- Osome Blog HK

- How To Change My Hong Kong Company’s Registry Address

How To Change My Hong Kong Company’s Registry Address

- Modified: 13 October 2024

- 5 min read

- Incorporation

Renee Yang

Business Writer

Fintech companies, government agencies and private companies, Renee has experience writing for them all. Her writing inspires startups to establish their business and succeed in Asia and Europe. Here at Osome, she helps make running a small business more accessible. Her articles help entrepreneurs succeed in every step of their business journey, covering accounting and bookkeeping advice to tax must-knows. She also has copywriting experience covering branding, website copy, printed publicity collateral, blog articles and interviews.

You may have registered your company in Hong Kong for a few years or you’re considering moving to another location due to a high rental cost of your current registered address. You may even want to consolidate your multiple companies into one registered address. If that’s the case, maybe it’s time for you to change your company’s registered address.

It’s important to inform the relevant authorities within 15 days when you change your company’s registered address to avoid expensive fines. In this article, we will explain the process and what you need to know about changing your company registered address.

What Is a Registered Address?

A registered address is a place where the company will receive official correspondences from the Hong Kong SAR government. Sometimes, the government might perform an on-site inspection under special circumstances.

It must be a commercial address. A P.O Box address or a residential address is not accepted. According to Section 658 of the Companies Ordinance of Hong Kong, all companies are required to maintain a registered office in Hong Kong after incorporation.

If you are looking for a suitable registered address, Osome is able to provide one for you. Drop us a chat at any time of the day or week.

Is There a Difference Between a Registered Office Address and Business Office Address for a Limited Company?

Yes. A registered office address does not need to be the place where your business is conducted while a business office address is a place where business activities are conducted. It can be done in a commercial building, such as a warehouse.

After incorporating a company, you would need to apply for a Business Registration Certificate at the Inland Revenue Department, which will then be displayed at the place you operate your company.

Example

Mr Hon has a warehouse in Kowloon where he conducts most of his business activities, such as meeting his clients and issuing invoices. This will be considered as his business address, but his registered address is located in Wan Chai, Hong Kong Island.

Registered addresses are managed by Companies Registry while business addresses are managed by Inland Revenue Department (IRD). For every new office address under the same company name, you would also need to display a branch registration certificate.

How Do You Change Your Registered Address?

o change your registered address, your company needs to report the change to Companies Registry via one-stop notification service at e-Registry, which will then notify the Business Registration Office to issue an updated Business Registration Certificate to the company.

To change your business address details (like changes in address, business name, nature of business), the company needs to notify the Business Registration Office to obtain an updated branch registration certificate to the company.

Changing Company Registry Address of Multiple Companies to 1 Registered Office Address

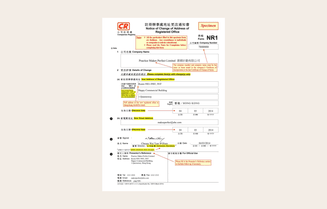

Now, what about business owners who decide to change the registered office addresses of their multiple companies to one registered office address? The process is simple. You can report the new changes of your multiple companies in one go for up to 10 companies in the NR1 e-form – Notification of Change of Address of Registered Office at the e-Registry.

Example

Mavis has three companies under her name in Hong Kong. The nature of her businesses is different from one another. To consolidate her businesses, she decides to change the registered office addresses of her three companies to one registered address. She logs onto e-Registry and fills in NR1 e-form.

When Do You Need To Notify the Local Authorities?

Notify the Hong Kong Companies Registry within 15 days after the change of your registered address. It is a serious offence if you fail to report the change of address. How serious? Section 658(5) of the Companies Ordinances (Cap. 622), states that if the company, and every responsible person of the company fails to report the change of address, it is an offence. You will be hit with a level 5 fine. This means that the court can impose a fine of up to HK$50,000 to you, and on top of that, charge you with a further fine of $1000 for each day the offence continues.

The Hong Kong SAR government sends letters from the Statistics Department and Inland Revenue to companies every year. As the registered address of your company is the only detail that the government has to send you official notices like tax returns from the Inland Revenue Department, or surveys from the Census and Statistics Departments, it is important for you as the company owner to maintain the correct address and reply to these documents.

Too many things to remember? As a business owner, your task is to grow your business. Let our experienced company secretaries and accountants in Hong Kong work for you in the background, reminding you of these important but easily overlooked details.

What Documents Do You Need To Submit?

You can either submit NR1 e-form at e-Registry or submit a hard copy original Form NR1 with inked electronic signature to Companies Registry. Here is a sample of NR1 form.

If you are planning to submit a written notification or an original signed NR1 form, you will need to provide the following:

- Your company number;

- Your company name;

- The new registered address and date of change

- Presentor’s Reference

Checklist of Change of Registered Address

After you’ve changed your registered address, there are actions that you need to take. Here are the things you need to do:<br>

- Inform your customers and clients

- Inform your respective banks and insurance agencies

- Inform your suppliers, service providers, vendors and government agencies

- Update your new address on your company’s website and other correspondences

- Update your company’s new address on company’s letterheads, envelopes, name cards and invoices etc.

- Place a temporary notice on the door of a new office if your new company signboard is still in progress.

This is to ensure that all mail correspondences can reach your new company address, and all your stakeholders are made aware of this change.

The process of changing your company registered address seems simple, but it can be frustrating when you have to deal with these formalities while you are growing your business.

On the other hand, you will also want to communicate smoothly with the government departments and your suppliers during this change. Rest assured that our experienced team is here to help with any corporate secretarial paperwork in Hong Kong that you need to get done so that you can focus on the running of your business.