Pointers To Get Your ID Approved by Companies Registry on Your First Try

When setting up a company in Hong Kong, foreign directors and shareholders must submit a notarized copy of their ID. We explain how to obtain a document that will pass the requirements

When setting up a company in Hong Kong, each director and shareholder must submit a copy of their ID to Companies Registry (CR), the government body overseeing the registration of new businesses. Unfortunately, CR often rejects these copies for not meeting their standards. People then have to send the documents again, delaying the incorporation and costing them money.

This short article will help you do everything exactly the way Companies Registry wants you to and get your company started in Hong Kong on the first try.

What ID docs are we talking about?

All directors and shareholders must submit a copy of their identification document. The copies need to be certified true copies.

Certification for Hong Kong residents can be done by

- Certified Public Accountants;

- Hong Kong Solicitors;

- Notaries Public.

Directors and shareholders from outside of Hong Kong, need to get notarized copies of their IDs. That means they need to find a notary public and buy the service of notarization.

How to certify true copies of documents in Singapore?

It is extremely important to ensure that all the documents you are submitting are genuine and legal. So you will have to send certified true copy samples. As a rule it is done by a notary public. Notaries public are senior lawyers of Singapore with more than 15 years of professional experience. They are appointed and follow the Notaries Public Act.

What is a notarized copy?

A notarized copy is quite similar to a certified true copy. The difference is that certified true copies are recognized only inside the country they have been certified in and notarized documents are recognized internationally.

How do I ensure a person has the capacity to act as a notary public?

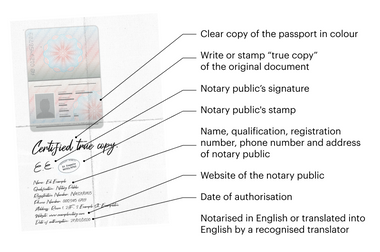

Here’s what Osome recommends to help ensure your notary public will meet Companies Registry standards:

1. Before arranging your appointment, confirm the notary public’s commission is current. If it is not, any document notarized by them will not be legally authenticated.

2. During your appointment, obtain a copy of the notary's certificate confirming his commission as a notary public. This usually includes their legal name, identification or registration number and the dates of when the commission took effect and the date on which it expires.

3. Ask the notary public to note their website on the copy for verification purposes. Some of them do not include this by default.

What should a notarized passport copy look like?

- The document must be in English.

- The certified true copy of your passport must be in colour, clear, and easy to read. Don’t risk your time submitting a blurry one.

- If your document is not in English, the copy must be translated into English by a recognised translator. CR will not accept the copy in any other language.