How To Set Up a Limited Company in the UK: Step-by-Step Guide

- Modified: 30 August 2024

- 9 min read

- Starting a Company

Jon Mills

Author

Jon relishes writing content that both educates and entertains the reader. With a background in copy and content writing for brands, he's told unique stories in creative ways, adding value to products in the luxury sector. Now, he works with our accounting experts and small business owners to bring their advice and journeys to life for Osome's readers. He aims to inspire ambitious entrepreneurs to set their sights high, and build highly-respected, flourishing businesses.

If you are thinking about how to set up a limited company in the UK, it is probably because you want to start your own business. By forming a limited company, you can set up your own business with a legal entity that enables you to protect your personal assets and trade as a separate legal entity from yourself.

Here’s a step-by-step guide on setting up a limited company online, from choosing a company name to fulfilling all legal requirements.

What Is a Limited Company?

A limited company is a legal structure, in which the company has limited liability. This means that the shareholders or members of a limited company are not liable for any debts or liabilities incurred by the business.

So, if there is a financial crisis within the company, the creditors can’t hold the shareholders accountable for it or force the owners to manage it using their assets. That’s also why limited companies are referred to as «separate legal entities».

In addition to being protected from creditors, there are other benefits of setting up a limited company. For example:

- You own and retain all your assets.

- You enjoy all the profits made after the income and corporation tax.

- Your personal assets are protected by the limited liability of the company.

- You have the flexibility to carry out new activities without having them appear on your personal tax returns.

- You can grant shares in the company to employees or other people who may be interested in investing in the business.

- In case of a financial crisis, you are only liable to pay off the amount that’s equal to your initial investment even if it means that your liabilities are 50x more than your investment. For instance, if you invested £1,000 in a company that’s registered as a limited company and it incurs a loss of £5,000 later on, you would only be responsible for paying £1,000.

How Do I Set Up a Limited Company?

Setting up a limited company is one of the most first things that many entrepreneurs do when they start their business and it can be a little daunting, to say the least.

The good news is that there are only a handful of things that need to be done when you set up your company. Here is a step-by-step guide on setting up a limited company quickly and without any hassle.

1 Choose the Type of Limited Company

There are two types of limited companies: public and private.

Public limited company

A public limited company is one where shares are publicly traded. Anyone can buy shares in the company and once they are bought, they can participate in the decision-making process by putting in their votes.

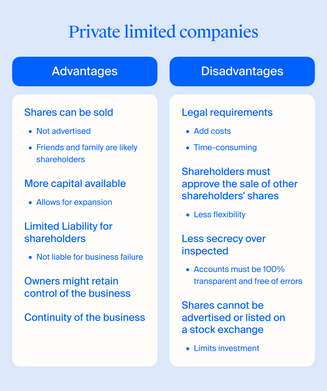

Private limited company

A private limited company is for those who want significant control over their business than what is offered by a public limited company, but who also do not want to run their business from within a traditional business structure.

For a private limited company to be formed, it must go through the company registration process with Companies House, and its members must be at least two people who wish to share managerial responsibility for the company’s affairs. Additionally, the company must appoint at least one director. A private limited company can only sell its shares to a few interested buyers, such as employees and company directors.

2 Choose the Company Name

You will need to choose a company name as soon as you register it with Companies House. Your company name should be memorable, easy to spell, and easy to remember. Your company’s name could either be a commonly used word or a portmanteau.

That said, the internet has made the world a smaller place. Most thoughts and ideas have been said and done. That’s why finding a good domain name is one of the biggest challenges of registering any business.

To avoid that, make sure you perform a Google search or look up your prospective names on the Companies House register or Intellectual Property Office (IPO).

Ensure that the name isn’t already used by any other company in the UK or anywhere in the world. This is crucial because you might start at the local level but there is no telling how much you might end up expanding.

Another important detail to remember when choosing your company name is to avoid words that could mislead people, such as including certifications or qualifications that you don’t possess. For instance, if you are an education company sans the credentials, don’t make the mistake of calling yourself an «academy.»

3 Prepare the Documents

The process of setting up a limited company is usually straightforward when you have the right documents. Your documents should be drafted in accordance with the Companies Act 2008 and your state’s laws. Here’s everything you need to prepare, fill, and submit:

Memorandum of Association (MoA)

The MoA is a document that sets out the name of your limited company, its purpose, who owns it, and how it is run. You also need to include details about any shareholders, directors, and managers. Bear in mind that your limited company must have at least one director.

Articles of Association (AoA)

These legal documents define the eligibility criteria for company directors, their duties, and other operational rules within the limited company. It may include details about how much profit each shareholder gets and what activities they can engage in, as well as rules governing how businesses are run — such as shareholders voting on important issues.

Form IN01

The UK government requires every limited company to submit this document, which includes information on your resources, capital, guarantee, compliance, and proposed officers.

4 Select Company Officers

While setting up a limited company, you need to mention who will be responsible for the minor and big picture operations. Usually, it is the company director and a company secretary who make for the upper management or C-suite level foundation of the limited company.

