- Osome Blog HK

- Guide to Hong Kong Tax for SME Owners

Guide to Hong Kong Tax for SME Owners

- Modified: 6 May 2025

- 7 min read

- Money Talk

Osome Content Team

VIP Contributor

Osome has been collaborating with 21 authors from 4 countries. We embrace diversity and are proud that lawyers and founders, journalists and financial analysts choose to work with us.

Hong Kong can boast one of the simplest and cheapest tax systems in the world. Is there a value-added tax? No such thing. How about a withholding tax or a capital gains tax? Again — nope. We will explain which taxes for private limited companies do exist in Hong Kong and how to pay them.

Hong Kong can boast one of the most comprehensive, simplest and cheapest tax payment systems in the world. Is there a value-added tax? No such thing. How about a withholding tax or a capital gains tax? Again — nope.

We will explain which taxes for private limited companies do exist in Hong Kong and how to pay them.

The mighty duo is Profits Tax (that’s what they call Income Tax in Hong Kong) and Property Tax. Let’s take a closer look at both.

How Does Profits Tax (Income Tax) Work?

Profits tax is a percentage of the money you make that you give to the authorities.

Not all the money your company earns is necessarily taxed. The Hong Kong tax system uses the territorial source principle to determine which income is subject to taxation.

And not all the money that is taxed is taxed at the same rate. But we’ll get to that.

How does the territorial principle work?

Only the profits that you make in Hong Kong are taxed.

This is true for over 40 countries that have Double Taxation Agreements with Hong Kong.

Let’s have a look at a couple of examples:

Example

John has a Hong Kong company with an office in the UK. His products are sold in the UK, too. He only pays UK taxes.

Now let’s look at Keiran. He has a Hong Kong software company, his office is also here, and his clients are in the UK. His company will be taxed in Hong Kong because the product team and the sales team both work in Hong Kong.

Next we have Harry. He has offices both in Hong Kong and the UK. The British office makes a profit in the UK. This income is taxed in the UK and not in Hong Kong. His office in Hong Kong makes a profit in both Spain and Hong Kong. Profits made by the Hong Kong office are all taxed here.

The Inland Revenue Department (IRD) has developed some tests you can use to figure out if your income is taxable in Hong Kong. Here are the questions you should ask yourself:

- Is your office that does all the work to make a profit located in Hong Kong?

- Is the work that is most relevant to generating the profit done in Hong Kong?

- Are the business decisions associated with making a profit made in Hong Kong?

- Does the money you earn come from Hong Kong entities?

- Is your main office that carries out the work and decisions in Hong Kong?

If you answered “yes” to any of the questions above, it’s most likely that you will be taxed in Hong Kong.

In the tax form, you will find a field for the income that you want to be exempt from tax based on the territorial principle. IRD might request additional documents to support your claim. They have the final say on whether your profits should be taxed in Hong Kong.

What Are the Income Tax Rates in Hong Kong for SMEs?

Hong Kong uses a profits tax rate that is two-tiered. This means that different rates apply depending on how much money you make. Here are the rates:

Assessable profits (aka taxable income) | Tax rate |

|---|---|

| First HK$2 million | 8,25% |

| After first HK$2 million | 16,5% |

It’s not that the rate changes once you pass the HK$2 million threshold. The 16,5% rate only applies to the earnings above HK$2 million. The first HK$2 million are still taxed at 8,25%.

If you are the majority shareholder in more than one Hong Kong business, the entities are considered connected through you. In this case, you can only choose one business in which to use the two-tiered system.

Entities are also seen as “connected” if the more than 51% in both of them is owned by a company, not a person.

Are There any Income Tax Deductions?

You pay tax on your profits, not on your revenue. Thus, every expense that helped you make a profit is deductible from the taxable income.

Deductions are covered by section 16 of the Inland Revenue Ordinance. Let’s take a look at how the deductions work.

Expenses to refurbish a building

These include “expenditure on renovation or refurbishment of business premises”: renovating your office, buying new furniture and things like that. These spendings do not result in profits directly, but your sales agent can’t strike a deal if there is no desk to sign the papers on, right?

Such expenses are split into 5 parts and deducted from the income over 5 years including the year they were incurred .

