- Osome UK

- Ecommerce Accounting

Ecommerce accountants for effortless growth

Move on from traditional accounting. From returns to discounts, gift cards and global VAT needs, we know ecommerce.

Tailored financial management for online sellers

Accountants that know ecommerce

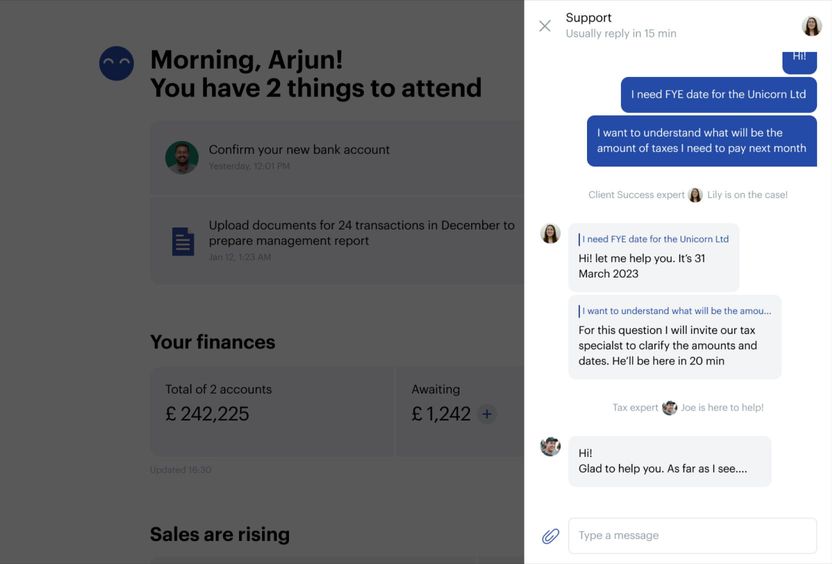

We handle processing sales platform fees, discounts, refunds and gift cards. Chat with your local accountant through our app, and they'll reply within one day.

Directly integrate sales platforms

Say goodbye to platform hopping. We process platform fees, discounts, returns, and gift cards with Amazon, Shopify and eBay connections. Plus, we process payments from PayPal, Stripe and Square.

Access to international markets

Easily sell in international markets. We automatically calculate and file for VAT for every country you sell in.

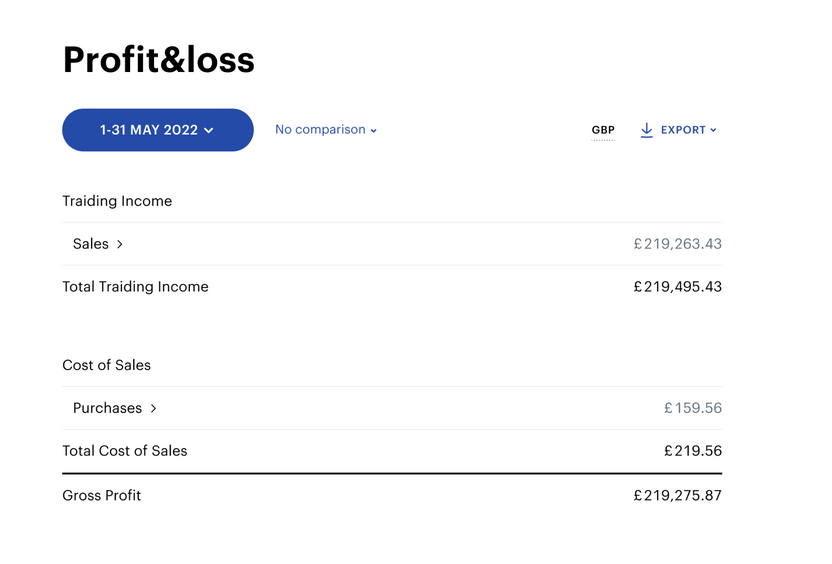

Full control and transparency of your sales

All in one place

Choose which sales platforms, payment gateways and banks you want to work with.

Experts on the ground

Expand your business into new markets. Get VAT automatically calculated and returns filed for the country you sell in.

Absolute clarity

Know exactly what makes you profit. Get complete run-downs for each SKU, market and specific country tax rates.

