How Online Sellers Can Get Ready for EU VAT Changes in July 2021

The EU is set to introduce a new eCommerce VAT package that will come into effect on the 1st of July 2021. Understanding your VAT requirements is already a tough task, especially if you specialise in cross-border eCommerce. Unfortunately, however, it’s about to become even more complex.

The EU is set to introduce a new eCommerce VAT package that will come into effect on the 1st of July 2021. Understanding your VAT requirements is already a tough task, especially if you specialise in cross-border eCommerce. Unfortunately, however, it’s about to become even more complex.

Good news, the UK government has introduced a SME Brexit Support Fund to help small and medium-sized businesses like yours if you are new to importing or exporting. You could get up to £2,000 to help with training or professional advice including from our experienced accountants in the UK specialising in ecommerce accounting. Osome can help you understand these VAT changes and help you ease the tax burden while staying compliant.

Why Are These Changes to VAT Being Implemented in the EU?

New VAT rules for online business-to-consumer (B2C) sales of goods and services are going into effect throughout the European Union on July 1, 2021, to accommodate the growth of digital and cross-border commerce that takes place online and often on large marketplaces.

The original EU indirect tax rules cannot keep up with the rapid growth of E-commerce. The result has been unfair competition from overseas sellers who fail to charge VAT on goods sold to EU consumers. An estimated €5 billion is lost annually due to the complex rules and non- compliance of cross-border digital sales of goods.

The EU is introducing changes that will simplify VAT compliance for E-commerce companies so that they are not subject to double taxation, as well as ensuring level ground for EU sellers and traders located overseas.

A significant goal of the new rules is to ensure that VAT is paid where consumers are located starting January 1, 2021, so local businesses will no longer be penalized. Second, a set of administrative simplifications will be applied in order to reduce the burden on businesses. Thirdly, online marketplaces will have a greater role in charging and collecting VAT on specific scenarios involving EU consumers.

While the authorities hope that this will eventually make the process of reporting and paying VAT easier, it will obviously lead to short-term disruption—so it’s crucial that you understand what these changes are, how they’ll affect you in terms of tax liabilities and how your operations will be affected by these new frameworks in the EU and UK, and where you can turn to for support.

What Are The New EU VAT Changes?

Right, let’s examine the new EU VAT rules and outline who’s impacted by these changes.

- No More Distance Selling Thresholds for Online Sellers Shipping Within the EU

- One Stop Shop (OSS) VAT Return for E-commerce

- Importing Low-Value Goods into the EU will be subject to VAT

- Online Marketplaces Will Become Responsible for Charging and Collecting VAT on Behalf of Sellers in Specific Scenarios

