What Is Accrual Accounting? A Complete Guide

- Published: 18 July 2024

- 15 min read

- Running a Business

Heather Cameron

Author

Heather is here to inform and inspire our readers. Boasting eight years in the world of digital marketing, working in diverse industries like finance and travel, she has experience writing for various audiences. As Osome’s resident copywriter, Heather crafts compelling content, including expert guides, helpful accounting tips, and insights into the latest fintech trends that will help entrepreneurs, founders and small business owners in Hong Kong take their businesses to the next level.

Accrual accounting records revenues and expenses when they are earned or incurred, not when cash changes hands. This gives you a full picture. This article will cover the principles, benefits, challenges and cash accounting. Real-world examples will show how accrual accounting works in practice.

Key Takeaways

- Accrual accounting gives you a full picture of a company’s financial activities by recognising revenues when earned and expenses when incurred, not when a company receives cash.

- The two main principles of accrual accounting are revenue recognition and the matching principle. These principles are part of standard accounting practice and ensure that revenues and expenses are matched in the same period for profit analysis.

- While the accrual method of accounting provides a more detailed and accurate view of a company’s financial position, it is more complex and costly to implement and maintain, requiring good accounting practices and possibly specialist staff.

What Is Accrual Accounting?

Accrual accounting is a type of financial accounting where you record revenue when earned and expenses when incurred, regardless of when cash is received or paid. Cash accounting (or cash basis method) only records business transactions when cash is exchanged.

Accrual accounting is a language of business that allows you to tell financial stories with clarity and detail. Essentially, this accounting method means:

- You can record transactions as they happen, not when cash moves

- Using the double-entry accounting method to capture all financial events

- Offering a true picture of what’s happening in your business

Imagine a world where strategic thinking is based on solid financial facts; that’s what the accrual method of accounting gives you.

Partnering with accounting services by Osome can help you navigate the intricacies of accrual accounting and ensure your financial picture is accurate and insightful.

Unlike cash basis accounting, accrual accounting differs in that it gives you the whole picture by including earned revenue and incurred expenses so you can make informed decisions and plan strategically. It’s the foundation of financial reporting for big businesses, especially regarding tax. Picture a construction company that recognises revenue and expenses as a project progresses; this is what accrual accounting looks like in action.

Key principles of accrual accounting

The key to mastering the accrual method of accounting lies in understanding its two fundamental principles: revenue recognition and the matching principle. Revenues are to be recognised when they are earned and realisable, a concept upheld by the generally accepted accounting principles (GAAP) and international standards, which both demand that revenue be recorded when a sale occurs. This cornerstone of accrual accounting ensures that a business’s earnings reflect real economic events.

Adhering to the matching principle, expenses are recognised when they are incurred, regardless of when the cash is paid out. This principle is the balance to revenue recognition, as it ensures that expenses are matched with the revenues they help generate within the same financial period. Accrual accounting paints a more accurate picture of a company’s profitability by aligning revenues and expenses, offering critical insights for assessing financial performance.

Accrual accounting examples

The construction firm mentioned earlier is a good example of accrual accounting that illustrates this method in practice, particularly in handling accrued revenue from ongoing projects. It meticulously records a portion of the revenue and the related expenses based on the percentage of work done in a reporting period. This way, the financials reflect the company’s true economic activity; it’s transparent and informs the decisions, accurately captured in the revenue account, unlike cash accounting, which focuses solely on the cash account. It’s a far cry from cash basis accounting, where only the actual cash flows are recorded, and the real performance of the business is hidden.

Big companies use the accrual method of accounting to match their financial reporting to the services rendered or goods sold, regardless of when the cash is exchanged. This is especially important when you consider the complex financial environment they operate in, where cash transactions are not always cash-settled, and companies may not immediately receive payment but are part of the ongoing story of the company’s financial health.

How Does Accrual Accounting Work?

Here's how accrual accounting works: it carefully records income and expenses at the time they are earned and incurred, respectively. This method reflects the actual timing of revenue and expenditures, distinguishing itself from cash accounting, which records only when cash is physically exchanged. Imagine a business landscape where financial tales unfold in real time, with each chapter accurately transcribed for future reference. This is how accrual accounting works, providing the framework for such a narrative.

Central to this method is the concepts of accounts receivable and payable, key components that manage the flow of cash yet to be received and expenses yet to be paid. These accounts, besides offering a precise long-term view of profitability, are crucial elements of a balance sheet that reflect a company’s accurate financial position. Accrual accounting, through adjusting accounting journal entries, guarantees that financial statements are more than just snapshots; they are dynamic records of a company’s continuous financial journey, including the liability account.

