- Osome Blog UK

- What Is A Unique Taxpayer Reference (UTR) Number?

What Is A Unique Taxpayer Reference (UTR) Number and How To Get One?

- Modified: 17 November 2025

- 8 min read

- Accounting & Bookkeeping, Taxes & Compliance

Jon Mills

Author

Jon relishes writing content that both educates and entertains the reader. With a background in copy and content writing for brands, he's told unique stories in creative ways, adding value to products in the luxury sector. Now, he works with our accounting experts and small business owners to bring their advice and journeys to life for Osome's readers. He aims to inspire ambitious entrepreneurs to set their sights high, and build highly-respected, flourishing businesses.

Learn about the Unique Taxpayer Reference (UTR) number, its importance for tax management in the UK, and the steps to get one. Also, find out how to recover a lost UTR and understand its role for both individuals and companies.

A Unique Taxpayer Reference (UTR) number is a unique identifier used by HM Revenue and Customs (HMRC) to keep track of your tax information in the UK. It is a 10-digit number that is assigned to you when you register for self-assessment or any other tax service.

How To Get a Unique Taxpayer Reference (UTR)

If you are new to self-assessment or need a UTR for any other reason, you can easily get one by registering with HMRC. The registration process is straightforward and can be done online. Simply visit the HMRC website and follow the step-by-step instructions provided. You will need to provide some personal information and details about your income and employment. Once your registration is complete, HMRC will issue you a UTR number, which you will need for all of your future tax affairs.

Registering with HMRC helps you manage your taxes efficiently. By getting a UTR in the UK, you make sure your tax affairs are properly recorded and monitored. This unique reference number acts as an identifier for your tax records and helps HMRC keep track of your financial activities.

Having a UTR number is not only essential for self-assessment but also for other tax-related matters. For example, if you are a sole trader or a partner in a business, you will need a UTR to file your annual Self-Assessment tax return. Furthermore, if you plan to work as a contractor or freelancer, clients may require your UTR before engaging your services.

It is worth noting that your UTR remains the same throughout your lifetime, even if your circumstances change. Therefore, it is crucial to keep your UTR number safe and accessible. You may need it when communicating with HMRC or when seeking professional advice regarding your tax affairs.

How Do I Register for UTR?

To register for a UTR, you will need to gather some essential documents and information beforehand. Make sure you have your:

- National Insurance number

- Contact details

- Income details

- Details of employment

You’ll also need to provide your date of birth and your unique taxpayer reference if you have one. Once you have these documents and information ready, you can proceed with the online registration process.

During the registration, you’ll be asked to create an online account with HMRC if you don't have one already. This account will allow you to manage and access your tax information easily. Once you have completed the registration and provided all the necessary information, HMRC will review your application and send you your UTR number.

The time it takes to receive your UTR number may vary, but typically, you can expect to receive it within a few weeks. Keep track of your application and ensure that all the information provided is accurate to avoid any delays in receiving your UTR.

Managing tax affairs can be daunting, especially if you're new to self-employment or running a business. Getting help from professional accounting services can greatly simplify this process, ensuring you stay in line with HMRC requirements.

Where Can I Find My UTR Number?

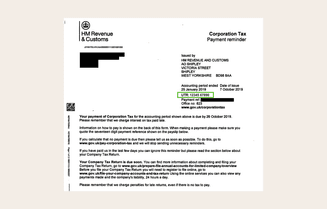

Your UTR number can be found on any letters from HMRC regarding your tax affairs. It is usually included on documents such as self-assessment tax returns or notices to file a tax return. If you’re unsure or unable to find your UTR number, you can contact HMRC directly for assistance. They will be able to provide you with the necessary information.

Recovering a Lost UTR Number

If you have lost or forgotten your UTR number, don’t panic! It is essential to retrieve it as soon as possible, though, as you’ll need it for any tax-related transactions. The fastest way to recover a lost UTR number is to contact HMRC directly. You can call their helpline or use their online services to request your UTR number. Make sure to have your personal details and relevant tax information ready, as they may ask for verification purposes.

Alternatively, if you have registered for an online account with HMRC, you may be able to find your UTR number by logging in and navigating to the appropriate section. The website should display your UTR number once you are logged in.

Differentiating Unique Taxpayer Reference Numbers from Tax Codes

It's essential to understand the difference between your UTR number and your tax code. While both are important for your tax affairs, they serve different purposes. Your UTR number is a unique identifier specific to you, whereas your tax code determines how much tax you will pay. The UTR number is assigned to you by HMRC, whereas your tax code is calculated based on your income and personal circumstances.

It's crucial to keep both your UTR number and tax code safe and accessible. You will need to provide your UTR number whenever you interact with HMRC, such as filing a tax return or making changes to your tax details. Your tax code, on the other hand, is used by your employer or pension provider to deduct the correct amount of tax from your income.