No More Distance Selling Thresholds for Online Sellers Shipping Within the EU

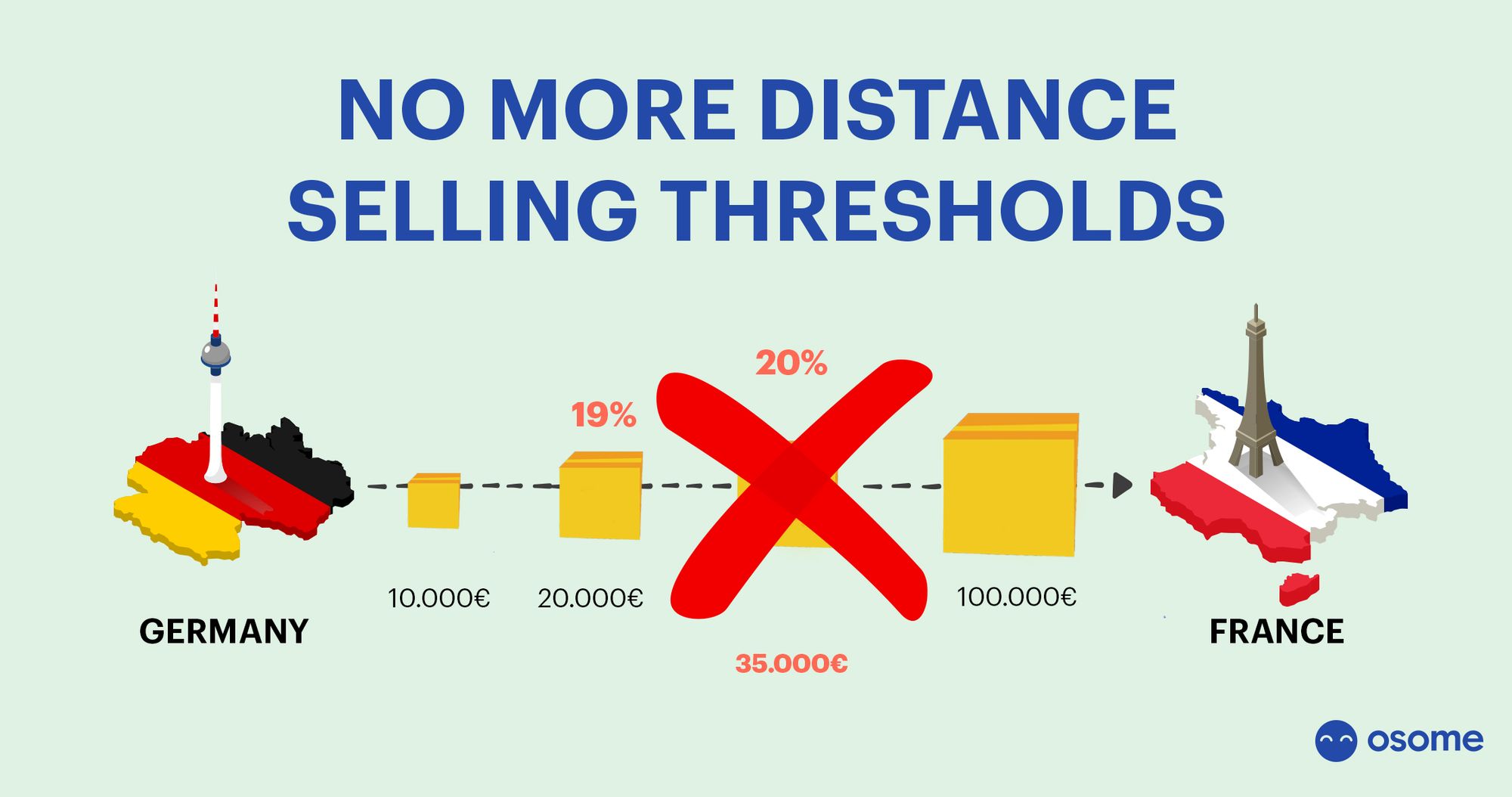

Currently, intra-EU B2C sales are subject to VAT in the country where the goods depart from. Well, up until a certain point—this is known as the local threshold. In some member states this threshold will be €35,000, whereas in others, it might be as high as €100,00.

Once the value of the goods that you sell in a particular state exceeds this threshold, you then have to register for VAT, charge the member state’s VAT on arrival and remit the collected VAT to the member state’s tax authorities.

After 1st July 2021, however, there will be no more distance selling thresholds—meaning all goods will be taxed in the member state itself upon arrival. However, if you follow the One-Stop-Shop (OSS) scheme then you can avoid having to register for VAT in each EU member state. You can instead report all B2C sales via a quarterly return to one single member state’s tax authorities, though note: the OSS scheme doesn’t apply to B2B supplies.

Lastly, EU businesses that are only established in a single member state can opt to be taxed in the member state of departure provided the total value of their B2C sales doesn’t exceed €100,000.

