What To Do if you Need a Nominee Director for Your Company

Find out what you need to know if you need a nominee director, along with their roles, and what could go wrong in the process to avoid mistakes.

If you’re in the process of starting your company, you would probably have heard of the option to appoint a nominee director for your company. Choosing a nominee director is an optional part of forming your company, and will typically take place in the first stages of registering your company. However, you may be unsure about what a nominee director is and why do you need to appoint one.

Why Do You Need a Nominee Director?

In order to successfully register your company, you must provide a director’s name which will be included in the board of director’s list. Choosing a nominee director gives business owners the benefit of anonymity when handling business-related operations.

If you are still unsure about how to start with the registration process, we can help you with your company formation in the UK.

There are two main reasons why you need a nominee director.

You do not want your name to appear in the Public Registry

All registered companies will appear on the official register that is maintained by Companies House, together with director names. Therefore, if you do not wish to have your name listed on the register for various reasons such as confidentiality or business sensitivities, you can appoint a nominee director to take your place as the ‘face’ of the company. Nonetheless, you are still the beneficiary owner who has full control of your business.

William is starting a company in the UK, but he has other appointments as well in other companies. Thus, he prefers to not appear in the public registry as the owner of the company. William can appoint a nominee director to take his place as director of the company, but he will still have total control of his company. The nominee director does not have control of the company and will be working under the instructions of William.

You want to avoid unnecessary extra taxes

If you are a foreign investor or overseas business owner wanting to open a company in the UK, you will be worried about the income loss due to taxation. Most investors would like to avoid paying extra or double taxes. Not having your name in the public registry will help to reduce the tax burden for you.

What Are the Duties of a Nominee Director?

Appointing a nominee director is legitimate. However, be sure to note that your nominee director fits the job requirement. The requirement of a nominee director is somewhat similar to how you would appoint a real director.

The nominee director

- Must be a natural person;

- Must be over 16 years of age;

- Has not ever been disqualified from a director role;

- Is not bankrupt;

- Is not the company’s auditor

The foremost duty of a nominee director is to do what is asked of him by the beneficiary owner. In simpler terms, the nominee director must only act on your behalf and is unable to make any decisions by themself. Doing so will result in a breach in the contract agreement signed prior to appointment and the nominee director can face legal charges.

How Do I Get a Nominee Director for My Company?

Do-it-yourself (DIY)

You can search and appoint a nominee director yourself, but it will take a lot of time and effort. Not to mention that you will have to single-handedly process all the legal documents that are required. These documents require a certain competency to prepare and will have dire consequences if done incorrectly. In the next section, we will list the documents needed for the appointment.

Thus, we would not encourage business owners to appoint nominee directors through DIY. The DIY option should only be considered if you have prior experience with nominee director appointments and are fully confident that you can handle the process.

Get help from a Corporate Service Provider (CSP)