Expenses for IT hardware and plant and machinery expenses

This category covers all your company’s spendings related to technology, from buying a work laptop for your assistant to building a new production line at your local plant.

These expenses are deducted from the income in full the year they were incurred.

Installation of environmental protection machinery

If you buy energy-saving equipment or rebuild your plant to reduce harmful air emissions, you can deduct these expenses from your taxable income.

This law came into effect in 2018/2019.

The whole sum can be deducted from the income the year it was spent. If your company bought eco-friendly vehicles, their cost is a deductible expense, too.

Depreciation allowances

They are deductible too. But there is a set of rules for them:

If you build a factory:

- You can deduct 20% of the cost of construction of the premises the first year.

- Then you deduct 4% of the cost of construction of the premises annually until the whole sum is covered.

Here’s what happens if you sell the building:

- if the amount you get paid for it is more than its residual value, you will have to pay profits tax on the difference, it’s called the balancing charge;

- if it’s in reverse, you get less than the residual value, it’s a deductible expense and is called the balancing allowance.

If you build commercial buildings:

- 4% of their construction cost can be deducted annually from the income.

- Just like with the factories, there will be either a balancing charge or a balancing allowance.

Plant and Machinery depreciation

These expenses are deducted in several steps. Take a look at the list below:

- The year you incurred the expense, you deduct 60% of it.

- Then, at a rate of 20% a year, you write off the costs of the equipment as expenses throughout its useful life period.

- If the equipment is sold for more than its residual cost, IRD charges a profits tax on the difference.

- If the equipment is sold for less, the difference is deducted from the income.

How Does the Property Tax in HK Work?

The Property Tax is a tax on the income generated from real estate. Income in this context is the rent and any deposits or key money received from the tenants. Income is taxed at the rate of 15%.

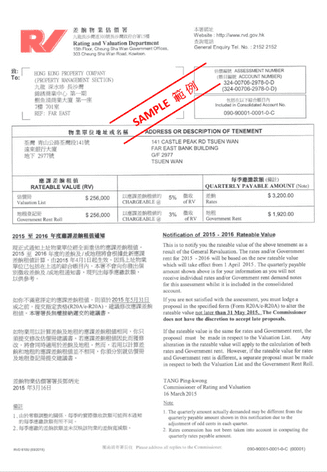

Let’s figure out what is taxed. When owners of real estate in Hong Kong file their tax reports, the Rating and Valuation Department (RVD) uses the data they provide to assess how much different types of Hong Kong properties cost.

The RVD then publishes their findings on their website. These sums are the estimated taxable income on the basis of which the property tax is calculated.

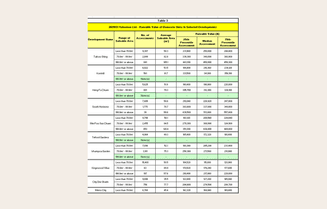

Here’s an RVD’s spreadsheet for 2020/2021:

Each year the RVD reevaluates the property. When they do, owners receive a notification. In this notification, you can see the estimated annual revenue you generate by renting it out. The notice looks like this:

If you disagree with the valuation of your property, hurry up and send the RVD R20a form (e-version). You have up to 28 days to do this after receiving the valuation. There you will have to specify if the value of the property should be higher or lower and provide justification for revaluation. Justification could be, for example, the actual rent you get from the tenants.

As for deductions, there is a 20% allowance for renovation purposes. When filing taxes, it’s deducted from the annual rental value. It doesn’t matter if the allowance is actually spent on the property.

Additional indirect property taxes in Hong Kong

You can see that there are two quarterly taxes mentioned. The Government Rate (5%) and the Government Rent (3%) are indirect taxes that property owners have to pay. It doesn’t matter if they have any tenants or not. If they do have tenants, it’s either the tenant or the owner who pays them. It depends on the terms of the contract.

How To Pay Taxes?

During the first 18 months after you have set up the company, nobody will bother you. But then, each year, the Inland Revenue Department will issue tax forms to businesses. Usually it happens on the first day of the Year of Assessment (April 1st). You have to fill in all the relevant data in these forms. This data, among other things, includes your income and any deductions for tax purposes you are allowed to make. Scared to miss the deadline? Turn to your Accounting services provider and get the support you need.

