Everything You Wanted To Know About EBITDA

How to calculate EBITDA and, most importantly, why? A practicing financial analyst and investor Dan Satkunas explains how to assess business decisions based on EBITDA margin—and makes it all look quite interesting.

As a business owner, you might come across this number when you are looking for investors. Typically, investors need to use various tools to understand the valuation of a company before buying its stock.

One of the valuation measurements is EBITDA. When used the right way, EBITDA can give a clear insight into the earnings of a company, and how well it manages its resources.

Meanwhile, if you have further questions on other valuation measurements, you can ask our trusted accountants in the UK to help you out.

What Is EBITDA?

EBITDA is a method that measures the operating and financial performance of a company. Simply put, the meaning of EBITDA is measuring core profit trends since it eliminates some external factors and allows investors to compare "apples-to-apples."

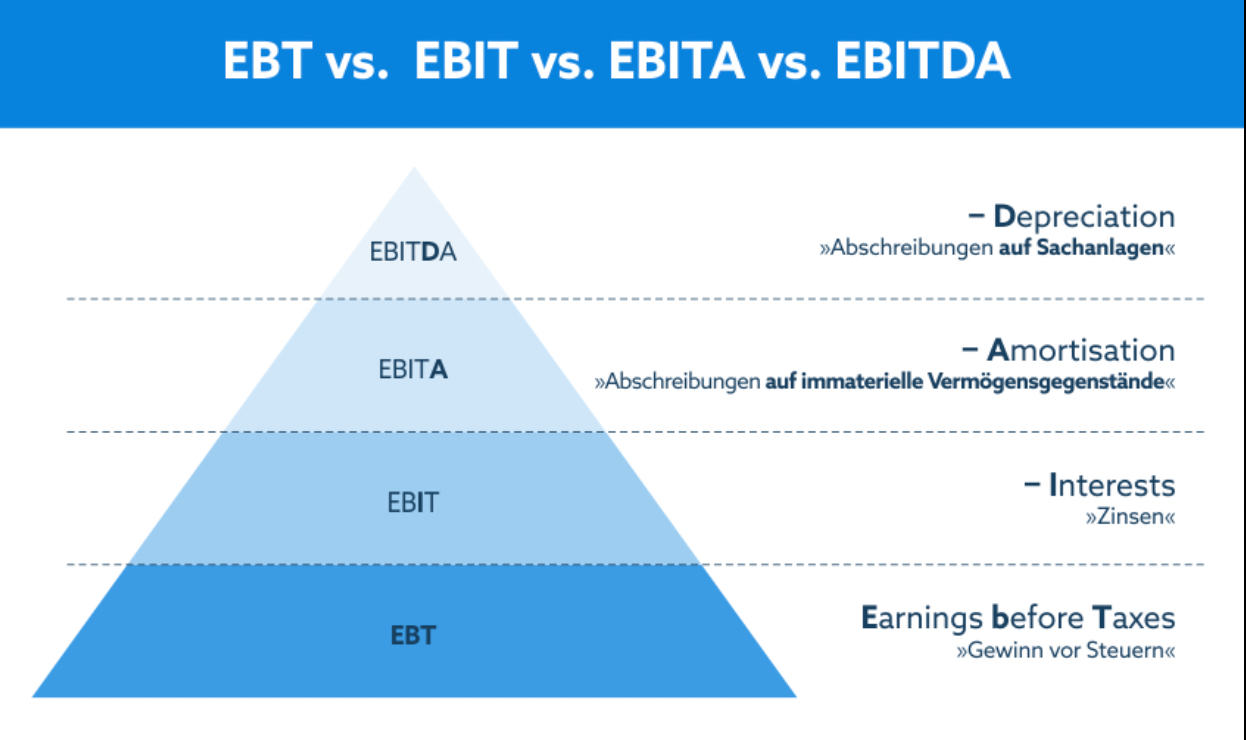

It stands for Earnings before Interest, Taxes, Depreciation, and Amortization. In EBITDA, the letter "B" refers to the items that are deducted while measuring a company’s operational performance. In addition, taxes, depreciation, amortization, and interest are deducted too since they do not influence the operating performance of the company.

