P60 Form: What Is It and How To Deal with It?

The P60 form is a part of the UK payroll system that features tax payments and National Insurance contributions of a certain employee. We look deeper into the nature of the document.

A P60 form is an integral part of your payroll system as a businessman in the UK. It is the bookkeeping services provider who normally deals with payroll and specifically this form.

However, it is to appear in your business life only if you have any employees. You can get one even if you are the boss. And it opens the door to get tax refunds. So, here’s everything you need to know about a P60.

Who prepares the P60 forms?

What should I do to get a P60 form done?

What does it include?

What if an employee loses the P60 form?

What if an employee doesn’t get the P60 form?

What if there are mistakes/changes in the P60 form?

Do I get a P60 being a limited company director?

What about a P60 and a sole trader?

When do I need a P60?

What is a P60 form?

Prove how much tax you paid.

Similar to a P60 form, a P11D form records benefits-in-kind that is not part of actual salary. They have a monetary value and is taxable. You give a copy to HMRC and your employers.

A P60 is a record you must provide to your employees once a year. They need the form to, for example, claim a tax refund or provide it as evidence that they are able to pay for a mortgage.

“Once a year” means “at the end of every tax year” — the period you account for, reporting your profit and expenses to HM revenue and customs. In the UK, a tax year starts on the 6th of April and ends on the 5th of April next year. The company is obliged to give the P60 forms to the employees by 31 May.

The P60 form is a part of the PAYE (Pay As You Earn) system, which is a way to pay taxes and national insurance contributions.

The employees in question are only those who are working for you on the final day of the tax year — which is the 5th of April.

The Brownie Bakery LTD. employed a confectioner named Ted in April 2018 and fired him in October 2018. In April 2019 the bakery does not have to send Ted his P60. He will get a P45 form instead.

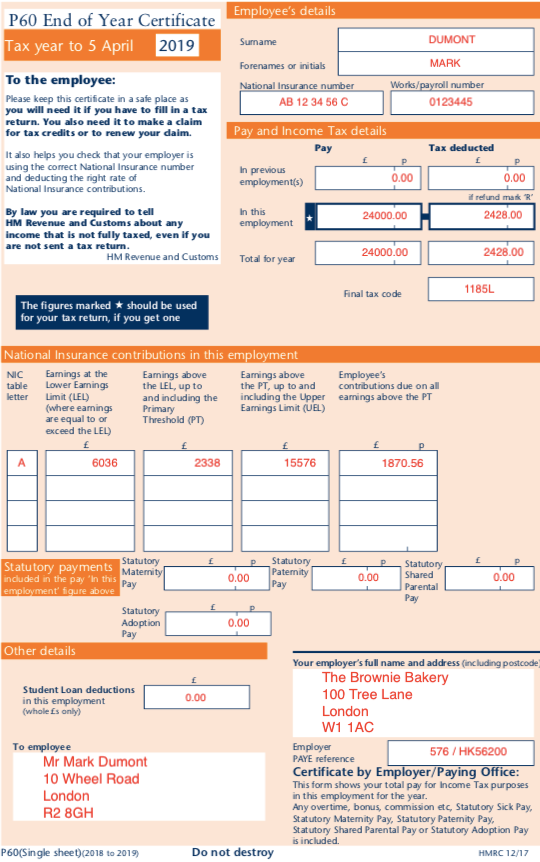

Mark the cashier was employed in April 2018 just like Ted. In April 2019 he still works at the Brownie Bakery. Mark will receive his P60.

Who prepares P60 forms?

You can do your whole payroll under PAYE (including the P60 forms) yourself using payroll software or hire a payroll provider to do it for you (an accountant or a company).

If you choose to do it yourself and don’t want to do it online, the government has a plan of action for you as well.

What should I do to get a P60 form done?

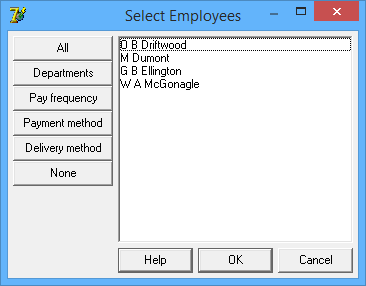

Fill in the form. Usually, it’s done automatically via payroll software, e. g. Xero payroll or Moneysoft. It works like this with Moneysoft: you go into payroll samples sections, then click ‘Forms — End of year P60’ in the main menu, select ‘All’ and automatically produce P60s to each of the employees on the list.

You can use whichever payroll software you would prefer, or just download the one offered by the government for free. The government-provided software, though, works only for businesses which have up to 10 employees.

You can also fill in the form manually: for this you can order certified copies from HM revenue and customs (they promise to deliver them within 7 days) or use any alternative substitute they view as legit.

Give the form to the employee. You can either give them their P60 as a piece of paper or send it to them via email. But for this, you need to get their agreement to receive it in a digital form.

What does it include?

- Employee’s name

- National insurance number

- Gross pay

- Tax paid

- Contributions to National Insurance from the current place of work

- Statutory pay

- Student loan deductions

What if an employee loses the P60 form?

The employee has a right to turn to you to get another copy, which, as well, can be given either in paper or electronically. And it is to be marked as ‘duplicate’.

What if an employee doesn’t get the P60 form?

If you are lucky, the employee will just ask you for it. If you are not, your worker will turn directly to HMRC. HMRC may charge you with a penalty of up to £300, and also add an extra penalty of up to £60 per day for further violation.

What if there are mistakes/changes in the P60 form?

You can give your employee either another P60 form, that should be marked ‘replacement’, or just send them a letter, outlining and confirming the change in the form.

Do I get a P60 being a limited company owner?

If you are employed by your company — yes, you are to give yourself a P60.

Want to register your UK company online? Get in touch with us and we will assist you.

What about a P60 and a sole trader?

If you pay yourself a salary through PAYE, you need to issue yourself a P60. You will also need to give P60s to your employees, if you have any.

When do I need a P60?

- Seeking a loan or mortgage — to prove your ability to pay

- Applying for tax credits & refunds

- Filing your personal (self-assessment) tax return

| ❓ | ❗️ |

|---|---|

| What is it for? | To claim tax refunds, prove you can pay for a loan/mortgage, file the personal tax return |

| Who gives it to who? | Employer to employee |

| How is it calculated? | Through payroll systems |

| When is it delivered? | Once a tax year, by the 31st of May |

| Is it replaceable? | Yes |

It is not only bookkeeping advice we can give you! Talk to our accountants online if you have any accounting needs you need to fulfil.