Post-Brexit VAT Rules on Services and Products

With the United Kingdom no longer a member of the EU’s single market and customs union, we’ve had to say goodbye to a few key processes. We’ve welcomed more import/export documentation, new post-Brexit VAT rules, and a new VAT system. We unpack it all here.

With the United Kingdom no longer a member of the EU’s single market and customs union, we’ve had to say goodbye to a few key processes. We unpack it all here and guide you through how to make sure your business stays VAT-compliant in a post-Brexit world.

Skip to:

What Is Brexit – and What Does It Mean for Businesses?Do I Need To Pay VAT When Importing From the EU?

Do I Have To Pay VAT When Exporting Products to the EU?

Post-Brexit VAT Rules for UK and EU Ecommerce Businesses on Amazon and Online Marketplaces

3 Things EU Companies Need To Know To Trade in the UK Post-Brexit

Do I Have To Pay VAT When Providing Services to Companies Based in the EU?

Customs and VAT After Brexit Are Pretty Much the Same

Let’s Look At Data Protection Regulations Post-Brexit

Tools To Help You Adapt to the Changes of Brexit

What Is Brexit – and What Does It Mean for Businesses?

It’s been two years since, on January 1, 2021, the United Kingdom officially packed in its euro ticket and left the European Union.

With Great Britain no longer a member of the EU’s single market and customs union, we’ve had to say goodbye to a few key processes. No more single trading areas with zero tariffs or border checks. Instead, we’ve had to welcome more import/export documentation, new post-Brexit VAT rules, and a new VAT system.

These new post-Brexit VAT rules and border restrictions mean Great Britain now has its own customs borders with the EU. The UK and EU legislatures managed to wrangle a trade deal between the UK and EU countries. This trade deal allows the two to give each other preferential treatment. Since May 1, 2021, there have been no customs tariffs and no need to meet the “rules of origin” quota.

However, there is now a requirement for customs documentation, new laws, and VAT accounting requirements. We’ll unpack them in detail here to help you understand what changes Brexit brought about, and what they mean for your business.

So, let’s get into it.

Do I Need to Pay VAT When Importing from the EU?

VAT on EU imports after Brexit now apply. Goods entering Great Britain before Brexit were called acquisitions. Now, they have a less fancy title; imports. With a new name comes a new law — goods coming into the UK are now subject to import VAT and duties. Even if your business is not registered for VAT in the UK, you will need to pay import VAT.

Identify the Importer of Record

If you are shipping to the EU, you’ll need to nominate an Importer of Record. This person is responsible for ensuring the imported products comply with local laws and regulations. It will also be their job to file a complete customs entry and pay the import duties and taxes on these products.

The person you nominate needs to be established in the EU, meaning the importer needs to have an EU entity, established business or a physical presence, to take responsibility for customs procedures and declaring the import.

If your company is importing into the EU and is not established in the EU, you can’t make a customs declaration for a shipment of products. The foreign company will require a third party to act as the IOR.

Apply for a UK EORI

What’s an EORI, you ask? It stands for Economic Operators Registration and Identification number, and if your business is based in the UK and needs to move goods between the EU, then you'll need one.

You'll need your EORI number if you:

- Hire someone to deal with customs on your behalf who is 'established' in the country from which you are importing or exporting.

- Prepare customs declarations

- Make use of customs systems such as the CHIEF system and the Northern Ireland Import Control System (ICS NI).

- Request a customs decision.

Do You Need an Import Licence?

If you intend to ship a Picasso painting or medical supplies from Europe to the UK, you need an import licence. This is needed when you intend to import special items the Government doesn’t want to come into Britain without their consent. It’s a way for the Government to cap and monitor imports and prohibit an oversupply of certain imports which would saturate the market. Items include military goods, artworks, plants, animals, and medicine (to name a few).

You can see what items require an import licence and apply for one via the Department for International Trade.

Working out your VAT Strategy

- Start by keeping track of the VAT paid on your business purchases

- Record the VAT you collected on sales

- Subtract the VAT you paid on purchases from the VAT you collected on sales

VAT Collected - VAT Paid = X

Et voila! If X equals a positive number, you need to pay that amount to HMRC. If it’s a negative number, you’ll get refunded that amount.