EBITDA definition refers to the net income or earnings of an organisation after adding back interest, taxes, depreciation, and amortisation. All these components are excluded because they do not affect a company's operating performance, giving a clearer picture of operating cash flow.

When used the right way, EBITDA can give a clear insight into the earnings of a company, and how well it manages its resources.

How To Calculate EBITDA?

The next question that crops up in investors’ minds is how to calculate EBITDA. It is a variance of operating income or EBIT that removes non-operating expenses and some specific non-cash expenses.

The purpose of excluding these is to do away with the discretionary factors, including capital structure, debt financing, taxes, and methods of depreciation. The metric is often used to show a company’s financial performance without considering its capital structure.

EBITDA mainly focuses on operating decisions because it looks into profitability from the core operational perspective before the influencing factor of capital structure, non-cash items such as depreciation, and leverage.

This metric is still not a recognised one by US GAAP or IFRS. Even some notable investors like Warren Buffet have a disliking for this metric because it does not consider the depreciating assets of a company.

If an enterprise has a significant amount of depreciable equipment, it may lead to a high depreciation expense. However, EBITDA does capture the cost of maintenance and sustaining all the capital assets.

How Is EBITDA Calculated?

Let us talk about the EBITDA formula:

EBITDA Formula 1

EBITDA = Operating Income (EBIT) + Interest + Taxes + Depreciation + Amortisation

In this formula, we can get EBITDA by adding a company’s operating income or EBIT, the expenses, such as interest, taxes, depreciation (reduction in asset value), and amortisation.

EBITDA Formula 2

EBITDA = Operating Profit (EBIT) + Depreciation + Amortisation

Similarly, in the second formula, we can obtain EBITDA by adding a company’s operating income (EBIT), depreciation, and amortisation. Here interest and taxes are ignored to focus on a company's actual operational profitability.

What is EBIT in these formulas? In simple words, EBIT, meaning the operating income that a company earns. We can get the operating income after deducting the expenses from the net income, except for taxes, depreciation, amortisation, and interest.

Not-so-fun Fact

Using EBITDA can often lead to misleading results. It is easy to predict and plan for debt on long-term assets, while it is not the case for short-term debt. Generating low income is never a good sign of a business’ health no matter if it uses EBITDA or not. Removing taxes, depreciation, amortisation, and interest can make even an unprofitable company look financially healthy. If we look back to the 2000s when the dot-com companies had no earnings and sustainability but seemed attractive in the investment world. Using EBITDA as a metric to show the financial health made those firms appear attractive. When the truth comes out about the real sales figures of companies that use EBITDA, things will fall apart, and the investors may lose their money.

Example Calculation

EBITDA is calculated by taking net income and adding interest, taxes, depreciation, and amortisation expenses back to it.

Let’s calculate EBITDA for a London startup called IDS ChatMaster LTD that creates Chatbots.

| IDS ChatMaster LTD | |

| Income Statement for the Year Ending

December 31, 2019 |

|

| Sales Revenue | £ 500,000.00 |

| Salaries | £ 48,000.00 |

| Rent & Utilities | £ 50,000.00 |

| Depreciation & Amortisation | £ 30,000.00 |

| Operating Profit (EBIT) | £ 372,000.00 |

| Interest Expense | £ 20,000.00 |

| Earnings Before Taxes (EBIT) | £ 352,000.00 |

| Taxes | £ 66,880.00 |

| Net Income | £ 285,120.00 |

The income statement of the company shows sales revenue of £500,000,000.

Now, to calculate EBITDA, we need to consider the operating profit (EBIT) of £372,000, and depreciation & amortisation of £30,000.

EBITDA = £372,000 + £30,000 = £402,000

Why Is EBITDA Important?

This metric is similar to cash flow and reveals the streams of cash that a company received during the reporting period that it may use in the future.

