How To Register a Business in the UK: A Comprehensive Guide for Entrepreneurs

- Modified: 22 August 2024

- 15 min read

- Starting a Company

Jon Mills

Business Writer

Jon relishes writing content that both educates and entertains the reader. With a background in copy and content writing for brands, he's told unique stories in creative ways, adding value to products in the luxury sector. Now, he works with our accounting experts and small business owners to bring their advice and journeys to life for Osome's readers. He aims to inspire ambitious entrepreneurs to set their sights high, and build highly-respected, flourishing businesses.

When the government introduced the Companies Act 2006, it implemented extensive changes to corporate law, including reforms that further simplified aspects of company governance and clarified directors’ responsibilities. While online company formation has been available since 2001, the Act reinforced and modernised the legal framework under which businesses operate. As such, many professionals now use online registration services to form their new business.

If you are considering setting up your own business in the UK but don't know where to start, starting the registration process should be your first step. It establishes your business legally, which can support your claims to IP and help you operate effectively. Additionally, registration is often a prerequisite for accessing financial services, such as loans and insurance coverage, Here's a detailed guide on how to register your business in the UK that will simplify your journey.

Why Should I Register a Business in the UK?

The UK has a stable business environment. The country has strong links with the rest of the world, making it a popular destination for domestic and foreign investors and those looking to register a business.

You can register a business in the UK, which is straightforward and often done through a simple online form. For most limited companies, you can register for Corporation Tax simultaneously when registering with Companies House, simplifying the process. Once approved, you will receive a Unique Tax Reference (UTR) number from HMRC that will be used for all your tax-related matters... If you're interested in registering a limited company as a separate legal entity, our services can guide you through the process smoothly.

Besides, there are some other reasons why you should register a business in the UK, such as:

- To legally establish your business: Many people start businesses to enjoy flexibility and control over their schedules. While specific licenses are required for certain industries, registering your business with the government ensures you are operating legally and helps you avoid penalties from HMRC for tax non-compliance or other violations.

- To avoid the risk of fines: It is crucial to register your business with the relevant authorities within the required time frame- such as registering with HMRC for tax purposes- to avoid fines and legal actions. This process allows HMRC to assess your business’s tax obligation and compliance.

- To protect your business against fraud: Registering your business gives it legal recognition, which can be crucial if you need to protect your business against fraud or take legal action in case of disputes.

- To access government incentives and support: Registered businesses may sometimes be eligible for various government grants and support programs that are not available for unregistered entities. These incentives can provide valuable financial support and resources to help your business grow.

Ultimately, registering your business provides a solid foundation for growth and success.

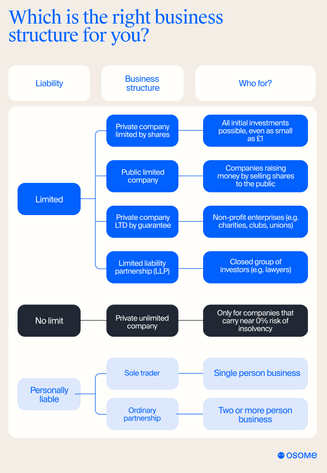

Which Business Structure To Choose for Registering

Before you register your business, it is essential to determine the most suitable structure for your needs. Each type of business structure has advantages and disadvantages, and each comes with specific legal requirements. The UK government provides several options for business structures, each designated to meet different needs, from sole traders and partnerships to limited companies and more.

Let’s explore the most common structures and the unique benefits they offer.

Sole Trader

A sole trader is someone who runs their own business and gets to keep all their business profits after paying income tax. This means that the person owns all of the assets and liabilities of their business, including the right to decide how the business will be run. The main benefit of running a sole trader is the flexibility to set your hours and have complete control over business decisions. However, a sole trader is personally liable for all the business's debts.

While sole traders do need to register with HMRC for tax purposes, they are not required to register with Companies House. Sole traders are still subject to all relevant laws and regulations despite having limited resources. As a sole owner, you are responsible for organising all company accounts and business records unless they outsource to an expert accounting provider.

You must register a business as a sole trader if your business profits from self-employment exceed £1,000 in a tax year. Here's what you need to do if you decide to operate as a sole trader:

- Keep a record of your accounts

- Invest in good insurance

- Pay income tax on your profits

- Register for VAT (Value Added Tax) if your turnover is more than £90,000

- Assemble the paperwork before you register your business

Partnership

A partnership is an agreement between two or more people to share profits, losses and other rights in a business venture. Partnerships are typically formalised through a written contract, known as a partnership agreement or partnership deed, which outlines how profits and losses will be distributed among the partners

If you want to register a Limited Liability Partnership in the UK, you need to register it with the Companies House. After registration, you must also notify HMRC for tax purposes. Partnerships, including LLPs, are legally binding agreements that offer some protection to all partners involved, depending on the structure chosen. In addition, the partnership may include one or more limited partners who provide financial support but are not involved in management.

