How To Open a Bank Account in the UK – Your Essential Guide

- Published: 19 January 2024

- 11 min read

- Grow Your Business

Gabi Bellairs-Lombard

Author

Gabi is a content writer who is passionate about creating content that inspires. Her work history lies in writing compelling website copy, now specialising in product marketing copy. Gabi's priority when writing content is ensuring that the words make an impact on the readers. For Osome, she is the voice of our products and features. You'll find her making complex business finance and accounting topics easy to understand for entrepreneurs and small business owners.

Navigating the world of banking can be a complex task. From understanding whether to choose a current account or a business account to different online banking options, the banking landscape has a lot to offer. But fear not, we’re here to guide you through this journey, helping you find the bank account that best suits your needs and teaching you how to open a bank account.

Key Takeaways

- The type of bank account you choose should align with your financial needs and goals, from basic current accounts for everyday spending to joint accounts for shared finances.

- Opening a bank account online in the UK is a straightforward process that involves gathering documents, comparing accounts, and applying through the bank’s website, with many offering mobile banking app options.

- Switching banks in the UK is facilitated by services like the Current Account Switch Service and Guarantee, ensuring a hassle-free transition. The Financial Services Compensation Scheme (FSCS) protects your deposits up to £ 85,000.

Choosing the Right Bank Account

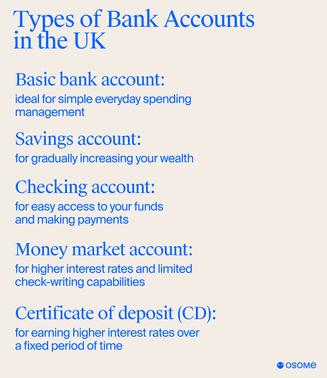

Selecting a suitable bank account is key to efficient personal financial management. The type of account you opt for depends largely on your individual needs and financial goals. Here are some options to consider:

- Basic bank account: ideal for simple everyday spending management

- Savings account: for gradually increasing your wealth

- Checking or current account: for easy access to your funds and making payments

- Money market account: for higher interest rates and limited check-writing capabilities

- Certificate of deposit (CD): for earning higher interest rates over a fixed period of time

Consider your financial goals and choose the account that best suits your needs.

Personal current accounts provide a more flexible option for everyday banking. For those sharing finances with a partner or a family member, a joint account could be the way to go. We will now dissect each of these account types for a better understanding.

However, if you're considering setting up a business, opening a business bank account is essential. Our partnership with several banking providers ensures that you'll have access to a range of options tailored to your business requirements.

Basic bank account

A basic bank account is a no-frills account that provides essential banking services without any fees or credit checks. This makes it a great option for those who want a simple and straightforward banking experience or for those looking to open a new bank account. It’s particularly useful for individuals who might not qualify for other types of accounts due to poor credit history.

Banks like NatWest and HSBC offer basic account with a debit card and offer options for managing finances through in-branch services, online banking, and a mobile banking app. Yet, one should remember that basic accounts usually lack overdraft protection, which might disadvantage some.

Savings account

For those looking to grow their wealth, savings accounts are a solid choice. These accounts provide interest on deposited funds, allowing your money to grow over time. This makes them suitable for individuals looking to save money for future expenses or investments. However, remember that savings accounts usually restrict the number of monthly transactions you can make.

Thus, you might find a current account more suitable if your banking involves frequent transactions.

Current account

Current accounts offer a flexible and versatile option for everyday banking. They provide a range of features, including overdrafts, rewards, and online banking. This makes current accounts suitable for managing many transactions and standardised payments. Banks like the Co-operative Bank offer a current account with various rewards and overdraft options, making everyday banking a breeze. However, personal current accounts might occasionally incur maintenance fees and necessitate keeping a minimum balance.

Joint account

Joint accounts, unlike individual current accounts, are designed for couples or partners who want to manage shared finances. You can add someone to an existing current account either when applying for it or at any time after it's open. A joint account allows both account holders to manage and access funds, most often via a mobile banking app, making it easier to manage joint expenses. However, bear in mind that joint accounts could compromise your financial independence; it’s a factor worth considering before making your choice.

