- Osome Blog HK

- A Guide to Opening a Representative Office in Hong Kong

A Guide to Opening a Representative Office in Hong Kong

- Modified: 12 November 2024

- 5 min read

- Incorporation

Safiah Alias

Business Writer

Safiah writes to make sense of the world. She has been writing articles for about 13 years on various topics, from social care issues to travel and food. She currently manages content for Osome.

Looking at opportunities in Asia as a starting base to expand your company, but don’t want to make too huge an investment? Foreign companies often explore Asia by registering a Representative Office in Hong Kong. Learn more about how to do it properly legally.

At some point as an entrepreneur, you might want to explore opportunities in Asia and consider registering your company in Hong Kong as a starting base. However, you don’t want to make too huge an investment before being sure that your business will grow in this region. With that in mind, opening a Representative Office is the best option for you.

When you open a Representative Office, your business activities are limited to promotion and liaising activities only. It doesn’t have legal status so you can’t enter into any contracts, and you can’t enter any activities which will create profits. This status is perfect for the market research stage before fully entering a market. This guide will provide details of setting up a Hong Kong Representative Office.

What Is a Representative Office in Hong Kong?

A representative office is a form of representation of your company. It makes it easier for you to start making connections with potential business partners in the market that you want to enter.The purpose of setting up this form of office is to register a place of representation, or liaison in Hong Kong. Usually, a staff member from the foreign parent company will be appointed to relocate to Hong Kong and manage this office and hire local employees as support staff. The Hong Kong Representative Office (RO) is available only to companies incorporated outside of Hong Kong companies.

Things you can and cannot do as a Representative Office

When you open a representative office, it acts as a cost centre. You can hire local Hong Kong staff, purchase goods and services, conduct market research.

What you cannot do is generate revenue or profit for the local office or the foreign parent company. Examples include providing consultancy for a fee, trading, selling and receiving money other than from your overseas parent company.

Example

Xazier Technologies is a company from Canada. They want to explore entering Asia as a market and decide to set up a Representative Office in Hong Kong. They can hire local staff to assist them with translation to find vendors to work with on product development but they cannot sell any of their products or services to the vendors.

Legal Standing

The Representative Office is not a type of body corporate and so, it does not have to be registered under the Companies Registry (CR) as a legal entity. By extension, this form of office has no independent legal standing or recognition. If the representative office enters into any debt or liabilities, the foreign parent company would be responsible for their actions.Even so, you will still need to get a Business Registration Certificate displayed at your office. This certificate is a form of approval for you to carry on with your allowable business activities as mentioned above.

Status on Taxes

As you are not making any profits as a Representative Office, you don’t have to file profit tax returns. You may apply to the Inland Revenue Department for an exemption from filing profit tax returns or file annual profit tax returns on a “NIL” basis.

Who Can Open a Representative Office in Hong Kong?

If you have a company in Hong Kong, it can’t have a Representative Office. It’s a form specifically designed for foreign businesses to explore Hong Kong.

If you’re wondering where to get one, talk to our experienced agents for a consultation. Otherwise, skip that and keep reading to find out more.

How To Apply for a Representative Office in Hong Kong

1. The registration should be submitted within 1 month after you set up your office in Hong. You would need to register with the Business Registration Office.

2. These are the information you would need to submit to register your Representative Office

a. Domestic Name

This refers to the business name registration of the foreign parent company at its place of incorporation. If the name is not in Latin letters on Mandarin, you will need a certified translation in English and/or Chinese. If you have more than one name for your company, submit them all.

b. Date of establishment of a “place of business” in Hong Kong.

The day you start operations. This is needed to ensure that you registered within 1 month since you opened the office.

d. Registered address of the foreign company in its place of incorporation

e. Particulars of the foreign company’s directors, manager, and/or company secretary

Their full names and signatures or electronic signatures are needed.

3. These are the documents needed:

a. Certified copy of applicant’s foreign company’s Certificate of Incorporation given by the authority of the country or jurisdiction where the company was incorporated.

b. Application Form 1(b) - “Business Registration – Application by a body corporate for registration” created by the Business Registration Office of the Inland Revenue Department.

All documents for submission to apply for this Representative Office would need to be Certified True Copy. This means that this document is the true copy of the original document and endorsed by a professional agency of Certified Public Accountant, Lawyer, or the authority that issues that document. A Certified True Copy bears the signature of the trusted agency as proof of certification. Take note that a Certified True Copy does not mean that the original document is genuine.

How Much Is the Government Fee To Set Up a Representative Office?

1 - Year (HK$) | 3 Year (HK$) | |

|---|---|---|

| Lodgement Fee (non-refundable) | 295 (one-off) | NA |

| Certification of Registration of non-Hong Kong company | 1,425 | NA |

| Business Registration Certificate (including fee and levy) | 2,250 | 5,950 |

Reference: Business Registration Fee and Levy Table

How Long Can I Expect To Receive My Business Registration Certificate?

The Certificate can normally be issued within 14 working days. You can collect it in person at the Companies Registry. A written authorisation will be required if you send a representative to collect the Certificate instead.

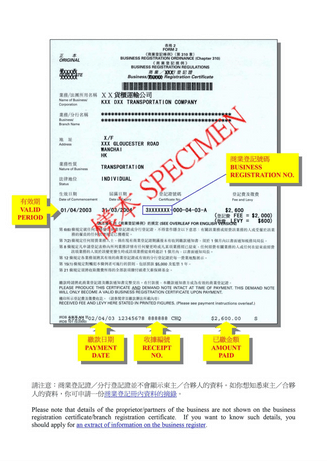

Here’s a sample of what it looks like:

Image from Inland Revenue Department (Hong Kong)

Summing Up

Here’s a checklist to set up your Representative Office:

- Set up your Representative office at aphysical address in Hong Kong

- Hire local staff if needed

- Prepare the information and documents needed

- Within one month, apply for your Business Registration Certificate at the Business Registration Office

- Make sure your office only spends money, and not create revenue or profit

Getting a Representative Office is a good option to test waters in Hong Kong before pumping in more resources into expanding your business in Hong Kong and the region. Let us help you with this process so that you can focus more on your business growth while we take care of the administrative processes. We can also help you with accounting in Hong Kong. Drop our experienced agents in Hong Kong a message and we’ll be in touch with you. The chat takes place fully online and we’re available 24/7.

We wish you all the best with your business expansion plans in Hong Kong and beyond.