Most businesses usually have to file these two kind of returns:

If a business rents out any real estate in Hong Kong, it also gets a Property Tax return.

The Employer’s return isn’t about paying taxes. The IRD collects information about all the employees in the country in order to have the correct data about their income. So in this article, we will mostly focus on the remaining two returns.

There may be a couple of supplementary forms you will get that the IRD first introduced in April 2019. The most common of them is S1. It asks for the data necessary for the application of the two-tiered income tax system (more info on that in the income tax section). However, most of the other forms cover super-specific cases that don’t concern most companies, like owning a ship, being in the insurance brokerage trade, and pharma R&D expenditures.

After you get the relevant forms, you have a month to fill them out. Since all these forms come in at the same time and all of them are due at the same time, it’s better to have everything ready in advance so that you don’t have to do a year’s worth of accounting in a single month.

In 2-3 months’ time, you will get a demand note. That means you have to pay your taxes in one month and that the IRD agrees with your calculations.

Provisional Tax in Hong Kong

In the demand note, there will be something called “provisional tax”. This is the tax you pay in advance for the next year of assessment. Next year you’ll only pay the difference between the actual amount and the provisional amount. If the difference is in your favour, you’ll get a refund.

So basically, you have to pay double your annual tax in order to pay the provisional tax for the next year of assessment (YA).

Provisional tax is paid in two instalments spread over the year of assessment.

Tax timeline

Date | What happens |

|---|---|

| April 1st | You get Profits Tax return, Employer’s Return, and Property Tax return forms |

| May 1st | The completed forms are filed with the IRD |

| July-August | Demand notes come in for Profits and Property taxes |

| August-September (a month after you get the notes) | Taxes should be paid |

A Hong Kong SME Tax Filing: 2 Examples

Let’s take a look at Iolanda Pizza Parlour Pte Ltd. in its second year of business:

Example

Iolanda opened her cafe in 2018. For 18 months, she didn’t get any tax forms. Then she got her first one. It was a BIR 52. She also chose to use the two-tiered tax rate, so she had to get an S1 too. There is a checkbox in BIR 52 that specifies that there will be an S1 attached to it.

Let’s have a look at some data she put in there:

| Total profits | HK$600,000 |

| Less: commercial building construction | 4% × HK$700,000= HK$28,000 |

| Less: plant and machinery | (60%+10%) × HK$140,000= HK$98,000 |

| Taxable profits | HK$472,000 |

| Tax due at 8,25% | 8,25% × HK$472,000= HK$38,940 |

Now let’s look at Josh, a landlord.

Example

Josh’s company has been renting his commercial property for 3 years now, so Josh’s business is a typical example of an entity which has to pay property tax. Here are the calculations his accountant did after the Property Tax forms came in:

| Assessable rental value for 12 months: | $120,000 |

| Less: 20% allowance on renovation | $24,000 |

| Less: 8% of rate and rent paid by the owner | $9,600 |

| Taxable rental value for 12 months: | $86,400 |

| Property tax at 15% for 2020/2021: | $12,960 |

| Provisional tax for 2021/2022: | $12,960 |

These examples above only show the most basic data you will need to file your taxes.

To help entrepreneurs, IRD has Profits Tax form completion guidelines. There you can find samples for every single form and relevant explanations on how to fill them in.

If the info that the IRD provides online doesn’t cut it, there is an option to contact them directly via phone, e-mail or even in person. However, sometimes it takes too long, considering that almost every business and individual taxpayer gets their forms at the same time.

Key Takeaways

- IRD will send all the forms you need to complete to pay taxes around April 1st each year.

- There is a provisional tax. You pay your taxes for the current Year of Assessment and the next one.

- Most businesses have to deal only with Income Tax.

- Only profits made in Hong Kong are taxed.

- There is a two-tiered system. Income up to HK$2 million is taxed at 8,25%. Income above HK$2 million is taxed at 16,5%.

- There are two types of taxes on property.

- If you simply own real estate, you pay 8% of its rental value.

- If you collect rent, you pay 15% of Property Tax on it.