For example, restaurant owner Jimmy bought his kitchen staff new paring knives and paid £200 VAT on the purchase. That evening, he collected £1200 worth of VAT from the evening’s takings. Jimmy owes HMRC £1000 in VAT as a result — he’ll have to keep that amount aside.

Decide Who'll Complete All Import Declarations

Brexit stands for two things: Britain’s exit from the EU, and paperwork. You’ll need to complete an import declaration whenever you bring or receive goods into the UK. You must nominate a representative to declare your goods to customs on arrival in the UK.

Once your goods have been presented to customs, you can make a full declaration within 90 days. It may also be possible to do this up to 30 days before your goods arrive — but your declaration will only officially be accepted when the goods have arrived and been presented to border control.

Prepare your UK Intrastat declarations (if necessary)

Intrastat is a system that collects stats about trade between countries in the EU. Since the UK is no longer part of the EU, as of 1 January 2022, Intrastat will only apply to the movement of goods between Northern Ireland (NI) and the European Union (EU).

Hurrah — that means one less job for you! You must only register for Intrastat if your business either:

- Receives over £500,000 worth of goods arriving from the EU into Northern Ireland.

- Moves more than £250,000 worth of goods to the EU from Northern Ireland.

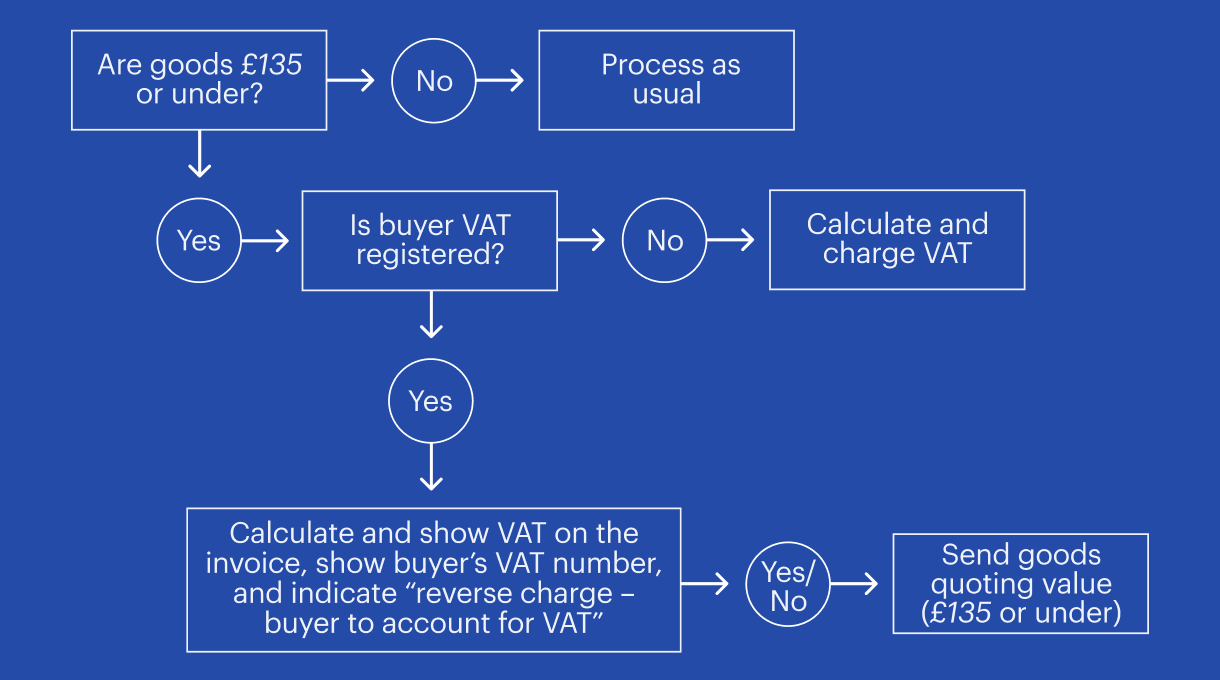

Remember the new £135 import rule

There's another new post-Brexit VAT rule in town. Goods worth £135 or less are now subject to supply VAT, which must be paid by the seller of products entering the UK.

