Total transparency and control over your finances

Dedicated accountant

Your accountant is on-call via the live chat function on the Osome App and responds within a day.

- Learn more

Audit and compliance filing

Every Hong Kong business must be audited by a certified third-party Auditor, who then submits the results to the Inland Revenue Department.

All documents in one place

Securely store all your important documents in one place. We automate the upload of bank statements, invoices, bills, and expenses for easy tax filing with our comprehensive accounting services.

Unlimited bookkeeping

Bookkeeping is included in your package. We'll take care of your financial records, taxes and reconciliation of transactions to comply with the Hong Kong Companies Ordinance.

Accounting services for every business, from startups to those scaling

Startups

Ambitious startups need flexible, proactive accounting services. We prepare financial statements and handle bookkeeping to give your business the support it needs to grow.

Entrepreneurs

As a founder, your time should be focused on building your business. We'll be your trusted adviser, providing bookkeeping and easy-to-access accounting support.

Corporations

As your business grows, so does our support with you. Our services will adapt to increasing turnover and evolving business needs.

Keep your finger on the pulse of your business finances

Experts who get to know your business

Get a personal accountant from day one. Our local team prepares your accounts and seamlessly manages the third-party audit and delivery to the Inland Revenue Department. Stay complaint the stress-free way.

Pay the right tax

We'll help you navigate the Hong Kong tax system, including rates and local allowances, so that you can do business while remaining compliant.

Never miss a deadline

We ensure you never miss a filing deadline with our streamlined processes, so you don't have to worry about nasty fines.

Bookkeeping?

Easy-to-use tools to handle all your business operations

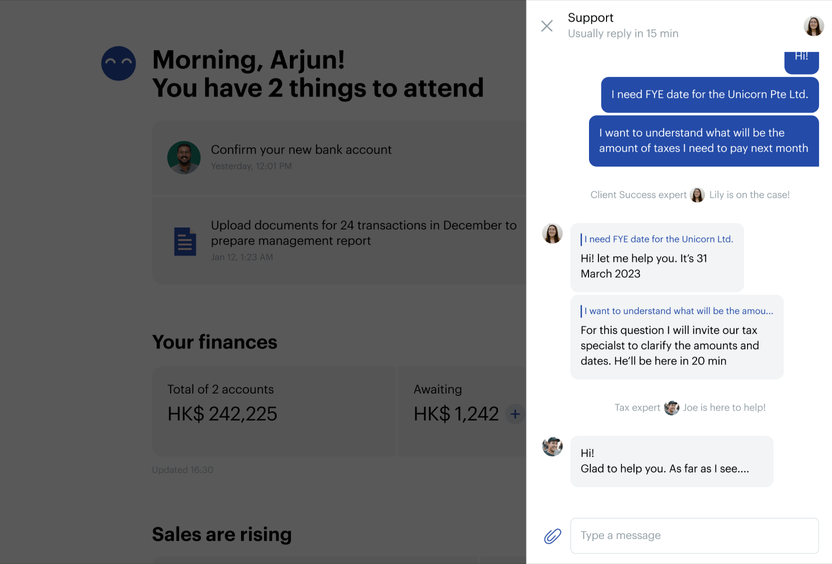

Consistent support from your accountant

Get answers and expert guidance within 24 hours from your accountant via live chat.

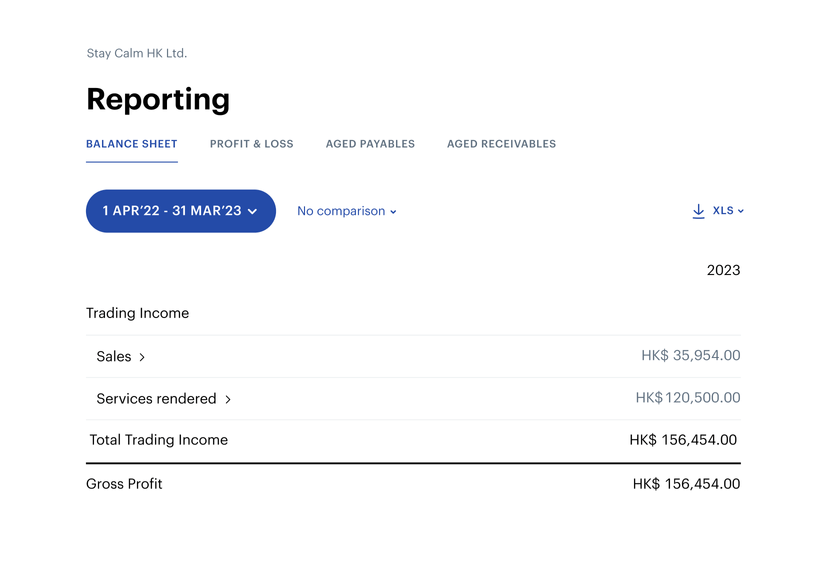

From bookkeeping to filing tax

We process documents within 24 hours, giving you an updated snapshot of your financials when needed. We'll file your reports when the time comes — you just need to sign and click ‘approve’.

