Limited Partnership Fund in Hong Kong

- Published: 23 April 2024

- 12 min read

- Starting a Company

Gabi Bellairs-Lombard

Business Writer

Gabi creates content that inspires. She's spent her career writing compelling website copy, and now she specialises in product marketing copy. As the voice of our products and features, Gabi makes complex business finance and accounting topics easy to understand. Her top priority is ensuring that her words impact and inspire her readers.

Are you in the process of navigating Hong Kong’s financial landscape? A Limited Partnership Fund (LPF) could be your key to leveraging private equity and venture capital investments. Renowned for its tax advantages, tax concessions and strategic position in the Asian market, the Hong Kong Limited Partnership Fund (LPF) stands out as a distinct and beneficial investment structure. This article will guide you through the advantages, establishment, and management of an LPF in Hong Kong without delving into technical jargon.

Key Takeaways

- A Limited Partnership Fund is a partnership-based investment vehicle registered in Hong Kong, featuring two main roles: The general partner, whose role involves managing investments and the LPF and the limited partner, who invests capital and has limited liability.

- A Limited Partnership Fund enjoys several benefits in Hong Kong, including profits tax exemption for qualifying transactions, strategic access to Mainland China markets and a supportive legal and regulatory environment that aligns with international standards.

- The LPF registration process involves submission by a licensed Hong Kong law firm or solicitor, adherence to specific formation criteria like having a Hong Kong office and compliance with annual reporting, AML standards, and potentially SFC licensing for regulated activities.

What Is a Limited Partnership Fund (LPF)?

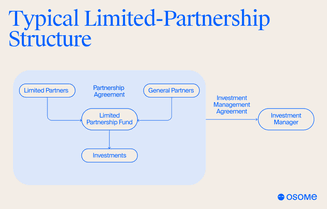

A Limited Partnership Fund (LPF) is an investment fund structured as a partnership designed to manage investments and generate returns for its investors. Under the limited partnership fund regime, these structures are registered with the Hong Kong Companies Registry, which places them under the jurisdiction of Hong Kong. This unique Hong Kong fund structure is utilised by various types of private investment funds, such as venture capital funds and private equity funds.

In the realm of a Hong Kong LPF, two key roles stand out - the general partner and the limited partner. The general partner is the decision-maker, taking on the responsibility of managing the LPF, while the limited partner is the investor, contributing capital in return for potential income and profits. We’ll now examine the roles of both the general partner and limited partner as well as the legal framework that governs a Hong Kong LPF in more detail.

Embarking on a business venture in Hong Kong? Our comprehensive company registration services are tailored to streamline the process, ensuring a smooth and hassle-free experience. From navigating the regulatory landscape to facilitating the necessary paperwork, our expert team is dedicated to assisting you every step of the way.

Key components

At the heart of a Hong Kong LPF are its partners - the general partner and the limited partner. An LPF must have at least one of each. The general partner is the navigator and decision-maker, responsible for the management and control of the LPF. The general partner will also appoint key service providers and bear unlimited liability for all the debts and obligations.

On the other hand, we have limited partners, such as investors in the LPF. They provide the capital and are entitled to income and profits from the LPF without having to engage in daily management or asset management duties. Their liability is limited to the amount they have contributed as capital.

However, if a limited partner takes on a management role, they risk becoming jointly liable with the general partner for liabilities incurred during their period of management.

Legal framework

The Limited Partnership Fund Ordinance (LPFO) is the cornerstone of the legal framework for LPFs in Hong Kong. Enacted in 2020, this legislation has fortified Hong Kong as a premier global asset management and wealth management centre. A key aspect of the LPFO is that an LPF is not recognised as a separate legal personality from its partners, meaning it lacks a legal personality of its own.

The LPFO grants a significant degree of contractual freedom to LPF partners. They have the liberty to make decisions about the operational aspects of the fund, such as the admission and exit of partners, interest transfer policies and investment decisions concerning investment scope and strategy. However, to be eligible for registration under the LPFO, a fund must meet specific criteria, including having a registered office within Hong Kong to facilitate communication and notice servicing.

