How To Register a Company in the UK: A Complete Guide

- Modified: 2 November 2023

- 7 min read

- Starting a Company

Gabi Bellairs-Lombard

Author

Gabi is a content writer who is passionate about creating content that inspires. Her work history lies in writing compelling website copy, now specialising in product marketing copy. Gabi's priority when writing content is ensuring that the words make an impact on the readers. For Osome, she is the voice of our products and features. You'll find her making complex business finance and accounting topics easy to understand for entrepreneurs and small business owners.

Planning on starting a new business in the UK? Congrats! Your first step is registering your new entity to be legal and officially recognised. In this complete guide, we’ll cover everything you need to register your new company successfully. We’ll look at the different legal structures, how to register a company online and the next steps once the process is complete.

Choose the Company Type You Want To Register

There are five main types of companies to choose from when you register a new entity: a limited (LTD) company, a partnership, a sole trader, a community interest company (CIC), and small and medium enterprises (SME). Read on to see which is the right choice for you.

1 Limited (LTD) Company

There are two types of limited companies in the UK: public (PLC) and private (LTD). PLCs are publicly owned, and anyone can buy or sell shares. The latter is privately owned, and shares cannot be bought publicly.

An LTD is the preferred structure in the UK as it offers more legal protection of personal assets and comes with tax benefits.

Pros of an LTD:

- Limited liability: all debts and obligations belong to the entity

- Tax planning and tax minimisation strategies

- Easier to raise capital

- Flexible management structure

Cons of an LTD:

- Higher accounting and administration requirements

- More expensive to set up and run

- Less privacy

- Restricted from some government grants

2 Partnership

A partnership is used when two or more individuals register a profit-making entity. Each partner shares the profits, losses, and responsibility for managing the operations.

There are two main types of partnerships in the UK: general and limited.

Pros of a partnership:

- Shared responsibility

- A collaborative approach to decision making

- Pooled skills and resources

- Flexibility in how profits are shared

Cons of a partnership:

- Structure means personal assets are at risk

- You can be held responsible for other partners' decisions

- Greater potential for conflicts

- Difficulty in raising capital

3 Sole Trader

A sole trader structure can be registered with only one owner and operator. That person is responsible for managing all activities, including operations, finances, compliance, decision making and distribution of profits.

Pros of a sole trader:

- Simple structure

- No company registering requirements

- Inexpensive to start

- All profits and decisions are yours

Cons of a sole trader:

- Unlimited liability

- Difficulty securing loans and traditional financing

- All responsibilities are yours

- It can be lonely

4 Community Interest Company (CIC)

A Community Interest Company (CIC) is a unique type of registered business. It was introduced in the UK in 2015 and is a good option for those focusing on a social benefit rather than maximising shareholder profits. CICs are often established by entities such as daycares or waste recyclers.

Pros of a CIC:

- Clear focus on social benefit

- Access to social enterprise funding

- A good reputation

- Reduced exposure to financial risks

Cons of a CIC:

- More paperwork than an LTD

- Strict legal obligations must be upheld, such as Asset Lock

- Restrictions on dividend payouts

- Difficulty accessing loans and traditional financing

5 Small and Medium Enterprise (SME)

An SME is typically defined as having less than 250 employees. While it's not a legal structure in the UK, it is the most common. According to the Federation of Small Businesses, 99.2% of companies in the UK fall under this category.

Pros of an SME:

- Less bureaucracy

- Quick decision making

- Access to SME government funding

- Small and closer to the customer

Cons of an SME:

- Difficulty in accessing traditional financing

- Fewer resources

- High competition

- Less bargaining power

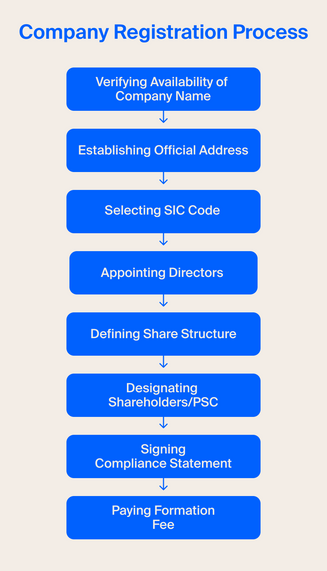

Company Registration Process

Knowing how to register a company in the UK may seem confusing, but it's actually a straightforward process and can even be completed online.

Registering a new company requires two legal documents: a Memorandum of Association and Articles of Association.

