- Osome Blog HK

- The Entrepreneur's Guide to Offshore Company Setup in Hong Kong in 2024

The Entrepreneur's Guide to Offshore Company Setup in Hong Kong in 2024

- Modified: 31 October 2024

- 10 min read

- Foreigner's Guide, Incorporation

Jon Mills

Business Writer

Jon's background is in copy and content writing for brands. He relishes writing educational and entertaining content. He's told unique stories in creative ways, and has added value to products in the luxury sector. Now, his stories bring the advice and journeys of Osome's accounting experts and small business owners to life, hoping to inspire entrepreneurs to be ambitious, set their sights high, and take pride in their growing businesses.

Economies around the world are interwoven more than ever before, and many entrepreneurs are looking towards foreign markets to expand their business operations. One location that has always been attractive to foreign business is Hong Kong, a dynamic and vibrant city renowned for its business-friendly environment. In this article, we’ll take you through the process of setting up an offshore company in Hong Kong — and why it might be the best decision your business makes in 2024.

Expand your business into Hong Kong with Osome's seamless company registration services. Let our experts handle the paperwork while you focus on growth. Get started today!

Key Takeaways

Here’s a quick summary if you’re considering an offshore company in Hong Kong:

- Hong Kong offshore companies, conducting most operations outside the city, provide benefits like favourable tax system, asset safety, and global market access.

- Entrepreneurs seeking international expansion, emerging market growth, or tax advantages should consider an offshore company in Hong Kong.

- Hong Kong is attractive for offshore company setup due to its fast registration, low tax rates, strategic location, English usage, political stability, and global finance hub status.

- Anyone above 18 can establish an offshore company in Hong Kong, with no residency requirements for directors or shareholders.

An offshore company in Hong Kong refers to a corporation that is formed under the Hong Kong jurisdiction but conducts its business operations primarily outside the city. Hong Kong offshore companies are completely legal and are fully recognised by the government. They offer a host of benefits, including but not limited to:

1 A favourable tax system

Hong Kong follows a territorial taxation principle, meaning it only taxes profits derived from or arising in Hong Kong. Therefore, profits that offshore companies earn outside Hong Kong are generally not subject to Hong Kong income tax. This presents businesses with the opportunity to structure their operations in a way that optimises their tax obligations.

2 Safeguard your assets

Assets held by these Hong Kong companies are protected under government law, which offers strong property rights protection. This could be especially helpful for businesses dealing with substantial assets or those in high-risk industries.

3 Operational agility

They are not subject to stringent regulations and bureaucracy that may apply in other jurisdictions. Such flexibility can be valuable for businesses that need to adapt quickly to market changes or business opportunities.

4 A gateway to global markets

Setting up an offshore company in Hong Kong can act as a springboard to global markets, especially in Asia. Given Hong Kong's strategic location and its role as an international financial hub, businesses can leverage their Hong Kong presence to forge partnerships and access markets worldwide.

Importantly, Hong Kong's adherence to international standards and its unmatched legal system provide an added layer of security to entrepreneurs. It's not just a city, it's a secure base for your global business ambitions.

When Should Entrepreneurs Consider Opening an Offshore Company?

Timing, is a make or break factor — in comedy, in love, and indeed, in your business endeavours. So knowing when to set up an offshore business is about aligning your business dreams with the market's rhythm and your financial compass. So, consider how much it would cost you to open an offshore company in Hong Kong, whether the market is in favour of your specific product, service or business model at this point in time, and where you see yourself ideally in the future. If all those things line up, what’s stopping you?

Have a chat with one of Osome’s expert accountants about Hong Kong company registration and let us get you up and running.

If an entrepreneur is seeking to expand into international markets, capitalise on the growth of emerging markets, or take advantage of a favorable tax environment, setting up an offshore company in Hong Kong could be a strategic move.

Benefits of Setting Up a Hong Kong Offshore Company

The easy and fast company formation process

The process of setting up an offshore company in Hong Kong is highly efficient and straightforward. The Hong Kong government has established a streamlined process for business registration, making it possible to incorporate a company within a week, provided all the necessary documents are readily available and correctly filled. This is significantly faster than in many other jurisdictions, making Hong Kong a highly attractive destination for offshore company incorporation.