One Stop Shop (OSS) VAT Return for E-commerce

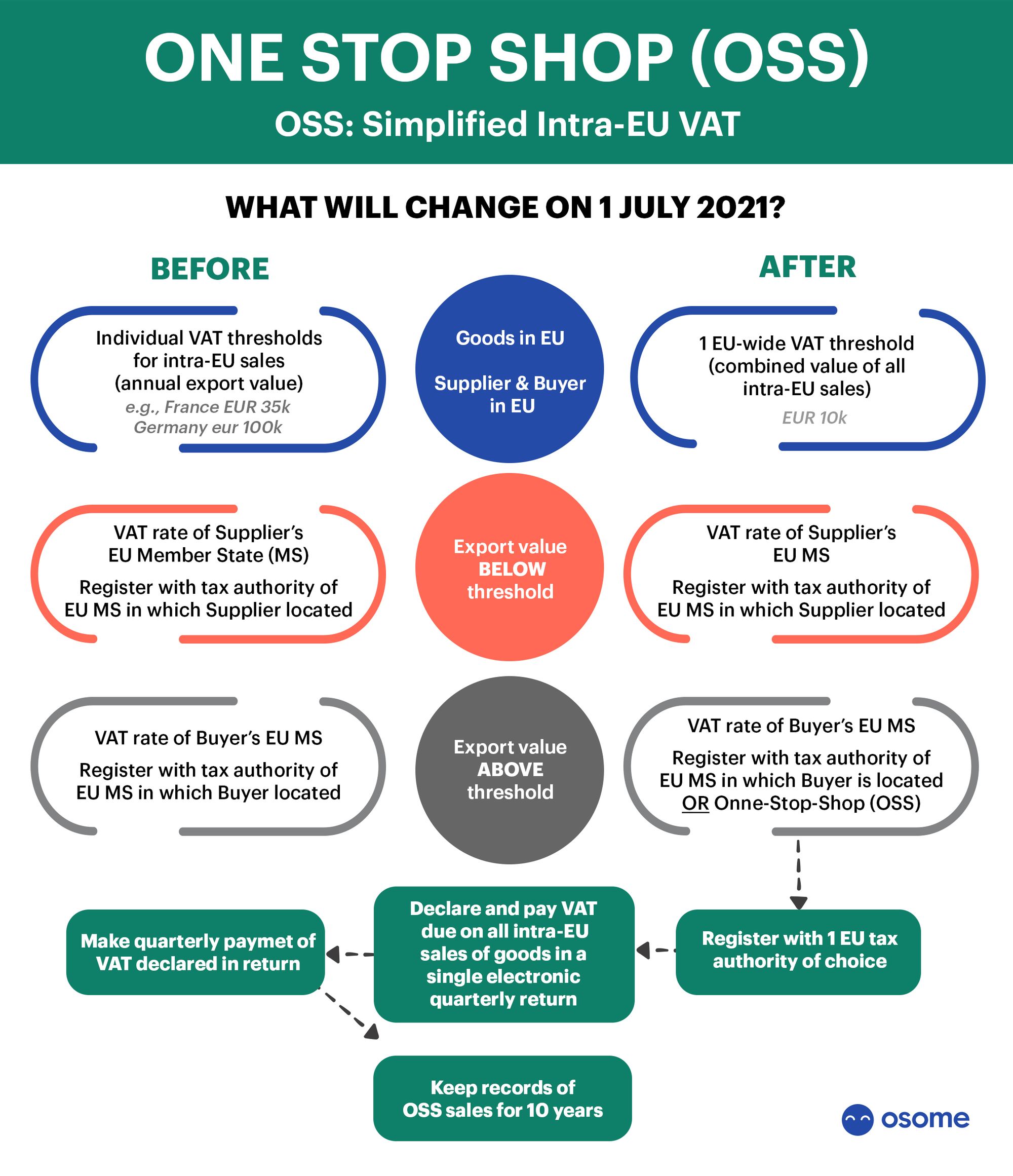

The current Mini One-Stop-Shop (MOSS) will be replaced by a far more comprehensive, wide-ranging OSS—making it easier to account for VAT on imports/exports.

Under the new rules, all VAT reporting can be completed with a single VAT return to just one member state’s tax authority. Sellers will still charge the customer country’s VAT but they will just have to report this to any one state's tax authority—these authorities will then handle forwarding VAT payments on to the necessary member states of consumption (i.e. other states in which the company has sold its goods).

You can still choose to register for VAT in each member state—but if you don’t have to then it makes no sense to unnecessarily incur this extra paperwork.