By using EBITDA, financial experts can conclude the following:

- Figure out whether a company needs to reinvest the money for its business expansion and manage its debts

- Can make an apple-to-apple comparison of similar companies easily since the sizes, taxes, and debts do not remain important factors anymore

- Calculate if the company has a positive cash flow, which is the lifeblood of a business

EBITDA is used as a core indicator for investors. When investors see an income statement with a high EBITDA, they realize that the company can generate profit and will get their share.

In a company’s reporting, EBITDA can look particularly attractive if the capital costs are high, as depreciation increases EBITDA. It means using this metric allows an organisation to hide some expenses and appears more attractive to investors.

Currently, there are no regulations from financial reporting standards to regulate the calculations of the EBITDA algorithm. Due to this, the onus is on a company to decide what it wants to include and exclude in the calculation. There are also chances that a business includes different items in its calculation for certain periods, like quarters or a year.

Understanding EBITDA

Does EBITDA Include Salaries?

The adjustments for EBITDA include owner salaries and staff bonuses. Often family-owned companies give higher salaries and bonuses to owners and family members than other executives. It is a way of compensating them for their ownership.

Now, an owner’s salary may become a benchmark for the company in terms of post-sale earnings. So, by showcasing the owner’s salaries, a business can make its EBITDA appear higher.

Is a Business Healthy? Debt/EBITDA Shows It

The net debt-to-EBITDA ratio shows a company’s financial health and whether it can pay off its debts or not. It also shows how long the company needs to run its operations at the current EBITDA levels and debt to repay all its debt.

Is a Higher or Lower EBITDA Better?

Higher debt-to-EBITDA ratios are an indication that a company may find it difficult to pay off its debts, considering its current EBITDA and liquid assets. Often credit rating agencies, corporate buyers, and prospective investors use this ratio to understand the financial position of the company.

Usually, debt-to-EBITDA ratios below 3 are acceptable. When the ratio is lower, there are high chances that the company can successfully repay its debt. If the ratios are higher than 3 or 4, they indicate “red flags” and show that the company may face financial distress in the future.

Can EBITDA Be Negative?

EBITDA can either be positive or negative. A business is in a healthy financial position when its EBITDA is positive for a long period. However, even profitable companies can witness short phases of negative EBITDA.

A negative EBITDA indicates that a business is facing some operational issues or is not properly managed. If EBITDA is below zero, it is considered negative.

How Can I Improve My EBITDA?

Business owners and operations managers need to focus on developing sustainability and grow the company’s profitability to maximize its value.

The main idea behind this is to get the company in a good financial position so that when initiating a sale, earnings look optimal and the overall outlook of earnings is favourable.

Here are a few tips that business owners can use to improve EBITDA:

- Increase profits from sales because it is the amount from which expenses are subtracted to get EBITDA.

- Improve amortisation since it is a component of EBITDA.

- Increase the percentage of depreciation as it is a part of EBITDA too.

- Add more of other components such as taxes and interest expenses since they are parts of EBITDA.

Also, do the following changes in the remaining expenses:

- Lower the cost of goods sold

- Reduce salaries

- Reduce rent

- Lower utilities

After subtracting all these expenses from the sales profits, business owners can get EBITDA.

| Great Oak Furniture LTD | |

| Income Statement for the Year Ending

FY 2022 |

|

| Sales Revenue | £ 700,000.00 |

| Cost of Goods Sold | £ 500,000.00 |

| Salaries | £ 30,000.00 |

| Rent & Utilities | £ 20,000.00 |

| Depreciation & Amortisation | £ 10,000.00 |

| Operating Profit (EBIT) | £ 140,000.00 |

| Interest Expense | £ 1,000.00 |

| Earnings Before Taxes (EBIT) | £ 139,000.00 |

| Taxes | £ 26,410.00 |

| Net Income | £ 112,590.00 |

| EBITDA | £ 150,000.00 |

As we mentioned above, EBITDA is not included in the income statement, but let us include it for now so that we have the whole picture.

Daniel’s recommendations for Great Oak Furniture LTD are:

- take out a loan (a loan will increase the interest which is part of EBITDA );

- buy a shop and a storage space that will help the company sell more and cut rent;

- buy bigger batches of goods for lower prices (it’s obvious but it works; especially when the company owns a shop and a storage);

- buy software and hardware in order to reduce salaries;

- use compensation schemes based on the company’s stock to increase non-cash bonuses that are included in EBITDA.