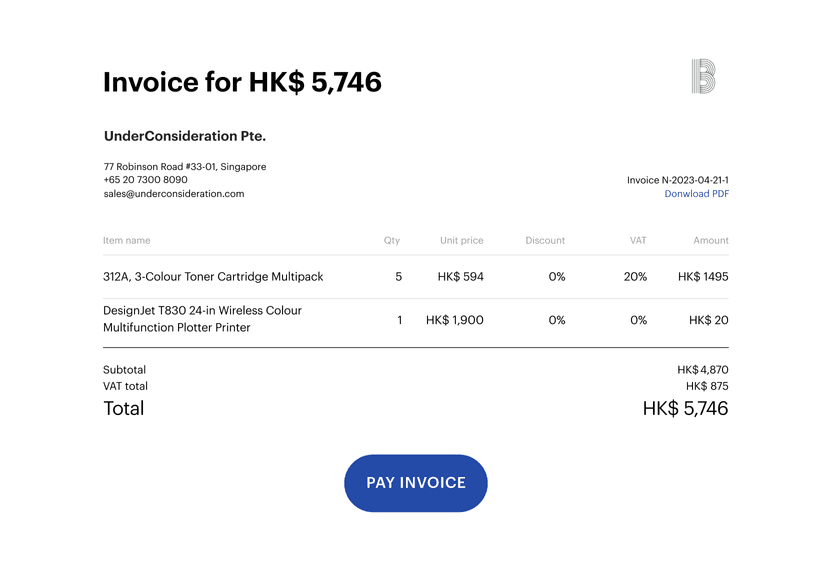

Get paid quicker

Issue invoices, nudge late payers and get paid faster. Pre-filled fields in the template means there's no more need for manual data entry whenever you need to issue an invoice.

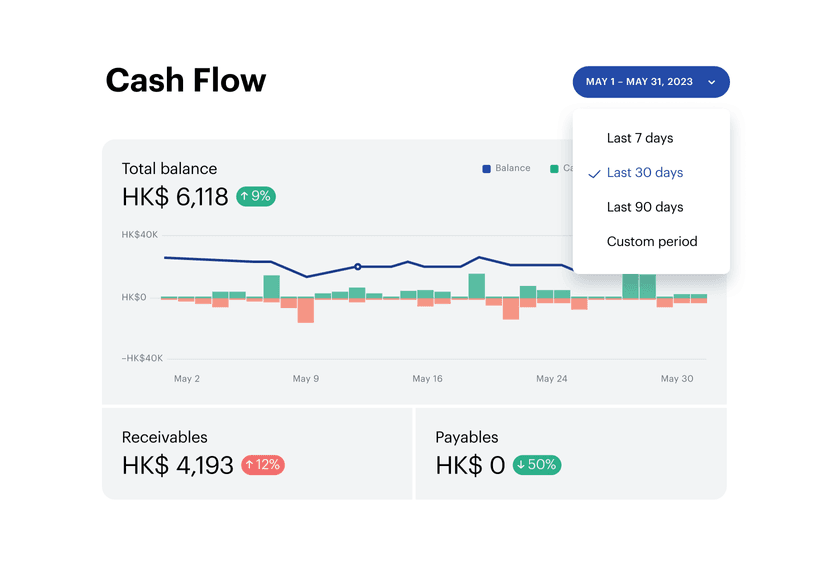

Know your cash flow

See your balance aggregated from all connected ecommerce platforms and bank accounts.

Plans to fit your business

Our packages are tailored to your business stage and annual revenue. When your revenue falls above or below the selected threshold, we'll either invoice you for the difference or credit your account. As your business grows, you can customise your package with add-ons to meet your evolving needs.

Operate

When you want to nail your first year of business and stay compliant

from

HK$ 3,500 billed annually, per financial year

Financial software

Bookkeeping

Expert service

Optional add-ons

Grow

For growing businesses requiring additional admin and advisory support

from

HK$ 4,200 billed annually, per financial year

Financial software

Bookkeeping

Expert service

Optional add-ons

Scale

For founders who need audit and tax support for compliance and regulatory filing

from

HK$ 8,500 billed annually, per financial year

Financial software

Bookkeeping

Expert service

Audit service

Optional add-ons

Add-ons you might need

Payroll services, per employee

HK$ 220/m

All payroll particulars handled for you, including payroll calculations and payslips.

Urgency filing

HK$ 3,000

An urgency fee applies for filing deadlines longer than 2 months, while custom pricing is available for shorter timeframes.

