Automated accounting solutions tailored to online selling needs

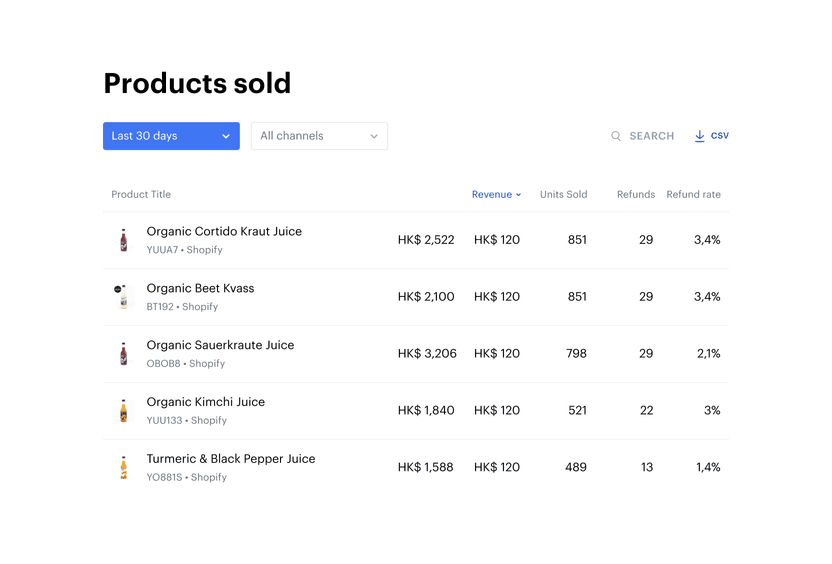

Up-to-the-minute sales insights

Osome Accounting seamlessly integrates with your marketplace data via our API, ensuring automatic synchronisation. Stay informed about your online sales performance effortlessly.

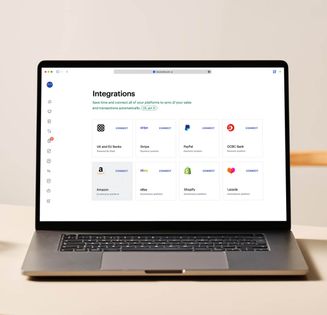

Seamless platform integration

No more platform-hopping for sales insights! Our system handles fees, discounts, returns, and gift cards across Lazada, Amazon, Shopify, and eBay. Plus, there is seamless integration with PayPal and Stripe payment gateways.

Accountants that know ecommerce

Let us handle processing your sales platform fees, discounts, refunds, and gift cards. Ensure transparency in your commissions — our skilled accountants are ready to assist you with taxes and necessary marketplace calculations.

Streamline your operations with easy-to-use tools

Restock what sells

Know the best performing SKUs so you can order them before they run out.

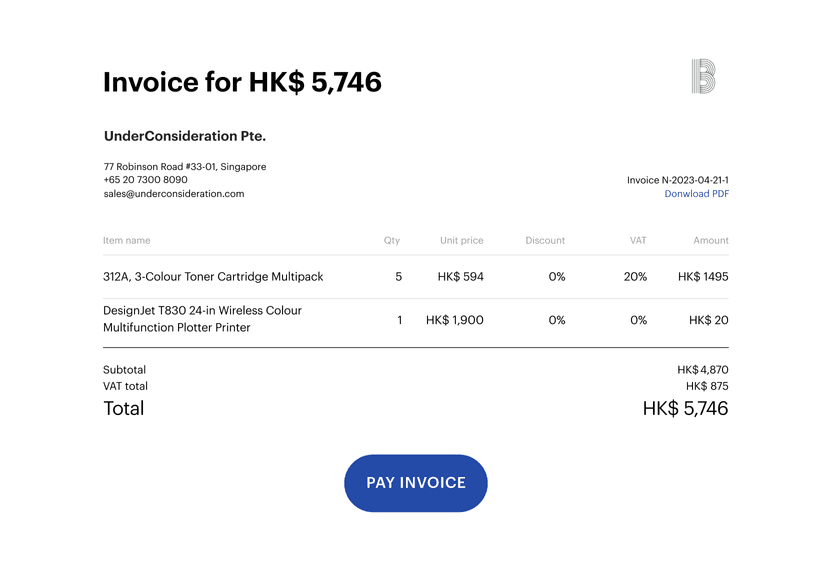

Get paid quicker

Issue invoices, nudge late payers and get paid faster. Pre-filled fields in the template means there's no more need for manual data entry whenever you need to issue an invoice.

