Documents To Prepare Before Registering Your Company

A guide of the most common legal documents you’ll need to prepare to get your startup registered and running as a working business.

For your company to reach its full potential, there are a few important legal considerations that every new business founder needs to know about. Beyond the legalities and competitive advantage, the company registration documents you prepare allow you to protect your IP and business ideas and be clear on the roles and responsibilities of partners and founders. In this article, we’ll walk you through the most common documents you’ll need to prepare to get that private limited company up and running.

The What and Why of Company Registration

Maybe you’re yet to set up your business or perhaps you’re currently a sole trader thinking about setting up an incorporated company. Either way, the motivation for doing so often comes down to business structure and liabilities. It’s not personal. It just means that any credit or business litigation faced is exactly that; limited. Your personal liabilities stay personal and separate from your business’ assets and cash flow. Incorporating your own company can also make things easier when it comes to making important calls or votes about key business decisions or even raising finance for your startup.

When you start an official UK company, the Companies House is the single, solid, reliable and regulatory body that ensures all the administrative and legal boxes are ticked. So unless your business has been incorporated at Companies House under the Companies Act 2006, you can’t operate. Simple.

By the way, we can help you with registering your company. While you focus on getting your business up, we’ll prepare these documents for you:

1. Certificate of Incorporation

2. Memorandum of Association

3. Articles of Association

4. Minutes for your first board meeting.

What documents are most important in the process to incorporate my UK company?

1. Memorandum of Understanding

What: A document that clearly outlines the terms of your agreement with any parties who may be involved in the setup of your company, before you get into the legal documents or sign formal contracts.

Why: Manage shared expectations and cement commitment by ensuring everyone’s visions are aligned to a common course of action.

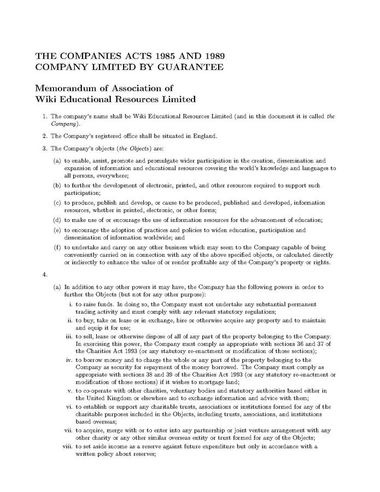

2. Memorandum of Association

What: A formal statement signed by you, and any fellow shareholder, made up of different clauses and a statement of compliance.

Why: To serve as legal proof and record of the agreement to form your company based on the Companies Act 2006.

3. Articles Of Association

What: A set of rules, rights and restrictions signed by directors, shareholders and your company secretary.

Why: To serve as the legal outline of how your newly incorporated company will be run and establish guidelines for owners to highlight roles and responsibilities.

What types of rules, rights, or restrictions could these include?

- Administrative outlines: Everything from employee provisions and company seals and logos, to director indemnity and insurance.

- Business model outline: Interpretation of the chosen model of business: Clearly summarised explanation of business type and associated terms (i.e Limited Liability Partnership registration)

- Director rules: Responsibilities, appointment and decision-making power.

- Shares and distribution outlines: Clearly established methods of any capital, dividend or other profit distributions.

- Shareholder decision-making outlines: Clauses for general meetings and how they’re run, including voting in these forums.

Did you know?

You can update, edit and refine your Memorandum of Association and Articles of Association. These, along with your application to register your UK company, are the most important documents to prepare.

What other documents do I need to prepare to start my company in UK?

Shareholders’ Agreement

What: A document that gives structure and formality to the relationships between individual shareholders and their relationship to the company in their respective capacities.

Why: Avoid any confusion or interpersonal issues that may stem from shareholder-related business decisions to ultimately safeguard everyone’s interest and protect your investment in the business.

The Shareholders’ Agreements address these questions:

- Shares: How are they proportioned and what are the different types?

- Vesting terms: Do they apply and what’s the timeframe?

- Decision-making: How do things work if someone leaves or wants to sell shares?

Non-Disclosure Agreement

What: A document that’s used when writing up contracts for third-parties, collaborators and employees or when pitching your product, service or business ideas to potential investors.

Why: To establish trust with everyone who’s part of your new business setup and protect the information you intend on sharing but want to keep confidential (i.e not made public, copied or shared without permission). This could be an innovative IP or simple process or business info that would be detrimental to your operation if lost or leaked.

Directors’ Service Agreement

What: An employment agreement for company directors that serves as a record of core duties beyond those that you’re legally obliged to.

Why: To avoid any complications by giving clarity to business partners intentions, contributions and responsibilities.

Employment Agreements & Service Contracts

What: A contract for any new hires to outline role-related duties and unpack specific employer-related obligations.

Why: To give clarity on expectations from employers and for employees in a manner that is legally enforceable.

Quick fact

When a new director joins your business, you’re legally required to have a written Directors’ Service Agreement signed, sealed and delivered within their first 2 months of employment. The same applies to all employee contracts, whether short-term, fixed-term or permanent, which should cover:

- Title, duties and expected deliverables (both time and output-based)

- How payment and any tax-related process is managed

Terms & Conditions for Goods or Services

What: A general documented list or written overview that outlines your approach, commitment and operating process of doing business with your customers.

Why: To serve as a legally binding agreement that gives certainty and helps avoid any tricky situations that may arise as a result of providing your products or services.

Website: T&Cs, Privacy Policy & Use of Cookies and Software Development Agreement

What: 3 important written outlines that specify information related to the use of your website services, information gathered, software produced and information protected. They are all legally binding and exist online in varying forms.

Why: To meet legal obligations if you’re selling your online products or services and build trust, show transparency and send signals of relevance to search engines.

| Website Terms and Conditions | Privacy Policy & Use of Cookies | Software Development Agreement |

| As a business who’s operating online, your T&Cs are legally required to include key info about your company (naming, pricing, contact details, business registration and trading particulars) | Disclosure of how your website collects data and uses or stores any personal info. If you’re using cookies, you’ll also need to create a cookie policy when setting up your new business’ website and are obliged to ask for consent when users visit. | A way to map out the process and track any specific software development (that will be your IP when completed, based on your NDA). |

Let’s recap!

The most important documents to prepare and submit to Companies house along with your business registration application are your Memorandum of Association and Articles of Association. Then it’s time to prepare a few other documents that will help cement a foundation for success for your company’s success.

Drop us a chat if you need to talk over any specifics with our team who make it our business to give your business the support it needs!