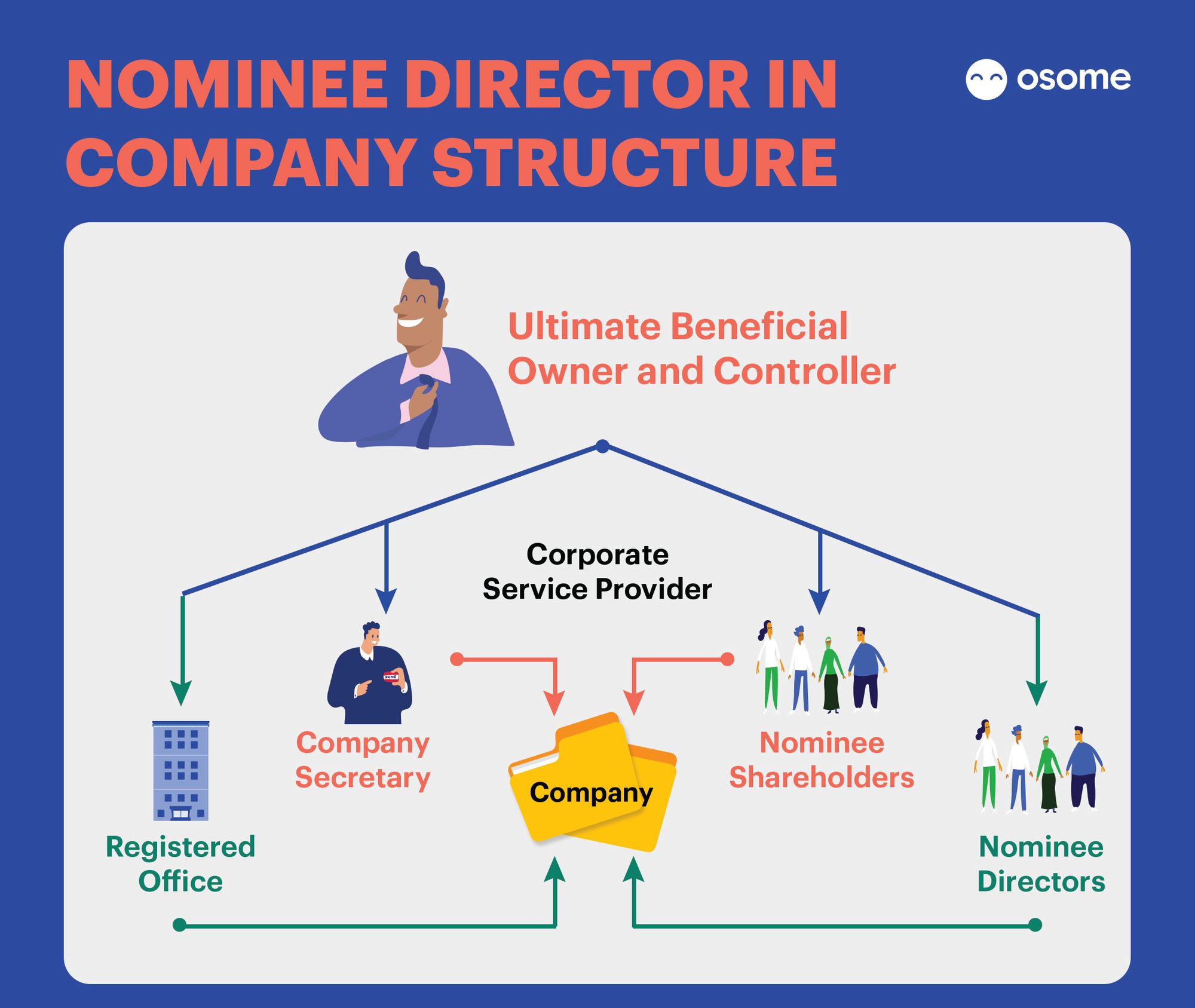

The second option is to engage the professional services of a corporate service provider to help with the appointment of your nominee director. In such cases, all you have to do is to provide the information needed and the process will be fully handled by the CSP at a cost.

This option is highly encouraged for both first time and experienced business owners, simply due to the convenience and professional services you get with a minimal cost. You can also put your mind to ease, knowing that legal matters are properly taken care of by your CSP.

Things To Provide to Your Nominee Director Service Provider

If you are going to engage a service provider for nominee director services, they will appoint the director to you, with your approval. To make things easier, you can consider preparing these few things first.

- Proof of identity and address of the beneficiary owner or business owner

- Reasons for choosing nominee director

- Nature of your business, as most service providers do not provide nominee services for finance or cryptocurrency-related companies

Things You Need To Appoint a Nominee Director

As mentioned before, to appoint a nominee director you will need a few documents to make the appointment legal. These documents also serve to protect you in case the nominee directors do not do what is required of them.

An agreement stating full details of both parties

This agreement should contain the full details of both parties, the beneficiary owner (you) and the appointed nominee. This includes name, tax identification number, address and more.

Then, the details of the nominee director will appear on Companies House’s records. Your details, on the other hand, will remain hidden.

Nominee’s agreement

This agreement confirms that the nominee director does not have control over the company and that full control is in the hands of the beneficiary owner.

Your details will be included to show that you are fully responsible for the company. The agreement should be signed by the appointed nominee director.

Beneficiary owner’s agreement

This agreement serves to protect beneficiary owners, showing that the ownership of the company belongs to you. In any case, when proof of ownership of the company is needed by the authorities, this document can be used to prove the actual owner of the company.

Signed but undated resignation letter from the nominee director

This signed but undated resignation letter is needed to ensure that you still have full control over your company. In cases when the nominee wishes to resign or if you decide to cease the nominee director services, rights will be transferred back to you. This resignation letter should be completed by the nominee director, signed and the date left blank.

General power of attorney

In order to complete director duties such as opening bank accounts, signing agreements, debt collection and other essential activities, a general power of attorney document is necessary.

As the beneficiary owner’s name will not appear on Companies House, this document acts as proof to allow the beneficiary owner to act for the company. It may also allow the nominee director to do the above tasks with a power transfer.

Cost breakdown from the service provider

Your service provider should go through in detail the costs involved in this process. Naturally, the costs will differ if you request for additional services such as having your nominee director perform tasks unlisted in the agreements. New documents and instructions will have to be drafted out in writing during the appointment.

One thing to always remember is that the nominee director only serves as a representative. They are not liable for any actions taken for the company. You, being the actual director and beneficiary owner, must be the one in charge of giving out instructions and being in full control of all company decisions. Thus, it is important that you are hands-on with company operations to ensure that things are going in your direction.

What May Go Wrong When Using a Nominee Director?

Banks don’t recognise them

In the UK, some banks do not recognise nominee directors and may cause some trouble when opening bank accounts. You should definitely check with your bank before making the decision for a nominee director. Before your trip down to the bank, you can prepare documents that may be required, such as your passport details or identification methods, and the complete details of the nominee director.

Not enough experience in the field

It is important to check with your service provider if the nominee director has had experience in the field, or whether they are well versed in handling a company. Keep in mind that nominee directors do not have the right to make decisions by themselves and any decision lies strictly in your hands. You have to keep an eye on the nominee director to make sure that they are working in compliance. Failure to do so may result in negative consequences for your company.

Exclusivity

Also, in some uncommon cases, when hiring the services of a nominee director through a service provider, the nominee appointed to you may not be exclusive to you. This means that the nominee director may have multiple appointments with other companies at the same time. You can check with your service provider if they provide an exclusive service, where the nominee appointed to you will only focus on your company. This exclusive service may come at an extra cost.

All in all, if you are completely sure that you do not want your personal information revealed in public records but still wish to have full control of your company, appointing a nominee director can save you a lot of headaches. Note that this decision must be made in the early stages of company formation.

If you are still unsure of how to go about with forming your company, we are here to help. Other than company formation, we are also more than happy to assist with accounting for SMEs and E-commerce companies as well.