Getting Started With Bookkeeping – Guide for Beginners

- Modified: 8 September 2023

- 7 min read

- Running a Business

Lim Wan Er

Author

Always game for a good cup of iced latte and soggy fries, Lim Wan Er indulges in a solo vacation at least once a year for the sole purpose of exploring the local cuisine.

Bookkeeping is the process of maintaining records of your company’s financial transactions and balancing these against your bank statement. It’s essential for a business to thrive as it helps you understand the money coming in and out of your business. It’s also a crucial part of reporting to the government and paying taxes. Use our helpful guide to find out what you need to get started.

What Is Bookkeeping and Why Is It Important?

When you run a business it’s important to keep track of your finances by recording, classifying and organising financial transactions such as:

- Sales of your products or services

- Supply purchases

- Deposits

- Money transfers

- Bill payments

- Salary and bonus payouts

- Taxes

- Bank statement balances

Our bookkeeping services offer comprehensive support in managing these financial transactions. We ensure accurate recording and classification of your financial data, providing you with organised records that are essential for making informed business decisions and ensuring compliance with tax regulations.

Bookkeeper Meaning and Specifications

The core role of a bookkeeper is to keep regular, accurate records of a company’s financial activity, balancing it against your bank statement and summarising it into reports. They may also have wider responsibilities like invoicing, paying bills, payroll duties and preparing tax returns.

Sometimes bookkeepers also take on a strategic role, developing forecasts, looking at how to increase business revenue or reviewing internal systems.

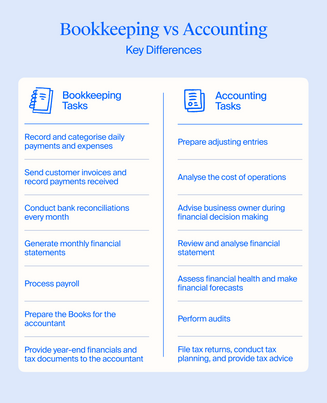

Bookkeeping vs Accounting: What’s the Difference?

The process of keeping books comes before accounting. It involves gathering data on day-to-day transactions and collecting relevant documents, such as invoices and receipts. This data is sorted into categories like ‘credit’ and ‘debt’, and recorded into a system like a physical ledger, a spreadsheet or bookkeeping software like Osome.

Accounting comes next, it analyses and summarises the data to provide reports that show how much tax is owed.

Bookkeeping Basics – Methods Every Beginner Should Know

It’s important to pick the method that suits your needs:

- Single-entry – uses one listing for each transaction

- Double-entry – a system that ‘balances’ the accounts by recording transactions as both debits and credits

You’ll also need to decide if you use a cash basis or accrual basis. Cash basis accounting records the transaction when money is received or paid and accrual basis records the transaction when it occurs.

Cash Receipts and Cash Disbursements

Cash disbursements are payments made with cash or a cash equivalent, such as a cheque. Tracking these allows you to see whether the money flowing in and out of your business is positive or negative.

If you use the accrual basis for your accounts, disbursements are reported when they are generated, not when they are actually paid. For example, someone raises an invoice in November, when work is completed, and that amount is attributed to November, but the invoice may be paid 30 or even 60 days later.

Inventory Account

Inventory is the stock you purchase and plan to sell on to customers. Inventory accounting lists the value of these items as assets on your balance sheet. It helps you set prices and budgets by taking account of fluctuations in the value, like a change in market price, or items getting old or damaged.

Loans Payable

Loans payable includes three main things:

- Receipt of loan

- Repayment of loan principal (the original sum you agreed to pay back)

- Interest expense

Any principal on a loan that is payable within the next year is classed as a current liability on the balance sheet. Portions of the principle that are payable in more than one year are classed as long-term liabilities. Interest on the loan that has to be paid in future is only recorded in your accounts when it becomes an actual liability.

Payroll Earnings

Payroll looks at a number of types of payments associated with staff, including employee earnings, holiday pay, sick pay, paternity, and maternity pay, and various taxes. Analysing these costs is a useful basis for setting staff salaries and calculating payroll costs.

