- Osome Blog HK

- A Guide to Taxable Income for New Business Owners in Hong Kong

A Guide to Taxable Income for New Business Owners in Hong Kong

- Modified: 16 December 2025

- 5 min read

- Taxes & Compliance

Renee Yang

Author

Fintech companies, government agencies and private companies, Renee has experience writing for them all. Her writing inspires startups to establish their business and succeed in Asia and Europe. Here at Osome, she helps make running a small business more accessible. Her articles help entrepreneurs succeed in every step of their business journey, covering accounting and bookkeeping advice to tax must-knows. She also has copywriting experience covering branding, website copy, printed publicity collateral, blog articles and interviews.

With so many new rules and regulations every year, it’s hard to keep up with what is taxable and what is not taxable. In this article, we will take you through an overview of taxation in Hong Kong and the types of income earned that are taxable.

As a business owner, you may have operated your business in Hong Kong for a few years now. For some, registering a business in Hong Kong as a new business venture excites you. Whether you are an established or a new business owner, one thing that often confuses many is the taxation.

With so many new rules and regulations every year, it’s hard to keep up with what is taxable and what is not taxable. In this article, we will take you through an overview of taxation in Hong Kong and the types of income earned that are taxable.

For businesses in Hong Kong, there are three types of incomes that are taxed under Inland Revenue Ordinance (IRO). They are mainly:

Salaries Tax

The salaries earned by employers and employees are considered as income taxable. Like profit tax, salaries tax is chargeable based on a territorial basis. Meaning to say, if an employee earns his salary in Hong Kong, the amount earned will be chargeable based on the current tax rates in the country.

Example

Yueh sells leather goods in Hong Kong, and with the profits she earns from her customer, she uses it to pay salaries to her two employees. As Yueh is the director of the company, her director fees will be taxable. Similarly, her employee’s salaries are also taxable.

If the person is employed under a non-Hong Kong company, his income will be assessed based on the services he has rendered to the company.

Currently, the tax rates have risen from 2% to 17% with every HK$ 50,000 net chargeable income.

Profit Tax

Corporations, partnerships, and individuals who are conducting their business in Hong Kong are subject to tax on any income deriving from Hong Kong (except for profits arising from the sale of capital assets).

The income earned will be chargeable based on its two-tiered tax system: 8.25% for the first HK$ 2 million of assessable profits and 16.5% for the remainder of assessable profits.

Are dividends taxable?

No. Dividends are not taxable in Hong Kong.

Example

Jeremy is one of the shareholders of a successful F&B establishment. He receives his dividends payout every twice a year. As the dividends have been subject to profits tax, Jeremy’s payout will not be affected.

Dividends that are received from overseas are also exempted from tax as they are considered as foreign-source income.

What about capital gain tax?

In Hong Kong, capital gains are not taxable, but profit gains on any buying or selling , or other transactions of capital assets could be subject to profit tax if this is considered part of your company’s business activity.

Property Tax

If you own a property in Hong Kong and collect rental fees from your tenants, you will be taxed on the rental income. Tax is charged at a standard fee of 15% of net assessable value of the property.

Net assessable value refers to rent and other charges that are payable to the owner. These items include:

- Rent

- Payment for the right of use of premises under licence (licence fee)

- Lump sum premium

- Service charges and management paid to the owner

To have a clear understanding of your net assessable value, here is an example of the calculation:

Example

Peter rents out an office space of two workstations to a start-up company, and he collects rent of HK$ 30,000 monthly. The calculation of net assessable value will be:

Rental income – rates paid by owners = Assessable Value

HK$ 30,000 – 15% = HK$ 25,500

Assessable value – Statutory allowance (20%) = Net Assessable Value

HK$ 25,500 – 20% = HK$ 20,400

There might be a period when your tenants are unable to pay rent on time. It could be due to poor business or economic recession. However, the rental income will still be subject to property tax, and it is not possible to claim a deduction of irrecoverable rent. This is because even though the tenants do not pay on time, it is considered as outstanding, and not irrecoverable.

Other Types of Taxable Fees

The following fees are considered as taxable:

- Salaries, wages and director’s fee

- Allowances, perquisite and gratuities

- Sales commissions, bonuses and leave pay

- Pensions

- Termination payments and retirement benefits

- Stock awards and share options

Is Social Security income taxable?

No, it isn’t. Social security income is exempted from taxation, as there is no social security tax system in Hong Kong.

Employers and employees are required to join the Mandatory Provident Fund (MPF) scheme, and make a regular mandatory contribution of 5% of the employees’ relevant income. If you are employed or self-employed for a limited period of time in Hong Kong, you are exempted from this scheme. Similarly, if you are a member of an overseas retirement scheme, you do not need to join this scheme.

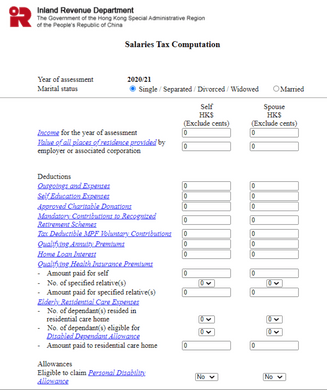

How to use the Inland Revenue Department Tax Calculator to calculate your salaries tax

To determine your tax liabilities under salaries tax, you may use this tax calculator provided by IRD.

Salaries tax is payable based on the progressive rates of your chargeable income or the standard rate of your net income.

This is how the calculation works:

Total income – Deductions – Allowances = Net chargeable income

Total income – Deductions = Net income

Is Interest income taxable?

Interest income is when your company receives interest from a bank or financial institution. It will be deemed taxable in Hong Kong if the interest is derived through or from the carrying on of business in Hong Kong by the bank or financial institution.This will be subject to profits tax.

However, if the income interest is derived from a deposit placed in Hong Kong with a financial institution, it will be exempted from taxation.

Seems confusing? Let’s see the examples below:

Example

Pierre runs a small electronic shop. Every month, he deposits his money into a business account. Over time, the bank will pay Pierre a certain percentage as credit interest every month. This interest will not be taxable.

Mr Lam lends a sum of money to a business associate for a big building project as an investment. The project is a success, and Mr Lam is able to receive interest from this investment. In this case, the interest he receives will be taxable. This will be considered as Income from Investment.

Assessable Income vs Taxable Income

Taxable income refers to the amount of money you earned, which you will need to report when you file tax returns, such as salaries for individuals, sales income for business.

Assessable income is the amount that is used when you calculate your tax. Generally speaking,

Assessable income = Taxable Income - Deductible Expenses

Example

Sally works as a sales executive at a private company. She earns HK$ 15,000 every month. That is considered as her taxable income before she files her tax.

Joseph earns a gross income of HK$ 20,000, and after deducting other items such as donations and health insurance of HK$ 15,000, he will pay tax of HK$ 5,000 Net Assessable income.

Summing Up

At this point, it is easy to remember that Hong Kong taxation covers three main types: salaries tax, profits tax and property tax. But under each umbrella, there are incomes that are taxable and not taxable. In order not to provide inaccurate figures during filing of tax, using a tax calculator by IRD will help you to report the right figures.

As a business owner, it is important to review your accounting practices yearly. This is so that it will not affect the running of your business in the long run. Your main priority is always your business. If you feel like the paperwork is drowning you, reach out to us for trusted help.