- Osome UK

- Bookkeeping Services

Bookkeeping services in the UK

We handle your bookkeeping for you so you can focus on doing business. Pay the right tax, reconcile transactions, and prepare invoices, all in one online platform.

Professional bookkeeping services with Osome

Dedicated bookkeeper

You'll work with a dedicated professional to streamline your business's bookkeeping. Pay the right tax from day one with our online service.

Easy-to-use software

Online software where all your important business documents are stored in one, safe place. Our software helps you manage bookkeeping effortlessly.

Real-time data, daily

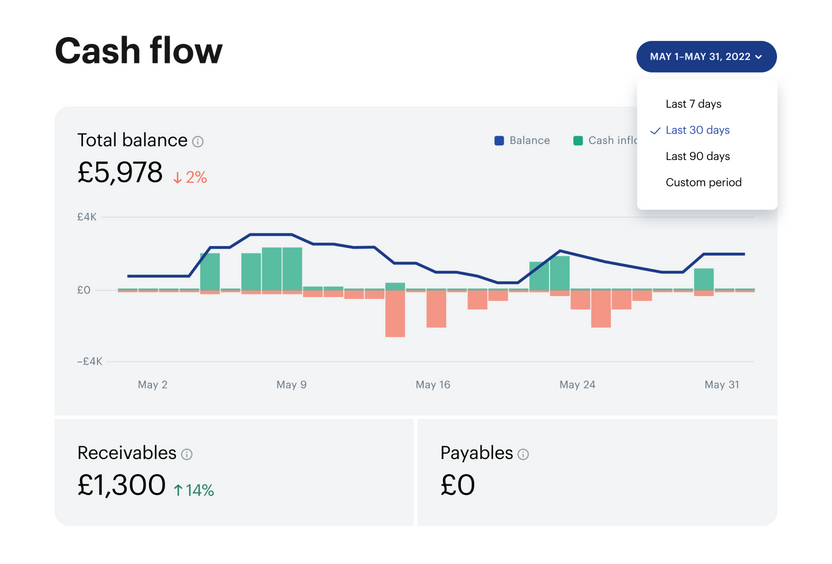

Get insight on your cash flow daily in real-time, with professional bookkeeping services to help you make sense of it all.

Compliance and Reporting

Leave the tax, deadlines, and filing with HMRC to us while you do business. Our online bookkeeping services ensure you pay the right tax and stay compliant.

Benefits of Osome services

Bringing order to your documents chaos

We make sure your books are up-to-date and in order every day — not just at the end of the month.

Books done in minutes

Send us your documents the minute you receive them. We reconcile every 24 hours and show what's missing, meaning you don't have to spend hours retracing old invoices.

A dedicated bookkeeper

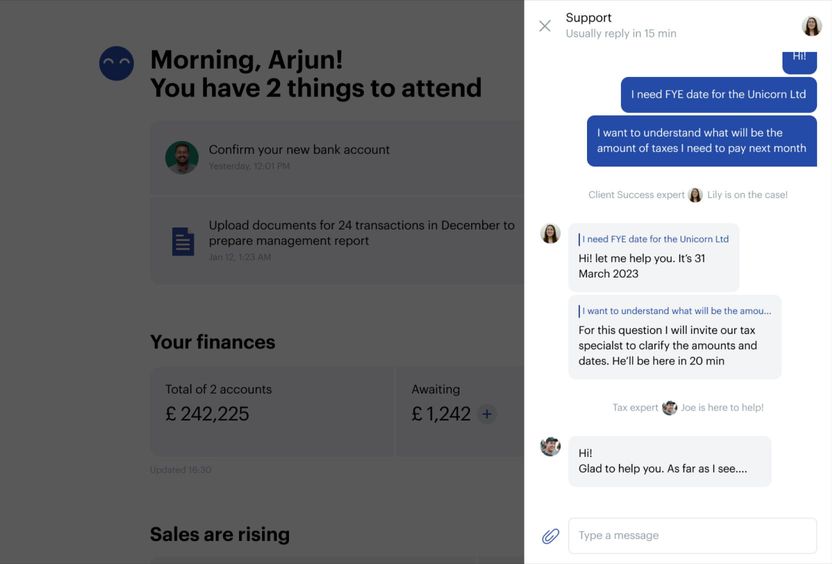

We respond quickly to any live chat queries, even late at night or over the weekend.

Included in every

Easy-to-use tools to handle your bookkeeping and finances

From bookkeeping to filing tax

Our professional bookkeeping services have you sorted, from accuracy and compliance to reduced stress and valuable financial insight to help your business grow.