Opening a Bank Account Online

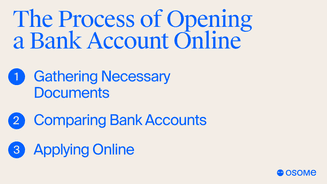

Having explored various types of bank accounts, we will now look at opening a bank account online. The advent of digital banking has made it easier than ever to open an account from the comfort of your home and even just from the respective mobile banking app. But what does this process entail? It involves gathering necessary documents, comparing different bank accounts, and applying through the bank’s website. Here’s a step-by-step guide.

Gathering necessary documents

Before you start the application process, you must gather the necessary documents. This typically includes an official form of photo identification, such as a passport or national ID card, and a document to prove your address, like a utility bill, document from a bank or building society, or bank statement. If a standard ID is unavailable, banks may accept alternatives such as a benefits letter or immigration status document.

Comparing bank accounts

One of the most important steps in opening a bank account is comparing different account options. This involves considering factors like fees, customer service, monthly account fee, and convenience.

Websites like MoneySavingExpert and CompareBanks.co.uk offer reliable comparisons of different bank accounts, helping you make an informed decision. Our experts at Osome are also well-connected with a variety of banking partners, so we can help you make the best choice according to what you need.

Applying online

Once you have selected a bank and gathered the necessary documents, you can start the online application process by submitting your personal details. This involves filling out an application form on the bank’s website and submitting it. Some banks even offer instant approval, making the process quick and convenient.

Banks like Barclays, Halifax, Starling, Chase, and Monzo provide online applications for their bank accounts, making the process hassle-free.

Mobile Banking Apps and Features

With the prevalence of smartphones, mobile banking apps have become an essential tool for managing finances. These apps offer a range of features, from secure access to your account information to the ability to manage your account and make contactless payments. When doing your research, try to get testimonials directly from the bank's online banking customers.

Here’s a deeper look into these features.

Secure mobile banking app

Security is paramount when it comes to mobile banking. Thankfully, mobile banking apps today have robust security measures to protect your account from potential threats. This includes features like multi-factor authentication, encryption of data, and regular updates to ensure the app is secure.

Account management

Beyond security, mobile banking apps also offer features for effective account management. This includes monitoring your balance, tracking spending, setting up alerts, and transferring funds. Whether you have a current account or another type of account, most banking apps allow you to manage your finances whenever you want as long as you have a mobile phone. Additionally, you want to make sure that you are able to make contactless visa debit card payments effortless and safely.

Utilising these features to their fullest can help streamline your financial management and align you with your financial goals.

Contactless payments

One of the biggest advantages of mobile banking apps is the ability to make contactless payments. With just a tap of your phone, you can make payments quickly and securely, reducing the need for physical cards or cash.

Most mobile banking apps support popular contactless Visa debit card payment options like Apple Pay and Google Pay, making transactions a breeze.

Switching Banks With Ease

What if you’re unhappy with your current bank and want to switch? Thanks to services like the Current Account Switch Service and the Current Account Switch Guarantee, switching banks is now easier than ever so that you can find an account with more appealing features such as no monthly fee or a better user experience on the banking app. These services ensure a smooth transition of your current account details and payments, giving you peace of mind during the switch.

We will now examine these services more closely.

Current account Switch Service

The Current Account Switch Service is a free service that makes switching an existing current account to a different bank a hassle-free process. Your new bank will transfer your payments and balance from your old bank, closing your account.

This service completes the switch within seven working days, making it a quick and convenient option for those looking to switch banks for their current account.

Current Account Switch Guarantee

The Current Account Switch Guarantee ensures a seamless transition when switching banks. This guarantee ensures that your new bank will transfer your payments and balance, and any charges or missed interest incurred due to the switch will be refunded. This provides a safety net for customers, ensuring the switching process is as smooth as possible.