To see if this advice works, let’s do some time travelling and also visit two parallel universes. In one universe, Great Oak Furniture followed Daniel’s advice. In the second one, they did not. Let’s compare the two income statements we would get while travelling around.

Great Oak Furniture LTD

| Income Statement for the Year Ending

FY 2022 |

|

| Sales Revenue | £1,200,000.00 |

| Cost of Goods Sold | £700,000.00 |

| Salaries | £92,000.00 |

| Rent & Utilities | £50,000.00 |

| Depreciation & Amortisation | £20,000.00 |

| Operating Profit (EBIT) | £338,000.00 |

| Interest Expense | £40,000.00 |

| Earnings Before Taxes (EBIT) | £298,000.00 |

| Taxes | £56,620.00 |

| Net Income | £241,380.00 |

| EBITDA | £358,000.00 |

| Income Statement for the Year Ending

FY 2022 |

|

| Sales Revenue | £1,900,000.00 |

| Cost of Goods Sold | £1,000,000.00 |

| Salaries | £56,000.00 |

| Rent & Utilities | £9,000.00 |

| Depreciation & Amortisation | £120,000.00 |

| Operating Profit (EBIT) | £615,000.00 |

| Interest Expense | £160,000.00 |

| Earnings Before Taxes (EBIT) | £455,000.00 |

| Taxes | £86,450.00 |

| Net Income | £368,550.00 |

| EBITDA | £755,000.00 |

- Even though the company didn’t follow Daniel’s recommendations, it still continued growing. But it rented the storage space instead of buying it, so the Rent and Utilities part of the budget remained high, and the EBITDA does not look great. In addition, they clearly need to attract investors so as to be able to buy bigger batches of goods.

- Having followed all of Daniel’s recommendations, the company grew very fast and showed excellent financial results. Net Income and especially EBITDA grew more than 4 times in 3 years.

What Is a Good EV/EBITDA Ratio?

Typically, the EV/EBITDA for the S&P 500 has averaged between 11 and 14 in the recent past.

EBITDA calculates a company’s overall financial performance, whereas EV figures out its total value.

As of January 2020, the average EV/EBITDA for the S&P 500 stood at 14.20. The general guideline to a good and above average EV/EBITDA is when the value is below 10.

EBITDA vs. Other Indicators

Is EBITDA the Bottom Line?

Although the use of EBITDA is widespread, it is still not part of the standard accounting methods like GAAP. Due to this, businesses can report EBITDA according to their discretion. The problem lies with this type of reporting is that it does not give the true picture of a company's financial performance. On many occasions, investors may even avoid EBITDA altogether or use it with other more effective metrics.

Is EBITDA the Same as Gross Profit?

EBITDA and gross profit are not the same. Gross profit is the profit that a company generates after deducting the costs of production and services. Gross profit appears on the income statement of a company.

On the other hand, EBITDA is a metric of measuring a company's profitability that comprises earnings before interest, taxes, depreciation, and amortisation.

| E-bikes LTD | |

| Income Statement for the Year Ending | |

| Sales Revenue | £ 800,000.00 |

| Cost of Goods Sold | £ 500,000.00 |

| Salaries | £ 48,000.00 |

| Rent & Utilities | £ 50,000.00 |

| Depreciation & Amortisation | £ 30,000.00 |

| Operating Profit (EBIT) | £ 172,000.00 |

| Interest Expense | £ 20,000.00 |

| Earnings Before Taxes (EBIT) | £ 152,000.00 |

| Taxes | £ 28,880.00 |

| Net Income | £ 123,120.00 |

EBITDA = 172,000 + 30,000 = £202,000

Gross Profit = 800,000 – 500,000 = £300,000

As we see, the difference between EBITDA and Gross Profit is £98,000. In other words, these two are certainly different things.