Advantages of Establishing a Limited Partnership Fund Regime in Hong Kong

Establishing an LPF in Hong Kong comes with a plethora of advantages. The city’s advantages include:

- Strategic location

- Mature financial services

- Supportive legal infrastructure

- The proximity of Hong Kong to Mainland China, which opens up opportunities for LPFs to tap into this massive and growing market

Collectively, the tax incentives, enhanced connectivity with China, and the role of Hong Kong as a financial epicentre, shape an attractive ecosystem for establishing and operating a Limited Partnership Fund in Hong Kong. We’ll further explore these advantages and understand how they contribute to making Hong Kong an ideal choice for LPFs.

Profits tax exemption

One of the significant advantages of establishing a Hong Kong LPF is the potential for profits tax exemption. As per the Inland Revenue (Profits Tax Exemption for Funds) (Amendment) Ordinance 2019, all funds, including LPFs, may be exempt from profits tax if they fulfil certain conditions.

To qualify for the exemption, the LPF must generate profits from ‘qualifying transactions,’ which include:

- Securities

- Shares

- Debentures

- Futures contracts

- Instruments of private companies

Special Purpose Entities (SPEs) owned entirely or partly by LPFs can also enjoy the profits tax exemption provided they adhere to the stipulated conditions. In addition to this, LPFs established in Hong Kong are not subject to capital gains tax, making them an attractive investment vehicle.

Access to Mainland China markets

Hong Kong is in a unique strategic position to offer several advantages to LPFs. The proximity to the Greater Bay Area andthe city’s role in the internationalisation of the renminbi offer distinct market access advantages and increased investment scope for LPFs. Limited Partnership Funds are aimed at bolstering capital investment into companies, particularly supporting the growth of start-ups in the Greater Bay Area’s burgeoning technology and innovation sector.

Moreover, the Stock Connect program enhances Hong Kong LPFs’ access to Mainland China’s equity markets, including the Hong Kong stock market. Proposed expansions of this program would deepen this access by bringing international players into the Southbound channel, leveraging Mainland China’s capital for fundraising ventures in Hong Kong.

Regulatory environment

The supportive regulatory environment in Hong Kong is another distinctive advantage for LPFs. They are typically not required to be registered and authorised by the Securities and Futures Commission (SFC) unless they are targeting retail investors, simplifying regulatory procedures for these investment vehicles.

However, to ensure financial transparency and accountability, LPFs must:

- Appoint a Hong Kong-registered auditor

- Arrange proper custody of the fund’s assets

- Appoint a responsible person to handle anti-money laundering (AML) compliance

These requirements align the LPF regime with international AML standards.

Registration Process and Requirements

If you’ve decided to establish an LPF in Hong Kong, it’s essential to understand the registration process. The general partner or investment manager must submit an application to the Hong Kong Companies Registry. This application must be done by a Hong Kong-registered law firm or solicitor.

Once registered, the LPF must file annual returns and inform the Hong Kong Companies Registry of any changes in particulars. If the general partner is an LPF or a non-Hong Kong limited partnership without legal personality, an authorised representative must be appointed. Professional legal advisors can provide guidance throughout this process and ensure ongoing compliance with the Limited Partnership Fund Ordinance.

Formation and the Limited Partnership Agreement

The formation of a limited partnership registered as an LPF requires at least one general partner and one limited partner. The fund must also have a registered office in Hong Kong. Central to the operation of the LPF is the Limited Partnership Agreement (LPA), which provides a legal framework for its management and operation.

There is no requirement for a minimum capital contribution for an LPF, offering flexibility in capital management. The Limited Partnership Agreement should specify in detail the responsibilities of the general partner, including asset and proper custody arrangements, financial record keeping and maintaining partner transaction records.

After formation, the LPF is obligated to raise external funding within two years to comply with the LPFO requirements.

Securities and futures commission

In addition to the registration requirements, the general partner or investment manager of an LPF conducting regulated activities in Hong Kong must obtain the appropriate Securities and Futures Commission (SFC) licenses. Some LPFs with regulated activity may be eligible for license exemptions, depending on the fund's specific arrangements. These exemptions are assessed on a case-by-case basis.