This means that VAT on shipments worth £135 will no longer be collected at the time of import but will be paid by the seller at the time of sale. If the buyer is UK VAT registered, they can utilise the EU reverse charge VAT method after Brexit.

Here’s how you can work it out:

Do I Have to Pay VAT When Exporting Products to the EU?

If you are selling or transferring goods out of the UK, you don't usually need to charge VAT.

You don't need to charge VAT if goods are exported from:

- Great Britain to any destination outside the UK

- Northern Ireland to any destination outside the UK and EU

Remember to keep evidence of the export and proof the goods arrived. You are legally required to submit this evidence within three months from the point of sale.

Determine the Exporter of Record

Another change with Brexit is that you must have an Exporter of Record (EOR). It’s a requirement for international trade under new UK legislation. The EOR has to be based in the UK with a registered office or permanent place of business here.

So what’s their job? To make sure goods are exported successfully. They are in charge of everything — from sorting the documentation to understanding the relevant laws and regulations that apply to the countries your business ships goods to. Trade compliance can be extremely confusing, so your EOR needs to be the industry expert to help you navigate the field. They’ll ensure you avoid fines and help your goods reach their end destination on time.

Figuring out whether you need an export licence

Apply for any licences you need to export your goods.

As with importing, there are particular requirements for exporting goods post-Brexit. You may need to get a license or certificate if you are exporting specific products. You can check what goods need a license here.

Deciding who will complete export declarations

You need to nominate a representative who declares goods with customs before they are allowed to be shipped out of the UK.

The declaration must include the following:

- Customs procedure code

- Commodity code

- Your declaration consignment reference, which is the primary reference number that links declarations.

Compiling the must-have information

100% of UK-EU trade will continue to be tariff-free. This is a significantly better scenario than the prospect of businesses having to pay tariffs on imported and exported goods.

However, because the UK has now left the Customs Union, a hard customs and regulatory border now exists between the EU and UK.

Here’s a quick summary of what this means for importers and exporters:

- You’ll need to get an EORI number to move goods between Great Britain and other countries.

- All goods exiting the UK into EU countries require export declarations and exit Safety and Security declarations.

- VAT on imported goods worth up to £135 is now collected at the point of sale, not the point of importation. That means UK supply VAT rather than import VAT is due on such consignments.

- If you buy online from suppliers in the EU, customs duties (for deliveries worth more than £390) and VAT must be paid.

Submitting your EU import customs declarations

All goods under the new post-Brexit customs procedures need to be declared, regardless of their status as Union or non-Union goods.

You can submit your customs declaration electronically, verbally, or in writing. The documents you need to present for the declaration include paperwork proving the value, origin, or identity of the goods, determining the amount of duty or helping to identify any prohibitions and restrictions that may exist.

Remember that Intrastat doesn't apply

Intrastat is an EU organisation that collects trade stats on the movement of goods between EU Member States. As of 1 January 2022, Great Britain no longer has to file Intrastat (arrivals) declarations when moving goods from the EU to GB.

Post-Brexit VAT Rules for UK and EU Ecommerce Businesses on Amazon and Online Marketplaces

All ecommerce sellers and marketplaces must also now abide by the new post-Brexit VAT rules when exporting goods based in the EU into the UK.

Before Brexit, ecommerce companies set up in the UK had easy access to a nearby market of nearly 748 million citizens — almost a tenth of the world’s population. Best of all, they could sell to these consumers almost as easily as if they were selling to their next-door neighbour.

Since 1 January 2021, all ecommerce sellers and marketplaces have to abide by new VAT rules when exporting goods based in the EU into the UK. The VAT rules depend on whether your products are located outside or within the UK at the time of sale and whether they are valued above or below £135.

Charging VAT at the time of sale for goods located outside the UK under £135

Both UK and EU-based sellers must charge sales VAT at the point of checkout.

But, if you’re selling through a facilitating online marketplace (OMP) like Amazon, then the OMP would be responsible for charging VAT as, in this arrangement, they’re deemed to be the supplier.

In either case, you’ll have to invoice EU countries VAT after Brexit to accompany the goods as they pass through customs. The VAT will then be paid by the seller or by the OMP when they submit a regular UK VAT return.

Key points to remember:

- Clearly state that VAT was paid at the point of sale.