EBITDA vs. EBT and EBIT

Earnings before tax or EBT shows how much operating profit a company has generated before accounting for taxes. While EBIT drops both taxes and interest payments from the calculation. A company can obtain its EBT by considering net income and adding taxes back to calculate its profit.

By excluding taxes, investors can use EBT to assess the operating performance of a business after removing a variable that it cannot control. EBT and EBIT are similar and both are variations of EBITDA.

Earnings before interest and taxes or EBIT is the net income of a company before deducting income tax and interest. The purpose of using EBIT is to analyse the performance of a company without including tax and the costs of the capital structure that may influence the profit.

The formula below is applied to calculate EBIT:

EBIT = Net Income + Interest Expense + Tax Expense

Whereas you can calculate EBITDA with the formula below:

EBITDA = Net Profit + Interest + Taxes + Depreciation + Amortisation

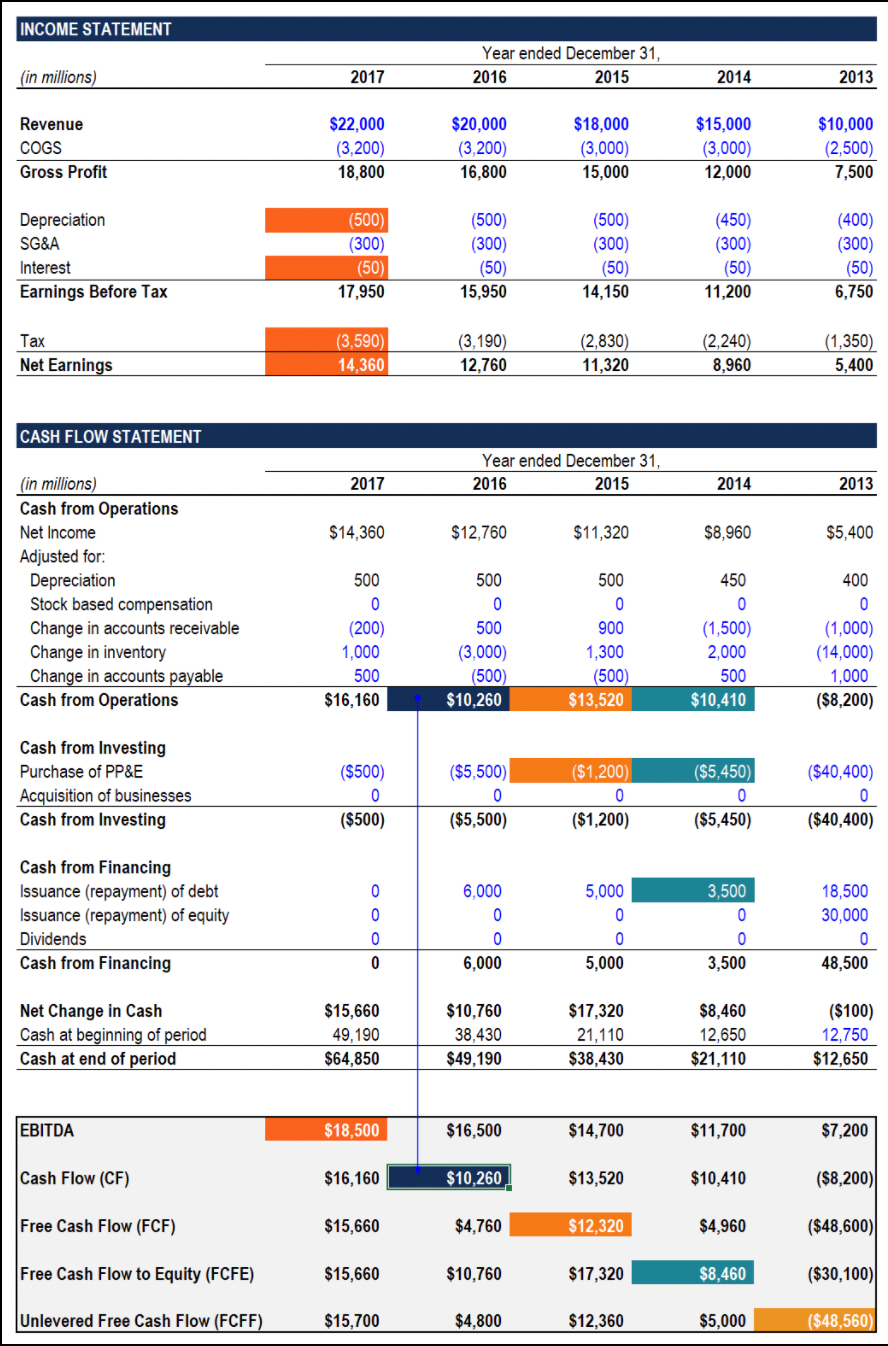

EBITDA vs. Operating Cash Flow

The operating cash flow helps to measure how much cash a company generates since it adds non-cash expenses such as depreciation and amortisation back to net income. It also includes the variables in working capital that also provide cash, for example, changes in inventories, account receivables, and payables.

Factors like working capital are crucial when calculating a company’s cash flow. Often investors exclude variables in working capital in their reviews and depend mainly on EBITDA. However, they might miss the factors that indicate whether a company is not generating enough cash for not making any sales.

How Is EBITDA Used in Investment Decisions?

How Is EBITDA Connected to a Company's Value?

According to investors and analysts, a company’s valuation is 4 to 10 times higher than its EBITDA.

Seasoned buyers will, however, try to buy for a lower price by considering the company’s average financial performance in recent years as a base value.

If a company is doing business in a high-growth industry, buyers often expect a substantial purchase bonus. Their offer to buy the company could be 4–10 times higher than the EBITDA results. Six times EBITDA is mostly a regular multiple to make a deal.

