How to Find an Accountant for a Small Business? The Ultimate Guide

- Modified: 4 February 2025

- 10 min read

- Running a Business

Heather Cameron

Author

Heather is here to inform and inspire our readers. Boasting eight years in the world of digital marketing, working in diverse industries like finance and travel, she has experience writing for various audiences. As Osome’s resident copywriter, Heather crafts compelling content, including expert guides, helpful accounting tips, and insights into the latest fintech trends that will help entrepreneurs, founders and small business owners in Hong Kong take their businesses to the next level.

Sherman Ieong

Reviewer

Sherman Ieong is our Accounting & Tax Manager based in Hong Kong. She is on hand to help our writers level-up our blog posts and guides by making sure the information is accurate, informative and inspiring. Osome’s all-in-one accounting services make managing tax effortless - and that’s exactly what Sherman ensures we do with our Hong Kong-focused blog content, applying her knowledge of day-to-day bookkeeping, monthly financial reporting, Profits Tax Returns and much more.

Finding an accountant for your small business is essential for managing finances and staying compliant with tax laws. This guide will show you how to find an accountant for small business activities, covering the services they offer and tips for evaluating their qualifications and costs. You’ll get clear steps to make an informed decision.

Key Takeaways

- Small business accountants perform essential roles in tax preparation, financial insights, bookkeeping, and payroll services, which are crucial for maintaining the financial health of a business.

- To find the right accountant, business owners should follow structured steps, including identifying specific needs, seeking referrals, evaluating qualifications, and assessing communication skills.

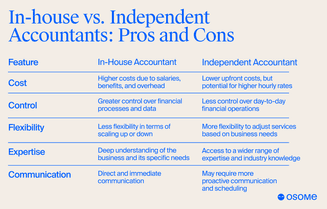

- Choosing between an in-house or independent accounting consultant depends on a business’s specific needs and budget, with in-house options offering tailored services and immediate access, while independent accounting firms provide flexibility and cost-effectiveness.

What a Small Business Accountant Does?

A small business accountant wears many hats, acting as a financial advisor, tax preparer, and record keeper. They play a vital role in examining your business finances, preparing detailed financial reports, and ensuring that all financial data is accurate and up-to-date. Their primary responsibilities span tax advice, financial analysis, and bookkeeping, making them indispensable to your business’s financial health.

From invoicing and bill payments to transaction categorisation and payroll processing, small business accountants provide a wide range of services, including tracking of direct deposits, that keep your business running smoothly. They are also crucial during tax time, helping you prepare and file income tax returns while ensuring compliance with tax laws and maximising tax benefits. Additionally, they analyse cash flow, manage inventory, and develop pricing strategies to support your business’s growth.

Osome offers comprehensive accounting services tailored for small businesses in HK. Our team of experienced accountants can handle all your accounting needs, including bookkeeping, tax preparation, and financial reporting. Knowing your finances are in the hands of experts allows you to focus on growing your business with confidence.

Small business accounting is essential for maintaining financial health.

Tax preparation and filing

One of the most critical roles of a small business accountant is tax filing and preparation. They help you navigate the intricate maze of tax laws, ensuring your business complies with all regulations and avoids penalties. Accountants can identify ordinary and necessary expenses to maximise your savings on business taxes and ensure you benefit from all possible tax deductions.

During tax season, a good accounting professional will prepare and file your tax returns accurately and on time. They will also offer strategic advice on structuring your business to achieve tax efficiency. Their expertise in laws and regulations ensures that your business remains compliant, reducing the risk of audits and penalties.

Financial management and planning

Financial management and planning are essential for the long-term success of any small business. Accountants provide invaluable insights by analysing financial patterns, preparing budgets, and forecasting future performance. These insights support informed decision-making, enabling you to manage your cash flow more efficiently and effectively.

Accountants create detailed budgets to allocate resources aligned with your business goals. They also identify trends and assist in setting financial targets, developing cost strategies, and saving for future expansion. Their guidance ensures that your business remains financially healthy and poised for growth.

Bookkeeping and payroll services

Bookkeeping, account setup, and payroll services are the backbone of any small business’s financial operations. Accountants manage these essential day-to-day tasks, ensuring that all financial records are accurately maintained. This includes handling payroll deductions and submissions to tax authorities, which is crucial for compliance and employee satisfaction.

Accurate bookkeeping is always in the best interest of your business and helps ensure your company's growth. Accountants ensure that your financial statements are up to date, which is essential for making informed business decisions and preparing for tax time. Their expertise in managing both payroll and bookkeeping services helps keep your business running smoothly.

5 Steps on How To Find an Accountant for Your Small Business

Finding the right accountant or accounting firm for your small business can seem daunting, but it’s a crucial step in helping your business grow. Following a structured approach can simplify this process and help you find an accountant who understands your needs and can provide the right support. Here are five steps to guide you through the process.

These steps include identifying your specific accounting needs, seeking referrals, evaluating qualifications, assessing communication skills, considering costs, verifying credentials, and signing an engagement letter. Each step is designed to help you make an informed decision and find a potential accountant who will be a valuable asset to your business.

| Step | Description |

| 1. Identify your specific accounting needs | Define the accounting services required based on business size and complexity. |

| 2. Seek referrals and recommendations | Get recommendations from other business owners, professional networks, and online directories. |

| 3. Evaluate qualifications and experience | Check credentials like CPA or enrolled agent status and assess their experience with similar businesses. |

| 4. Assess communication and compatibility | Ensure the accountant can use your preferred accounting software and has good communication skills. |

| 5. Consider cost and fees | Compare pricing structures (hourly vs. fixed fees) and assess affordability. |

Step 1: Identify your specific accounting needs

Understanding what your business requires in terms of accounting services will guide your search and ensure you find a good fit. Whether you need comprehensive help with business processes or specific services like tax filing or bookkeeping, knowing your needs is crucial.