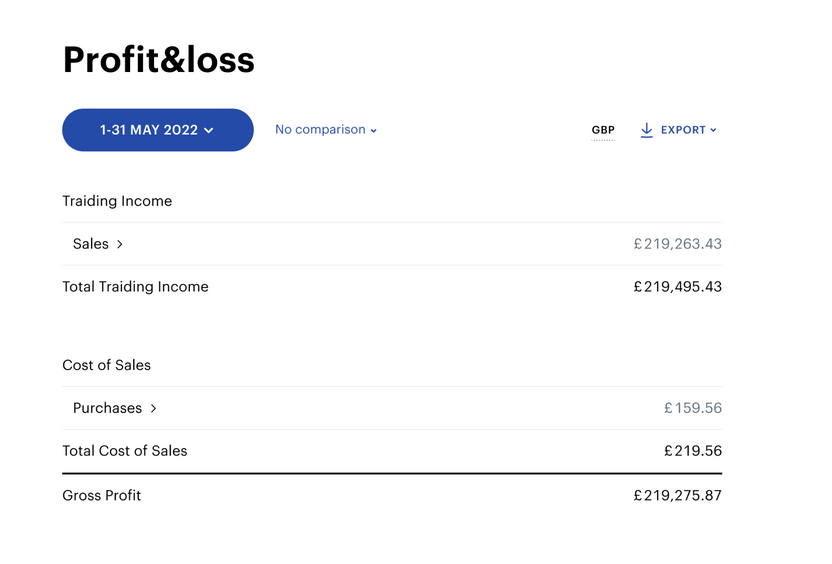

Real-time data

Get daily, real-time visibility into your finances, supported by expert bookkeeping services to assist you in understanding and using this information to make business decisions.

Get clear on your cash flow

Using Osome's online bookkeeping services means having clear insight into your cash flow and better control over your finances.

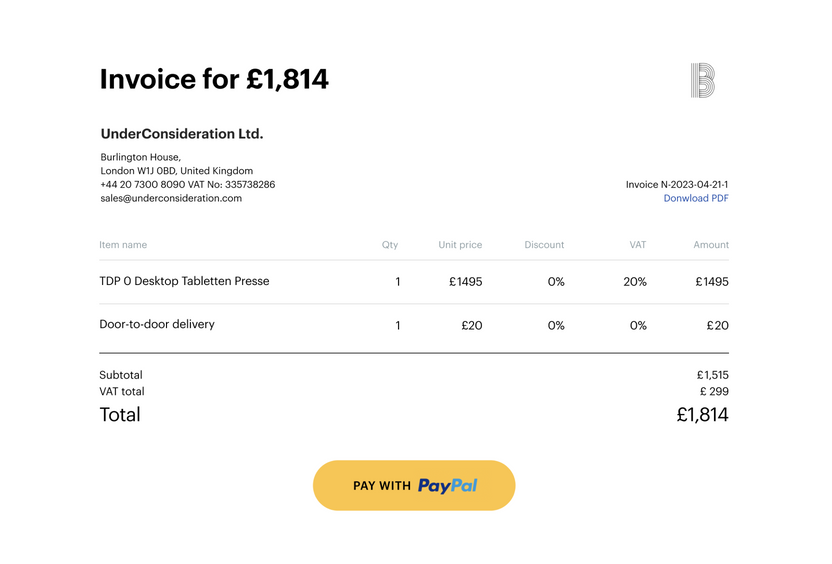

Get your invoices paid quicker

Send invoices and reminders to late payers, and help your clients pay faster with our PayPal integration.

Your accountant, available always

Reach out to your dedicated accounting professional via live chat and get the answers you need within 24 hours.

Plans to fit your business. Bookkeeping included in all packages.

Our packages are tailored to your business stage and annual revenue. When you reach £350,000 in revenue, we'll upgrade your account to our Scale package. As your business grows, you can customise your package with add-ons to meet your needs.

Operate

For business owners who want to ensure they tick all basic compliance boxes as they grow

from

£ 850 billed annually, per financial year + VAT

Financial software

Bookkeeping

Expert service

Tax and filings

Payroll

Company admin

Historical work

Grow

For businesses nearing VAT registration, seeking up-to-date analytics and consultations

from

£ 1,640 billed annually, per financial year + VAT

Financial software

Bookkeeping

Expert service

Tax and filings

Payroll

Company admin

Historical work

Scale

For entrepreneurs earning £350k+ annually, managing multiple roles and seeking to simplify financial tasks

from

£ 2,690 billed annually, per financial year + VAT

Financial software

Bookkeeping

Expert service

Tax and filings

Payroll

Company admin

Historical work

What our clients think about Osome

“Osome just made everything easier.”