Easy-to-use tools to handle all your business operations

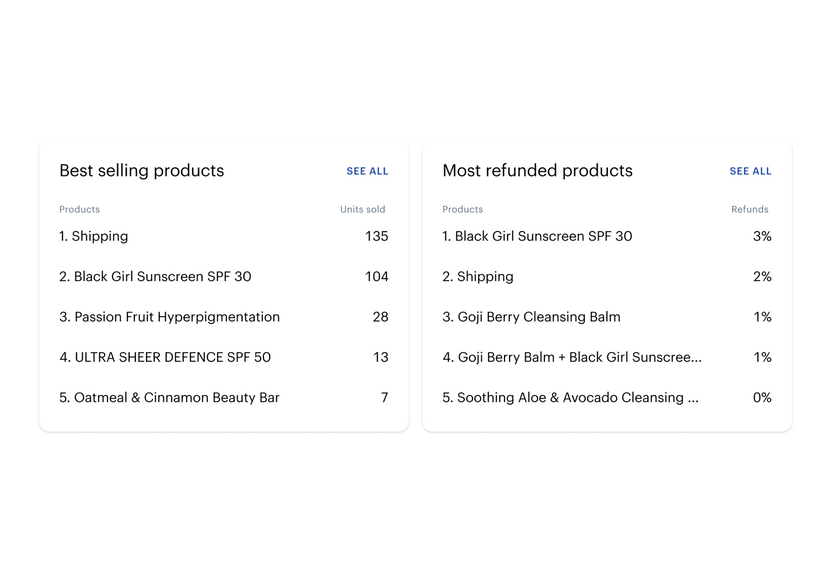

Know what makes you money

Review revenue and costs at the channel, SKU or country level for cross-border sellers.

Restock what sells

Know the best performing SKUs so you can order them before they run out.

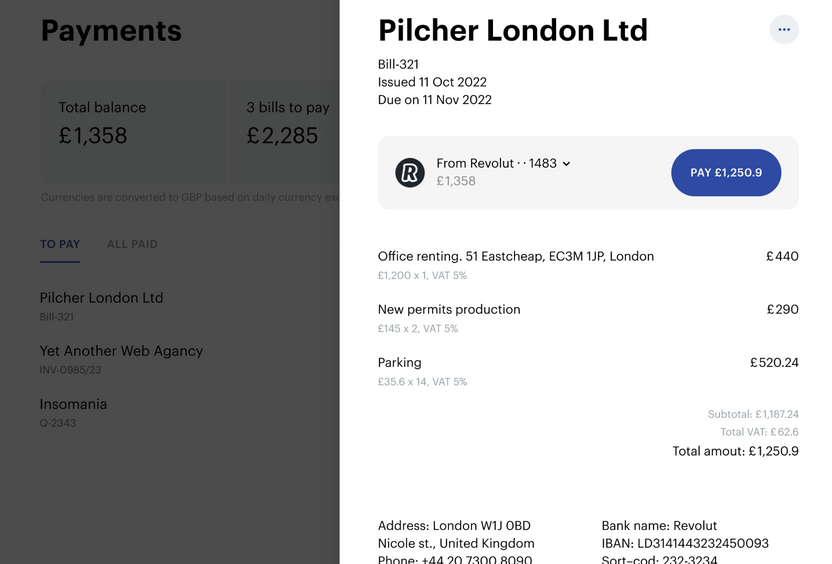

Easy payments from upload to paid

Simply drag and drop your bills. We accurately extract billing data, show you a prioritised list of payments, so you know what to pay first, and help you settle in a click.

