HMRC

Her Majesty’s Revenues and Customs (HMRC) is the main tax collecting authority in the UK.

It is responsible for collecting:

- Income Tax

- Corporation Tax

- Capital Gains Tax

- Inheritance Tax

- Insurance Premium Tax

- Stamp Duty

- Land and Petroleum Revenue Taxes

- Environmental taxes

- VAT

- Customs duty

- Excise duties

- Trade Statistics

- National Insurance

- Tax Credits

- Child Benefit

- Enforcement of the National Minimum Wage

- Recovery of Student Loan repayments

- Climate change tax

- Aggregates levy

- Landfill tax

As a business, you can pay taxes directly to HRMC or get an accounting services provider — to know for sure when and what to pay and not to miss the deadlines or possible rebates.

CRCA

HMRC self assessment

HMRC personal tax account

HMRC VAT

HMRC tax refund

HMRC how to pay

HMRC contact

Appealing HMRC tax decisions

CRCA

HMRC as a department was established in 2005 by CRCA — the Commissioners for Revenue and Customs Act. It set out the rules of HMRC interaction with Treasury: HMRC reports its activities to Parliament though Treasury Minister who oversees HMRC spendings.

It is the Treasury which draws strategic tax policy and its development. While HMRC leads on this policy maintenance and implementation. This interaction is known as policy partnership.

HMRC self assessment

Self-assessment is a system HMRC created to get Income Tax. As a rule, Income Tax is usually taken out automatically from your wages/pensions/savings. However, if you have any other income, you must report it in a special tax return. This return must be submitted to HMRC after the end of the tax year which is the 5th of April. You must send a tax return if you are:

- Self-employed as a “sole trader” and earned more than £1,000 in a particular tax year.

- A partner in a partnership.

The type of income also matters, though:

No special tax return: if your income is only from wages and pension.

Must send tax return: if there is income coming from renting out a property; tips and commission; saving, investments and dividends; foreign income.

HMRC offers a tool to find out whether you need to file a tax return.

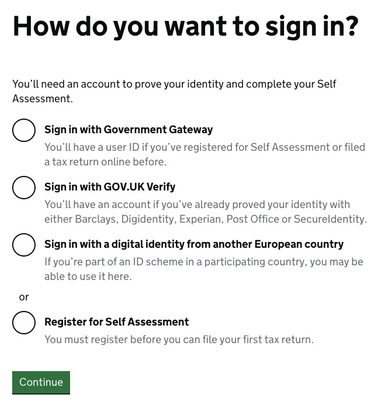

Once you know that you need to do it, you can send it either in a paper form and online. To file the documents, you would need to sign in the system and prove your ID.

HMRC personal tax account

HMRC personal tax account allows you to:

- Check your Income Tax estimates and your tax code

- Manage your personal tax return (fill it in, send and view)

- Claim a tax refund

- Check out and manage your tax credits

- Check your State Pension

- Check and track the tax forms that you have submitted online

- Check and update your Marriage Allowance

- Report to HMRC if you change your address

- Check and update benefits you get from work (e.g. company car details or medical insurance)

- Find out your National Insurance number

As a business, you register within HMRC if you have set up a limited company or other type of organisation that needs to pay Corporation Tax; or, your business operates PAYE because you have started to employ people; or, you need to charge VAT because your taxable turnover is over £85,000.

HMRC VAT

If your business VAT taxable turnover exceeds £85,000, you must register your business for VAT within HMRC. The department helps you to calculate the turnover.

Once you register for VAT within HMRC, you will be able to view and manage tax returns in an online VAT account. You must:

- Charge the right VAT sums

- Pay VAT to HMRC

- Submit your VAT returns

- Keep VAT records and account

HMRC tax refund

If it comes to your mind that you might have overpaid taxes, you can try and get a tax refund. You can do this if you have paid too much tax on:

- Pay from your current/previous job

- Pension payments

- Income from life/pension annuity

- A redundancy payment

- A Self Assessment tax return

- Interest from savings or PPI

- Foreign income

- UK income if you live abroad

- Fuel costs and work clothing for your job

The type of the payment you want to get a refund on defines your course of action — which you can check out at the HMRC website. You will have to answer several questions before HMRC tells you what to do next.

HMRC how to pay

You can pay HMRC directly through the corresponding links. Here is what you can pay for:

- Air Passenger Duty

- Alcohol duties

- Capital Gains Tax

- Child Benefit overpayments

- Construction Industry Scheme (through PAYE)

- Corporation Tax

- Environmental

- Fuel Duty

- Gambling duties

- Income Tax and National Insurance

- Inheritance Tax

- Insurance Premium Tax

- Money laundering regulation fees

- PAYE

- Pension schemes

- Property taxes

- Self Assessment

- Shares

- Soft Drinks Industry Levy

- Tax credit overpayments

- VAT

- Other payments like (taxes, penalties or enquiry settlements, Intrastat penalties)

HMRC contact

The way to contact HMRC is defined by the issue you what to know. First find what you are interested in, and then go ahead with checking out how to address this question to HMRC.

For example, if you have corrected errors in your VAT return and want to know for sure that HMRC is aware of it, call 0300 200 3700.

Appealing HMRC tax decisions

If you do not understand why you have been taxed, try to reach HMRC for help and explanation . However, if you have made your own counting and are sure that they are wrong, you can always appeal the tax decisions.

When you send the appeal, you will get a letter from HMRC — letting you know if you can appeal against this particular tax decision. Your appeal can be done by someone who deals with your taxes, for example, your accountant. You usually will have to pay your own costs if you appeal a decision. You can also delay tax payment while appealing.

Here is a list of issues you might try to appeal:

- A tax bill (Self Assessment, Corporation Tax, VAT)

- A tax relief claim

- A request for information or to check your business records

- A penalty (for example, if you filed or paid a tax return late)

Want to set up a limited company in the UK online? Get in touch with us and we will assist you.