91 %of customers recommend Osome services

“They’ve been a great help with accounts and VAT returns, answering any questions and helping me stay on top of things.”

Sarwech Shar

FAQ

Why should you use professional bookkeeping and accounting services?

Using professional bookkeeping and accounting services offers numerous benefits that can greatly enhance the financial health and efficiency of your small business. Outsourced bookkeeping services paired with simple software will make sure you never miss an important deadline and that you always remain compliant. Outsourcing bookkeeping and accounting also allows you to focus on what you do best, while our experts manage your financial data efficiently.

How much do bookkeeping services cost?

The price of your bookkeeping service depends on the package you choose and your business's needs. Our experts can help you choose one that suits you best.

Are bookkeeping services necessary for small businesses?

Bookkeeping services can be highly beneficial for small businesses, and in many cases, they are essential. They will help you keep accurate financial records, stay tax compliant, save time, and grow your business. You'll also avoid fines associated with missing deadlines because a professional bookkeeper will help you stay on top of these.

How bookkeeping with Osome works?

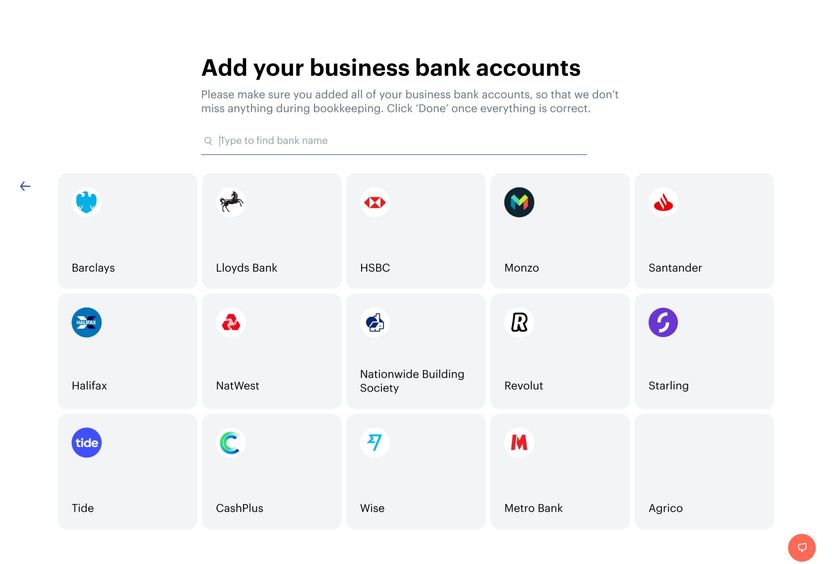

You need to send us your receipts in invoices in any format you have them, like scans or pictures on your phone. If anything is amiss, Osome platform makes it easy to track docs and gently reminds you to send them in. Everything else we'll do ourselves.

Which bookkeeping software do you use?

Access our platform at any time, from any device. Send over documents in a way that suits you, have files automatically stored and sorted out, and get in touch with your questions 24/7. So sit back, relax, and let us handle your bookkeeping responsibilities.

Can I switch from another bookkeeping firm to Osome?

Absolutely. We make the transition seamless on your end. We’ll get in touch directly with your current accounting service provider, take over all your financial documents, and audit them to make sure your company is compliant. We check for any loose ends with HMRC, organise historical data, and then prepare and file necessary reports. We offer up ongoing advice about relevant tax exemptions, helping you be smarter with your taxes. Now that your accounting is in good hands, you can focus on what you do best: running your business.

What if my annual revenue exceeds £350,000?

If your annual turnover exceeds the £350,000 threshold at the end of the financial year, we'll send you an invoice for the difference. However, you can avoid unexpected costs by notifying us earlier — for instance, midway through your financial year — and we'll upgrade you to the Scale package.

Fresh insights from our business blog

Small Business Grants: What Is Available in the UK This Year?

In this article, we run through the full list of grants available to small and medium-sized businesses across the UK. Discover the region-specific and UK grants that your business could be eligible for, and learn how you can apply for them. Let Osome lend a hand when you set up your business!

10 Steps To Starting an Online Business in 2025

Launch a successful online business in 2025 by following these 10 steps. From understanding the basics to driving traffic and setting up payment methods, Osome’s guide gives you a roadmap to a profitable venture. With expert insights and top tips, start your ecommerce journey with confidence.

How To Start a Business in 2025 in 10 Steps — A Comprehensive Guide

Ready to be an entrepreneur in 2025? Follow Osome's comprehensive 10-step guide to starting a business. From refining your idea to growing your venture, we'll walk you through each phase with clear, actionable steps. Your successful business journey starts here!

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?