Step-by-Step Guide to VAT Registration for Your Business

- Modified: 26 December 2024

- 10 min read

- Tax & VAT

Gabi Bellairs-Lombard

Author

Gabi is a content writer who is passionate about creating content that inspires. Her work history lies in writing compelling website copy, now specialising in product marketing copy. Gabi's priority when writing content is ensuring that the words make an impact on the readers. For Osome, she is the voice of our products and features. You'll find her making complex business finance and accounting topics easy to understand for entrepreneurs and small business owners.

This guide will help you understand the VAT registration process, the £90,000 threshold, and how to comply with VAT return regulations. We will also help you understand VAT purposes, how it impacts small businesses and larger corporations, and why you should take advantage of VAT's compulsory registration rules.

Key Takeaways

- Value Added Tax (VAT) is a consumption tax in the UK that's added to most products and services sold by VAT-registered businesses. The tax was introduced in 1973

- If you're a small business in the UK with not less than £90,000 of taxable turnover in a 12-month period or within a 30-day period of being expected to surpass that level of turnover, VAT registration is compulsory.

- VAT registration can be completed using an online account via Government Gateway, simplifying the registration and filing process for businesses of all sizes.

- Small businesses may benefit from voluntary VAT registration. You may also claim back the tax you paid on services and goods solely used for your business.

What Does It Mean To Be VAT Registered?

Registering for VAT becomes mandatory once your taxable turnover meets or exceeds the current threshold of £90,000. Other businesses, such as businesses moving goods to or from Northern Ireland or other EU countries into the UK, must register and add VAT to all taxable sales.

You can complete your VAT registration with HM Revenue and Customs (HMRC) in person or online. After registering, you will receive a VAT registration number, which you will use when filing your returns. Once you have the VAT number, you can start adding VAT to your sales and purchases.

From that point on, an additional consumption tax will be levied upon your goods and services throughout each stage in the supply chain, and your consumers will pay for that total upon taxable sales. Meanwhile, the business registered for VAT is responsible for promptly filing the returns with the HMRC throughout the year. It is important to integrate VAT registration with your overall company registration process to ensure compliance and seamless business operations.

Failing to register for VAT or late returns can result in penalties ranging from 5 to 15% of the VAT owed, with a minimum of £50. Hence, many small businesses choose to register voluntarily regardless of their turnover value.

When Do You Need To Register for VAT?

VAT registration is a must if your business’s VAT taxable turnover exceeds the threshold of £90,000 in a 12-month period or if you anticipate surpassing it within a single 30-day period. It’s crucial to note that the effective date of VAT registration is the date when you realise you will exceed the threshold, not the actual date of crossing the threshold.

Businesses based outside the UK must register as soon as they supply goods or services to the UK or expect to do so within the next 30 days.

What Is the Registration Threshold?

The VAT registration threshold is a crucial figure for businesses to monitor. In the UK, it currently stands at £90,000 of VAT taxable turnover. Businesses are required to register for VAT if they exceed this threshold within a 12-month period or within a 30-day period. Many business owners often wonder how much VAT they need to pay once they cross this threshold.

It’s crucial to note that the effective date of VAT registration is one month and one day after the month-end, on which the threshold was exceeded. So, how does one register for VAT?<br>

How Do You Register for VAT in the UK?

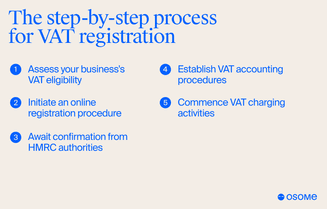

VAT registration is a multi-step process that includes the following steps:

- Determine your business' eligibility for VAT.

- Embark on an online registration process.

- Await confirmation from HMRC.

- Set up VAT accounting.

- Add VAT to taxable sales.

- Submit VAT returns.

1 Determine eligibility

The first step in VAT registration is determining if your business is eligible. This involves evaluating your business’s VAT-taxable turnover. If it hits or exceeds the VAT registration threshold of £90,000 in a 12-month period, or if you anticipate that it will exceed this threshold in a single 30-day period, then compulsory registration for VAT is necessary.

