- Osome Blog UK

- Understanding The Significance of a Share Premium in Company Finances

Understanding The Significance of a Share Premium in Company Finances

- Modified: 26 December 2024

- 5 min read

- Money Talk

Gabi Bellairs-Lombard

Author

Gabi is a content writer who is passionate about creating content that inspires. Her work history lies in writing compelling website copy, now specialising in product marketing copy. Gabi's priority when writing content is ensuring that the words make an impact on the readers. For Osome, she is the voice of our products and features. You'll find her making complex business finance and accounting topics easy to understand for entrepreneurs and small business owners.

Mosan Ali

Reviewer

Mosan Ali is our Accounting Manager based in the UK and has a wealth of knowledge of UK GAAP, VAT, and PAYE. With 12 years of experience crunching numbers and ensuring compliance, he keeps our financial reporting ship-shape. Think of Mosan as our blog's accounting guru. He carefully reviews our UK-focused content, ensuring it's accurate, up-to-date, and packed with helpful tips for UK businesses. Get your taxes right from day one with our informative blog posts.

Discover the significance of a share premium in company finances. Learn why companies issue shares at a premium, its impact on shareholder equity, financial implications, and how it influences investor perception. Gain valuable insights into this vital aspect of corporate finance.

A share premium is an extra amount investors pay for shares above the nominal value, boosting a company's capital when invested beyond face value.

Investing in a company's shares is an exciting opportunity for many individuals. Understanding the various financial aspects that play a role in a company's structure is crucial for investors. One such aspect is the share premium, which is important in company finances. This article will delve into share premium's definition, purpose, and implications while examining its role in a company's capital structure.

Definition and Purpose of Share Premium

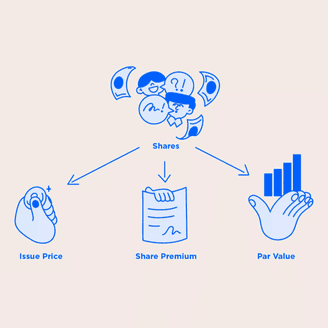

Share premium refers to the additional amount that investors pay for shares over their nominal or face value. It is the difference between the issue price of a share and its par value.

In the dynamic world of finance, understanding the concept of share premium is crucial. It is a financial instrument that allows companies to raise additional capital for various business activities and expansion plans. By offering shares at a premium, companies can indicate their market value and establish confidence among potential investors.

When a company decides to issue new shares, it sets a par value, which is the minimum price at which the shares can be issued. However, the market value of the shares may be much higher due to factors such as the company's performance, growth prospects, and market demand. The difference between the issue price and the par value is known as the share premium.

One might wonder why investors would be willing to pay more than the face value of a share. The answer lies in the potential benefits of investing in a company. Investors can become shareholders and participate in the company's success by paying a premium. They believe that the company's prospects are promising, and its growth trajectory will result in higher returns on its investment.

The share premium serves as a valuable source of additional capital for companies. This capital can be utilised for various purposes, such as financing research and development initiatives, expanding operations into new markets, acquiring assets, or paying off existing debts. Companies can fuel their growth by raising funds through share premiums and remain competitive in their respective industries.

Furthermore, issuing shares at a premium can enhance a company's reputation and credibility in the financial markets. It signals to potential investors that the company is confident in its future prospects and is willing to offer shares at a higher price. This confidence can attract more investors, increasing liquidity in the company's shares and potentially boosting its stock price.

It is important to note that the decision to issue shares at a premium is not taken lightly. Companies must carefully assess market conditions, investor sentiment, and their own financial position before determining the premium price. Additionally, regulations and legal requirements regarding share premiums vary across jurisdictions, adding another layer of complexity to the process.

Share Premium vs Share Capital

Although share premium and share capital are related, they represent distinct aspects of a company's finances. So, share premium vs share capital? Share capital refers to the total nominal value of all the company's shares. On the other hand, share premium represents the surplus amount raised above the nominal value of those shares during their issuance. Both share capital and share premium contribute to a company's equity and serve as financial strength indicators.

Role of a share premium in capital structure

The share premium contributes to a company's capital structure, determining the equity and debt financing proportion. When a company issues shares at a premium, it increases the equity portion of its capital structure. This, in turn, strengthens the company's financial position as it expands its equity base and reduces its debt-to-equity ratio. The presence of a significant share premium can attract potential investors and present the company as a reliable investment opportunity.

Reasons for Issuing Shares at a Premium

Companies may issue shares at a premium for several compelling reasons that significantly impact their finances.

Increasing shareholder equity and capital reserves

One crucial objective is increasing shareholder equity and capital reserves. The company can raise additional funds by issuing shares at a price higher than their nominal value, which is then added to the share premium account. This, in turn, enhances the overall equity held by shareholders and strengthens the company's financial position.

Funding expansion and investment initiatives

Another essential reason for issuing shares at a premium is funding expansion and investment initiatives. The surplus capital generated from the premium-priced shares can support the company's growth plans, such as expanding into new markets, investing in research and development, or making strategic acquisitions, all of which contribute to the company's long-term success and competitiveness.

Issuing Shares at a Premium: Procedure and Implications

Issuing shares at a premium involves specific procedures and carries significant implications for the company and its shareholders.

Share premium calculation and determination

One critical step is the calculation and determination of the share premium. This entails assessing various factors, including the company's financial health, prevailing market conditions, and the perceived value of its shares. Financial experts, accounting services, and valuation techniques are often utilised to arrive at an appropriate premium that accurately reflects the company's worth.

Impact on shareholders and company financials

The implications of issuing shares at a premium encompass two main aspects, including how to calculate a share premium. Firstly, it can positively impact business shareholder equity and bolster the company's capital reserves, providing a more robust financial foundation. However, on the other hand, it may also affect the company's financial ratios and earnings per share, factors that existing shareholders and potential investors closely monitor.

Share Premium and Investor Perception

The presence of a share premium account in a company's financial structure can significantly influence how investors perceive the company and its prospects.

Impact on share price and valuation

One crucial aspect, especially for a company limited by guarantee, is the impact on share price and valuation. When shares are issued at a premium, it often indicates confidence in the company's future growth and profitability. As a result, investors may interpret this as a positive signal, leading to increased demand for the company's shares in the market. This heightened investor interest can potentially drive up the share price, benefiting existing shareholders.

However, potential investors should also consider certain factors before making investment decisions. The higher share price resulting from the premium may lead to a higher price-to-earnings ratio, prompting investors to assess whether the premium is justified based on the company's financial performance and growth potential. Careful evaluation of the share premium becomes even more critical for a company limited by guarantee, as it directly affects its financial outlook and ability to fulfil its obligations to its members.

Considerations for potential investors

Additionally, they should carefully evaluate how the additional capital raised through the premium will be utilised and its potential impact on future returns and dividends. Conducting thorough due diligence is essential to make informed investment choices.

Conclusion

In conclusion, understanding the significance of a share premium is crucial for investors seeking to comprehend a company's financial structure. Share premiums are vital in a company's capital structure, allowing them to raise additional capital, attract potential investors, and strengthen its financial position. Companies can demonstrate their market value and establish investor confidence by issuing shares at a premium. So, whether you are an experienced investor or just starting, keeping an eye on the share premium can provide valuable insights into a company's financial health and growth prospects.