A Complete Guide to Cash Basis Accounting

- Modified: 25 February 2025

- 9 min read

- Running a Business

Gabi Bellairs-Lombard

Author

Gabi creates content that inspires. She's spent her career writing compelling website copy, and now she specialises in product marketing copy. As the voice of our products and features, Gabi makes complex business finance and accounting topics easy to understand. Her top priority is ensuring that her words impact and inspire her readers.

Cash basis accounting is as simple as it sounds: businesses record revenues when they’re received and expenses when they’re paid. Ideal for small businesses and individuals, this method strips away complications and shines with tax benefits. Meanwhile, accrual accounting recognises income and expense once it's incurred. This article breaks down the pros and cons of each accounting method so you can decide if cash basis accounting is right for your business.

Key Takeaways

- Cash basis accounting only records revenue and expenses when a transaction occurs. Accrual accounting records the revenue and expenses upon insurance regardless of transaction status.

- The cash method simplifies bookkeeping and comes with tax benefits as you record expenses and report income on the go, allowing certain transactions to be reported in the next accounting period. However, the GAAP prefers the accrual method.

- The cash method may overlook liabilities or overstate financial performance if accounts receivable and payable aren’t considered.

What Is Cash Basis Accounting?

Cash basis accounting documents the actual money movement, creating a real-time snapshot of how money goes in and out of your company. The cash basis method of accounting focuses solely on the present and excludes any upcoming payments and expenses.

Osome offers expert accounting services specifically designed to provide a more in-depth understanding of your business's health and help you navigate tax complexities. We'll ensure your finances are in order so you can focus on growing your business.

Examples of cash basis accounting

A house painting service that uses cash basis accounting completed a job in April but wouldn't get paid until May. Hence, it will only record revenue for that job in May after the money is received.

Similarly, the business will record its April electric bill once it is paid in May versus when the bill was received. This gives the business owner more leniency, especially if they rely on a business line of credit.

Who should use cash basis accounting in business?

Cash basis accounting is the preferable accounting method for small businesses, individuals, and cash-only or cash-dominant businesses. This accounting method accurately reflects the ins and outs of money in real-time.

How Does Cash Basis Accounting Work?

Cash basis accounting documents the actual money exchange. A small business that uses cash basis accounting method records revenue when a payment is received: not before, not after. Expenses are recorded the same way, but they are only logged when money leaves your bank account. For tax purposes, a business should record the actual purchases made using a business credit card instead of the payments made to the credit card balance.

In short, cash accounting means every transaction has happened with no hypotheticals.

Why should you use cash basis accounting?

Cash basis accounting ensures easy tracking and cash flow management, allowing someone to only switch to the more complex accrual accounting when business grows. By only recording transactions as payment or expense takes place, cash basis accounting turns bookkeeping into a straightforward task, even for those who aren’t financial gurus.

Moreover, the tax benefits of cash basis accounting cannot be overstated for small businesses. It offers a strategic tool to control the timing of income and deductions, potentially easing tax burdens.

Handling accounts receivable and payable

Within cash basis accounting, accounts receivable and payable don’t exist until they materialise as actual cash transactions. The balance sheet in this realm is free from the hypotheticals of what’s owed or due until the cash has physically entered or left the business.

This means business transactions are documented solely when the cash is in hand or out the door, providing a true reflection of company finances at that time.

Tax Benefits for Small Businesses

When it comes to taxes, small businesses have a trusted friend in cash basis accounting. With the ability to recognise income when it’s actually in the bank and deduct expenses when paid, smart business owners can navigate the tax waters with more control and pay income tax more easily, making this accounting option extremely profitable for small companies.

Thanks to the Tax Cuts and Jobs Act, more small businesses can now fly the cash basis flag, with those with average annual gross receipts of $30 million or less can use this method. It simplifies inventory accounting and makes sure there’s enough cash in the bank to meet tax obligations without breaking a sweat. Plus, it gives a clearer picture of revenue from business records.

Pros and Cons of Cash Basis Accounting

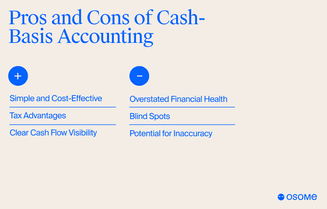

Cash basis accounting has its advantages and disadvantages. It offers a streamlined approach that can make tax time less taxing and provides a clear view of the cash on hand. However, it may not always fully picture a business’s long-term financial trajectory.

Benefits of using cash basis accounting

Cash basis accounting, also known as cash accounting, is alluring because of its simplicity and cost-efficiency.