Low-value Goods Into The EU Will Also Be Subject To VAT

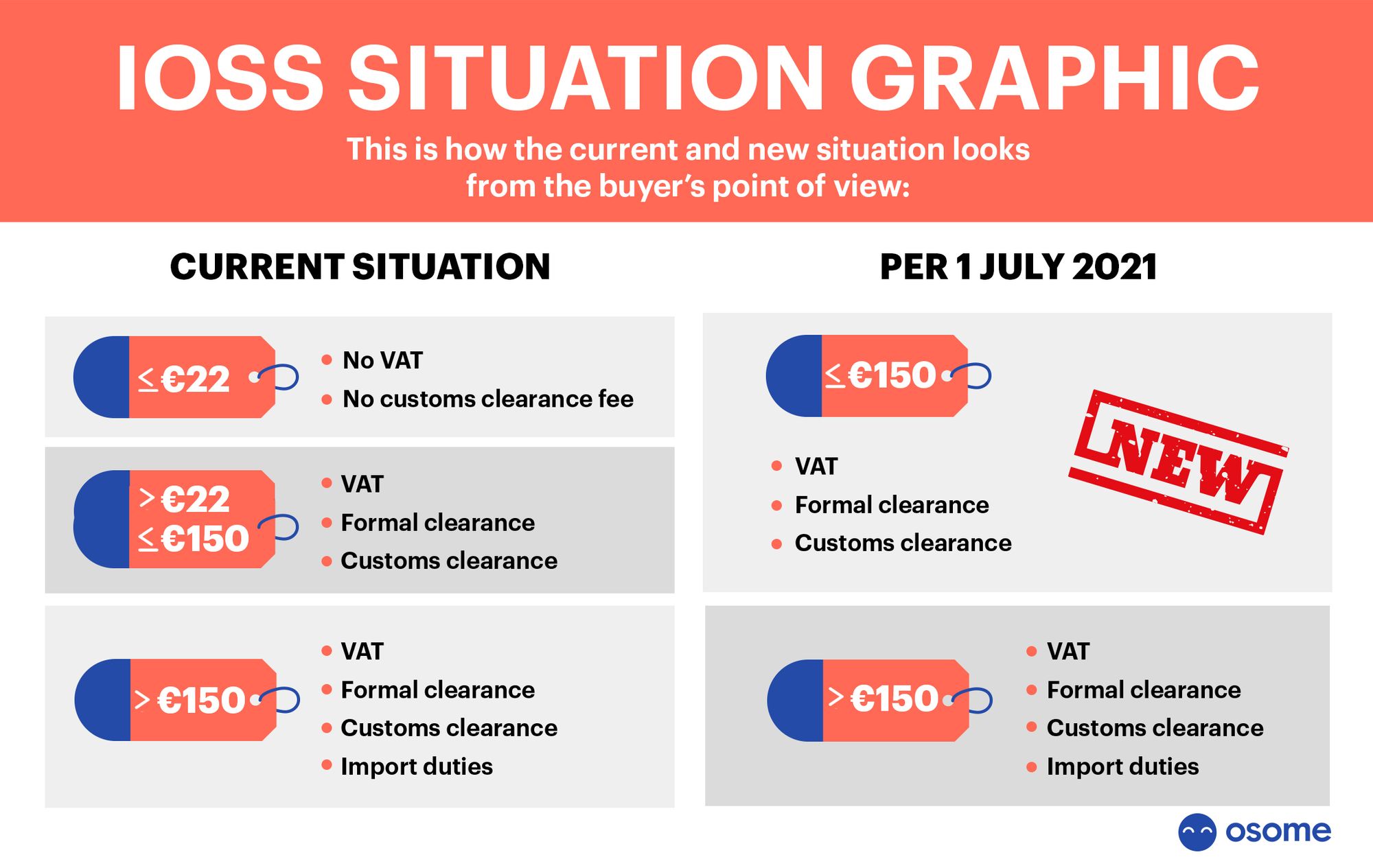

Currently, goods with a value below EUR22 are exempt from VAT when it’s imported into the EU. This exemption has led to an increase in fraudulent transactions with the boom of e-commerce. EU tax administrations have lost a significant amount of VAT revenue due to unfair practices. To put a stop to this, the EU is removing this VAT exemption at importation.