Lowest tax rates and share capital

Hong Kong is well-known for its low tax rates, offering one of the lowest corporate tax regimes in the world. Under Hong Kong law, the current corporate tax rate is 16.5% for profits exceeding HK$2 million. In addition, there is no minimum share capital requirement, and dividends, capital gains, and offshore profits are not taxed. This fiscal landscape allows businesses to optimise their tax planning and potentially achieve significant savings.

Access to China and the rest of East Asia, and Southeast Asia

Hong Kong's strategic location offers unrivalled access to major East and Southeast Asian markets, including the vast and rapidly growing Chinese market. With its unique position as part of China yet maintaining its own legal system, Hong Kong serves as the perfect gateway for businesses seeking to tap into these lucrative markets. Also, its well-developed logistics and communication networks ensure efficient regional and global connectivity.

English as a second official language

Despite being a Special Administrative Region of China, English is an official language in Hong Kong and is widely spoken and understood. Legal documents and proceedings are conducted in both English and Chinese, reducing language barriers for international entrepreneurs and making it easier to conduct business.

The political stability of the country

Despite its geographical location, Hong Kong maintains a high degree of political stability under the "one country, two systems" principle. This principle ensures that Hong Kong retains its own legal system separate from mainland China, which is particularly attractive to foreign businesses looking for a stable and predictable business environment.

Reputable country

Hong Kong has a sterling reputation as a global financial hub. Under Hong Kong law, it adheres to international business standards and has an unmatched legal system in place, making it a trustworthy and reliable jurisdiction for international business operations. This reputation enhances the image of businesses incorporated in Hong Kong, providing them with an added competitive edge in the global market.

Who Can Set Up an Offshore Company in Hong Kong?

To start with the basics, anyone above the age of 18 can start a business in Hong Kong, regardless of nationality or residency. This means no matter where you’re from, Hong Kong welcomes you with open arms. It's a city that truly embodies diversity, offering equal business opportunities to everyone.

Hong Kong offers ample flexibility with directors and shareholders too. There's no requirement for company directors or shareholders to be Hong Kong residents. Even corporations are allowed to play the role of directors, offering yet another level of flexibility.

Your company structure is also pretty straightforward. The only requirement is that your company should have at least one director and one shareholder. These roles can even be filled by the same person, which can simplify your company setup considerably.

But every company needs someone familiar with the local waters, which is where company secretarial services come in handy. The company secretary needs to be a Hong Kong resident or a registered Hong Kong company. This ensures that there is someone who knows the local regulations well and can navigate the company through Hong Kong's legal and regulatory codes of conduct. This requirement applies to both traditional registration and acquiring a Hong Kong shelf company.

The Difference Between Opening a Company Onshore vs Offshore

Onshore and offshore refer to the location where a company is incorporated and conducts its business operations. An onshore company is incorporated in the country where it conducts the majority of its business operations. In contrast, a offshore company is incorporated in one jurisdiction (Hong Kong, in this context) but conducts its business activities primarily outside that jurisdiction.

There are various reasons why a company might choose to incorporate offshore rather than onshore. These include favorable tax conditions, increased confidentiality, asset protection, ease of international business, and potential access to new markets.

Onshore and offshore companies might seem like jargon terms, but they're rather straightforward once we break them down. They simply refer to where a company is incorporated and where it carries out its main business activities.

Home ground advantage of onshore companies

An onshore company is incorporated and conducts the majority of its business in the same country. For example, if you register a company in the UK and run your operations primarily there, you've got yourself an onshore company. Onshore companies often enjoy a certain level of comfort and familiarity with the local laws, culture, and business practices. They are closely connected to their customer base and can tap into local networks for growth opportunities.

However, onshore companies are also subject to the local taxation policies and regulatory landscape, which might be challenging, particularly in countries with complex or high tax regimes.

Exploring new horizons with an offshore company

An offshore company, on the other hand, is incorporated in one jurisdiction but carries out its business activities primarily outside that jurisdiction. So, if you incorporate a company in Hong Kong but your clients and operations are mostly located elsewhere, you've set up an offshore company.

The motivations behind setting up a Hong Kong offshore company vary widely. One of the main attractions we mentioned earlier is the potential for favourable tax conditions. Offshore companies that earn their profits outside Hong Kong generally won't be subject to Hong Kong income tax.

Apart from tax benefits, offshore companies can offer increased confidentiality too. Some jurisdictions provide privacy protection for company directors and shareholders, keeping their identities confidential. This can be particularly appealing to entrepreneurs looking for an additional layer of privacy.

