Form P50: Get Your Money Back Before the End of the Tax Year

If you overpay your taxes and you don’t get any taxable income for 4 weeks, you can contact HMRC and claim your refund straight away. That is what P50 is for. We look into the process and give tips on how to make things happen.

If you overpay your taxes, at the end of the fiscal year you receive P800 form from HMRC stating how much money you can get back. But if you don’t get any taxable income for 4 weeks, you can contact HMRC and claim your refund straight away. That is what P50 is for.

Keep in mind that this form is about your relationship with HMRC, not your employer's. So their accounting services provider in charge of payroll is not involved with filing this form, the onus in on you.

What is a P50 form?

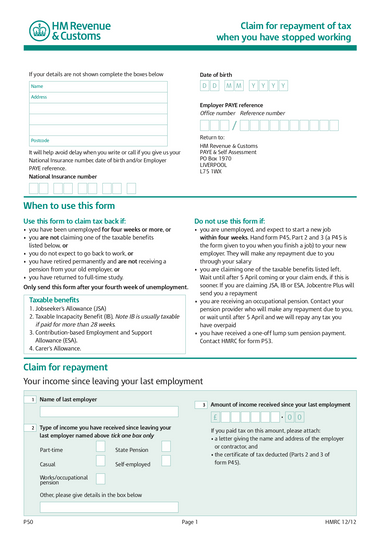

P50 is an option to claim your overpaid tax during the fiscal year. To do that, you have to meet certain requirements as well as apply at the right time. The document itself looks like this:

When sending P50, you can state yourself for how long you do not plan to earn any taxable income. The term is limited by the duration of the current tax year, which is April 6th to April 5th of the next calendar year.

Great! When do I use it?

When you do not receive any taxable income for more than 4 weeks and you have overpaid your taxes. For example, you are in between jobs for more than a month. Or you retired before your pension plan kicked in and you still have a couple of months before you get paid. Or you are a student studying full-time and working in between semesters. In this case, the taxes were probably counted under emergency rates in which case you have overpaid.

Usually, HMRC applies one of its emergency tax codes for short-term employment. After HMRC gets more data about your income from your employer, your tax code will change. The emergency tax rates are normally higher, which means you are likely to overpay when taxed at those, so you can claim a refund.

Mind that taxable state benefits make you ineligible for a P50 tax refund, so make sure you are not receiving any of them. Here is the benefits list:

- Jobseeker’s allowance;

- Taxable incapacity benefit;

- Employment and support allowance;

- Carer’s allowance.

If you are on any of those benefits, the offices responsible for providing them will handle any possible tax refund issues for you based on parts 2 and 3 of your P45 form that you got from your employer when you quit your job. The same goes for switching jobs. In that case, it will be your new employer who will take care of it.

How do I apply?

You can apply online or find all the needed forms on the official P50 form webpage. Keep in mind that you will also need parts 2 and 3 of your P45 which you should have gotten from your employer when quitting.

If you are not sure whether you will have any taxable income later in the current tax year, do not worry. You can file a P50 tax form multiple times in a single year.

After you have sent all the needed documents HMRC will process your application. If you expect your refund to come in the form of a cheque it, may take them up to 5 weeks. Refunds going to bank accounts are usually processed in 5 working days. If after 6 weeks nothing still happens — contact HMRC. The easiest way might be to call their international line in the morning. This way the odds are that you won’t have to listen to stock synth music for long.

Tip

You can not claim your tax refund unless your last paycheck came more than 4 weeks ago. This is important because you might stop working before getting your last payslip, for example.

I’m Not Sure If HMRC Owes Me Any Money

Well, it’s still better to send in your P50 than to wait till the end of the year when you get your P800, especially if you do not plan to have any other taxable income for some time. Even if you do find a new job or apply for benefits, the refund amount will be adjusted based on your P45.

Simply the fact that you have stopped working in the scope of one year changes your tax rates.

It very well might be the case that you started working under emergency tax rates which are higher. It is common practice for probation periods. And sometimes you might be taxed under a wrong tax code. Every case is reviewed individually by HMRC and if you are actually not due any refund, HMRC will contact you and tell you so stating the reasons.

Make sure you have a UK-based bank account. If you relocated outside the UK, you will have to fill in a P85 form to get a tax refund for the amount you paid while being in the UK.

What if I Can't Use a P50 form?

There are some reasons when you can't use a P50 claim tax refunds. In case your pension lump sum is small you'll have to file a P53 instead. Either apply directly to HMRC after April 5th or to your pension provider to get the payment.

Want to register your UK company online? Get in touch with us and we will assist you.