Here's how to register your business as a partnership:

- Ensure that you fulfil the minimum requirement of having at least two people in the partnership.

- Choose a business name that is unique. You can use our company name check tool to ensure your prospective company name hasn't already been taken. As a general rule of thumb, consider choosing a name that any other business in the world hasn't used. This will help you have a global appeal should you expand to other parts of the world. Also, ensure that your name doesn't violate the guidelines and is free of offensive words. The UK government maintains a list of sensitive words that you need to obtain permission to use in a business name. Once you have a registered company name, you can move on to the next step.

- Determine who will be the ‘nominated partner.'The nominated partner is responsible for registering the partnership with HMRC and submitting the partnership’s tax return. Each partner is responsible for filing their individual self-assessment tax returns.

- Register for VAT if the annual turnover exceeds £90,000.

Limited Company

A limited company can be formed by at least one shareholder and offers limited liability, which meansthatyour personal assets are seperate from business assets potecting you from being personally liable for business debts. Shareholders’ liability is limited to the unpaid amount on their shares. To be a separate legally recognised entity, a limited company must be registered with Companies House, protecting your personal assets regardless of the company’s financial situationю You can also choose to register for Corporation Tax when registering with Companies House or do it later through HMRC.

Once recognised as a separate legal entity by the Companies House, limited companies can trade, buy or sell assets, borrow money, take on other people's debts, distribute to its members, pay dividends and offer company shares to interested buyers. Limited companies can also become legal employers to help grow the business, which means increased responsibility, such as managing payroll and paying for employee National Insurance. However, providing workplace pensions to eligible staff can help reduce your tax bill.

To register your business as a limited company, you must:

- Choose the type of limited company you want to establish.

- Select a unique business name that doesn't violate copyright or offend others.

- Prepare the necessary documents for submission to Companies House.You can either do it yourself or work with a company formation agent or accountant with relevant experience and expertise in registering a new business.

- Once you receive your company registration number and the Certificate of Incorporation, you can register for VAT later if you meet the requirements. The detailed rules for VAT registration are outlined in the following sections.

How Do You Register a New Business With HMRC?

This process applies to sole traders, limited companies, and partnerships: the first step to registering a business in the UK is to start with the government website. This will allow you to set up business bank accounts for tax-related matters and receive official recognition from HMRC.

You should register your business - whether it's a limited company, partnership, or sole trader entity - as soon as possible after establishing your business to avoid tax penalties, pay national insurance contributions, and fulfil your accounting obligations with HMRC. Sole traders should register by October 5th of their business’s second tax year (the tax year lies between 6 Apr to 5 Apr the following year), while limited companies must register with Companies House before commencing operations.

The registration process requires completing an online form on the UK government website, which typically takes about an hour. Before proceeding, ensure you are familiar with the terms, conditions and eligibility criteria relevant to your business structure.

During the registration process, you will need to provide the following information about your business:

- The business name

- Official company address (where it will be based)

- Your contact details – including email address and telephone number

- Your business structure – this may include whether your company is a sole trader, limited company or partnership

- Your team, including the information on the directors, secretaries and shareholders (for limited companies)

Once you complete the registration process, you will receive a UTR (Unique Taxpayer Reference)via post, which will be used in all your dealings with HMRC and is essential for managing your business’s tax obligations.

Small Business VAT Registration with HMRC

Navigating the complexities of VAT (Value Added Tax) is a crucial aspect of running a small business in the UK. Understanding the requirements, registration process, and ongoing compliance obligations can help ensure that your business meets legal standards and avoids financial penalties. This guide breaks down the essential information business owners need to know about VAT registration and legal compliance with HMRC (Her Majesty's Revenue and Customs).

VAT registration requirement

Small business owners have specific responsibilities when it comes to VAT registration and compliance with HMRC (Her Majesty's Revenue and Customs). If your business turnover exceeds the VAT threshold of £90,000 in any rolling 12-month period or is expected to do so in the next 30 days, you must register for VAT and pay tax accordingly to HMRC.

Penalties for late registration

To avoid penalties, it's crucial to register for VAT as soon as you expect to meet the threshold.. HMRC imposes penalties based on the VAT due from the date you should have registered, with the penalty percentage increasing the longer the delay. Timely registration ensures you avoid these penalties and stay compliant.

Registration process with Companies House and HMRC

For limited companies and LLPs, registering with Companies House is the first step between registering for VAT with HMRC. Sole traders and partnerships, however, only need to register with HMRC directly. The VAT registration process requires providing details such as your business turnover, activities and bank information.

Online registration

You can register your business for VAT online via the HMRC website, making the process accessible and straightforward. After registering, you will receive a VAT registration number, which must be included on all invoices and relevant financial documents. This number signifies that your business is compliant with VAT regulations and allows you to reclaim VAT on eligible business expenses.