- Remember the £135 total excludes additional costs involved in supplying the goods (travel, insurance, import taxes, etc).

- If the customer is a VAT-registered business here in the UK, they should provide the seller/OMP with their VAT number — this means the UK customer can use the reverse charge mechanism.

Who charges VAT for goods located outside the UK at the time of sale for products valued over £135?

For this arrangement, the old rules still apply. That is, the seller is in charge of paying the import VAT and duties, which they can then reclaim if they have a UK VAT number.

However, the seller may decide to have their customer pay at customs or to the delivery agent — but this will certainly be the exception rather than the norm.

Who charges VAT for goods located inside the UK at the time of sale for non-UK sellers in the EU?

If your goods are located within the UK, then different VAT after Brexit rules apply — though these vary depending on the nature of the company in question. It also depends if you are selling on an Online Marketplace or not.

Non-UK sellers using an Online Marketplace (for B2C goods)

Let’s say your company is an Italian company, and you sell shoes via Amazon. Your inventory, however, is currently being held in an Amazon warehouse in the UK. In this scenario, the online marketplace, i.e. Amazon, would be deemed the supplier for VAT.

This applies to any value of goods—so the £135 rule is essentially scrapped.

This is because the seller will have already paid import VAT when moving the goods from wherever they were manufactured into the UK-based Amazon warehouse. All they will have to do is to sell the shoes to Amazon as a zero-rated supply, and Amazon will then sell the goods to the end consumer using the normal UK VAT rates.

Non-UK sellers using your website

If you are, for example, a company selling leisurewear for dogs online, then the old rules apply. Your non-UK based company must be registered for UK VAT and charge this UK VAT to any businesses or consumers that you deal with.

What changes affect my Online Marketplace (OMP)?

An online marketplace is an ecommerce website where products or services are provided by many third party sellers.

OMPs must have several key pieces of information to hand for any given purchase:

- Where the items are being shipped from.

- The overall value of the goods.

- If the goods are already within the UK at the time of sale, and if so, whether the seller is also based in the UK.

- Whether or not the customer is a VAT-registered business located in the UK. If they are, they won’t have to pay tax on any imported goods that fall under the £135 threshold.

- The nature of the goods — this will determine whether they’re subject to standard, reduced, or zero-rated VAT rules.

Does anything change for businesses fulfilling orders via Amazon or Amazon FBA?

In the past, Fulfilment by Amazon (FBA) has allowed all EU-based ecommerce companies to benefit from the European Fulfilment Network (EFN). UK-based ecommerce companies could send their inventory to Amazon fulfilment centres in the UK. Amazon would then handle the rest of the process, sending these goods over to Europe and making sure the orders were fulfilled.

Now, however, UK-based ecommerce companies will no longer be able to benefit from this system. Amazon post-Brexit means they’ll need to handle the process of exporting their inventory over the border to Amazon’s European fulfilment centres themselves.

3 Things EU Companies Need to Know to Trade in the UK Post-Brexit

Whether you’ve already been trading in the UK before Brexit, or are now looking to expand to the UK market, there are many new regulations you need to be aware of. The new import and export regulations are the most important changes for sellers, but they’re not the only changes. Don’t fall into the trap of thinking that you’re all sorted because your finances and taxes are.

There’s some financial implications: VAT and Customs

The biggest implications of Brexit for businesses have been the financial ones. As of July 2021, country-specific VAT thresholds were abolished and replaced by an EU-wide threshold for distance selling of €10,000. Below this threshold, deliveries and services are taxed at the local VAT rate, and VAT is paid in the home country. As soon as distance sales exceed the EU-wide threshold, VAT is due in each country to which goods are sold.

The first step to VAT compliance is to register your business for VAT in the UK. Items valued between ₤0 and ₤135 have VAT collected at the point of sale by either the seller or the online marketplace if you do not sell the items directly. Items valued over ₤135 have import VAT collected along with other fees at customs.

You also need to collect VAT at the point of sale if you store and sell an item in the UK. If you serve customers in the UK, but store your goods outside of the UK and import them, you should make your customers aware of customs and other fees that might be added on during the import process in your terms and conditions.

There’s been a shift in price competitiveness

Due to new VAT regulations and customs, domestic sellers may have certain advantages compared to international sellers. You might have to use new strategies to stay competitive.