The general partner or investment manager must also appoint a responsible person to handle anti-money laundering (AML) compliance. The SFC provides clarification on licensing requirements for various entities, including LPFs, aiding in maintaining regulatory compliance.

Navigating Migration and Re-domiciliation

For existing foreign funds considering transitioning to an LPF in Hong Kong, the transition process is seamless and offers numerous advantages. The re-domiciliation process requires an application to the Companies Registry via a Hong Kong law firm and a statement confirming compliance with requisite conditions, including obtaining consent for de-registration from their original jurisdiction.

Successfully re-domiciling to the LPF regime in Hong Kong enhances a fund’s compliance with global tax standards by aligning domicile with economic substance requirements. Moreover, the transition process ensures continuity for the fund, as it does not constitute the creation of a new legal entity, thereby preserving all existing contracts, rights, and properties of the original fund.

Onshorisation and offshore funds

Hong Kong’s proactive initiatives in facilitating the transition of offshore funds to onshore ones offer unique benefits. Some of these initiatives include:

- A collaboration between Hong Kong and Shenzhen to facilitate venture capital investments for Hong Kong LPFs

- Accelerating the entry of Hong Kong LPFs into the onshore market

- Streamlining the administrative process

These initiatives aim to make it easier for offshore funds to transition to onshore funds and take advantage of the opportunities in Hong Kong’s wealth management centre market.

The Qianhai Authority in Shenzhen is committed to helping eligible Hong Kong LPFs establish investment entities in Qianhai. This is done under an expanded Qualified Foreign Limited Partnership (QFLP) scheme with a broader investment spectrum, which further enhances the appeal of Hong Kong as a preferred domicile for LPFs.

Migrating existing funds

Migrating existing funds to the LPF regime in Hong Kong is a smooth process that provides several benefits. Qualifying funds can migrate through a streamlined process that avoids disruptions to identity or continuity and eliminates profits tax or stamp duty.

Hong Kong’s LPF regime offers similarities to other jurisdictions, including no capital duties on capital contributions made, no Hong Kong stamp duty on transfers and safe harbour activities for limited partners. These factors constitute significant competitive advantages for funds pondering migration to an LPF in Hong Kong.

Dissolution and Winding Up of an LPF

Just as there is a process for forming an LPF, there is also a process for its dissolution. An LPF may be voluntarily dissolved according to the specific terms set in the Limited Partnership Agreement. Alternatively, in certain default situations, an LPF can be dissolved without the need for a court order.

Sometimes, dissolution may be involuntary. For instance, natural person, a partner of the LPF or a creditor has the statutory right to petition for court-ordered dissolution under prescribed circumstances. Following the dissolution of an LPF, necessary tax clearance must be obtained, ensuring all tax liabilities have been appropriately addressed.

Voluntary dissolution

The process for voluntary dissolution of a Limited Partnership Fund (LPF) is articulated within the Limited Partnership Agreement (LPA) and is typically uncomplicated. Voluntary dissolution can be activated by events outlined in the LPA, such as the fund reaching its term expiration, successful achievement of investment objectives, or other predefined triggers.

In addition to the LPA provisions, voluntary dissolution may also occur through the mutual consent of the partners. This feature underscores the flexibility inherent in the management of an LPF and the power of partner agreement in the process.

Involuntary dissolution

Involuntary dissolution of an LPF is a different story. It may occur by the order of a court, often initiated by a partner or creditor under prescribed situations that demand legal intervention.

Understanding this aspect of LPFs allows partners to be aware of their rights and options in complex situations, helping them navigate the landscape of investment funds more effectively.

Professional Support and Services

Managing an limited partnership ordinance is not a solo venture. It requires a myriad of skills and knowledge in investment, legal, risk and accounting disciplines. It also needs you to understand investment restrictions. Fortunately, Hong Kong offers a large pool of skilled professionals who can provide essential support in these areas, including:

- Investment advisors

- Lawyers who specialise in fund formation and compliance

- Risk management consultants

- Accountants and auditors

Professional advisors play a crucial role in navigating the intricacies of LPFs, from understanding the legal and regulatory framework to managing the daily operations of the fund. We’ll further explore the roles of these professionals and the services they provide.