Accrual Accounting vs. Cash Accounting

Comparing cash and accrual accounting methods is akin to comparing a high-definition photograph with a sketch. While both capture an image, the former offers a level of detail and depth that the latter cannot match. Cash accounting allows you to record transactions only when cash changes hands, making it simpler and more straightforward, particularly for smaller businesses managing their cash account, as they record revenue only when they receive payment or when customers pay, whereas accrual accounting records cash transactions in the revenue account when they are earned. For instance, a consulting services company that receives cash payment only after rendering service operates under the cash basis accounting method, ensuring they record income only when they receive payment.

However, this simplicity can come at the cost of accuracy, as cash accounting, reflected solely in cash payments in the cash account, may offer a distorted view of a company’s short-term financial health, which can be more accurately captured in the revenue account through accrual accounting.

The accrual accounting method differs from other methods in that it records revenues when they are earned and expenses when they are incurred, providing a comprehensive picture that aligns more closely with a company’s actual financial activities. This approach ensures a more accurate representation of a company’s financial health.

What Are the Types of Accruals?

Accruals, including accrued revenue, are the foundation of the accrual accounting method. They are placeholders for transactions that have happened but have not yet been settled in cash. There are different types of accruals, each representing a different part of a company’s financials. Accrued revenue is income earned but not received; accrued expense is cost incurred but not paid. The accruals work together to make financial statements a real picture of what’s happened in the business.

The types of accruals include prepaid expenses and deferred revenue, each with its own part of the story. Prepaid expenses are funds paid before the service or product is received, and deferred revenue is payments received before the service or product is delivered. These accruals work together to make a web of financial transactions that are carefully recorded through the accrual accounting method so every financial move is tracked.

Accrued revenues

Accrued revenues are like promises made today that will be fulfilled tomorrow. They are income a company has earned but not yet received in cash. Accrued revenue is recorded as an asset account, an expected cash inflow that has not yet materialised.

The process of recording accrued revenue involves debiting accounts receivable and crediting revenue. This accounting method ensures revenue is recognised in the reporting period it is earned, keeping the financial statements intact and stakeholders informed of the company’s financial position.

Accrued expenses

On the other hand, accrued expenses are the financial obligations a company has incurred but not yet paid. These are recorded as liabilities in future cash outflows that haven’t been settled. An example of an accrued expense is employee bonuses that have been earned but not yet paid.

To record accrued expenses, the company debits the expense account and credits the accounts payable account. This way, interest or other expenses are recognised when they’re incurred, following the matching principle and keeping the financials accurate.

Prepaid expenses

Prepaid expenses are costs paid upfront for services rendered or goods to be received in the future, and they are recorded in the asset account on the balance sheet. These are recorded as assets on the prepaid expense account because they give future economic benefits. Prepaid expenses follow the matching principle and are recognised over the period they are used. Examples are insurance premiums and rent, where a cash payment or advance payment is made for the coverage and use of space for a certain period.

The prepaid expense is expensed on the income statement when the service or good is used. This systematic allocation of cost over time ensures the accrued expenses are matched with the period the benefit is received, moving amounts from the prepaid expense account to the expense account so we get a clear picture of the company’s operations.

Deferred revenue

Deferred revenue is at the other end of the spectrum from accrued revenues. It’s cash received before a service or product has been delivered, recorded as a liability because the company owes value in the future. For example, a gym that gets paid for a six-month membership upfront will record that as deferred revenue and recognise it as earned revenue each month as services are provided.

This is especially important for SaaS companies, where revenue recognition is complicated and deferred revenue needs to be managed carefully for financial reporting. Accrual accounting differs because it ensures these transactions occur when services and products are delivered, not when cash is received.

Benefits of Accrual Accounting

There are numerous benefits of accrual accounting, primarily including:

- The accurate depiction of a company’s financial situation

- Recognising economic events when they occur

- Providing a consistent financial narrative

- Aiding in strategic planning

- Smoothing out earnings over time

It offers a clear perspective on the company’s overall financial position, accounting for all underlying business transactions and future cash movements so that you can manage your working capital. Consulting with a professional for specific accounting tips and implementation strategies can be invaluable for businesses just starting with the accrual accounting method.

Accurate financial picture

Accrual accounting gives a more accurate view of a company’s position. Seeing transactions occur gets to the heart of a company’s economic activity rather than the distortions that can occur with cash accounting. This is especially good for reflecting a company’s health, which is key to making informed decisions.

Accrual accounting follows the matching principle, so revenues are matched with their generated expenses. This gives stakeholders a clear view of the company’s profitability and overall position, which is fundamental to planning and performance measurement.

Improved cash flow management

Beyond the snapshot of financial health, accrual accounting is about cash flow management. Recognising revenue and expenses when incurred gives you immediate visibility of expected cash in and out so you can plan ahead. This forecasting is gold for businesses as it enables them to make better investments, expenses and cash reserve decisions.

Accrual accounting gives you a strategic advantage by allowing you to forecast future cash needs and manage them. You won’t get caught out by unexpected expenses and can keep a healthy cash balance to support ongoing operations and growth initiatives.

