How To Register as Self-Employed in the UK

- Published: 9 November 2023

- 9 min read

- Starting a Company

Gabi Bellairs-Lombard

Business Writer

Gabi is a content writer who is passionate about creating content that inspires. Her work history lies in writing compelling website copy, now specialising in product marketing copy. Gabi's priority when writing content is ensuring that the words make an impact on the readers. For Osome, she is the voice of our products and features. You'll find her making complex business finance and accounting topics easy to understand for entrepreneurs and small business owners.

The freedom to choose your own clients, set your own schedule, and pursue your passion – these are just a few of the many benefits of self-employment. If you’re considering taking the leap into being your own boss, it’s important to understand the process of how to register as self-employed in the UK. Navigating how to pay tax and local regulations can seem daunting, but with the right guidance, you’ll be on your way to a successful self-employed career in no time.

In this blog post, we’ll walk you through the essential steps to register as self-employed in the UK, from understanding the importance of registration to managing your self-employed business after registration. Whether you’re just starting out or looking to expand your freelance work, this guide will provide the information you need to ensure a smooth transition into self-employment.

Key Takeaways

- Choose a legal structure and gather the necessary information to register as self-employed with HMRC.

- Keep accurate records of sales, income, expenses, payrolls and documents for compliance and financial health.

- Submit a Self Assessment Tax Return before the deadline and pay National Insurance Contributions (Class 2 & Class 4) plus Income Tax to remain compliant with UK tax regulations.

Why Do You Need To Register As Self-Employed?

Starting your own business means registering as self-employed — a move that ensures your adherence to tax regulations and helps avoid financial penalties. As a self-employed individual, you’ll be responsible for paying income tax and National Insurance Contributions on your earnings at your own expense. Failing to register as self-employed could result in unnecessary financial penalties due to non-compliance with tax requirements.

Our team of experts offers seamless self-assessment registration services, ensuring that you navigate the process smoothly and avoid any potential penalties. Don't hesitate to contact us today!

If you’re unsure about your employment status, the HMRC online employment status checking tool can help you determine whether you qualify as self-employed or part of a limited liability partnership. If taxation and financial obligations prove challenging, consider seeking assistance from an accountant specialising in self-employment or arranging a free consultation to guide you in managing business debts and financial obligations.

When Do I Need To Register as Self-Employed in the UK?

You must register as self-employed in the UK when you start working for yourself or generating income from self-employment, covering your own expenses. The HMRC has formulated specific criteria that must be fulfilled to be considered self-employed, such as working for an agreed fixed price. To avoid penalties and ensure correct tax payment, registering as self-employed is essential.

If you fail to register as self-employed when required, HMRC may impose a penalty of up to £100. Additionally, employed individuals must include their wages from employment on their tax return if they also have taxable income from self-employment. Registering within the correct timeframe can avoid financial penalties and ensure compliance with UK tax regulations.

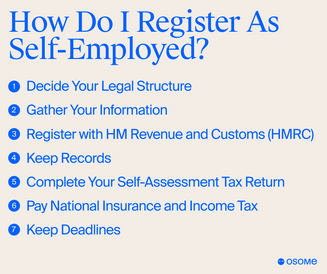

How Do I Register as Self-Employed?

This guide will provide the right steps to follow on how to register as self-employed, covering aspects like choosing a legal structure (sole trader, limited company, or limited liability partnerships? These are the questions!), collecting necessary information, and enrolling with HMRC.

With these steps in mind, you can confidently navigate the registration process and establish your self-employed business.

1. Decide Your Legal Structure

Before registering as self-employed, you must decide on the appropriate legal structure for your business. The options available are sole trader, limited liability partnerships, or limited company. Registering as a limited company can protect small business owners and instil confidence in their businesses. When selecting a legal structure, consider factors such as financial liability, taxation and National Insurance implications, and potential funding sources for the business. Additionally, it’s important to register your chosen structure with Companies House.

Sole traders and partnerships offer greater privacy, as there is no requirement to disclose business information. Ultimately, your choice of legal structure will depend on your individual circumstances and the nature of your business. Carefully weighing the pros and cons of each option will help you make an informed decision.

2. Gather Your Information

Prior to registering as self-employed, you must gather personal and business information required for the registration process. You will need:

- Your National Insurance number

- Full name (including any previous names)

- Current address

- An email address and password for establishing a Government Gateway account.

Accuracy in providing information during the registration process is paramount for maintaining compliance with tax regulations. Double-check your personal and business details before submitting your registration to avoid any issues or delays.

3. Register with HM Revenue and Customs (HMRC)

To ascertain the accurate payment of income tax and National Insurance Contributions, registration with HMRC for self-employment is vital. For construction workers or those in the industry, you may also need to register for the Construction Industry Scheme (CIS). To register with HMRC, sign in or set up a personal or business tax account on the HMRC website and provide specific information about your business.

