- Osome Blog UK

- Oops, I’ve Overpaid an Employee

Oops, I’ve Overpaid an Employee

- Modified: 20 May 2025

- 6 min read

- Money Talk

Gabi Bellairs-Lombard

Author

Gabi is a content writer who is passionate about creating content that inspires. Her work history lies in writing compelling website copy, now specialising in product marketing copy. Gabi's priority when writing content is ensuring that the words make an impact on the readers. For Osome, she is the voice of our products and features. You'll find her making complex business finance and accounting topics easy to understand for entrepreneurs and small business owners.

On a settlement day you understand that you paid too much to one of your employees last month. Or the employee comes to you and awkwardly says that they have been receiving way more money than the employment contract requires. How to solve any overpayment? Here are the answers.<br>

It’s settlement day. You go through your online bookkeeping records and realise you’ve overpaid one of your employees. Or perhaps your employee comes to you and awkwardly says that they want to discuss the overpayment of wages they’ve been receiving that exceeds way more money than their employment contract stipulates.

Want to solve the issue of overpayment of wages? Here are the answers

Employers & Wage Overpayment: Is There an Obligation to Pay Back?

UK-based employers have the legal right to reclaim their money if they’re overpaid at work and allocated money to an employer inadvertently. Whether your accountant has put in a wrong figure or a manager has given this wrong figure to them — either way, don’t worry. The law is on your side!

It says that in case of a wrong payment, you can get your money back taking the sum from future salaries. To minimise your risks in case of any dispute, it’s always better to include a special clause to your employment contracts, explaining that if they’re overpaid by their employer, that overpayment is treated as a civil debt.

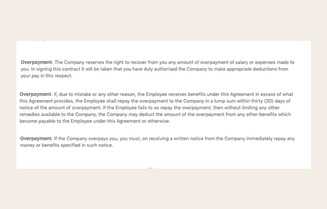

Here are some other examples of such clauses, setting rules for employees who may be overpaid at work:

Overpaid by a Month? It’s Quite Easy To Get That Repayment Back

Such overpayment of wages in the UK can usually be sorted out within one next employee’s salary. But you should always notify the person about your plans to give them less next month. Moreover, a good employer would ask the employee whether the deduction can cause any financial difficulties to them and comes up with a suitable arrangement of the payment.

Example

Steve got £300 over his salary in April, but he forgot to tell his employer as his wife gave birth to their son that month. His boss Jim lets Steve know that he wants the money back in May. But Steve has already spent the money and all his May salary is already planned for spending. Jim understands the situation and gives Steve a short-term corporate loan for him to continue getting the salary and still be able to cover the overpayment.

The law does not oblige you to help your employee out. But if you do so, the gratitude of the person will be a huge return on this small investment. Taking £300 out of your company’s reserve for one month might not be a price too big to pay if you get a person’s loyalty in return.

It May Be Harder To Get Wage Overpayments Back After a Few Months

In the case of an overpayment of wages for several months you can run into a few obstacles:

The employee owes you more than they earn monthly. You clearly can’t just take all the money (and more) from the employee, because in this case, the employee might see it as unfair and take the case to court. The best way is an amicable agreement, when you and the employee come up with a scheme of the deductions.

Example

Jim has an employee who owes him £6000, getting a monthly salary of £3000. Jim has an option to claim the whole sum by just withholding the salary for 2 months, but he chooses to split it, by deducting £500 each month. That brings him the money back and doesn’t put the employee in a hard financial situation. Everyone is happy.

An overpayment of wages is made after employment terms with you have lapsed: An ex-employer overpayment might not bother your former employee much. However, let’s imagine that you are lucky and the employee in question has not moved to Sri Lanka. If you manage to get to the person, it’s just a half-way, because they can refuse. If they do refuse and you insist — you will meet up in court.

Example

Jim used to have a cleaner, Jane, who left the company five months ago. He realises he overpaid her £150 for several months before she left. Jim knows he can take this to court, but understands it will take time and effort. Jim lets the debt go.

However, Jim then notices that Erik the designer who also doesn’t work for the company anymore was overpaid £10,000 and refuses to cooperate in repayment. Jim turns to court and wins the case, as he had a clause in the contract that any overpayment is treated as a civil debt.

Addressing the Overpayment of Wages in the UK

Recovering payments from former employees is possible and can be drama-free if dealt with correctly. Above all, you need to let the employee know about the issue. And it’s better to do it on paper — by sending them a letter requesting payback for any salary overpayment you made unintentionally. This proves your fair approach to the situation and shows that the employee in question had a chance to get engaged and let you know about any issues from their side.

Here’s what should be included in a proper salary overpayment letter in the UK:

- State the overpayment of wages was a mistake

- State the sum and how you expect to reclaim it

- Leave contact details for the ex-employee to refer to if they have questions

- State a timeframe you propose for recovering overpayments from your former employees

- State that the ex-employee has a right to dispute the overpayment or the way it is to be repaid

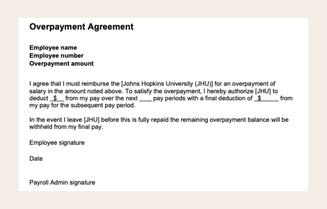

Sign a Wage Repayment Contract

It’s very good to reach an agreement with your employee, but don’t forget to put it on paper, signing the repayment contract, stating the overpayment of salary rights. As for the actual repayments, they can be done in your general payroll system.

The law applied to regular employees is also applied to freelancers and they’re also obliged to give you back the overpayment. In such cases l, you’d better think about a proper contract clause specifying what to do in this case but if all goes smoothly, the freelancer just writes off the sum of t from a future invoice and you are done.

How To Avoid Wage Overpayment Mistakes

Using payroll software or a trusted online accounting service reduces the risk of mistakes. Aside from that, don’t shrug off regular audits which will also help you to see any financial discrepancies as soon as they crop up. You can also offer benefits to employees for reporting any unusual or unclear overpayments.

Could Trying To Recover Overpayments From Former or Current Employees Land Me in Court?

The employee who thinks that you are demanding money unfairly can file an appeal to a civil court (not the employment tribunal, because salary deductions for overpayment are exempt from the Employment Rights Act). In this case, the court will look into how you handled the situation and how the employee acted. The judge is likely to take into consideration what the employee did with the money and how much effort they made to initially report the overpayment.

They will also look at how good you were at providing proper payslips to the employee and letting them know about the overpayment. So, don’t neglect sending official notification letters and don’t rely on just verbal agreements from the very beginning.

How Far Can the Deductions Go?

If a company overpays an employee in the UK accidentally, the salary deductions can legally be below the National Minimum wage — which is counted on a case by case basis, depending on the age of the person and whether they are currently employed.

| Do I have a legal right to make deductions from salary overpayments? | Yes |

| Can the employee refuse to pay and file a court appeal? | Yes |

| How to lay the safe ground from the beginning? | Add additional clauses to the employment contract. |

| Should I make an overpayment agreement in written form? | Better yes |

If a Company Overpays an Employee, What Rights Does That Employee Have?

Even if an overpayment was made by mistake and you have the right to get the money back through the salary deductions, you still can't do it without notifying the employee about it. The more steps you take towards securing the deal with the employee, the better.

If something goes terribly wrong, you will need as much proof as possible that you let the employee know about the overpayment, tried to come to amicable repayment agreement and did everything you could not to lay a financial burden on the employee.

Incorporate your UK company with Osome!