules in the UK, submit customs declarations, access simplified procedures, and benefit from customs simplifications and authorisations. It also enables tracing trade statistics, identifying high-risk shipments, and effective monitoring of trade movements.

Purpose and Benefits of an EORI Number

The importance of an EORI number in international trade cannot be overstated. It acts as a gateway to seamless trade operations, contributing to the following benefits:

Simplifying customs procedures

The EORI number plays a vital role in simplifying customs procedures by providing authorities with essential information about traders and their shipments. This leads to smoother customs clearance processes and reduced transit times.

Facilitating import and export declarations

With an EORI number, businesses can accurately declare goods for import or export. This facilitates the collection of taxes and duties while enabling effective tracking of trade activities.

Compliance with trade regulations

Maintaining an EORI number is a proactive step towards complying with trade regulations. It ensures businesses operate within the legal framework and adhere to necessary standards.

EORI Number Application Process

The process of obtaining an EORI number is relatively straightforward. Businesses must submit an application to their national customs authority, providing relevant information about their organisation, such as company details, legal status, and trading activities.

Who needs an EORI number?

Any entity expanding to the EU from the UK and is involved in international trade within the EU requires an EORI number. This includes importers, exporters, customs agents, and businesses involved in intermediary trade activities.

How to apply for an EORI number

The process of applying for an EORI number varies by country but typically involves submitting an application to the relevant customs authority. This application can often be completed online, simplifying the process and reducing administrative burdens.

Required documentation and information

Applicants are typically required to provide information such as company details, VAT registration numbers, and a description of their trade activities.

Additionally, supporting documentation might be necessary to verify the provided information.

Validity and Renewal of EORI Numbers

EORI numbers typically have a set validity period, which varies by country. To ensure seamless trade operations, businesses need to be aware of their EORI number's expiration date and initiate the renewal process well in advance. As a crucial item on the post-Brexit checklist, renewing the EORI number ensures uninterrupted trade activities between the UK and EU. Overlooking this renewal could lead to disruptions in customs clearance and shipment delays, impacting the overall flow of goods. Therefore, proactive management of EORI number renewals is vital for businesses to sustain smooth cross-border trade post-Brexit.

EORI number expiry and renewal

EORI numbers have a defined validity period, which varies by country. To ensure uninterrupted trade operations, businesses must be vigilant about the expiration date of their EORI number and initiate the renewal process in a timely manner.

Updating information and changes

In the dynamic landscape of international trade, businesses might undergo changes in their operations, such as address changes or alterations to their trade activities. It's essential to keep the EORI authority informed about such changes to maintain accurate records.

Using the EORI Number in Trade

Once businesses have obtained their EORI number, it is essential to ensure its proper utilisation in trade activities

Role of EORI number in customs declarations

EORI numbers are essential components of customs declarations, allowing authorities to quickly identify traders and their shipments. This speeds up customs clearance and contributes to the overall efficiency of trade operations.

Ensuring smooth cross-border transactions

Smooth cross-border transactions are contingent on accurately utilising the EORI number. Its correct inclusion in trade documents and declarations is crucial to prevent delays and ensure the seamless movement of goods.

EORI Number and Brexit Implications

With the UK's withdrawal from the EU, businesses have significant implications regarding EORI numbers.

EORI number's role post-Brexit

With the UK's exit from the EU, EORI numbers have gained even more significance. UK-based businesses now require a UK-specific EORI number for trade with the EU and their existing EU-issued EORI numbers.

Navigating trade changes and adjustments

The post-Brexit landscape has changed trade procedures and requirements. Businesses must adapt to these changes and ensure their EORI numbers are aligned with the new regulations.

Common Mistakes and Challenges

While obtaining and using an EORI number is essential for international trade, there are common mistakes and challenges that businesses may encounter.

Errors to avoid during EORI number application

When applying for an EORI number, businesses should take care to provide accurate and up-to-date information. Errors in the application can lead to delays in issuance and potential disruptions in trade operations.

Overcoming EORI-related trade issues

Challenges related to EORI numbers can arise, such as delays in issuance, difficulties in updating information, or confusion regarding their use. Businesses should proactively address these challenges to maintain efficient trade processes.

EORI Number and Digital Solutions

Digital solutions have revolutionised various aspects of international trade, including EORI number management. Many customs authorities now offer online platforms and tools for businesses to register and manage their EORI numbers. This modernisation has streamlined the application and renewal processes and enhanced the accessibility and accuracy of EORI-related information.

As part of the digital transformation, these platforms often provide additional features such as the ability to update business details, track application status, and even verify what a trading name is in the context of EORI registration. Embracing these digital solutions empowers businesses to efficiently navigate the complexities of international trade and EORI compliance in the modern era.

Integration with modern trade platforms

Modern trade platforms and digital solutions can integrate EORI numbers, automating various trade processes and reducing the likelihood of manual errors. This integration enhances efficiency and accuracy.

Leveraging technology for efficient trade operations

Technological advancements, such as blockchain and AI, as well as online bookkeeping services for further guidance and keeping your accounts in order, can be leveraged to enhance the capabilities of EORI numbers further. These technologies can streamline record-keeping, improve transparency, and enhance security.

Legal and Regulatory Considerations

Businesses must understand the legal and regulatory framework surrounding EORI numbers. Compliance with customs regulations, accurate reporting and record-keeping, and adherence to data protection and privacy laws are essential to utilising an EORI number.

EORI number compliance and legal requirements

Using an EORI number comes with legal obligations. Traders must ensure that their trade activities align with the information associated with their EORI number and adhere to relevant trade regulations.

Data protection and privacy concerns

The handling of sensitive business information through EORI numbers requires stringent data protection measures. Businesses must ensure the security of their EORI-related data to prevent unauthorised access and misuse.

Industry Insights and Case Studies

Various industries have been impacted by introducing EORI numbers, and insights from these experiences can provide valuable lessons for other businesses. Case studies and industry-specific examples can shed light on best practices, challenges faced, and the benefits of using an EORI number.

Businesses can learn from real-world scenarios and adapt their trade strategies in manufacturing, retail, or services. This understanding can improve efficiency, cost-effectiveness, and compliance within the global trade landscape.

Success stories of businesses optimising EORI numbers

Numerous businesses have experienced smoother trade operations and reduced delays after implementing efficient EORI number strategies. These success stories underscore the significance of proper EORI utilisation.

Learning from challenges and adaptations

Businesses that have overcome EORI-related challenges share valuable insights. Adapting to changes, maintaining accurate records, and staying informed about regulatory updates are common lessons from these experiences.

Conclusion

Obtaining an EORI number is an essential requirement for businesses engaged in international trade and must be obtained during the company registration process. The streamlined customs processes, enhanced security, and operational benefits it provides are invaluable for navigating the complexities of global trade.

By understanding the purpose and importance of an EORI number, mastering the application and utilisation process, and staying informed about legal and regulatory considerations, businesses can successfully streamline their international trade operations and embrace the opportunities that come with it.