These effects are also not going to affect all industries in the same way. Products that are often imported might be less affected than products that are mostly manufactured in the UK.

If you are considering expanding into the UK now, you should carefully analyse the new competitive landscape and plan your products and prices accordingly.

Amazon sellers need to look at their inventory and brand

For Amazon sellers accessing the UK, Brexit has multiple consequences. It’s a good idea to set up an inventory in the UK in addition to your EU inventory. This will help you avoid longer delivery times and higher shipping costs compared to using an inventory outside of the UK.

Do I Have To Pay VAT When Providing Services to Companies Based in the EU?

If you and your supply hub are based in the UK, then you charge and account for VAT in accordance with UK VAT rules. If you live in the UK but the location of your service is in another EU country, you do not have to pay UK VAT.

However, in some cases, you might have to register for VAT in the country of supply. Consult with the country’s tax authorities to determine how to treat the services you are providing. There’s a full list of EU VAT contacts in Notice 725.

If your service is not provided in the EU, you are not required to charge EU VAT, but you need to include the sale in box 6 on your VAT Return.

How should B2B businesses charge VAT?

If you are selling to someone with an EU VAT number, then you don't charge them VAT. Remember to deduct any VAT you paid to make that sale from your quarterly return though. If the customer doesn't have an EU VAT number, you apply your country's VAT to the sale.

What about B2C businesses?

Back in the day, before 1 January 2021, B2C sales of goods from the UK to the EU that were below the distance selling threshold were subject to UK VAT. Sales above the distance selling thresholds were subject to the VAT rate applicable in the Member States where the goods were delivered.

Now, post-Brexit, all B2C sales of goods into the EU are considered exports. This means they are no longer subject to UK VAT.

However, sales of less than €150 enact EU VAT obligations on UK businesses. Instead of having multiple EU VAT registrations, UK businesses can opt for an EU IOSS registration to simplify compliance. You still need to review the delivery terms agreed with customers for sales of goods over €150 to make sure VAT is correct.

Customs and VAT After Brexit Are Pretty Much the Same

The rules for importing goods from outside the UK post-Brexit haven’t changed. They’re almost identical, even if the goods come from the EU or another non-EU country. Let’s look at them now:

Customs duty

- Travellers are allowed to bring up to £390 worth of items with them without paying customs duty.

- If they bring in more than this, they have to pay duty at a rate based on the value and country of origin of the items.

- Only goods worth £135 or less and free of tobacco or alcohol are exempt from customs tax when purchased from a store in a foreign country. The same restrictions apply to gifts.

VAT

- Travellers who bring in less than £390 worth of goods are also exempt from paying VAT. They have to pay import VAT at the relevant rate if they purchased the items in the UK in excess of £390.

- Goods purchased from a store in another country are always subject to UK VAT.

- Gifts delivered from a person overseas are free from VAT if they are: valued at £390 or less, contain no alcohol, tobacco, or perfume, or contain less than the specified restrictions for such commodities (which vary from product to product).

Let’s Look At Data Protection Regulations Post-Brexit

Following Brexit, the UK is no longer governed domestically by the EU's GDPR, which regulates the processing of all personal data of individuals within the EU.

The new UK GDPR is basically identical to the EU's GDPR. The only difference is it now only governs the personal data of individuals located inside the United Kingdom. It enforces the following data protection guidelines:

- Your website must get explicit consent from your users before processing their personal data via cookies and third-party trackers

- You must safely store and document each valid consent.

- You must offer a set of rights to UK users, specifically the right to delete and the right to have corrected already collected personal data.

Tools To Help You Adapt to the Changes of Brexit

If you have not been using tools to automate VAT or for accounting purposes, you may want to consider them now. If you already use automated tools, you should make sure they are ready to comply with the new rules.

There are also tools for specific businesses and industries out there perfectly attuned to the needs of their niche.

Tip

Leave your VAT Registration to Osome. Our expert accountants keep you compliant and specialise in ecommerce, and our smart software makes sure never overpay taxes.

Brexit Tips for Small Businesses

As the kinks of Brexit are ironed out, you should make it your priority to stay up to date with the latest changes — the UK government posts regular updates on changes with the most up-to-date guides.