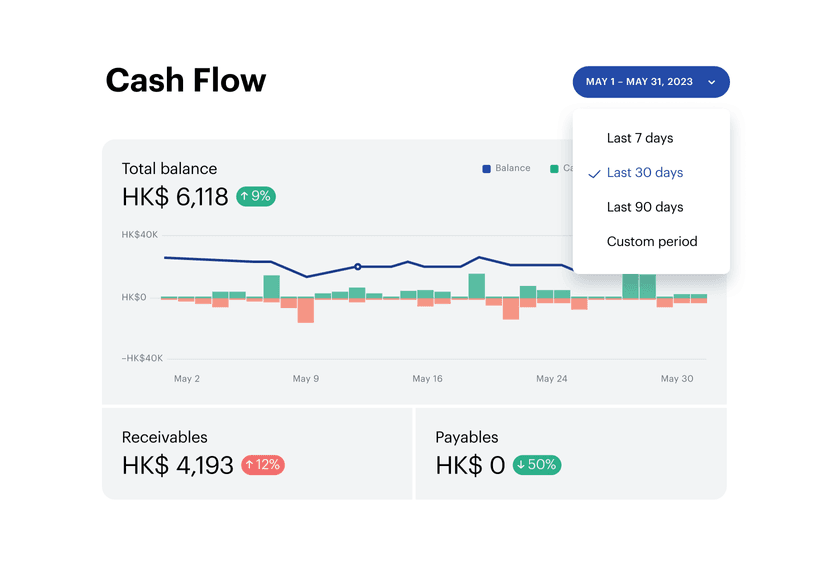

Know your cash flow

See your balance aggregated from all connected ecommerce platforms and bank accounts.

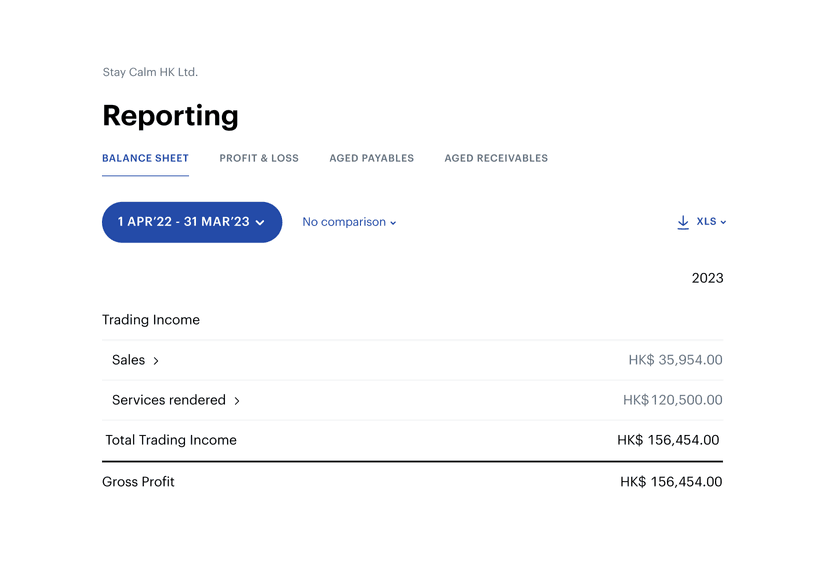

From bookkeeping to filing tax

We process documents within 24 hours, giving you an updated snapshot of your financials when needed. We'll file your reports when the time comes — you just need to sign and click ‘approve’.

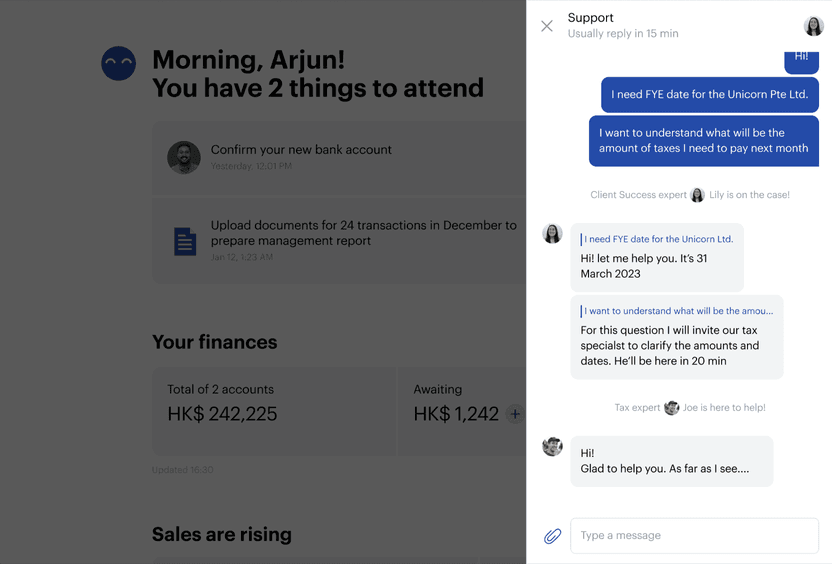

Consistent support from your accountant

Get answers and expert guidance within 24 hours from your accountant via live chat.