But what if your business hasn’t reached the threshold yet? Fear not. You can still register for VAT voluntarily.

2 Register online

Most businesses in the UK register for VAT online through the Government Gateway portal. The process is straightforward and allows you to save your progress and complete the registration later if necessary.

But what happens after you’ve submitted your VAT registration online?

3 Await confirmation

Once you’ve submitted your VAT registration, you’ll receive a confirmation email with a unique reference number and your VAT certificate. This reference number is also your VAT registration number. You can use this number to track your application’s progress, but don’t worry if it disappears after approximately two weeks - your application remains submitted.

If you don’t hear back within the expected processing time, you can contact HMRC’s Registration Team for an update. But while waiting for confirmation, you can start setting up your VAT accounting system.

4 Set up VAT accounting

Setting up VAT accounting involves understanding the tax point, which is the event that triggers VAT liability, and could be the receipt of payment or delivery of the supply, whichever happens earlier, and not necessarily when the income is recognised for income tax. You also need to issue a VAT invoice within 30 days after the tax point if you provide standard or reduced-rated supplies to another VAT-registered customer in the UK.

Various VAT accounting schemes that can help simplify administrative tasks or cash flow management include:

- Annual accounting scheme

- Cash accounting scheme

- VAT margin scheme

- Flat-rate scheme

- Agricultural flat-rate scheme for farmers

5 Add VAT to taxable sales

VAT-registered businesses will begin to charge VAT from the first day of the second month after their turnover exceeds the VAT threshold in a rolling 12-month period. If you expect to exceed the threshold in a single 30-day period, you must add VAT to your taxable sales immediately.

If your registration date is later than the first day you need to pay VAT, you're legally required to notify HMRC of this delay, and the agency may apply a penalty based on how late you were in registering for VAT.

6 Submitting VAT Return

Businesses must submit their returns to HMRC, detailing the VAT charged on sales and what has been paid on purchases. VAT returns are normally due every three months, aligning with a company’s accounting period. Failing to submit your VAT return on time can lead to penalties, with HMRC estimating the VAT owed, potentially resulting in penalties if the estimated amount is lower than the actual VAT owed.

Now that you’ve registered, what information should you have ready?

Required Information and Documents

The following information is required to register for VAT.

- General information such as turnover amount, business activities, and bank account details

- For individuals and sole traders: a National Insurance number

- For limited companies: the company registration number and details of Self Assessment, a bank account under your business name, Corporation Tax, and PAYE

What Happens After You Register?

After VAT registration, businesses have certain responsibilities and requirements to meet. These include charging VAT at the appropriate rate on all taxable sales, paying VAT owed to HMRC, and submitting quarterly returns. The VAT owed to HMRC is generally the difference between the VAT charged to customers and the VAT paid on business purchases.

But it’s not all about obligations - there are numerous benefits that come with being VAT-registered.

Benefits of Being VAT Registered

Being VAT registered comes with an array of benefits for businesses, including:

- Improved business credibility

- The ability to reclaim VAT on business expenses

- Competitive advantage

- Facilitation of international trade

- The benefits that come with voluntary registration.

Let’s delve into each of these benefits.

1 Improved business credibility

Being VAT-registered can significantly enhance a company’s professional image, making it appear more trustworthy and legitimate in the eyes of buyers, lenders, suppliers, and clients. It often serves as a requirement for doing business with larger corporations and government entities, thus opening more opportunities for business expansion.

2 Reclaiming VAT on business expenses

One of the significant financial benefits of being VAT registered is the ability to reclaim VAT on business-related expenses, including purchasing IT equipment, premises costs, stock payouts, professional service charges, marketing spending, and travel expenses.

3 International trade facilitation

VAT can simplify cross-border transactions while providing the opportunity to reclaim VAT on imported goods. Any overseas transactions, including transactions coming into the UK from other EU nations, such as Northern Ireland, must register for VAT regardless of the turnover amount.

4 Voluntary VAT registration

A business grows, and sometimes, that revenue explosion is unpredictable. Instead of facing the risk of receiving penalties for late VAT registration, many businesses anticipating rapid growth choose voluntary registration since businesses registered for VAT are often more trusted. After all, the voluntary registration basically states that you expect significant growth for your company in the upcoming years.