Consider the complexity and scale of your business operations as you outline your business plan and consider how they might evolve in the future, especially if you operate in a niche industry. Clearly define your financial goals with the help of financial advisors and communicate these effectively to potential accountants. This will help you find an accounting firm that can provide the services you need and support your business’s growth.

Step 2: Seek referrals and recommendations

Seeking referrals and suggestions like personal recommendations, networking and online directories from other small business owners can be incredibly helpful in finding a good accountant. Personal recommendations provide valuable insights into an accountant’s reliability and effectiveness. Networking on platforms like LinkedIn can also help you find professional accountants through your connections and online communities.

Utilising professional networks and other online communities can streamline your search for the best accountants. Look for accountants with high ratings and positive reviews from your network to ensure you find someone trustworthy and competent. These helpful resources can be invaluable in your quest to find the right prospective accountant.

Step 3: Evaluate qualifications and experience

Evaluating an accountant’s qualifications and experience is a critical step in the selection process. Look for recognised certifications such as CPA or enrolled agent status to verify their credentials, and consider if they hold an accounting degree or related bachelor's degree.

Consider their experience with different business structures and their track record with clients similar to your business. Request references and case studies to gauge their problem-solving skills and reliability. This will help you find a good accountant who can meet your evolving needs and support your business’s growth.

Step 4: Assess communication and compatibility

Communication and compatibility are key factors in choosing a qualified accountant. Ensure the accountant is familiar with the accounting software your business uses, as this will facilitate efficient management of financial assets. Assess their technical skills and ability to integrate seamlessly with your existing systems.

Meet face-to-face with multiple accountants to gauge your comfort level and assess their communication skills, ensuring the accountant helps facilitate a seamless collaboration. Ask for references to understand how they interact with clients and resolve issues.

Finding a prospective accountant who communicates well and fits with your business culture is essential for a successful partnership.

Step 5: Consider cost and fees

Cost and fees are important considerations when selecting a business accountant. Small businesses typically spend between $1,000 and $5,000 annually on accounting services. Accountants may charge hourly rates or fixed fees, so it’s crucial to understand the billing methods and choose one with an accountant cost that fits your budget.

Outsourcing accounting services can reduce overall costs compared to employing a full-time accountant, making it a cost-effective option for the self-employed. Be aware of additional potential costs like accounting software fees and consultation charges. Understanding these costs, including the median salary of accountants for in-house options, will help you plan your budget effectively and save money.

Step 6: Verify credentials and insurance

Verifying an accountant’s credentials and insurance is crucial to protect your business from potential liabilities. Ensure your accountant is licensed and insured.

Check for any disciplinary actions or complaints against them to ensure they have a clean professional record.

Step 7: Sign an engagement letter

The final step is to sign an engagement letter that outlines the scope of services, fees, and responsibilities. Review this document carefully to ensure it meets your specific needs.

This written agreement protects both parties and sets clear expectations for the professional relationship.

In-house vs. Independent Accountants

Choosing between an in-house accountant and an independent accounting firm can significantly impact your business. Full-time accountants provide direct interaction and immediate access to financial expertise, making them suitable for businesses with complex and frequent financial needs. On the other hand, independent accountants offer flexibility and can be a cost-effective option for small businesses with varying needs.

Consider your business’s specific requirements and preferences when deciding between these options. Each has its advantages, and the right choice depends on your business’s unique financial situation and growth prospects.

Benefits of an in-house accountant

Choosing to hire an accountant can offer numerous benefits, especially for businesses with complex financial operations. Full-time accountants provide exclusive access to their expertise, ensuring that your business’s financial needs are met promptly and efficiently. This direct interaction enhances communication and responsiveness, ensuring the accountant helps your business make timely financial decisions.

These full-time accountants can also offer tailored advice based on their deep understanding of your business’s operations and finances. This can be particularly beneficial for businesses experiencing rapid growth or dealing with complex transactions.

Advantages of hiring an independent accountant

Independent accounting consultants can be a cost-effective alternative to choosing to hire an accountant. They offer a range of services from basic bookkeeping to complex financial advisory roles, providing flexibility for small businesses. Independent accounting firms are often more affordable, making them a suitable choice for small businesses or the self-employed with limited budgets.

Small accounting firms can provide personalised attention and specialised expertise, which can be particularly beneficial for very small businesses. If you hire an accountant, it’s essential to establish clear expectations regarding communication and response times to ensure a smooth working relationship.

Evaluating costs and expertise

When choosing between in-house and contracted accountants, it’s important to evaluate the costs and expertise associated with each option. In-house accountants provide immediate access to financial expertise, which can be beneficial for businesses with frequent and complex financial needs. However, they can be more expensive due to salary and benefits costs.

Independent accounting firms offer flexibility and cost savings, especially for small businesses with varying needs. Understanding the different billing methods, such as hourly rates versus fixed fees, is crucial for budgeting.

Additionally, consider any potential software fees and consultation charges that may apply.

Summary

In summary, finding the right accountant for your small business involves a careful evaluation of your specific needs, seeking referrals, assessing qualifications and compatibility, considering costs, and verifying credentials. Whether you choose an in-house or independent accounting firm, the right professional can provide invaluable support in managing your business finances and ensuring compliance with tax laws.

Being informed before you hire an accountant can significantly impact your business’s growth prospects. By following the steps outlined in this guide, you’ll be well-equipped to find a business accountant who meets your needs and helps your business thrive.

For expert financial guidance tailored to your HK small business, look no further than Osome! We offer a comprehensive suite of accounting services, from bookkeeping and tax compliance to financial reporting and strategic financial advice. Contact us today to learn more and see how we can help your business reach its full potential!