Resources catered to digital entrepreneurs at every level

Dropshippers

Boost your margins and achieve greater success in the ecommerce industry with the support of our expert team.

Brand owners

Whether you're a garage entrepreneur or expanding to your first office, our services fit your needs.

White-label sellers

Channel your efforts into product and revenue growth while we take charge of tax management, filing, and financial backend.

Plans to fit your business

Our packages are tailored to your business stage and annual revenue. When your revenue falls above or below the selected threshold, we'll either invoice you for the difference or credit your account. As your business grows, you can customise your package with add-ons to meet your evolving needs.

Operate

When you want to nail your first year of business and stay compliant

from

HK$ 3,500 billed annually, per financial year

Financial software

Bookkeeping

Expert service

Optional add-ons

Grow

For growing businesses requiring additional admin and advisory support

from

HK$ 4,200 billed annually, per financial year

Financial software

Bookkeeping

Expert service

Optional add-ons

Scale

For founders who need audit and tax support for compliance and regulatory filing

from

HK$ 8,500 billed annually, per financial year

Financial software

Bookkeeping

Expert service

Audit service

Optional add-ons

Add-ons you might need

Payroll services, per employee

HK$ 220/m

All payroll particulars handled for you, including payroll calculations and payslips.

Urgency filing

HK$ 3,000

An urgency fee applies for filing deadlines longer than 2 months, while custom pricing is available for shorter timeframes.

What our clients think about Osome services

92 %of customers recommend us

“We saved a lot of time which we could reallocate to scaling our business”

“Accounting, audits, and any raised question was resolved quickly and professionally — an exceptionally good service level!”

Arif Dewi

FAQ

What are the benefits of an ecommerce business?

The rise of the internet has transformed society around us in just a few short decades. As life rapidly moved online, retail quickly followed suit. Once a mere online bookstore, Amazon has become a global behemoth. The Alibaba Group now brings in $72 billion annually — only 21 years after being launched in Jack Ma’s humble apartment. It’s safe to say that the ecommerce revolution is well underway.

What is ecommerce accounting?

The definition of ecommerce accounting is reporting about your ecommerce business financials to the government. As an online vendor, you move products in and out, manage stock, and sell to customers in different countries via different channels.

How to do accounting for ecommerce?

There are several things your ecommerce accounting includes:

- Bookkeeping, which lists every transaction. For example, when you accept products to your storage, or sell on Amazon, or have to accept back a pair of shoes on eBay. Bookkeeping keeps track of every money or asset movement, and provides a document covering every such event.

- Management reports, which gather all the sales data and try to make sense of it. For example, how much of each product you sold, what are the costs of operating every channel, and where do you actually make money.

- Tax filing & statutory reports. These depend on where you sell, for each government has a different tax system. Tax reports constitute a very detailed recount of every transaction and the categories they fall under. Depending on the categories, different types of tax are derived. An experienced accountant can also help make sure you get the benefits and exemptions available to your business under each specific tax code.

How does pricing work?

Our pricing is revenue based. We don’t charge on the number of transactions in your account or the number of invoices you upload. All prices are based on the financial year, not the calendar one.

What if my actual annual revenue differs from my chosen accounting plan's revenue range?

No worries! We'll adjust your accounting plan to match your actual revenue — either by sending you an invoice for the pro-rated package or crediting the amount back to your account.

Fresh insights from our business blog

Digital Banking: Complete Guide to Modern Financial Services

Digital banking services revolutionise how customers access financial institutions through digital channels, eliminating the need for physical bank branches while offering comprehensive and convenient banking solutions. This allows users to handle their finances securely and efficiently from anywhere using mobile devices and online.

Top Payment Methods in Hong Kong for Businesses and Consumers

Reliable, secure, and efficient payment methods can be a game-changer for your business, ensuring customer satisfaction and minimising overhead costs related to payment processing. Wondering which online and offline payment methods are best in Hong Kong? This article breaks down options like credit cards, digital wallets, and bank transfers. Learn about their benefits and challenges to choose the right one for your needs.

The 10 Best Ecommerce Hosting Services in 2025

When you are setting up your ecommerce shop, the right hosting provider can make all the difference. However, with a variety of options out there, choosing the best one can be confusing.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?