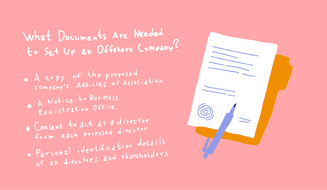

What Documents Are Needed To Set Up an Offshore Company?

Setting up a Hong Kong offshore company comes with its own checklist of essentials. One of the primary tasks is gathering the right documents, as thorough paperwork is crucial to a smooth and successful company registration process. Below are the key documents you'll need to prepare:

Articles of Association

The Articles of Association, often abbreviated as AoA, outlines the regulations for the company's operation and defines the responsibilities of the directors, the kind of business to be undertaken, and the means by which the shareholders exert control over the board of directors. This document is basically the rulebook for your company and must be submitted during the registration process. We can prepare your articles of association for you.

Notice to business registration office

Hong Kong requires a formal notice to the Business Registration Office as part of the company registration process. This notice serves as a declaration of your intent to establish a company in Hong Kong and includes essential details about your company such as the proposed company name and address.

The Business Registration Office in Hong Kong is a division of the Inland Revenue Department responsible for administering the Business Registration Ordinance.

Consent to act as director

Every proposed director of your offshore company must provide a formal consent to act in this role. This document confirms that the individual is aware of their directorship and agrees to the responsibilities that come with the position.

Personal identification details

Lastly, you'll need to provide personal identification details for all the proposed directors and shareholders of your offshore company. This typically includes a copy of their passport or other valid ID and proof of residential address, like a utility bill or bank statement. These details ensure that the company's leadership can be properly identified and held accountable, in line with Hong Kong's commitment to corporate transparency.

While the documents mentioned above form the backbone of your application, check with Osome directly to make sure you've covered all your bases. We can provide you with the most current, comprehensive list of requirements based on your specific situation and the latest regulations in Hong Kong.

Steps To Get Your Hong Kong Offshore Company Up and Running

Setting up an offshore company in Hong Kong involves several crucial steps:

1 Choose and confirm your company name

First, pick a unique company name that's not too similar to existing ones or infringing trademarks, and confirm its availability.

2 Prepare necessary documents

Next, prepare the required documents, including the Articles of Association, a Notice to Business Registration Office, and consent forms for each proposed director. Gather the personal identification details of all directors and shareholders.

3 Register your company

Submit your documents to the Hong Kong Companies Registry for registration. It usually takes about 4 days to process. You'll receive a Certificate of Incorporation and a Business Registration Certificate (BRC) upon successful registration. BRC is a mandatory document issued by the Inland Revenue Department (IRD) in Hong Kong

4 Open a corporate bank account

Once your documents are submitted to the Hong Kong Companies Registry, you can begin to open a corporate bank account. Contact the bank in advance to understand their specific requirements.

5 Ensure compliance with local regulations

Finally, ensure that your company complies with all local regulatory requirements, including obtaining necessary business licenses such as the Business Registration Certificate and a Certificate of Incorporation, as well as permits.

The process typically takes a week if you have all documents ready, leading to a smooth setup of your Hong Kong offshore company.

An Estimated Total Cost of Registering and Maintaining Company in Hong Kong

Launching an offshore company in Hong Kong comes with its expenses, but having a clear grasp of these costs can make the planning process a lot smoother.

Initial setup costs

The initial expenses encompass mandatory government fees for company and business registration, payable to the Hong Kong Companies Registry and the Inland Revenue Department, respectively. Please refer to our pricing.

Annual maintenance costs

Keeping your offshore company afloat includes recurring costs like the annual return filing fee and business registration renewal fee. Additionally, hiring a company secretary, a requirement, and opening a representative office in Hong Kong may add up to HK$3,000 annually.

To maintain company compliance in HK, you should have an accountant to prepare the financial statements and tax filing. Accounting and audit fee is on top of the set up fee.

Conclusion

Offshore companies offer potential benefits over onshore ones such as tax advantages, confidentiality, asset protection, and ease of international business.

Necessary documents for offshore company setup include Articles of Association, a Notice to Business Registration Office, director consent forms, and directors' and shareholders' identification details.

Setting up involves selecting a company name, preparing documents, registering the company, opening a corporate bank account, and ensuring local regulatory compliance.