Overdrafts and Borrowing Options

An arranged overdraft and other borrowing options are key features many bank accounts offer for a current account. An overdraft allows you to borrow money through your current account, often up to a certain limit. However, understanding the fees and interest rates associated with an arranged overdraft is crucial to avoid potential financial pitfalls, as well as the arranged overdraft limits that best suit your lifestyle so that you don't overborrow.

Let’s now dissect the specifics of overdrafts and borrowing options.

Arranged overdraft

An arranged overdraft is a feature that allows you to borrow money up to a predetermined limit through your current account. This can provide flexibility in managing your finances, especially during times when your account balance is low. However, it’s important to know the costs associated with an arranged overdraft on your current account, as the interest can add up over time. You can ask to increase, remove or reduce your limit at any time in online banking, by phone or in-branch.

Interest rates

Interest rates on an arranged overdraft through your current account can vary depending on various factors, including the bank and the borrower’s credit score. Higher rates can make an arranged overdraft expensive, so it’s crucial to understand these rates before opting for an overdraft on your current account.

Borrowing limits

Borrowing limits, or the maximum amount you can borrow through an arranged overdraft, are determined by the bank based on your individual circumstances. Factors such as your credit score, income, and financial history can impact your borrowing limit.

It is important to understand your borrowing limit and ensure it aligns with your financial needs before deciding on an arranged overdraft or other loan options.

Additional Services and Features

Banks offer additional services and features that can enhance your banking experience. These include specialised accounts like packaged and student accounts.

Here’s a deeper look into these features.

Packaged account

A packaged account is a type of bank account that offers additional benefits for a monthly fee. These benefits include insurance policies, discounts on mortgages, and financial rewards. While the monthly fee can be a downside for some, the added benefits can make a packaged account a valuable option for others.

Student account

Student accounts are specifically designed to cater to the needs of students. These accounts often offer features such as interest-free overdrafts, which can be particularly helpful for students managing their finances while in school.

Most major banks offer student accounts with various perks, making them a great option for students.

Financial Ombudsman Service

The Financial Ombudsman Service plays a crucial role in the UK banking sector, resolving disputes between customers and financial institutions. If you have a grievance with your bank, you can contact this reliable service for help.

This service is free and aims to resolve disputes in a fair and impartial manner.

Protecting Your Money: The Financial Services Compensation Scheme

Your hard-earned money deserves the best protection. That’s where the Financial Services Compensation Scheme (FSCS) comes in. This scheme protects your deposits in case your bank fails, ensuring you won’t lose money.

The FSCS covers deposits up to £ 85,000, providing a safety net for your finances.

Tips for Choosing the Best Bank for Your Needs

Selecting the appropriate bank is a significant decision with implications for your financial management. Some factors to consider when choosing a bank include:

- The types of accounts offered

- The fees associated with the accounts

- The quality of customer service

- The availability of online or mobile banking options

- Usability of the online banking service (especially in the digital era where individuals need to be able to manage their money easily and on-the-go)

Considering these factors can help you identify the bank that best aligns with your needs and financial objectives.

Fees and Costs

Banking can come with various fees and costs, including ATM fees, overdraft charges, and account maintenance fees. It’s important to be aware of these potential costs when choosing a bank and to consider ways to minimise or avoid them. For instance, some banks offer fee-free ATM withdrawals, while others may waive account maintenance fees if you maintain a certain balance.

Understanding these fees can guide you to a well-informed decision when selecting a bank.

Summary

Choosing the right bank requires careful consideration of various factors, from the types of accounts offered to the fees associated with these accounts. By understanding these factors and comparing different banks, you can choose a bank that best fits your needs and financial goals. Whether you’re looking for a basic account for everyday banking, a savings account to grow your money, a current account for flexible everyday use, or a student account that caters to your specific needs, there’s a bank account out there for you. And with the convenience of online banking and mobile banking apps, managing your finances has never been easier.