While both UTR number and tax code are important for your tax affairs, they serve different purposes. Your UTR number is a unique identifier specific to you, whereas your tax code determines how much tax you will pay.

Unique Taxpayer Reference (UTR) Numbers for Companies and Individuals

UTR numbers are used by both individuals and companies for tax purposes. If you are a self-employed individual, you will need a UTR number to file your self-assessment tax return. Similarly, if you are a director of a limited company or involved in any other form of business, you will also require a UTR number to manage your tax affairs.

For companies, the company unique taxpayer reference number is typically issued when they register with Companies House, which is responsible for maintaining the official register of companies in the UK. Once registered, the company will receive its UTR number, allowing it to conduct its tax operations and ensure compliance with HMRC regulations.

Importance of Unique Taxpayer Reference Numbers

There are three important things to know regarding your Unique Taxpayer Reference Number.

1 HMRC monitorings over tax obligations

The UTR number plays an integral role in how HMRC monitors your tax obligations. By assigning each taxpayer a unique number, HMRC can effectively keep track of all tax-related transactions linked to that number. This includes tracking your income, checking if you've paid the right amount of tax, and ensuring you meet all your tax obligations on time.

If you're self-employed, your UTR number becomes especially important. HMRC uses it to track your earnings and calculate your tax liability. If you're late on payments or have discrepancies in your tax returns, your UTR number helps HMRC locate and rectify these issues promptly. In essence, your UTR number acts as a bridge between you and HMRC, enabling a more efficient tax monitoring process.

The UTR number plays an important role in how HMRC monitors your UK tax obligations. Maintaining accurate accounting records is also essential in keeping track of your income, expenses, and taxes due. Your UTR number is a key component of this system, tying all your tax-related transactions to your unique identifier.

2 Tax returns filings

When it comes to filing tax returns, your UTR number is vital. This number, unique to you, is required whenever you submit your Self-Assessment tax return, whether it's done online or through the post. Your tax return provides HMRC with detailed information about your income for a specific tax year. By including your UTR number, you ensure that the data you provide is correctly linked to your tax record.

Therefore, whether you're a sole trader filing your annual tax return, or a director of a company providing corporate tax details, your UTR number is a necessary identifier that assists HMRC in processing your tax returns accurately and efficiently.

3 Partnerships with accountants

UTR numbers are also useful when you engage with accountants or tax professionals. As trusted partners in managing your tax affairs, these professionals need your UTR number to access your tax records and liaise with HMRC on your behalf. By providing your UTR number, your accountant can handle a range of tasks for you, such as submitting tax returns, dealing with tax queries, and ensuring you meet all tax obligations and deadlines.

Remember! Only share your UTR number with trusted professionals and certified accountants to avoid potential misuse of this sensitive information.

Changes to Unique Taxpayer Reference Numbers When Acquiring a Company

If you acquire a company or become a director of an existing company, there may be changes to the UTR number associated with that business. When acquiring a company, it's important to notify HMRC of the change in ownership and provide any additional information they may require. This ensures that the correct UTR number is linked to the new entity and that the tax affairs of the business continue smoothly.

If you have any doubts or questions regarding changes to UTR numbers during company acquisitions, it's best to consult with a tax professional like Osome, or seek guidance from HMRC directly. This will ensure compliance with tax regulations and avoid any potential issues in the future.

Other Essential Information on UTR Numbers

Your UTR number is not the same as your National Insurance (NI) number. While both are personal identifiers, they serve different purposes. Your NI number is used for social security-related matters, such as benefits and pensions, whereas your UTR number is specifically for tax-related purposes.

HMRC may send you important notifications and updates regarding your tax affairs to the address associated with your UTR number. Keep your contact information up to date to ensure you receive all relevant communication from HMRC. If your address changes, notify HMRC as soon as possible to avoid any potential complications.

Reactivating UTR numbers

If you haven't used your UTR number for a while, for instance, if you've been employed and haven't had to fill out a Self-Assessment tax return, you may need to reactivate it. To do this, contact HMRC directly. They'll guide you through the process, which usually involves confirming your identity and possibly filling in a tax return for the current tax year. Once reactivated, you can use your UTR number as before, for your tax filings and interactions with HMRC.

Cost implications of UTR numbers

Getting a UTR number is free of charge, but there are cost implications associated with its use. Your UTR number is associated with your tax payments and liabilities. Failure to provide the correct UTR could result in your tax payments not being credited to your account, leading to potential penalties for missed payments.

If you're self-employed and your business grows to the point where you need to become VAT registered or employ staff, your UTR number will be used by HMRC to monitor these additional tax responsibilities. Mismanagement of these obligations can lead to financial penalties, highlighting the importance of accurate record-keeping and use of your UTR number.

While there's no direct cost to get or keep a UTR number, the consequences of misuse or incorrect reporting can lead to financial implications.

Osome helps you stay organised, keep accurate records, and gives you professional advice whenever you need it. So you can tackle your tax responsibilities and get down to business.