To make sure that a company gets the highest valuation, owners try to increase its financial performance at least for the past 3-4 years. The first step towards that goal is preparing impressive financial statements.

What Is the EBITDA Multiple?

The EBITDA multiple is a financial ratio that compares a company's Enterprise Value with its annual EBITDA. This multiple can figure out the valuation of a business and compare it to others.

In this context, we also need to know about the EBIT multiple, which is a financial ratio to measure a company's earnings.

EBIT multiple = Earnings before interest and taxes ➗ Enterprise value (EV)

On the other hand, the EBITDA multiple of a company provides a ratio for variances in taxation, capital structure, fixed assets, and compares operational disparities in various companies.

EBITDA Multiple = EV/EBITDA

EV (Enterprise Value) = (Market capitalization + Value of debt + Minority interest + Preferred shares) – (Cash and Cash equivalents)

EBITDA = Earnings before Tax + Interest + Depreciation + Amortization.

| Market Data | Financial Data | Valuation | ||

| Company Name | Share Price, $ | EV, bln | EBITDA, bln | EV/EBITDA |

| The Coca Cola Company | 45.86 | 225.735 | 9.786 | 23.1× |

| Pepsico Inc. | 110.48 | 184.232 | 12.509 | 14.7× |

*The data was taken from www.stock-analysis-on.net

At Osome.com, we can help you figure out EBITDA multiples by industry UK to compare with similar companies.

What Is the EBITDA margin?

The EBITDA margin measures the company’s profit before Interest, Taxes and Depreciation as a percentage of its Total Revenue. This margin shows a company's efficiency and is used to compare the enterprise’s real performance to others in the related industry.

The formula for determining it is quite simple:

EBITDA margin = EBITDA divided by Total Revenue (or Sales Revenue) * 100%.

Here are income statements of two similar London companies that create chatbots. Mr Hammer is an investor from Texas. He wants to invest money in an IT company based in London and is choosing between IDS ChatMaster and ChatLabs. Anyone can notice that the Net Incomes are the same. So how can Mr Hammer choose a more profitable business? Let’s work out the EBITDA margin and help him out.