It’s a user-friendly way to make the daunting task of bookkeeping feel like a gentle breeze. Small business owners, in particular, can benefit from its tax advantages, effectively planning their fiscal year to optimise tax outcomes.

Additionally, the immediate visibility into available cash ensures that a business knows exactly how cash-rich or cash-poor it is at any moment, allowing for more informed financial decisions.

Drawbacks of using cash basis accounting

Despite its simplicity, cash basis accounting can sometimes present a misleading picture of a company's performance.

Accounts payable often exceed the cash reflected on the books, which can paint an inaccurately rosy picture. Additionally, the method’s exclusion of accounts payable and receivable from the financial records can leave a business blind to incoming and outgoing financial currents, potentially leading to overlooked unpaid debts or misconceptions about money available for spending.

Moreover, the temptation to manipulate financial data by delaying payments or deposits can lead to potential inaccuracies in operating cash flow.

What Is Accrual Basis Accounting?

Accrual basis accounting, the counterpart to cash basis accounting, takes a broader view, recognising revenue and expenses when they are earned or incurred, not just when cash changes hands. It’s built on the matching principle, ensuring that a business's financial tapestry is woven with threads of transactions tied to their appropriate periods, regardless of cash flow.

Accrual-based accounting paints a more accurate picture of business performance by reflecting:

- nuances of revenue and expenses as they happen over time

- trends and patterns

- impact of everything

This approach gives a more complete and accurate view of the business’s financial situation, allowing for better decision-making and planning.

What Is the Difference Between Cash Basis Accounting and Accrual Basis Accounting?

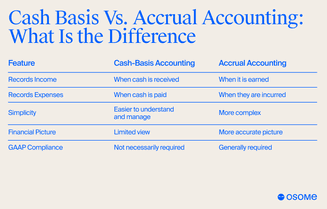

Timing is everything when assessing the differences between cash basis and accrual accounting. They lie in when they recognise revenue and expenses.

Key features of Cash Basis Accounting

The cash basis method may reflect a rollercoaster of profitability that aligns strictly with cash movement. It:

- Recognises revenue when cash is received and expenses when cash is paid.

- Easier to understand and manage, especially for sole proprietorships.

- Doesn't necessarily comply with Generally Accepted Accounting Principles (GAAP).

- It may not provide the full picture of a company's financial health, as it ignores outstanding debts and future income.

The cash basis accounting method records income when received and expenses when paid. It's simpler but may not provide the full picture of a company's health.

Key features of Accrual Basis Accounting

The accrual method provides a smoother picture of earnings over time. It:

- Recognises revenue when earned, regardless of when cash is received.

- Recognises expenses when incurred, regardless of when cash is paid.

- Shows a more accurate picture of a company’s financial performance and of its overall liabilities.

- Required for companies that follow GAAP.

- More complex and requires a more advanced accounting system.

While cash basis accounting captures the financial story as cash enters and exits, the accrual method records the chapters of income and expenses as they are generated, offering a continuous and comprehensive tale

Which Accounting Method Aligns with GAAP?

The accrual method receives the generally accepted accounting principles (GAAP) seal of approval in financial reporting. Cash basis accounting, with its occasional misleading or inaccurate picture, cannot walk through the gates of audited financial statements, a requirement for companies that adhere to the rigorous standards of GAAP.

As businesses grow and their financial narratives get more complicated, a transition to accrual accounting becomes not just an option but a necessity. It ensures regulatory compliance and provides a more accurate representation of company health, a crucial factor for making informed decisions that propel business growth.

How To Choose the Right Accounting Software

In the digital age, the right accounting software can navigate your financial journey, especially when using cash basis accounting. The ideal software should simplify cash flow management and suit the business's specific needs, be it through automation, compatibility, or ease of tax preparation.

Options abound, including:

- Osome’s AI-powered processes

- ABSS’s user-friendly interface

- Express Accounts’ cost-effective solutions for small teams

- QuickBooks’ advanced features for complex transactions

The choice boils down to a blend of functionality and simplicity that resonates with the business’s unique financial rhythm. For example, if your company uses accrual accounting, a tool that automatically tracks subscription renewals and upcoming expenses may suit you more.

If you're unsure which method to choose, contact us! In Osome, you can consult with a professional accountant who can advise you based on your specific circumstances.

Summary

Cash and accrual accounting are two of the most common bookkeeping methods, and knowing the differences between the two is crucial. The simplicity of cash basis accounting may attract a small business owner, whereas the comprehensiveness and tax compliance of accrual accounting may be preferred by growing enterprises. Armed with the right accounting software, you can chart a course that reflects your business’s current financial status and steers you towards future prosperity.