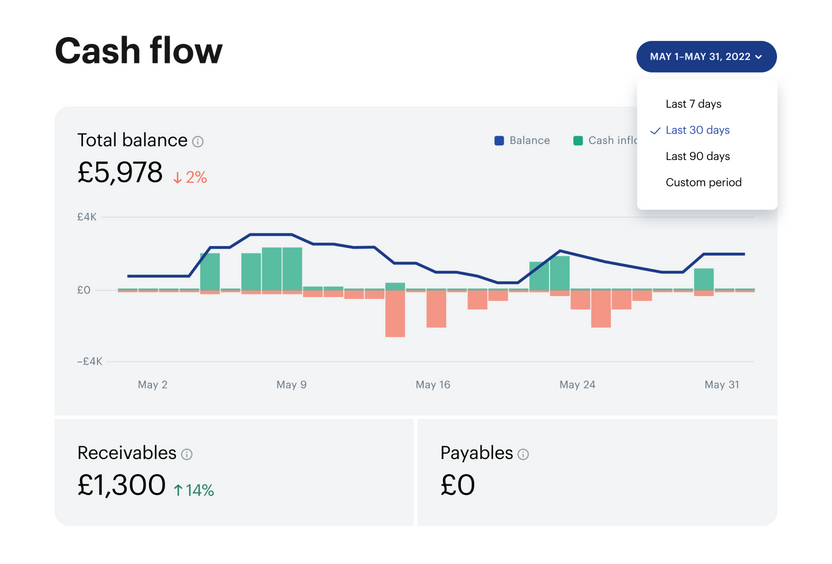

Get clear on your cash flow

See your balance aggregated from all connected ecommerce platforms and bank accounts.

Real-time data

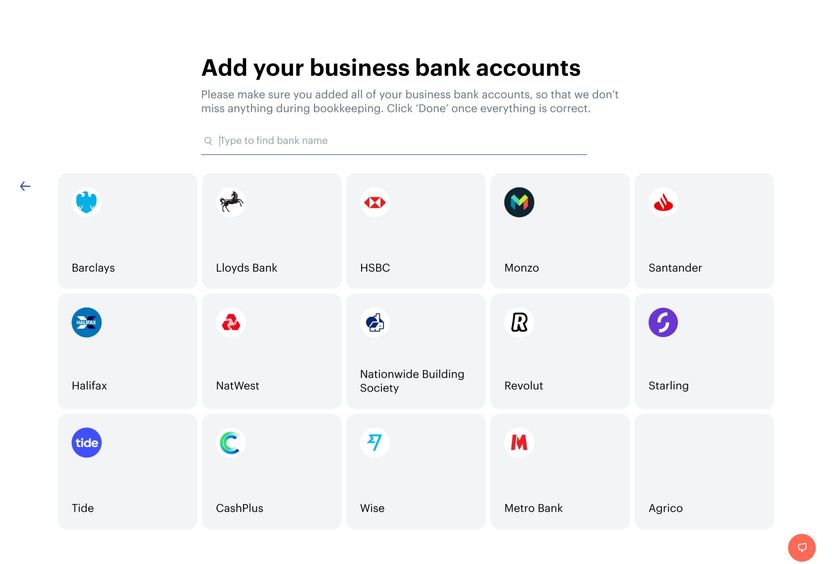

We connect your bank accounts via open banking and exchange data instantly to power your decision making.

From bookkeeping to filing tax

We process your documents within 24 hours. You get a snapshot of your financials at any given moment. When it's time to file, we have reports at the ready and reach out to you to sign and approve.

Your accountant is always there

Talk to your accountant via live chat, ask questions and get answers within 24 hours.

For new and experienced digital entrepreneurs

Dropshippers

Make the most of your margins and get seamless returns support. All with the help of our experts.

Your own brand

Whether you’re set up in your garage or opening up your first office. Our services scale as and when you need them.

White-label sellers

Focus on growing your products and revenue sources. We’ll handle the taxes, filing and financial back end.

Plans to fit your business

Operate

For business owners who want to ensure they tick all basic compliance boxes as they grow

from£71/m£850 billed annually + VATGet this plan- Financial software

- Create, send, and chase invoices

- Capture bills and receipts easily

- Pay bills in one click

- Reimburse expenses

- Connect your banks

- Use multiple currencies

- Get real-time ecommerce sales reports

- Connect one marketplace

- Bookkeeping

- Unlimited bookkeeping

- Automatic reconciliations

- Expert service

- Initial consultation with a tax expert

- In-app chat

- Tax advice on payroll and dividends

- Tax and filings

- Annual filings

- Self-assessment

- Annual review with accountant

- Payroll

- PAYE registration

- 1st Director Payroll

- Company admin

- Unlimited corporate changes

- Historical work

- Catch-up bookkeeping£38/m

- Urgency filing£200

- Historical annual filing and bookkeeping£680/y

Grow

For businesses nearing VAT registration, seeking up-to-date analytics and consultations

