What Is Making Tax Digital? A Complete Guide for Businesses

- Modified: 18 October 2023

- 6 min read

- Tax & VAT

Gabi Bellairs-Lombard

Business Writer

Gabi is a content writer who is passionate about creating content that inspires. Her work history lies in writing compelling website copy, now specialising in product marketing copy. Gabi's priority when writing content is ensuring that the words make an impact on the readers. For Osome, she is the voice of our products and features. You'll find her making complex business finance and accounting topics easy to understand for entrepreneurs and small business owners.

Making Tax Digital is revolutionising tax records in the UK. Osome can help you prepare with expert guidance for a seamless transition to digital records.

Making Tax Digital (MTD) was introduced by the UK government in 2022 to drive the digitisation of business taxation. The new rules mean businesses can no longer submit VAT returns as they used to, aiming to make filing taxes easier and more efficient for individual taxpayers and businesses.

This groundbreaking initiative represents a fundamental shift in how businesses in the UK manage and report their taxes. It aims to streamline and modernise the tax system by replacing traditional paper-based processes with digital ones, enhancing efficiency, accuracy, and transparency. For UK businesses, understanding the ins and outs of Making Tax Digital is essential for compliance and presents an opportunity to leverage technology for improved financial management. This comprehensive guide will delve into the intricacies of MTD, its implications, requirements, benefits, and how businesses can navigate this digital transformation seamlessly.

If you’re looking to set up your own business, check out our guide on how to register a business in the UK. Additionally, our experts offer hassle-free MTD registration services, ensuring that your business stays compliant and up-to-date with the latest tax regulations. Feel free to contact us today!

What Is Making Tax Digital?

In April 2022, all UK VAT-registered businesses were required to sign up for MTD. This included thousands of VAT-registered sole traders and small businesses not previously required to sign up if earning less than £90,000. Every VAT-registered business above or below the VAT threshold must be compliant.

Businesses can no longer submit returns through HMRC using the old manual process. Instead, they must now maintain their records digitally, capturing VAT registration information including:

- Business name

- Business description

- Company’s primary address

- VAT registration number

- Records of any common VAT accounting scheme

Businesses are also required to keep a record of all sales and purchases, including invoices, sales values and VAT rates.

What Is MTD for VAT?

If you sell goods or services, you may have to pay Value Added Tax (VAT). VAT is charged at a rate of 20% on turnover over £90,000, but this rate can vary depending on the goods and services. If your business earns less than £90,000, you can still register for VAT but you won't have to pay VAT on any sales below this threshold. However, you must still sign up for Making Tax Digital (MTD). As of November 2022, the government has implemented a new phase of MTD, which means that businesses can no longer file paper returns or use old VAT accounts online. To comply with MTD, businesses must now file returns and keep records digitally using an MTD-compliant software partner. You will also need to update HMRC quarterly and file annually, but please note that an update is not the same as filing a return - so you won't have to file four returns!

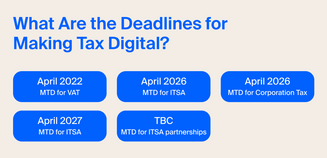

What Are the Deadlines for Making Tax Digital?

So, when does Making Tax Digital start? You might’ve missed some deadlines, like the one for all VAT-registered businesses to sign up for MTD and use compatible software for filing and want to make sure I don't miss any more deadlines. Here's a list of digital tax deadlines:

- April 2019: Businesses with a taxable turnover over £90,000 must keep records and submit returns digitally using compliant software.

- October 2019: 'More complex' businesses that were deferred from the April deadline need to comply with MTD.

- April 2022: MTD is compulsory for VAT-registered businesses with a turnover below the tax threshold.

- November 2022: All VAT-registered businesses must sign up to MTD and file returns using compatible software.

HMRC has also planned some additional MTD phases:

- April 2026: Making Tax Digital will apply to individual taxpayers who file Self Assessments for more than £50,000 per year (MTD for ITSA).

- April 2027: Self-employed workers earning £30,000 to £50,000 will need to comply with MTD when completing their Self Assessment.

How To Register for Making Tax Digital

To register for Making Tax Digital (MTD) in the UK, you'll need to follow these steps:

1. Create an HMRC online account

If you don't already have one, you'll need to create an HMRC online account. You can do this by visiting the HMRC website (www.gov.uk) and clicking on the "Sign in to your HMRC account" option.

Link Your Business to Your HMRC Account:

Once you've logged into your HMRC account, you need to link your business to it. You'll need your Unique Taxpayer Reference (UTR) and the National Insurance number or company registration number associated with your business. Follow the instructions on the HMRC website to complete this step.

2. Enrol for Making Tax Digital

After linking your business to your HMRC account, you can enrol for Making Tax Digital. To do this, you'll need to select the taxes you want to submit digitally. Most businesses will need to enrol for VAT under MTD if they're above the VAT threshold.

Choose MTD-Compatible Software:

To comply with MTD, you'll need compatible accounting or bookkeeping software. Make sure the software you choose is approved by HMRC for MTD submissions. Many popular accounting software packages are MTD-compliant.

3. Set up and use MTD software

Install and set up your chosen MTD-compatible software. You'll need to link it to your HMRC account and provide the necessary business information.

Submit Digital VAT Returns:

Use your MTD-compatible software to submit your VAT returns digitally to HMRC. You'll typically do this on a quarterly basis, following the deadlines set by HMRC.

4. Keep digital records

As part of MTD compliance, you'll need to keep digital records of your business transactions. Ensure that your chosen software allows for easy record-keeping and data storage.

5. Pay any tax due

After submitting your VAT return, make sure to pay any tax due to HMRC by the specified deadline.

