Brexit: Tariffs Depending on Where Your Goods Originate

Post-Brexit, UK SMBs need to know about the Rule of Origins to find out if they have to pay tariffs. This matter is perhaps more complex than it might initially appear—so let’s delve into it in more detail.

After years of back-and-forth, constant uncertainty, and the very real possibility of a no-deal scenario, the UK and the EU managed to strike a trade deal at the eleventh hour. This free trade agreement ensures that businesses trading between the UK and the EU won’t have to contend with any tariffs, meaning charges for bringing products across borders, or quotas on the quantity of the products.

However, there are some small print that all businesses registered in the UK need to be aware of. Namely, the issue of where your goods originated. This matter is perhaps more complex than it might initially appear—so let’s delve into it in more detail.

What does the Free Trade Deal apply to?

The free trade deal only applies to goods that have originated in either the UK or the EU. If you’re unable to produce satisfactory evidence that this is the case, you might have to pay additional tariffs.

What’s more, if your product contains elements that originate from outside the UK or EU, then you also may be subject to further costs. This is a slightly complex area. “Rules of origin” (i.e. where the end-product is deemed to originate) depends on a product-by-product basis.

For more information, head to annexes ORIG-1 and ORIG-2 of the official Trade and Cooperation Agreement (TCA).

Explaining the “Rules of Origin”

There are two different ways in which goods can technically “originate” in a country.

Wholly obtained

This means the good has fully originated in the country of question without the addition of materials that originated elsewhere. For instance, this usually applies to things like plants, animals, minerals, or products that are produced solely in one single country.

Substantially transformed

If you’ve used materials that originate outside the UK or the EU, but have since substantially transformed them in any way, then you might not have to pay tariffs.

So what does “substantially transformed” actually mean?

The full rules are complex and vary depending on the product can be found in annexes ORIG-1 and ORIG-2 of the TCA. However, to summarise, “substantially transformed” means that you have:

- Made the product more valuable

- Or, changed the product’s tariff classification

HMRC has provided detailed guidance on how these rules apply:

Rules of origin for goods moving between the UK and EU

Certain specific products and manufacturing processes automatically qualify as being substantially transformative in their nature—head to the TCA to find out more information.

How to Declare your Goods’ Origin

If only it was as easy as simply scrawling your office’s address on a shipment and watch it sail through customs. Unfortunately—each consignment has to be accompanied by a Statement of Origin detailing where the goods came from.

According to the TCA, businesses have two options regarding their Statement of Origin:

Self-declaration by the exporter

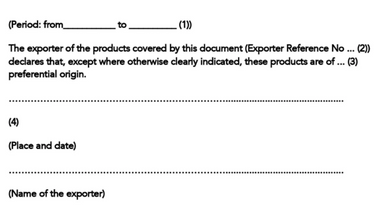

The exporter should make a simple statement on their commercial invoiceaccording to the exact wording as stipulated in annex ORIG-4 of the TCA.

This is as follows:

Importers’ knowledge

The importer themselves can also confirm that the goods originate in the UK or the EU, though this should be supported by additional documentation confirming this to be the case. Note: this information then has to be kept for four years.

Ask an expert

It’s not easy getting to grips with the new rules of origin. If you want to find out more information, or to work hand-in-hand with your very own accounting expert in the UK going forward, then get in touch today.