from£137/m£1,640 billed annually + VATGet this plan- Operate package +

- Financial software

- Connect unlimited marketplaces

- Expert service

- Video calls with an expert

- Ad-hoc tax advice

- Dedicated accountant

- Tax and filings

- Monthly review with accountant

- VAT filing

- VAT registration

- Payroll

- Full payroll, 5 employees

- Company admin

- Registered address

- Historical work

- Catch-up bookkeeping£38/m

- Urgency filing£200

- Historical annual filing and bookkeeping£680/y

Scale

For busy entrepreneurs juggling multiple roles, freeing up time from financial complexities

from£224/m£2,690 billed annually + VATGet this plan- Grow package +

- Expert service

- Senior dedicated accountant

- Payroll

- Full payroll, 10 employees

- Company admin

- Professional references

- Historical work

- Catch-up bookkeeping£38/m

- Urgency filing£200

- Historical annual filing and bookkeeping£680/y

What our clients think about Osome

“Osome just made everything easier.”

91 %of customers recommend Osome services

“Top class service for my Amazon business. Osome was able to offer me the complete accounting with bookkeeping package.”

Matthew Lowe

FAQ

What is ecommerce accounting?

The definition of ecommerce accounting is reporting about your ecommerce business financials to the government. As an online vendor, you move products in and out, manage stock, and sell to customers in different countries via different channels. So, there are several things your ecommerce accounting includes:

- Bookkeeping, which lists every transaction. For example, when you accept products to your storage, or sell on Amazon, or have to accept back a pair of shoes on ebay. Bookkeeping keeps track of every money or asset movement, and provides a document covering every such event.

- Management reports, which gather all the sales data and try to make sense of it. For example, how much of each product you sold, what are the costs of operating every channel, and where do you actually make money.

- Tax filing & statutory reports. These depend on where you sell, for each government has a different tax system. Tax reports constitute a very detailed recount of every transaction and the categories they fall under. Depending on the categories, different types of tax are derived. An experienced accountant can also help make sure you get the benefits and exemptions available to your business under each specific tax code.

How do I start an ecommerce business account?

When organising accounting for ecommerce sales you need to make sure that you have all your needs covered.

- All your channels. Do you sell via different platforms? You need a way to consolidate reports from various sources.

- All your tax jurisdictions. Do you sell in more than one country? You need to report for VAT everywhere you make money.

- No manual paperwork. Processing invoices and receipts is tiresome, and you probably have better ways to spend your time than that.

How do I record online sales on Amazon?

For optimum tracking of your Amazon online sales, we recommend linking it directly with accounting software. We seamlessly integrate this feed into your Osome dashboard, which refreshes every 24 hours, enabling real-time monitoring. Subsequently, whenever Amazon sends you a statement, it gets automatically uploaded to your account. We then process it, categorising and tagging the details, ultimately providing you with current financial data daily.

Which accounting software and bookkeeping software do you use?

We've developed proprietary software that you can access from your desktop or a mobile app. This software provides daily updates of your balance from all linked bank accounts, your pending invoices, and lists documents that need to be uploaded. Additionally, we provide swift responses to queries via chat, keep track of important deadlines, and reconcile daily transactions.

Can I transition from another accounting firm to Osome?

Of course! Switching to Osome from another accounting firm is a breeze, with little effort needed from you. We'll directly liaise with your existing accounting service provider, assume responsibility for all your financial records, and thoroughly review them to ensure your company's compliance. We check for unresolved issues with HMRC, arrange historical data, and compile and submit the necessary reports. Additionally, we provide continuous guidance on significant tax exemptions, assisting you in making the best tax decisions. With your accounting in our hands, you can now devote your full attention to what truly matters: managing your business.

Fresh insights from our business blog

Setting Up An Offshore Company in the UK

Want to set up an offshore company? It’s important to consider all aspects of the process, from your company structure and the jurisdiction to understanding tax liabilities. This article unpacks all you need to know about incorporating a business in an offshore jurisdiction. Shall we get started?

Clash Of The (property) Titans: Serviced Accommodation Vs. Buy-to-let

Starting your property investment journey can be overwhelming. This is especially true when you consider there are as many strategies to investing as there are properties on the market. With insights and advice from experts, you can navigate the confusion, and jumpstart your success.

Good News for Small Businesses in 2024 as the VAT Registration Threshold Increases

UK Chancellor delivered some good news for small businesses in the 2024 Spring Budget Speech. A lower VAT registration threshold will allow hundreds of businesses room to breathe. Read the Osome article for more.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?