Making Tax Digital (MTD) Compliance

In April 2022, HMRC announced a new set of rules called Making Tax Digital for VAT (MTD for VAT). These regulations have since become mandatory for all VAT-registered businesses, requesting companies to file all documents as digital records through MTD-compliant software instead of relying on physical copies or old-school PDFs.

The goal of this update is to simplify the filing process and ensure successful, on-time, and compliant records delivery. The only time a business may be exempted from the Making Tax Digital regulation is when the company can prove to HMRC that the reasonable and practical use of computers, software or the internet is genuinely impossible for them. For example, a member of a tribal community that strictly prohibits all use of electronics.

How To Claim VAT the Right Way

There are two components to your VAT returns: the part where you pay VAT from your customers to HMRC and the part where you reclaim any VAT paid for items exclusively used for your business, so long the sales are not VAT exempt. The final amount you owe or gain is the difference between the two numbers. When the VAT collected is higher than the amount reclaimed, you will pay the difference to HMRC. If it's the other way around, you will receive the difference as a refund. You can claim VAT to ensure your business maximises its financial efficiency.

Record-Keeping Requirements and Best Practices

Record all taxable sales and related details, including the time and value of supply and the corresponding rate. All VAT-registered businesses are required to submit VAT records to HMRC digitally using software that is compliant with the "Making Tax Digital" regulations. If you're unsure which software is MTD-compliant, leave it to Osome and its accounting software designed to meet all Making Tax Digital requirements.

Additionally, HMRC requires companies charging VAT to file the returns based on the frequency (monthly/quarterly/annually) following MTD regulations. Therefore, we recommend you to keep records separate in separate folders depending on the frequency. Once the year has ended, you can combine them into a larger annual folder for your yearly review and archival purposes.

Summary

To register for VAT is, in a way, to announce your company's steady growth and make yourself an official player in the UK's economy. Any small business that crosses the £90,000 threshold will need to register and pay HMRC on time to stay compliant with VAT rules. However, many choose to register voluntarily to take advantage of the enhanced credibility and competitive edge. Business registered for VAT can also reclaim any VAT paid on taxable sales used exclusively for the business itself.

You will receive your VAT number within 30 days of your registration date. This number is necessary to file your VAT return so you can properly pay HMRC the required amount owed (or get a refund). If you need help registering for VAT, talk to Osome's UK accountants today.

FAQ

What happens if I register late or don't register for VAT at all?

If you meet the mandatory requirements but have not registered for VAT yet, you can end up facing severe penalties. The exact penalty depends on how late your registration is. If you're over 9 months late to register, the penalty rate is 5%. If you're between 9 to 18 months late, the rate is 10%. If you're more than 18 months late from when you need to register, the penalty rate will be as high as 15%. The late period is calculated from the date you cross the threshold to the date when HMRC either receives a notification from you regarding the late registration or becomes fully aware of your need to register.

How can I reclaim VAT on business expenses?

You can reclaim any VAT paid on business expenses by submitting a VAT return to HMRC based on the frequency (monthly/quarterly/annually). For example, if you have chosen to submit VAT returns quarterly, it would be every three months. You may be able to reclaim tax paid on sales used exclusively for your business. For example, office supplies, laptops and software, or services for work purposes. However, you won't be able to reclaim VAT collected for company entertainment. If you need help filing quarterly returns to reclaim paid taxes, leave it to Osome's accountant.

What businesses are VAT exempt?

Certain goods and services, such as education, healthcare, and financial services, may not be subject to VAT. These sales are exempt from VAT, and you are not allowed to deduct the VAT you have paid on related purchases. Some VAT-exempt goods are antiques, items sold in a charity shop, medical and surgical appliances, most food and beverages, and children's clothing.

How long does it take to register for VAT?

The time it takes to register for VAT with HM Revenue & Customs (HMRC) ranges from a few days to several weeks. Registering online through the HMRC website is the quickest. If all required information is provided accurately, you should get your VAT registration number within 30 days. However, processing times may vary based on the current HMRC workload, the complexity of the application, and any additional documents required.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?