Challenges of Accrual Accounting

Despite its numerous benefits, accrual accounting is not devoid of challenges. The complexity inherent in managing the various rules and processes for recording transactions can be daunting, particularly for small businesses. Additionally, the method can be more expensive to implement and maintain due to these complexities, which may necessitate hiring specialised accounting professionals.

The potential for fraud also exists if proper control systems are not in place, highlighting the need for vigilance and robust accounting practices.

Increased complexity

The accrual accounting method's increased complexity arises from its comprehensive rules and processes for recording expenses and income. This complexity extends to tax forms and compliance, which can be significantly more intricate than those of the cash method.

Small businesses, in particular, may find the transition to accrual accounting challenging, as it requires a solid understanding of generally accepted accounting principles and the ability to manage a more sophisticated financial recording system.

Higher costs

Transitioning to accrual accounting can also mean higher operational costs for businesses, especially smaller ones. The need for full-time bookkeeping and accounting staff to manage the intricacies of accrual accounting can be a significant financial burden.

Thus, while accrual accounting's benefits are clear, the costs associated with its implementation and ongoing maintenance must be carefully weighed against its advantages.

How To Choose the Right Accounting Method?

Selecting the appropriate accounting method is a crucial decision for any business. Among the three accounting methods—cash basis, accrual basis, and hybrid method—it affects how financial transactions are recorded and how taxes are prepared and can influence the company's perceived financial health. While cash accounting may suit smaller businesses due to its simplicity, accrual accounting is often the method of choice for larger organisations that need a more accurate reflection of their financial position. Understanding the three accounting methods helps choose the best fit for a business's specific needs.

Consulting with a qualified accountant is recommended to determine the most appropriate accounting method for your specific business and ensure compliance with standard accounting practice. A professional accountant in Osome can help you choose the method that best suits your needs. Contact us, and we will consider your unique circumstances!

Factors to consider

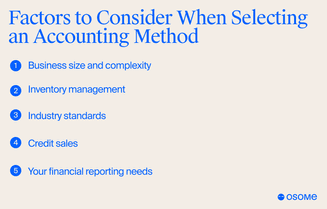

Choosing the right accounting method for your business depends on:

- Business size and complexity: Accrual accounting is better for larger businesses with more complex transactions. A more detailed picture of your finances becomes important as your business grows. Cash accounting is simpler for smaller businesses with fewer transactions. It’s all about recording transactions when cash changes hands, making managing it easier.

- Inventory management: If you manage inventory, accrual accounting is necessary to track the cost of goods sold (COGS). This means recording the cost of inventory purchases when they happen, regardless of when you sell the items. Cash accounting wouldn’t give you a more accurate picture of your profitability in this case.

- Industry standards: Some industries have accounting standards you need to follow. For example, most publicly traded companies are required to use accrual accounting. Following industry standards ensures consistency and makes it easier to compare with competitors.

- Credit sales: If you offer credit to customers, accrual accounting is necessary to track unearned revenue and revenue earned even if it has not yet been received. This gives you a more accurate view of your sales. Cash accounting would only show you the money coming in, potentially misrepresenting your actual revenue.

- Your financial reporting needs: Accrual accounting gives you a more complete view of your company’s financial performance, including outstanding accounts receivable and payable. This helps get loans or attract investors who need a full picture of your financial health. Cash accounting might not give you enough detail for that.

Thus, it’s not only about the current financial landscape but also about future aspirations, the need to meet investor expectations, and regulatory requirements.

Accrual accounting and IFRS

Accrual accounting standards are set by accounting standard-setting bodies around the world. Two prominent ones include:

- Financial Accounting Standards Board (FASB): Sets accounting standards in the United States.

- International Financial Reporting Standards (IFRS) Board: Sets international accounting standards many countries follow.

In Hong Kong, companies listed on the Stock Exchange must follow Hong Kong Financial Reporting Standards (HKFRS), which converge with IFRS. This means that Hong Kong companies use accrual accounting based on the international standards set by the IFRS Board.

Accrual Accounting Impact on Financial Statements

Accrual accounting improves financial statements by including earned revenue and incurred and accrued expenses in the right periods. It’s the only way to show what a company is really worth. Accrual accounting’s short-term assets and future liabilities equals a full financial report.

Accrual accounting uses accounting journal entries to affect both the cash flow statement and income statement. Revenue is recorded when earned in the income statement, and expenses are recognised when incurred during each period. That’s what stakeholders need to see to decide the company’s performance and future.

Summary

In short, accrual accounting is a full and fair accounting method that shows the reality of the business. It captures all the transaction complexities by recognising revenue and expenses incurred and earned. It has some difficulties—more complexity and cost—but the benefits of better reporting and cash flow are huge. Businesses must consider size, growth, and reporting needs and choose between accrual and cash accounting to achieve their long-term goals.