All commercial goods imported into the EU will become subject to VAT once the new rules are in effect. From July 1st 2021 onwards, any goods that you import will be subject to VAT unless you have decided to use the Import One-Stop-Shop (IOSS).

Hold up a second—what even is the IOSS?

It’s essentially a new scheme that helps organisations report the sales of low-value goods that they imported from outside the EU. It allows importers to immediately charge VAT at the point-of-sale (POS), meaning the customer picks up the bill, and they then declare this via monthly IOSS returns.

If you operate in an EU member state then simply sign up by contacting your local tax authority. If you’re located outside the EU, however, then you’ll need to register in the member state where your intermediary is based.

Online Marketplaces Will Become Responsible for Charging and Collecting VAT on Behalf of Sellers in Specific Scenarios

If you meet either of the following two requirements, keep on reading:

- You’re a non-EU business that ships within the EU and/or directly imports low-value goods from non-EU countries to customers within the EU;

- You’re an EU business that imports low-value goods from non-EU states (aka third countries) and sells them directly to EU-based customers.

Right, so which new changes will apply to you?

First, your platforms may now be considered suppliers if they are deemed to have facilitated the sale (i.e. they brought you in contact with your customers). By being deemed a supplier, they will therefore have to also charge and report VAT.

However, they will only be deemed suppliers if:

- Goods located outside the EU, and valued under €150, are imported and shipped directly to EU-based consumers;

- Goods located within the EU but sold by a non-EU seller (regardless of their value) are sold from within the EU to customers also located in the EU.

If either of these conditions is met then the platform has to charge VAT from its customers and report this to the authorities. The actual seller cannot themselves charge customers VAT (as the platform is now deemed to be the supplier).

You therefore need to:

- Clearly demarcate sales made from your own channels (i.e. your website) and those made through online marketplace platforms;

- Understand—and put into place—any necessary changes when it comes to your transactions’ mapping, internal IT system, and the invoices and contracts that you produce.

- Make sure you contact the marketplaces you sell goods on since they may be considered your deemed supplier for VAT purposes.

How can the SME Brexit Support Fund Help You Through These New VAT Changes?

The British government recognises that the EU’s new eCommerce VAT package will cause significant short-term disruption. With Brexit-related upheaval already hitting British businesses hard, they’re keen to ease this transition as much as they can—which is why they’ve introduced the SME Brexit Support Fund.

The SME Brexit Support Fund basically means that you could receive a grant worth up to £2,000 to spend on training or professional advice, helping you get to grips with the new rules and sidestep any potential hurdles.

Who’s Eligible?

Your company is eligible provided it meets the following criteria:

- It was established in the UK at least 12 months prior to you submitting your application;

- It has not previously failed to meet its tax or customs obligations;

- It employs no more than 300 people;

- Its annual turnover doesn’t exceed £100 million

- It only imports goods to and from Great Britain and the EU. If you have customers or suppliers based outside the EU then you are ineligible.

Meet the above requirements? Great! Let’s now get on to the fun stuff: what you can spend using the grant money.

What Can I Use the Grant For?

Unfortunately, you can’t use the money to throw a company-wide party, build a statue of your founder, or sponsor your favourite sports team. You must use the money for help with this specific new VAT package—for instance, to receive training on:

- Completing customs declarations;

- Managing customs processes (this also extends to using customs software and systems);

- Understanding import and export requirements (such as rules of origin);

- Seeking professional advice to ensure ongoing VAT compliance.

Right, How Do I Actually Apply?

The application process is being handled by PricewaterhouseCoopers (PwC).

Note

Note: the deadline is the 30th of June 2021, or earlier if all funding is allocated before this date. We say, the quicker you apply, the better.

Need More Help?

It’s great to hear that the UK government is offering small businesses up to £2,000 to help them deal with these new EU e- commerce VAT changes. This is the perfect chance to seek out crucial professional advice regarding setting up your supply chain, understanding the end-to-end VAT system, and conducting any necessary internal training.

Navigate these changes with a trusted accounting partner to help you get through these complex changes on the VAT and stay compliant as you sell more and grow your business.