The Memorandum of Association confirms the agreement of all shareholders or guarantors to form the entity, and each shareholder or guarantor must have at least one share.

Articles of Association are the written rules that your company secretary, directors, and shareholders or guarantors must read, agree to, and sign.

Verifying Availability of Company Name

The first step in registering your company online is choosing and verifying a name.

Your registered name doesn’t need to match the name you trade under.

When choosing the right company name, certain words, such as anything related to being “limited”, LLP or PLC, cannot be used if they are untrue.

When registering your chosen name, you should also avoid using sensitive words or terms suggesting a connection with the government or local authorities. And be cautious about using punctuation, special characters, or frequently used words. For example, using "Accredited" in your name requires the approval of the Department for Business, Energy, and Industrial Strategy.

Choose a suitable name relevant to your industry, and feel free to be creative. Use our handy online tool to check your company name availability.

Establishing an Official Address

You’ll need a valid business address to send all official business documents. If you operate from home, you can use your home address.

However, this address will be publicly available on the Company House website. To protect your privacy, you may opt for an office address, purchase a P.O. box or use an accountant when registering your company, who can then receive and accept your post. We handle this all online for you.

Selecting SIC Code

Part of registering a new company is selecting a SIC code, which stands for "standard industrial classification of economic activities." You can find all of these codes online when you register your business. This code identifies the nature of your activities. The Office of National Statistics provides a comprehensive list of SIC codes to help you select the most appropriate one for your business. You may add up to four SIC codes per entity and edit them at a later date.

Appointing Directors

Your company must have at least one director overseeing operations and reporting. To qualify, a director must have a UK office address, be at least 16 years old, and have yet to be previously disqualified from holding such a position.

The directors must have two addresses associated with them: a publicly available official address and a private residential address that is not disclosed to the public. If the service address is the same as the company's, you must provide an alternative residential address.

Failure to fulfil legal duties as a business director could result in disqualification, financial penalties, or even prosecution in severe cases.

Defining Share Structure

A ‘statement of capital’ must be included with your company registration. This provides details of every shareholder, including their name, contact information, number and type of shares, and the total value of shares and their currency. The statement of capital must also include ‘prescribed particulars,’ outlining the rights assigned to shareholders through the shares.

Designating Shareholders/PSC

If a person owns more than 25% of the shares, has more than 25% of the voting rights, or has the authority to appoint or remove the majority of the board of directors, they have significant control.

In an LTD structure, it's a legal requirement to designate shareholders and identify those with significant control. Failure to do so is considered a criminal offence.

Shareholders with significant control must be included in your PSC (person with significant control) records, and you must inform the Companies House of their role.

Signing Compliance Statement

A quick but important step in registering a company is signing the compliance statement, which checks a few boxes. This step acknowledges that the process’s requirements outlined in the Companies Act have been met and that the Memorandum of Association has been reviewed and accepted.

Paying Formation Fee

The formation fee is the final step in registering your company in the UK. The Companies House fee is £ 50, and payment can be made online through debit, credit, or PayPal accounts.

What To Do After You Register Your Company?

Now that you’ve discovered how to register a company, you’ll need to prepare for the next steps: tax and opening a bank account.

1 Register for Taxes

Once your business is active, you must register with HMRC, the UK's tax authority, within three months to start paying corporation tax.

All UK companies must prepare annual financial statements and file annual corporate tax returns. For an LTD, annual corporate taxes must be filed within nine months after the financial year-end.

2 Open a Business Bank Account

In the past few years, UK banks have made opening a bank account more stringent. It can now take up to four weeks to open a business bank account. You could shorten this time by using an online bank.

If you’re planning on trading with clients overseas, setting up a bank account offshore might be more beneficial.

FAQ

How long does it take to register a company?

The process can be completed within 24 hours in the UK, depending on your chosen method.

Three options are available: self-registration via Companies House, hiring a third-party agent, or getting the help of an accountant.

Registering your company by yourself may take longer, whereas using an incorporation service, like Osome, can take as little as 3 to 6 working hours.

How do I register a company name in the UK?

Start by checking if the name is available. You can do so online using this free tool.

Remember to choose a good name that represents your business well.

Do I need to register my company with HMRC?

Yes, an LTD must register online with HMRC for corporation tax, VAT, and other applicable taxes. You must do so within three months after you start trading.

What are the differences in the company registration process for UK and foreign nationals?

There’s no difference for foreign nationals or UK nationals who want to register in the United Kingdom. All documentation, requirements and costs are the same. Keep in mind that all directors must have a UK office address.

More like this

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?