What’s inside

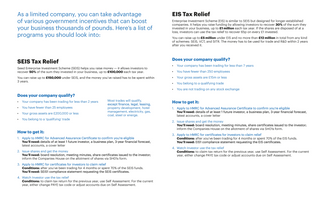

- SEIS Tax Relief

- EIS Tax Relief

- VCT Tax Relief

- SITR Tax Relief

- EMI Share Options Scheme

- Entrepreneurs’ Relief

- Capital Investment Allowances

- R&D Tax Credit

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?