There are three ways you can create a simple invoicing process:

- Via Post You can send invoices via post for customers who do not often check their emails. However, using the post is a much slower invoicing method. It is also less secure and harder to reach customers directly since registered addresses can often change.

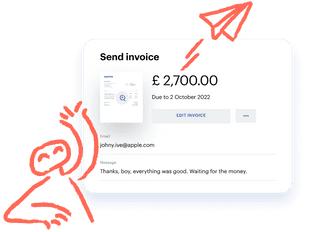

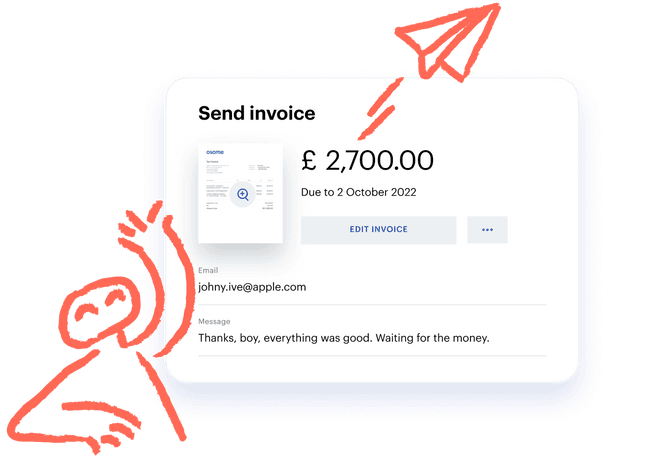

- By Email Business invoicing via email is a popular and easy method. Additionally, email invoices do not get lost. You only need to double-check the address before sending an email to ensure the right person receives your invoice.

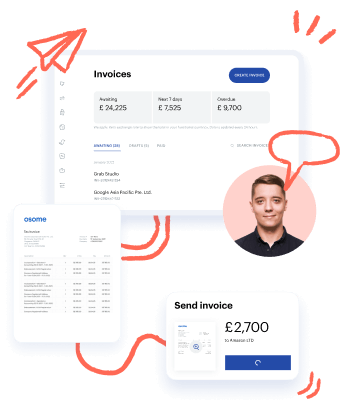

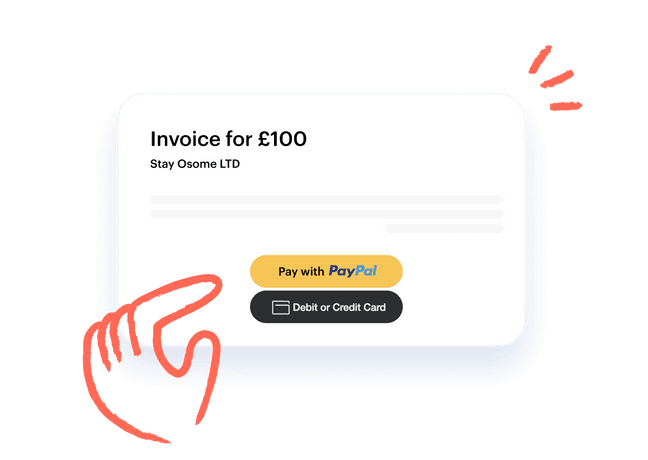

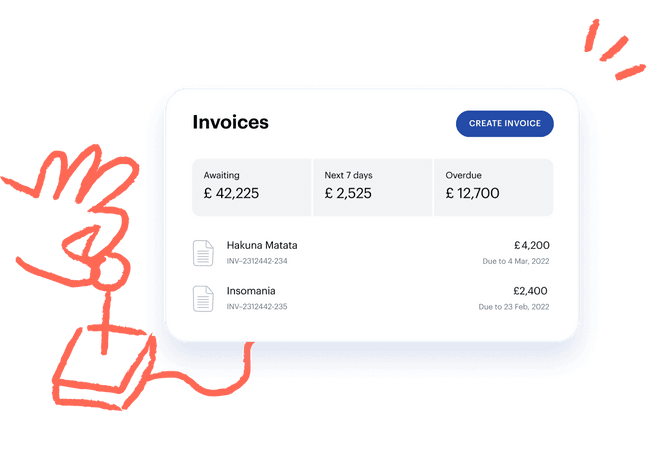

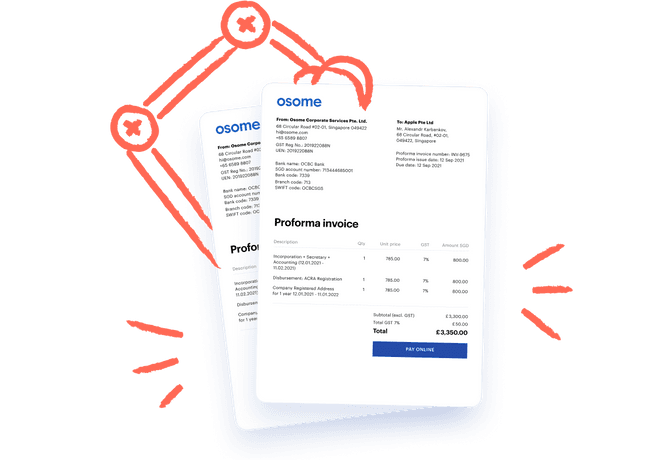

- Using E-Invoicing Online invoicing or e-invoicing is the fastest and most efficient method. After creating an invoice using a reliable software app like Osome, you can send a secure link to your customers. You can even see whether customers have opened the invoice. E-invoices also have a ‘pay now’ button that makes it easier for customers to pay online instantly using a debit/credit card or via payment channels like PayPal.