What Is A Special Purpose Vehicle (SPV)?

Over the years, special purpose vehicles have become popular with property investors, especially for setting up companies. In addition to property investments, there are other reasons why you should consider setting up an SPV as part of your business plan.

A special purpose vehicle (also referred to as an SPV) is a legal entity created for a limited purpose. It’s created by a parent or primary company to isolate financial risks. In other words, in the event a parent company were to go bankrupt, the SPV company (which is essentially legally separate) will not be affected.

There’s been a rise in popularity of using a special purpose vehicle structure to set up a company in the UK, especially with property investors. However, even if you are not dabbling in SPV property investments, you may want to consider including setting up an SPV in your business planning.

That’s where some Osome insights come in. In this article, we’ll unpack the meaning of SPVs and cover the details about how an SPV company / SPV limited company operates. Finally, to give you an understanding of how a special purpose vehicle (or special purpose entity) may help you on your business journey, we’ll delve into the applications of these in the context of investors and entrepreneurs.

Skip to:

Main Features of an SPV or SPE?What Are the Mechanics of an SPV?

Should I Use an SPV Company for My New Business?

Risks & Benefits of Special Purpose Vehicles

Why Would Investors Set Up an SPV Limited Company?

How Do You Form Your SPV?

Investing in a Special Purpose Vehicle? Know What to Look Out For

Main Features of an SPV or SPE?

Special purpose vehicles have their balance sheet, which is entirely separated from the parent company that created them. Parent companies usually do this to protect the parent company while undertaking a risky project, so that the parent company will not bear the bulk of the failure if the project goes underway.

Catherine is a new business owner who has just started up her company - Wardrobe Misfits. She decides to set up an SPV to attract potential investors and also to manage her investments. Nonetheless, Catherine’s business is not doing well and she finds herself having to close down. In her case, even if the parent company Wardrobe Misfits goes bankrupt, the SPV can still operate and will be under her name even if its financials are affected as well.

Here are some main features of an SPV:

- Can be formed as a limited partnership, a limited liability corporation, a corporation, a trust and other business types.

- The SPV’s financials will not appear on the parent company’s balance sheet. Instead, it will have its own balance sheet.

- It is possible to form several different SPVs for different projects to keep projects independent.

- If you place a property within an SPV, your property can be sold or transferred if you choose to sell or transfer ownership of the SPV.

If you’re looking to invest in a company, be sure to look at their balance sheets and always check if they are using SPVs. Remember, SPVs can be used as a way to mask company debt, and you may not be getting the full view of a company’s financial state if you do not look into their SPVs.

What Are the Mechanics of an SPV?

Acting as an affiliate of a parent corporation, a Special Purpose Vehicle sells assets off of its balance sheet. Through this, an SPV company becomes an indirect source of financing for the original corporation by attracting independent equity investors to help purchase debt obligations. When it comes to what an SPV is and what its benefits are, it becomes clear that they’re most useful for large credit risk items, like subprime mortgage loans.

Not all SPV companies are structured the same way. SPVs in the United States are often limited liability corporations (LLCs). Once the SPV limited company purchases the risky assets from its parent company, it normally groups the assets into tranches and sells them to meet the specific credit risk preferences of different types of investors.

Should I Use an SPV Company for My New Business?

Setting up an SPV for your UK company could mean getting the funding leg-up that you need as a new entrepreneur seeking funding. It’s been a trend for business owners to open SPV companies because of their role in assisting parent companies with financing. This makes sense when you consider that setting up an SPV means that UK business owners have a separate tool that allows potential investors to pool money, instead of them investing directly into the parent company.

Investing in a new company, especially a UK start-up, can be viewed as risky for some investors and sponsors. This is where a special purpose vehicle can come in handy. Aside from risk, investment in an SPV company in the UK (as opposed to investing in the parent company) more often than not, means that a lesser base amount for investment will be needed. This translates to more access to more investment opportunities to help you grow your business from risk-averse investors.