The director and a company secretary are responsible for managing the business, holding meetings, and dealing with shareholders’ queries. They must be at least 16 years old and must also sign documents on behalf of the company.

The company director is the one who have the responsibility for managing the company’s affairs, annual returns, legal changes, and finances. If you are registering a private limited company, you need to have at least one company director whereas a public limited company would require at least two directors on board.

On the other hand, the company secretary acts on behalf of the directors as their representatives during board meetings and other official business. They are often also involved with preparing minutes of board meetings and maintaining records of these minutes. A company secretary could either be an accountant or a lawyer or possess any other professional degree, which could be used to cater to the company’s consultation needs.

Shareholders are yet another entity that you could submit in your documents. A shareholder is someone who owns a share in a limited company, which gives them some rights over its assets and earnings, but without significant control. Shareholders do not have voting rights unless they hold shares with voting rights (called ordinary shares).

5 Choose How To Register a Limited Company

If you are thinking of registering a company in your own name, there are three ways to do it. You could either register it yourself or consider hiring an accountant or an incorporation agent like Osome to do it for you. The latter two options can cost you more because they have their own set of skills and experience that can help you with the tasks involved in setting up a limited company.

However, it is worthwhile in most cases because their expertise can ensure that the registration process is handled efficiently and correctly, reducing the risk of errors and ensuring compliance with legal requirements. Additionally, they can offer valuable advice on tax planning and company structure, which can save you time and potentially avoid costly mistakes in the future.

For example, an accountant can help you with matters such as keeping track of financial information and preparing annual accounts for your business. In addition, an accountant can work with your bank to register your business bank account so that you do not have to deal with any issues regarding bank accounts when setting up your company.

That being said, let’s take a look at the advantages and disadvantages of each one of them:

If You Do It Yourself

If you have the time, energy and inclination to do it yourself, it’s possible to set up a limited company on your own. The process is straightforward, but it requires some basic knowledge of how companies work. You will need to know the company details, its purpose, and the necessary documentation (e.g., the Articles of Association).

With an Accountant

You can engage professional accounting services to help set up a limited company and then file all the necessary forms with the government. A good accountant will be able to answer all your questions and explain how they expect things to go if you choose to work with them.

The cost of their service will vary depending on the size and complexity of your business as well as what their specialisation is. Typically, if an accountant specialises in your industry, they are likely to charge you a higher fee for their expertise.

With Company Formation Agent

The final option for setting up a limited company is to hire someone to act as a company formation agent — someone who has experience in company registration and knows what they are doing when it comes to filing paperwork and moderating with the government.

While such an agent might charge more than an accountant, they could help you avoid problems down the line by taking care of all paperwork beforehand and filing everything correctly, saving you money later down the line. They will be responsible for being the bridge between you and the government, so you won’t have to bother yourself with learning about the process.

6 Registered Office Address

Again, to have a company's registered office address in England, Scotland or Wales, you will need to complete an application form. You will be required to provide proof of ID and sign an oath that you are not disqualified from starting a company.

Once you have completed the application form and submitted it, you will receive confirmation that it has been received no later than a week. It usually takes around 8 to 12 days for a company formation certificate (CFC) to be issued by Companies House after they receive your documents if the process is done via post. Online applications receive their confirmation in as little as 24 hours.

You can also contact our experts for a company's registered office service to simplify your incorporation process!

Legal Requirements for Limited Companies

When setting up a limited company, you must file an annual return with the Companies House. If your company has been trading for more than three months, it must file an annual return with the Companies House. The information on this form is used to calculate income tax and corporation tax.

Next, you will have to provide your annual accounts and company documents related to corporation tax returns. Your annual accounts must be filed with HMRC (HM Revenue and Customs) within nine months after the end of the financial year. They must show all assets and liabilities of the company every year.

You must also register for VAT if your turnover is £90,000 unless everything you sell is exempt from VAT.

How Much Does It Cost to Set Up a Limited Company?

It costs £ 50 to get your limited company registered with the Companies House in the UK. You can pay the fee via debit or credit card and once paid, the government will provide you with a confirmation within 24 hours. Check out our incorporation pricing packages for more.

How Long Does It Take to Set Up a Limited Company?

Setting up a limited company could take anywhere between 24 hours to 12 days, depending on the approach you take to set up a new company. The only challenge is getting the paperwork right. If you have an expert by your side, you could accelerate the process. Preparing a business plan and assembling all the documents beforehand before submitting them to the Companies House can help significantly speed up the process.

What Should I Do After Registering a Limited Company?

Every new company registered with the Companies House receives a Certificate of Incorporation once its documents are approved by the government. It contains the details of your new limited company, including the date of establishment and information on the founders.

Once you receive this document, you are required to register yourself with the HMRC (HM Revenue and Customs) no later than 3 months after you have begun operations. This registration includes notifying HMRC about your corporation tax obligations. Failing to do so will attract a fine from the government.

And that is how you become a limited company!

More like this

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?