What Is a Holding Company: Structure, Benefits, and Considerations

- Modified: 11 October 2024

- 12 min read

- Starting a Company

Gabi Bellairs-Lombard

Business Writer

Gabi is a content writer who is passionate about creating content that inspires. Her work history lies in writing compelling website copy, now specialising in product marketing copy. Gabi's priority when writing content is ensuring that the words make an impact on the readers. For Osome, she is the voice of our products and features. You'll find her making complex business finance and accounting topics easy to understand for entrepreneurs and small business owners.

A holding company operates as a parent company and orchestrates subsidiary company operations without getting entangled in daily management. It oversees business organisation and investment strategies and also streamlines control and risk mitigation, often leading to tax optimisation for the parent company.

Key Takeaways

- A holding company, aka the parent company, owns and manages the assets of its subsidiary companies, including stocks, intellectual property, and real estate.

- A UK holding company alone doesn't engage in the subsidiaries' day-to-day activities. Rather, it focuses on its own business operations, such as providing centralised services and leasing assets to subsidiary units, alongside other strategies.

- A holding company can profit from surplus cash generated by dividends from multiple subsidiaries.

What Is a Holding Company?

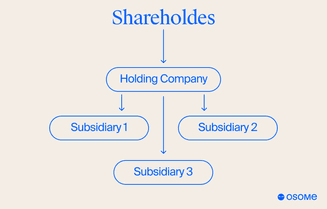

A holding company gains a controlling interest in another company. It is often referred to as the parent company. The term holding company refers to entities in the UK that focus on managing assets, such as financial assets, business premises, or intellectual property, along with investments and strategic direction. This business structure can own more than 50% of another company's shares, gaining what is known as the controlling interest. As a result, it controls the majority of voting rights and often has the power to designate or remove a majority of the board.

Using a holding company allows you to control and manage multiple subsidiary companies to diversify business risk, protect assets, and potentially realise significant tax benefits. Sometimes, a holding company owns 100% of its subsidiaries. In that case, those companies are called wholly owned subsidiaries. When the situation arises, a holding company can force subsidiaries to dissolve, especially if those subsidiary companies are wholly owned.

If you're interested in using a holding company to maximise your business efficacy, speak with Osome's UK company registration expert today and get professional advice.

What Are the Types of Holding Companies?

A holding company structure can come in different forms.

A ‘pure' holding company's main purpose is to possess stock in other firms. This type of holding company does not partake in any other business activities as it entirely focuses on owning shares of other businesses. It serves as a parent company to support a corporate group structure.

A personal holding company (PHC) is a C-Corporation whose majority shares of stocks or voting rights are owned directly or indirectly owned by five or fewer individuals. A PHC also receives over 60% of its income from passive sources. While a pure holding company can register as a limited liability company, a PHC is always a corporation.

Finally, a 'mixed' holding company structure actively participates in other business operations while holding stocks of other business entities. A mixed company is frequently seen in the real estate industry, and it may be used to lease out investment property to other entities.

How Does a Holding Company Make Money?

Instead of relying on day-to-day operations, a holding company's revenue stems from shares in its subsidiary businesses. The dividends generated by shares of different entities contribute significantly to a company's revenue stream.

A holding company can also provide services like IT, human resources, or administration to reduce their operational costs. Additionally, it can lease equipment and other assets, generating long-term passive income through those transactions.

The Role of a Holding Company

Operating as a separate business entity, it possesses controlling stock over its subsidiary entities. As a result, the holding company structure simplifies the management process of multiple companies that share common ownership.

Moreover, a holding company can help protect valuable assets and mitigate liabilities. Allocating business assets to the holding company streamlines asset transactions among other business structures and also generates additional revenue for the holding company. Since a holding company owns assets, it can also be used to pursue acquisitions, adding new companies to the existing corporate group structure.

Finally, holding companies also help manage corporation tax obligations as they benefit from several tax advantages. For example, holding companies have no tax liabilities on dividends received from other companies.

The Advantages of a Holding Company

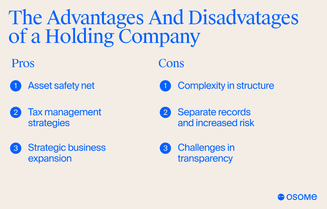

The main benefits of holding companies include asset protection, tax advantages, strategic expansion, and effective risk management, all of which support the growth of their subsidiary companies. By owning assets, they shield subsidiaries from creditors, in contrast to trading companies that engage in multiple trades and face greater legal risks due to their direct commercial activities.

There are also some tax benefits like reducing corporation tax and avoiding capital gains tax through exemptions. A trading company, in contrast, is subject to standard tax regulations. Lastly, a holding company drives expansion through acquisitions, while the main trading company focuses on generating revenue from its core operations.

The Disadvantages of a Holding Company

While holding companies provide various benefits, they also face several challenges.

One major issue is the complexity of their structure. Setting up a holding company involves selecting the right framework, registering with Companies House, and establishing control between the parent and subsidiaries. This complexity can lead to management conflicts, especially when the parent influences subsidiary company decisions.

Additionally, parent companies must maintain separate financial records for each subsidiary, complicating oversight and increasing the risk of asset loss to creditors. Transparency can also be a challenge, as this intricate structure makes it difficult for investors to assess the financial health of the company and its subsidiaries, despite regulatory efforts like the UK’s Economic Crime and Corporate Transparency Act 2023.

How To Set Up a Holding Company?

Setting up a holding company, which may include a trading company, involves several steps:

- Select and register a unique name, either as a corporation or a limited company. The term 'holding' has been used in the name since 2015.

- Appoint the board of directors and report the appointments within 14 days. UK laws allow both individuals and corporate directors, with few restrictions.

- Set up a business bank account to manage finances, track tax liabilities, and streamline payments.

- Consider formation fees, tax implications, and governance requirements, and seek advice from accountants.

- Develop a detailed business plan covering operations, market analysis, sales strategies, and financials to effectively manage the whole business.

Examples of a Holding Company

Real-world examples help clarify the concept of a holding company. Coca-Cola is a prime example, acting as the parent company to several subsidiary companies, each with independent operations, tax, and legal liabilities. While Coca-Cola doesn’t interfere with daily operations, it oversees and strategically manages these business entities.

Similarly, Alphabet Inc. was established in 2015 as a holding company for Google and its subsidiaries, enabling Google to focus on core business while Alphabet explored new ventures. These examples showcase the strategic role of a holding business structure across different markets.

Summary

In summary, holding companies are powerful business structures that allow for strategic management of multiple subsidiary companies. They offer many advantages, including asset protection, tax management strategies, and opportunities for strategic business expansion. However, they also present certain challenges, such as complexity in structure, the need for separate records, and potential transparency issues.

FAQ

What is a holding company?

A holding company is a parent company that owns and controls other companies and focuses on managing assets, investments, and overall strategic direction. This structure is implemented by different industries throughout the UK.

How does a holding company make money?

A holding company makes money primarily through receiving dividends from its subsidiary entities. It can also lease assets and provide services for its subsidiaries. This allows the company to have steady passive income streams while maintaining minimal tax liability.

Do holding companies pay tax?

Holding companies, or parent companies, do have an income tax liability. A holding company is taxed as a standalone business entity and is subjected to corporation tax. However, transactions incurring tax charges are sometimes deductible, such as interest generated from owning subsidiary dividends.

More like this

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?