6. Stay informed and compliant

Keep up-to-date with any changes in MTD requirements and deadlines. HMRC may introduce MTD for other taxes in the future, so it's essential to stay informed and ensure ongoing compliance.

It's important to note that the steps and requirements for MTD may vary depending on your specific circumstances, such as the nature and size of your business. Therefore, it's advisable to consult with a tax advisor or accountant who can provide tailored guidance based on your situation.

How To Sign Up for Making Tax Digital for VAT

If you are VAT-registered in the UK, you’ll need to keep records and send your tax returns digitally. This means signing up for Making Tax Digital on the UK government website.

Start by finding compatible software for submitting returns. Your records must be preserved for up to six years, so you’ll need software to pull the relevant information from your digital tax records. Here’s a list of compatible software for MTD.

These records should include your business name and contact details, your VAT number and details of any schemes used. You should also keep a digital record of any VAT on supplies, including the rate you have charged and what has been made or received.

Other information you must keep includes:

- Adjustments to returns

- Time of supply

- DGT or daily gross takings (retail schemes only)

- Reverse charge transactions – recorded as a supply made and received if your software doesn’t record these for you

If you use the Flat Rate Scheme, you should include details of asset purchases you can reclaim tax on. If using the Gold Accounting Scheme, you may need to include the sales value and the total output tax on these purchases.

Finally, you should keep documents covering supplies made or received on behalf of your business, including volunteers, third-party businesses or employees.

Whilst you can use spreadsheets to determine what to send to HMRC, you’ll still need compatible software. You may also need ‘bridging software’ to convert records to the correct format for submission.

Need help calculating VAT for your small business? Use our handy online VAT calculator.

Making Tax Digital for Income Tax

Starting April 2026, self-employed individuals, sole traders, and partnerships will be required to use compliant software to submit their tax returns instead of HMRC's old online services.

This will be done through Making Tax Digital (MTD), which will entail submitting quarterly updates to HMRC, followed by an end-of-period statement.

On the usual Self Assessment deadline of January 31st, you'll submit a single final declaration for all your income. Although MTD for Income Tax and Self Assessment (ITSA) was postponed due to the COVID-19 pandemic, it will now be launched in two phases.

- Phase 1: Those earning £50,000 and above will be required to sign up for MTD

- Phase 2: Self-employed workers earning £30,000 to £50,000 are required to comply with MTD

The government hasn’t confirmed the approach it will take for Making Tax Digital for individuals or businesses making less than £30,000.

What Is Making Tax Digital for Partnerships?

The original date for general partnership compliance with MTD for Income Tax was 2025. However, this is now on hold, with a new date to be confirmed.

VAT-registered businesses, including partnerships, were required to keep digital records and submit their VAT returns electronically using compatible software.

Here's how MTD for VAT applies to partnerships:

- Digital records: Partnerships are required to keep their VAT records in a digital format using MTD-compatible accounting or bookkeeping software. This includes details of all sales and purchases made by the partnership.

- Electronic submission: VAT returns must be prepared and submitted electronically through MTD-compatible software. This submission includes information about the partnership's VAT-registered activities, the amount of VAT owed, and any VAT reclaims.

- Accounting software: Partnerships need to use accounting software that meets HMRC's MTD for VAT requirements. This software needs to be capable of recording and storing VAT transactions digitally and submitting VAT returns online.

- Frequency: VAT-registered partnerships must submit VAT returns digitally on a quarterly basis, in most cases.

- VAT payments: The payment of VAT due still follows the existing payment procedures. MTD for VAT did not change the way VAT payments were made to HMRC.

Please note that tax regulations and MTD requirements may evolve, so it's crucial to check the most recent updates on the HMRC website or consult with a tax advisor or accountant to ensure compliance with the latest regulations related to MTD for Partnerships or any other tax matters.

Making Tax Digital for Corporation Tax

Here are some key points about MTD for Corporation Tax, based on the information available up to 2021:

- Future implementation: HMRC announced plans to expand MTD to include Corporation Tax in the future. The goal was to make it easier for businesses to manage their tax obligations by requiring digital record-keeping and electronic submissions for Corporation Tax.

- Digital record-keeping: Similar to MTD for VAT, MTD for Corporation Tax was expected to mandate digital record-keeping. Businesses would be required to maintain their financial records digitally using compatible accounting software.

- Electronic submission: Under MTD for Corporation Tax, companies would have to submit their Corporation Tax returns and related calculations to HMRC electronically through MTD-compatible software. This would replace the traditional paper-based filing.

- Timeline: While the government had announced its intention to introduce MTD for Corporation Tax, the specific implementation date was not finalized as of September 2021. Businesses were encouraged to stay informed about developments in this area.

- Software compatibility: Businesses subject to MTD for Corporation Tax would need to use accounting or tax software that meets HMRC's MTD requirements. HMRC usually maintains a list of approved software providers.

- Transitional period: When MTD for Corporation Tax is implemented, there may be a transitional period to allow businesses to adapt to the new requirements. During this period, businesses would need to ensure compliance with the digital record-keeping and electronic submission requirements.

If you need to sign up for Making Tax Digital, download our free MTD checklist for UK businesses, providing what you need to get started and complete the process.

Do I Have To Register for Making Tax Digital?

If your business is registered for VAT in the UK but you haven't signed up for Making Tax Digital (MTD), it's important to do so as soon as possible to avoid penalties.

The deadline for sign-up was November 2022. If you plan to register for VAT, you can reclaim VAT on items purchased for business purposes. Osome can provide expert support with VAT registration.

UK businesses generating less than £90,000 are not required to be VAT registered, but many choose to do so for a more professional appearance. After your first VAT return, you can sign up for MTD for VAT.

HMRC requires accounting records to be shared through MTD-compliant software on a quarterly basis using a milestone-based system. Annual returns and payment deadlines must also be met through this digital system.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?