What our clients think about Osome services

“We saved a lot of time which we could reallocate to scaling our business”

91 %of customers recommend Osome services

“Accounting, audits, and any raised question was resolved quickly and professionally — an exceptionally good service level!”

Arif Dewi

FAQ

Why should my small business or startup outsource an accounting service?

As a small business owner, you’ve shouldered the work of bookkeeping yourself to keep a close eye on your expenses. As your business grows, most owners find that their time is better served on focusing on their products and services, rather than your accounting debits and credits. Outsourcing these tasks means hiring a service that provides a full accounting department experience. With comprehensive accounting services, you can outsource everything from day-to-day accounts receivable, accounts payable, payroll and transaction coding, to filing Profits Tax Returns and financial reporting.

What accounting software do you use?

We have developed our own tools. We recognise invoices and receipts, reconcile them with transactions, and update your documents and outstanding bank balance daily. We support single and multiple currencies, show the actual list of all unpaid invoices and report to you if any document is missing.

In what form should I submit my data?

You can submit your records in any format convenient for you. Whether you have them in physical copies, digital files, or scanned documents, simply drop them into our user-friendly app, store them securely in the cloud, or send them via email to our dedicated accounting team.

Our certified public accountant is well-versed in handling diverse formats of financial data. They ensure that all information is accurately processed and meticulously reviewed. This includes preparing detailed financial statements and reports tailored to your company's financial year-end, and facilitating smooth financial reporting.

What are my tax filing requirements?

All companies are required to submit Profits Tax Return annually. A newly incorporated company will receive the first Profits Tax Return after 18 months of incorporation. Three months will be allowed for preparing the accounts and audit report for the first profits tax filing. Thereafter, the tax return should be filed with the deadline depending on the Company’s Accounting Year End Date.

Employer’s Return of Remuneration & Pensions is required annually as well. Companies that have hired employees should report the salary and wages paid to employees for each fiscal year (April to March) in April every year. Our accounting services can help ensure timely and accurate submission of these returns, and we’ll also assist in preparing annual financial statements to support your filings.

Why choose Osome as an accounting and bookkeeping service provider?

When you’re ready to take your business to the next stage of growth, you’ll want to hand over the routine and administrative tasks like accounting and bookkeeping to trusted experts who know what the entrepreneurial grind is like.

We help small businesses in Hong Kong with all the necessary accounting services. We prepare financial statements and handle bookkeeping. The accounting advice would save you time from figuring this out on your own and save costs by being compliant with the local authority instead of paying late fees or penalties which can add up to a huge sum.

You don’t only get your dedicated accountants with Osome, you also get access to all your documents and financial data anywhere you want to work, using our app. All your documents are digitized and stored securely on the cloud.

What is cloud accounting?

Cloud accounting, also known as online accounting, involves hosting the software on remote servers. It contains the same functionality as desktop accounting. However, the entire process gets moved to a cloud system. This is similar to the PaaS (Platform-as-a-Service) business model. The data gets sent to a different location, where it is processed and returned to the user or client.

What’s more, users can access software applications remotely using the Internet or Intranet. For a Hong Kong accounting firm, employees from other departments can access the same data and software version without missing any updates. Cloud accounting software also frees the business from having to install and maintain software on individual desktops. It’s a type of accounting that essentially enables users to get real-time reporting and visibility.

Furthermore, most cloud platforms have API functionality. With this, third-party software can connect to your system to provide even more value through your business accounting.

How does pricing work?

Our pricing is revenue based. We don’t charge on the number of transactions in your account or the number of invoices you upload. All prices are based on the financial year, not the calendar one.

Does Osome provide a Certified Public Accountant (CPA) for accounting services?

Yes, Osome offers a dedicated Certified Public Accountant (CPA) who specialises in providing comprehensive accounting services. Our CPA is adept at handling financial reporting, ensuring compliance with regulatory requirements set by the Inland Revenue Department, and offering expert guidance tailored to your business needs.

What if my actual annual revenue differs from my chosen accounting plan's revenue range?

No worries! We'll adjust your accounting plan to match your actual revenue — either by sending you an invoice for the pro-rated package or crediting the amount back to your account.

Fresh insights from our business blog

The 10 Best Ecommerce Hosting Services in 2025

When you are setting up your ecommerce shop, the right hosting provider can make all the difference. However, with a variety of options out there, choosing the best one can be confusing.

How To Write a Perfect Startup Business Plan

Crafting a compelling business plan is vital for startups seeking success and investor trust. Learn the importance of a strong plan, from defining your vision to understanding the Hong Kong market. Gain insights into financial strategies, securing licenses, and making your startup investor-ready.

10 Best Payment Gateways in Hong Kong for Ecommerce Businesses

Other than branding and marketing, these technologically savvy consumers are well acquainted with the Internet and convenient payment gateways and demand nothing less than a seamless ecommerce transaction.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?