If you have previously submitted a tax return, you can use the online CWF1 form along with the same UTR number and HMRC login that were utilised previously. The SA1 form can be used for those who have not submitted a tax return before and can be obtained from HMRC’s website.

4. Keep Records

To meet legal requirements like accurate tax return filing and avoiding financial penalties, keeping precise records is fundamental. As a self-employed individual, you should retain records of all sales and income, expenses, and payroll records if you have employees. Additionally, preserve copies of relevant documents such as receipts, bank statements, and invoices.

It is recommended that all pertinent documents related to a particular tax year be held for a period of five years for tax purposes. Keeping well-organised records will not only help you stay compliant with tax regulations but also enable you to monitor your business’s financial health and make informed decisions.

5. Complete Your Self-Assessment Tax Return

When you're self-employed, it's important tofile your Self-Assessment Tax Return annually with HMRC to report your income and expenses. Filing your Self-Assessment Tax Return must be done each year before the deadline on 31st January. Put this date in your diary! You can file your tax return either online or by post. To file online, you’ll need to register for HMRC’s online services before completing the online form. To file by post, download and fill in the paper form.

After filing your Self-Assessment Tax Return, it’s advised to keep a copy for your records. Also, remember to maintain records of all income and expenses for five years.

6. Pay National Insurance and Income Tax

As a self-employed individual, you must pay National Insurance and Income Tax on your earnings. Class 2 and Class 4 National Insurance Contributions are the two types of contributions you may be required to pay. If your profits exceed a certain amount, you are obligated to pay Class 2 National Insurance Contributions, which can be paid through your Self-Assessment tax return or by setting up a Direct Debit. Class 4 National Insurance Contributions are paid through your Self-Assessment tax return, and the amount payable depends on your profits.

You are also required to pay tax on your self-employed earnings, which can be done via your Self-Assessment tax return. Maintaining current tax and National Insurance payments will help you adhere to UK tax regulations, steering clear of potential financial penalties.

7. Keep Deadlines

Being mindful of important deadlines is vital for self-employed individuals to steer clear of penalties and stay compliant with tax regulations. Here are some key deadlines to remember:

- The deadline for registering as self-employed in the UK is the 5th October in your business’s second tax year.

- The deadline for submitting a tax return is the 31st of January annually.

- The deadline for paying taxes is also the 31st of January annually.

By keeping track of these deadlines and ensuring timely registration, tax return submission, and tax payments, you can avoid financial penalties and maintain a positive relationship with HMRC and Companies House.

What To Do After You Have Registered

Once you have successfully registered as self-employed, there are additional aspects of managing your business to consider. This includes determining the appropriate insurance coverage for your business, such as professional indemnity insurance, public and product liability insurance, and employers’ liability insurance if you have employees. Insurance requirements may vary depending on the nature of your work, so it’s important to assess your specific needs and consult with an insurance professional if necessary.

Additionally, self-employed individuals with special needs may be eligible for support and resources to help manage their business. Small business owners can also access various resources and support services to ensure the successful management and growth of their business.

If I Want To Stop Being Self-Employed

If you decide to stop being self-employed, there are specific steps you need to take to ensure a smooth transition. First, you must notify HMRC that you are no longer self-employed. You can inform HMRC by phone, post, or online, providing your name, address, Unique Taxpayer Reference (UTR) number, and the date of ceasing self-employment. Following the notification, it’s suggested to file a final tax return. If you've registered a limited company or limited partnership with Companies House, make sure you let them know, too.

Even after terminating self-employment, keeping records of your business transactions for at least five years is crucial. This practice will help you stay compliant with tax regulations and equip you with the necessary documentation for any future inquiries.

Summary

Throughout this blog post, we have provided a comprehensive guide to registering as self-employed in the UK. From understanding the importance of registration to managing your self-employed business after registration, we hope that this guide has equipped you with the knowledge and confidence to successfully navigate the world of self-employment.

As you embark on your self-employed journey, remember that careful planning, staying organized, and staying informed about tax regulations and deadlines are key to achieving success. With determination and the right guidance, you can build a thriving self-employed career and enjoy the benefits of working for yourself.

FAQ

How do I register as self-employed for the first time?

Registering as self-employed for the first time is simple: make sure you register through your business tax account and create a Government Gateway account if you haven't yet. Don't forget to register for both Self Assessment and Class 2 National Insurance too.

Does it cost to register as self-employed UK?

Registering as self-employed in the UK is free, but you may want to invest in self-employment insurance.

How do I register as self-employed to get a UTR number?

To register for a UTR number, you need to register online for Self-Assessment with HMRC. Once you do this, you will receive a UTR number within 10 days, or 21 days if you are outside of the UK. You will then receive an activation code for your Self-Assessment account.

What are the legal structures available for self-employed individuals?

The legal structures available for self-employed individuals are sole trader, partnership, or limited company.

What records should a self-employed individual maintain?

Self-employed individuals should retain records of sales and income, expenses, payroll records (if applicable), and relevant documents such as receipts, bank statements, and invoices for accurate bookkeeping.

More like this

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?