Ongoing compliance

In addition to registering for VAT, small business owners must maintain accurate records of all sales and purchases, submit regular VAT returns, and make timely VAT payments to HMRC. Compliance with these requirements ensures that your business remains in good standing with tax authorities and avoids any legal or financial repercussions.

By understanding and adhering to these VAT obligations, small business owners can effectively manage their tax responsibilities and contribute to the smooth operation and growth of their business.

Registering a Business at Companies House

Companies House is the UK's official registrar of companies. It acts as a central repository for information about companies, including their names and addresses, directors' details and financial information.

The registration process varies depending on the type of business you are starting, such as a limited company or LLP. You must choose a unique company name that complies with Companies House regulations, avoiding names that violate trademarks or are offensive. It’s advisable to check name availability before proceeding, as certain terms are restricted.

Once you have chosen your business name, you need to prepare the necessary documents/information, including:

- the Memorandum of Association (MoA) and Articles of Association (AoA): These are essential for forming a limited company, If you register your company online, you don’t need to write your own memorandum of association. It will be created automatically as part of your registration. You can either use standard articles (known as ‘model articles’) or write your own and upload or send them when you register your company

- Form IN01. This is the form used to apply for registration with Companies House

- SIC (Standard Industrial Classification) Code: This classifies your company’s business activities.

- Details of Directors and Shareholders: At least one director must be named and appointed

After submitting these documents, Companies House will review your application, Once approved, you will receive the Certificate of Incorporation, which will instantly legalise your business in the UK. And don't forget to register for Corporation Tax with HMRC within three months of starting business activities to stay compliant.

Get Your Business Started With Osome

There is a lot of information and advice out there on business registration in the UK. But the entire process is easier said than done. So, if you are overwhelmed with the thought of registering your business, consider partnering with professionals like us.

Osome is a company formation and business bank account opening platform that helps you set up your company, register it and prepare its financial foundation. We will guide you through every step of the way so that you know exactly what to do to become a legal company in the UK.

Our online service offers business services to individuals and small businesses who want to start their dream ventures with expert advice. From a free company name-checking tool to VAT registration, our solutions are end-to-end, so you don't have to stress or look elsewhere for support when registering your business.

The best part? Our service is completely online, so there is no need to worry about paperwork or filling out forms. It is paperless throughout, even if you are a non-resident. With our expertise, we can help you get your legal documents in order to save you stress and time so that you can focus on growing your business and watching those revenues grow.

Summary

Registering a business in the UK involves different steps depending on your business structure. If you are a sole trader or self-employed, you must register with HM Revenue and Customs (HMRC) for tax purposes. For those operating as a limited company, additional requirements include registering with Companies House while not legally required, opening a business bank account is highly recommended for financial management. Limited companies must provide details such as the company name, registered business address, and information about directors and shareholders. They also need to maintain statutory records, file annual accounts, and file a confirmation statement each year. These steps ensure compliance with UK legal and financial obligations for all business structures.

FAQ

Do I need to register my business in the UK?

Yes, in the UK, most businesses must register with HM Revenue and Customs (HMRC) for tax purposes, even if you're a sole trader or self-employed. Additionally, if you operate as a limited company, you must register your company with Companies House. While opening a business bank account is not a legal requirement, it is strongly recommended for separating personal and business finances.

Registering as a limited company involves providing details such as the company name, registered company address, and information about directors and shareholders. Once registered, you'll receive a unique company registration number and must comply with additional requirements, including maintaining statutory records, filing annual accounts, and submitting a confirmation statement each year. This ensures your business meets all legal and financial obligations in the UK.

How much does it cost to register a small business in the UK?

The cost of registering a small or online business in the UK can vary depending on the business structure and services you require. Registration for sole traders or partnerships with HMRC is generally free. Registering a limited company with Companies House now costs £50 for standard online registration. If you require same-day registration, the fee is £78. If you choose to register by paper, the fee is £71. There may be additional costs for legal or financial advice, depending on specific needs.

How do I start a business from home?

Starting a small or online business from home in the UK involves several steps, including choosing an idea, a business name, business registration (if required), creating a business plan, securing any necessary licenses or permits, setting up a dedicated workspace, managing finances, and marketing your business. It's essential to research and plan thoroughly to ensure a successful home-based business. Depending on your business, there may also be specific regulations or industry requirements to consider.

Do I need to register a sole trader business?

If you operate as a sole trader in the UK, you must register with HMRC to file a self-assessment tax return. Registration is necessary for sole traders to report their income and expenses for tax calculation and payment. However, registering as a sole trader is relatively straightforward and can be done online, and there is no fee for this registration.

Do I need a business address?

Whether you are a non-resident or a local, it is a legal requirement to have an official address for your business in the UK. For limited companies, this address must be a registered office address, which can be your home, an office, or the address of your accountant. If you prefer not to use your home address or need a prestigious address, consider registering for a virtual office address through a provider like Osome.

More like this

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?