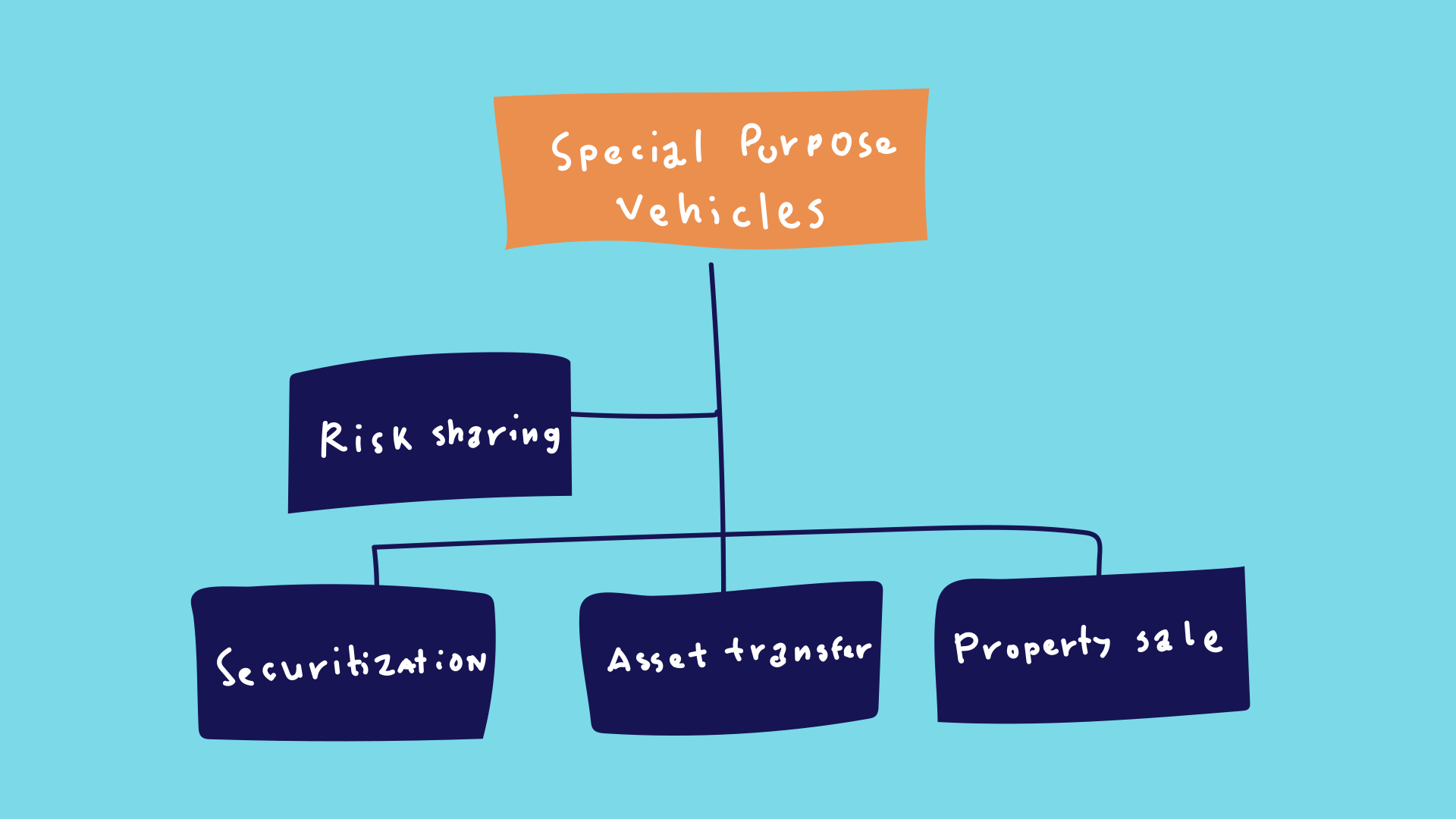

Common uses of SPVs include but are not limited to the following.

- Sharing Business Risks

You can set up an SPV company in the UK that is ‘tagged’ to different ongoing projects. Having an SPV allows you to legally isolate the risks of a certain independent project without affecting the others.