IDS ChatMaster LTD/ChatLabs LTD

| IDS ChatMaster LTD | |

| Income Statement for the Year Ending

December 31, 2019 |

|

| Sales Revenue | £500,000.00 |

| Salaries | £48,000.00 |

| Rent & Utilities | £50,000.00 |

| Depreciation & Amortisation | £30,000.00 |

| Operating Profit (EBIT) | £372,000.00 |

| Interest Expense | £20,000.00 |

| Earnings Before Taxes (EBIT) | £352,000.00 |

| Taxes | £66,880.00 |

| Net Income | £285,120.00 |

| ChatLabs LTD | |

| Income Statement for the Year Ending

December 31, 2019 |

|

| Sales Revenue | £500,000.00 |

| Salaries | £68,000.00 |

| Rent & Utilities | £59,000.00 |

| Depreciation & Amortisation | £1,000.00 |

| Operating Profit (EBIT) | £372,000.00 |

| Interest Expense | £20,000.00 |

| Earnings Before Taxes (EBIT) | £352,000.00 |

| Taxes | £66,880.00 |

| Net Income | £285,120.00 |

EBITDA margin (IDS ChatMaster) = (372,000+30000)/500000*100% = 80.4%

EBITDA margin (ChatLabs) = (372,000+1000)/500000*100% = 74.6%

An investor choosing the company as an investment will prefer the one which has a higher EBITDA margin. Three years after he invests, there may not be any interest expenses and amortisation because amortisation is restricted by time. Having done away with amortisation, the CEO could make a decision to pay off the company’s debt, so the company would get rid of the interest expenses, too. Hence, IDS ChatMaster would have a higher net income and cost more money, which is exactly what any investor wants.

What Is an Average EBITDA Margin?

Usually, an average EBITDA margin is between 10% and 50%, depending on the industry a company operates.

Free EBITDA Margin Calculator

Here is a free EBITDA margin calculator for your convenience:

EBITDA margin calculator (Google Sheets)

FAQ

What Is Operating Profit vs. EBITDA?

Operating profit and EBITDA are two different metrics. Operating profit is the total income of a company after deducting the operating expenses, depreciation, and amortisation.

On the other hand, EBITDA measures the overall profitability of a company.

Operating Profit = Gross Profit – Operating Expenses – Depreciation – Amortisation

EBITDA = Operating Income + Depreciation + Amortisation

What Is a Good EBITDA?

It is ideal for business owners not to think whether EBITDA is good or bad. Instead, EBITDA should be used as a metric to compare companies.

Investors often divide EBITDA by revenue to get the EBITDA margin. A good EBITDA margin is something that is generally high but also higher than its competitors.

When a company has a high EBITDA margin, it has a steady cash flow and can be profitable.

What is Amortisation in EBITDA?

Amortisation is closely related to EBITDA, which periodically reduces the book value of intangible assets during a specific period.

Amortisation is part of a company's financial statements. Some examples of intangible assets are intellectual properties such as trademarks or patents, goodwill from past takeovers.

Does EBITDA Have Limitations or Disadvantages?

Limitations

EBITDA adds expenses such as depreciation and amortisation back into the operating profit of a company. Usually, financial analysts depend on EBITDA to assess the ability of a company to generate revenues primarily from sales and compare with similar companies.

EBITDA is not a part of the GAAP measure, and business owners often use it intentionally to hide the actual financial performance of a company. Due to this reason, the use of EBITDA is rampant in developmental-stage businesses or the ones with heavy debts and expensive assets.

Considering these limitations, EBITDA is not an ideal metric for assessing the profitability of a company.

Disadvantages

Since EBITDA is a "non-GAAP" accounting measure, its calculation can be vastly different from one company to another. Often business owners consider EBITDA over net income due to its flexibility, and it can divert attention from other red flags in the financial statements.

A major red flag for investors to watch out for when a company starts highlighting EBITDA when it has not done much in the past. It may happen when a company is in a heavy debt burden or witnessing soaring capital and development costs. In such a situation, EBITDA can work as a distraction for investors and can be misleading.

EBITDA the same as Revenue?

No, they both are different. These two items are part of an Income Statement. Revenue is the income generated in a business and is a line item on the Income Statement.

On the other hand, EBITDA is what's remained from Revenue after subtracting the expenses.

Tip

Registing a new business in the UK? We will do all the work for you.