Legal and regulatory guidance

Legal advisors are invaluable guides in the complex landscape of LPFs. They help navigate the Hong Kong Limited Partnership Ordinance, assisting LPFs in adhering to the regulatory framework and staying up-to-date with legislation changes.

The general partner, for instance, has core responsibilities such as the investment restrictions, appointing an investment manager, an auditor, safeguarding the custody of fund assets and submitting annual returns. An LPF must also engage an independent auditor for transparent financial oversight and establish secure custody arrangements for its assets. Not to mention, they must appoint a responsible person, such as a bank authorised under the Banking Ordinance, a licensed corporation, or a professional in accounting or legal services, to undertake anti-money laundering and counter-terrorist financing activities.

Not to mention, they must appoint a natural person, such as a bank authorised under the Banking Ordinance, a licensed corporation, or a professional in accounting or legal services, to undertake anti-money laundering and counter-terrorist financing activities.

Authorised representative and corporate services

In the same vein, corporate service providers in Hong Kong assist LPFs with fund administration and corporate secretarial services as part of their suite of administrative services. General partners of an LPF must appoint an authorised representative based in Hong Kong to assume certain liabilities on their behalf in the event they cannot be contacted.

Furthermore, an LPF is required to maintain specific records, such as a register of partners and investor due diligence documents. These records can be accessed by government agencies but are not publicly available, reinforcing the regulatory compliance of LPFs.

Summary

As we traverse the labyrinth of investment vehicles, the Limited Partnership Fund (LPF) in Hong Kong stands out as a formidable structure. This investment fund vehicle, structured as a partnership, combines the best of flexibility, security, and profitability. Whether you’re an investor, a fund manager, or simply curious about this innovative financial instrument, understanding the intricacies and advantages of an LPF is crucial.

From its formation to dissolution, the journey of an LPF is filled with opportunities and challenges. But with the right knowledge, professional support, and a conducive regulatory environment, managing an LPF becomes a rewarding experience.

Such expertise and professional support are available to you through the services of Osome. Contact us today and take advantage of our experience and expertise in helping international clients set up a company in Hong Kong. Our services include Hong Kong company registration, accounting and audits, and more.

FAQ

What is a Limited Partnership Fund?

A limited partnership fund (LPF) is a fund structured as a limited partnership in Hong Kong, commonly used by private funds and investment partnerships to attract private equity investment and maintain day to day control over the management of the entity. It is designed to manage investments for the benefit of its investors.

Can a fund be a limited partnership?

Yes, a fund can be registered as a limited partnership, allowing it to re-domicile to Hong Kong and the limited partnership ordinance be governed under the Limited Partnerships Ordinance. This is part of the Limited Partnership Fund regime introduced in Hong Kong.

What is the difference between LPF and OFC in Hong Kong?

The main difference between LPF and OFC Hong Kong is that an OFC is an open-ended fund in corporate form domiciled in Hong Kong with a board of directors. On the other hand, LPFs have a proper management structure and are registered with the Companies Registry under the Limited Partnership Fund Ordinance (LPFO) and are administered by the Company Registry in Hong Kong.

What are the key components of a Hong Kong Limited Partnership Fund?

The key components of an Hong Kong Limited Partnership Fund include at least one general partner responsible for management, and at least one limited partner making capital contributions and sharing in income and profits.

What are the advantages of establishing an LPF in Hong Kong?

Establishing a Hong Kong Limited Partnership Fund offers tax exemptions, access to Mainland China markets, and a supportive regulatory environment, which can be advantageous for business growth and expansion.

More like this

Discover the Best Country to Start a Business as a Foreigner in 2024

Read

Understanding the Essential Roles of Memorandum and Articles of Association in Corporate Governance

Read

What Is Proof of Address and How To Obtain One Easily and Quickly in Hong Kong

ReadGet expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?