- Selling Property

The use of an SPV company in this context touches on the taxes on property sales. If the taxes are higher than the capital gains you attain from selling the property, you can set up an SPV that will own the properties that are put up for sale. Instead of paying the property sales tax from selling the property itself directly, you can pay the tax for selling the SPV.

- Transferring Assets

For certain types of assets requiring more work to transfer, you can create a special purpose vehicle to own these assets. Therefore, transferring these assets entails less work. You will only need to sell the SPV through a merger and acquisition process.

Risks & Benefits of Special Purpose Vehicles

If you are a new business owner in the UK, be transparent in your balance sheets for both your parent company and SPV. It is not a good idea to mask information from your investors. Being clear with your company’s finances is a better way to gain the trust of investors and in turn, gain more funding.

If you choose to close your SPV, the parent company will have to take back the assets, which will involve substantial costs for you. The parent company’s balance sheet will also be affected. You may think of this as closing down both the parent company and the SPV, although you could still operate the SPV.

| Benefits of SPVs | Risk of SPVs |

|---|---|

| Creation and set up is easy | Access to capital can be lower (as SPVs credit is not the same as the sponsor) |

| Financial risk is isolated | Changing regulatory changes are unknown and potentially risky |

| Direct ownership of specific assets | Accounting rules (e.g Mark to Market) could be triggered at the time of assets sales & impact balance sheets of sponsors or investors |

|

Tax savings *Depending on where SPV is created |

SPVs can get negatively perceived by public |

Why Would Investors Set Up an SPV Limited Company?

It comes down to tax efficiency. A landlord who purchases rental properties through an SPV limited company finds they benefit on the tax-efficiency front. This is largely due to the tax relief on finance costs that has recently been introduced for individual landlords.

A growing percentage of limited companies (including SPVs in the UK) now have access to mortgages. Setting up an SPV is very similar to the process of setting up any other kind of company in the UK, involving Companies House and a few other need-to-knows which we’ll cover below.

How Do You Form Your SPV?

Thinking of setting up an SPV company in the UK? Here are a few things you’ll need to know about what it entails.

- Appoint at least one director and one shareholder

- Prepare your company name, address, and details of director(s)

- The Memorandum of association (MOA) and Articles of association (AOA) should define the company as an SPV

- Define your SIC code

- Submit all information to the Companies House

You will need to incorporate and register your business first, then submit all relevant documents. It is not that much different from the process you’d go through to incorporate a business entity but it is a complicated process and it’s important to know exactly what it entails before you get started.

Osome helps entrepreneurs in the UK form companies, with the documents needed for company formation and we cover an exhaustive list of industries. We handle both e-commerce and traditional accounting, taxation and bookkeeping tasks that you may need throughout your business journey.

Investing in a Special Purpose Vehicle? Know What to Look Out For

From the investor’s view, you may not be getting the full view of a company’s financial situation just by looking at their balance sheet. Less seasoned investors are more likely to fall into the trap of investing in the wrong company or SPV. This can be seen from the infamous Enron company example.

One example of how a company can wrongly use an SPV to its sole advantage is the Enron Corporation incident in 2001.

- Enron Corporation was an up and rising energy company formed in 2001;

- Its stock price was soaring too rapidly;

- Enron started transferring the majority of its parent company’s stock into an SPV;

- The SPV was used to hedge assets that were on the parent company’s balance sheet;

- The stock price of the parent company dropped;

- As a domino effect, the value of the SPV dropped as well;

- Enron owed huge sums of money to creditors and investors;

- This resulted in the bankruptcy of the company.

As always, we do not recommend investing in a company when you are unsure of the dealings and history of a company, no matter how interested or certain you are in their business operations.

Creating a special purpose vehicle can be a benefit for your company, but it can also be dangerous if you are unsure of how to make use of it in your business operations. As a newbie entrepreneur, be sure that you fully understand the implied risk from choosing to create an SPV, and study more on this particular business model before you dive head-on into creating an SPV for your parent company in the UK.

Feel free to drop us a question if you’re looking to register a new company in any industry, big or small, traditional or e-commerce. We have specialists to assist you to sort even your bookkeeping tasks remotely. You won’t need to lift a finger, we will send and manage all your reports for you to review and sign digitally.