How Accounting Is Different from Bookkeeping?

In short, bookkeepers record transactions of your company, then accountants summarise, interpret and report them. We explain who needs both specialists and why a bookkeeper can't substitute an accountant.

In short, bookkeepers record transactions of your company, then accountants summarise, interpret and report them.

The line between the two roles may seem thin: there are basic responsibilities for each of the jobs, and some tasks can be done by both of them. For example, an accountant prepares financial statements yearly, and a bookkeeper deals with similar monthly reports.

Tip

You can turn to Osome for both bookkeeping and accounting services. Just saying.

Key differences between a bookkeeper and an accountant

| Bookkeeper | Accountant | |

| What they do | Keeps records of financial transactions | Analyses the information: prepares the financial statements, gives financial advice and sign off accounts. |

| Education required | Does not need a professional degree | Employers generally require some qualification. Usually, for entry-level positions,AAT certification is enough |

| Who controls the two | Controller or CFO | |

Smaller firms can do without a bookkeeper — every accountant has the qualifications to take over the bookkeeping tasks. However, generally, it can’t be the other way around. Accountants, for the most part, have diplomas to go along with the education bookkeepers normally don’t have.

It makes sense to have two separate employees for each set of tasks if you want to reduce the risk of mistakes and have the neatest papers possible. This comes in handy when you have an audit.

A bookkeeper tracks the money that comes and leaves

They deal with the data entries to the bookkeeping journals. They essentially are recording your business’ daily financial transactions. A bookkeeper is responsible for putting the right information into the right column when any money comes in or goes out of your bank accounts. Each entry typically goes with a date and details of the transaction. The entry’s debit/credit nature is also specified.

Say, on April 17, 2019, your company sells goods to the customers for £15,000 in cash. Your bookkeeper puts the info into the journal entry. The entry looks something like this:

| Date | Account title and explanation | Debit | Credit |

| 2019 April 17 | Cash | £15,000 | 2 |

| Sales | £15,000 |

Bookkeepers keep track of the business’ bank accounts too. You keep the records, your bank does it as well. The goal is to make sure the figures match. This is called bank reconciliation.

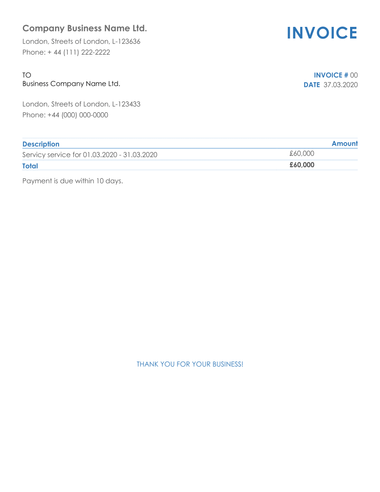

Bookkeepers are also Issuing invoices, or papers requesting a payment. In accounting terms, it means your bookkeeper also can manage your company’s accounts receivable. In business terms, it means that bookkeepers can be in charge of some operational tasks on top of their journal duty.

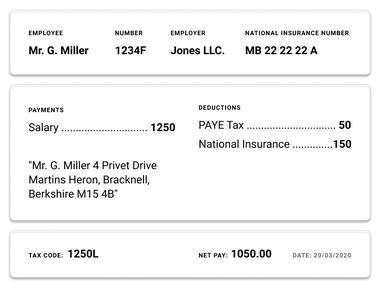

Usually, the bookkeepers are in charge of the payroll or the money you pay to the employees. A bookkeeper:

- Calculates how much to pay the employee;

- Calculates what amount of tax and government contributions to deduct from the payment;

- Makes sure that the money reaches the employee by the right date and with a proper payslip.

- Calculate, process and submit automated pension.

An accountant prepares and analyses financial statements, gives financial or tax advice

Preparing financial statements. They are the key financial documents of your company. Financial statements usually include:

- The balance sheet or the statement of the financial position. It shows how much your company has and owes and what is its current position.

- The income statement or the profit and loss account. It shows how much your company has earned and how much it has spent in a specific period.

- The cash-flow statement. It shows how much cash has moved through your business inside a certain period and how much it has right now.

Calculating and filing tax returns. An accountant counts the tax you are due to pay to HMRC and makes the tax reports. Your accountant can sign in for you and file the documents. You can integrate your accounting system with that of HMRC (known as Making Tax Digital or MTD) — for the figures to be downloaded automatically. An accountant is also to check your reports and those of HMRC and bring up and clear up any discrepancies.

Tracking the unpaid invoices. An accountant takes care of both what you owe and what is owed to you in invoices.

- They make two reports: aged payables (to whom, how much and by which date you owe money) and aged receivables (who, how much and by which date anyone owes you money).

- They can set up automatic reminders for the customers to let them know when they are due to pay.

- If the invoice remains unpaid, they act further to get the payments. This includes trying to reach the person by email or by phone or turning to invoice factoring — selling your invoices to a third party.

Giving a good piece of advice. A qualified accounting specialist can give you practical advice based on the analysis of your company’s financial indicators. This might include:

- Estimating startup costs;

- Giving an overview of the financial status of your business for a pitch for investors;

- Assessing how realistic it is to achieve a certain KPI given the financial status of your business, etc.

Who supervises bookkeepers and accountants

Here are some of the possible scenarios (can be combined):

- Your accountant manages your bookkeeper. However, many bookkeepers understand what accountants do and can serve as a second pair of eyes. Vice versa — an accountant is perfectly capable of checking the ledgers.

- You hire a controller. This person oversees the working process of your bookkeeper and accountant. They also control the cash flow and deliver the appropriate documents to the stakeholders. In addition, a controller does risk assessment and makes sure your accounting does not contradict the accounting principles.

- Your company’s Chief Financial Officer (CFO) supervises the bookkeepers’ and accountants’ work. The CFO deals with the long-term financial goals of your company, but can also perform some of the controller’s duties. Of course, no one expects a CFO to record transactions in the ledger, but ensuring accurate and timely financial statements reporting to the stakeholders is the CFO’s responsibility.

Want to start your company in the UK online? Osome will help you!