Retained Earnings

If your business pays dividends to shareholders, retained earnings are something you’ll need to track. As the name suggests, it refers to the cumulative net earnings or profits retained after you have accounted for dividend payments. These are carried into the next financial year.

What Should I Pay Attention to When Doing Bookkeeping?

Bookkeeping requires accuracy. You’re collating information from a number of sources, including receipts, invoices and bank statements.

If you’re using accounting software, information will need to be inputted and then matched to data that’s automatically imported from your bank account. That helps with accuracy as you’re matching the two sources together (the process is called «account reconciliation»).

Best Practices for Bookkeeping

Bookkeeping involves lots of repetitive tasks that need to be done accurately.

Creating checklists for regular accounting tasks like updating your cash flow forecast and inputting receipts helps to make sure you’re carrying out each step correctly. Book time in your diary so that you stay on top of everything.

Technology can help. If you use accounting software, it’s easy to input receipts as soon as you spend money. You can take a photo of a bill in a restaurant, for example.

Consider using outsourced bookkeeping or accounting services to reduce the amount of time you spend on administrative tasks and ensure everything is done correctly.

Finally, keep your personal and business finances separately. That means using separate bank accounts and avoiding spending your own money on business expenses where possible.

How Does Bookkeeping for a Small Business Work?

It’s easy for entrepreneurs and small businesses to get overwhelmed by financial records. Follow the best practice rules above and set out clear internal bookkeeping procedures, such as who processes post, invoices and payroll.

It’s common for small business owners to use a professional bookkeeper. They have the expertise to process financial information correctly and reduce the amount of time you have to spend doing your finances.

Make Sure to Track Financial Transactions

Digitally tracking your transactions is hugely beneficial — it’s more efficient, avoids loss and duplication, reduces the risk of human error and keeps everything in one central place.

Track your transactions in three simple steps:

- Connect your accountancy software to your bank account

- Categorise your transactions

- Ditch physical receipts by digitally capturing paper receipts

Conduct a Monthly Reconciliation of Your Bank Accounts

This fundamental task involves comparing your record of sales and expenses against your bank statement. Open your ledger of accounts alongside your bank statement and compare the entries one by one. If anything is missing, investigate the reason to avoid missed payments or overpayments.

In accounting software, these transactions are presented side by side and much of the information can be automatically calculated. You can also set up rules for regular transactions, so that they’re reconciled automatically. This makes the process significantly easier.

Daily, Monthly and Annual Bookkeeping: The Difference

Keep on top of your books on a daily, monthly and annual basis:

- Daily – Keep track of day-to-day documents, costs and income

- Monthly – Month-end reports should include bank reconciliation, accounts receivable and payable, inventory reporting and payroll. Check your cash for forecast against your bank statement

- Annual – Create an annual overview of your income and cash flow

Conclusion

Keeping financial records is a fundamental part of every business’s operations. It gives you a clear picture of the money coming into and out of your business and provides the data you need to budget and forecast with confidence. There are many different systems and it’s important to choose one that suits the size of your business and the number of transactions you handle.

FAQ

What is bookkeeping in accounting?

It involves gathering information about and organising all your financial activity, such as sales, money transfers and bill payments. The other core aspects are comparing your books to your bank statement and monthly reports. You’ll need to decide the best method for you, from single or double entry, cash basis or accrual basis. The process is often completed by a professional bookkeeper.

What is double entry bookkeeping?

The double-entry method works on the premise that there are at least two entries for each transaction, taking account of all the associated impacts of money being spent or earned. For example, when you make a loan repayment, it reduces your liability and is recorded as a payment.

What is virtual bookkeeping?

All your data and financial records are digitised in one central place. Osome’s easy-to-use cloud software takes care of tracking and categorising transactions, automates invoice reconciliation and prepares the reports you need to run a business.

What is the role of a bookkeeper?

A bookkeeper ensures your documents are in order and that there are no mistakes in reporting. Well-maintained books mean you don’t miss an invoice or pay the wrong account and help you avoid paying incorrect tax or facing fines.

What is the best free software for keeping books?

Osome offers pricing plans that are based on your company’s monthly revenue. This means you only pay for the bookkeeping services you need and you can easily upgrade when you scale.

More like this

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?